Gray Report Newsletter: February 29, 2024

Multifamily Forecasts Converge toward Optimism

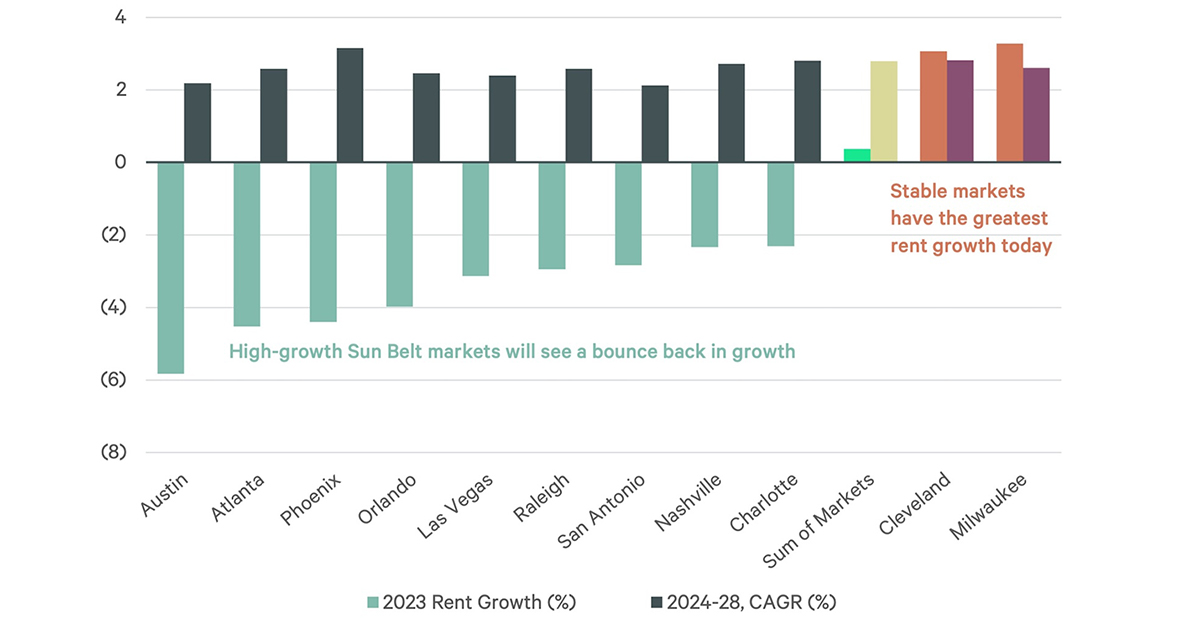

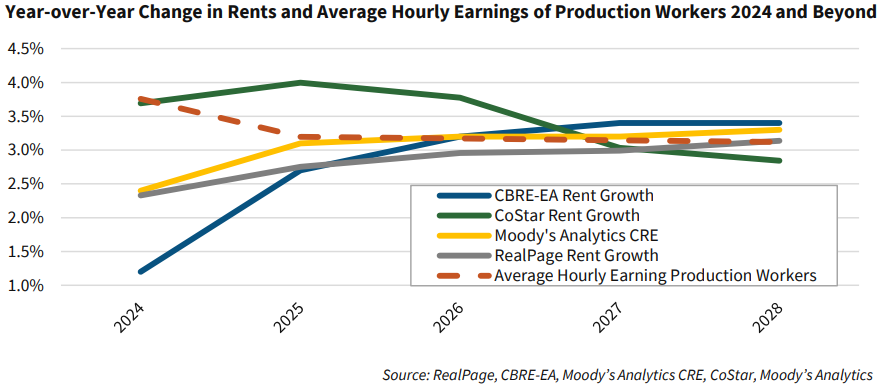

As we move further from the uncertainty and rent growth stagnation of 2023, an increasing number of sources are finding room for optimism in the multifamily investment market. A looming drop-off in multifamily supply, the consequence of a interest-rate-driven decline in new construction projects, has become a central part of projections for the multifamily market, leading to expectations of higher rent growth and increased apartment demand in 2025 and 2026.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

Multifamily Market Travails Not Likely to Last

Via CBRE: “Markets are never static and strong rent increases are likely to resume in traditionally higher growth cities . . . Midwestern cities have touted attractive affordability levels, but limited inventory and high mortgage costs are increasing the number of renters-by-necessity in those markets too.”

- Persistent, Lagging Connection between Rent Growth and Inflation (Moody’s Analytics)

- As Cap Rates Compress, Multifamily Investors See Value-Add Potential In Newer Properties (Bisnow)

- Home Prices Hit All-Time High, Leading Apartment Renters to Favor Long Leases (Marcus & Millichap)

Multifamily and the Housing Market

Multifamily and Economic Report: 2024 Outlook for Multifamily Affordability

Fannie Mae: “As shown on the chart above, Moody’s Analytics is projecting an annual increase of around 3.1% starting in 2025. This is in line with the rent growth projections for CBRE, Moody’s Analytics CRE, and RealPage that are also projecting rent growth in the range of 3% over this timeframe, but less than CoStar’s projection above 3.0% annually until 2028.”

- Aging boomers and the impact on the housing market over the next decade (Freddie Mac)

- Housing Market Update: More Homes Hit the Market as Spring Approaches, But 7% Mortgage Rates Keep Buyers on the Sidelines (Redfin)

- Case Study: What Has Zoning Reform Accomplished in Cambridge, MA? (Harvard Joint Center for Housing Studies)

Multifamily Markets and Reports

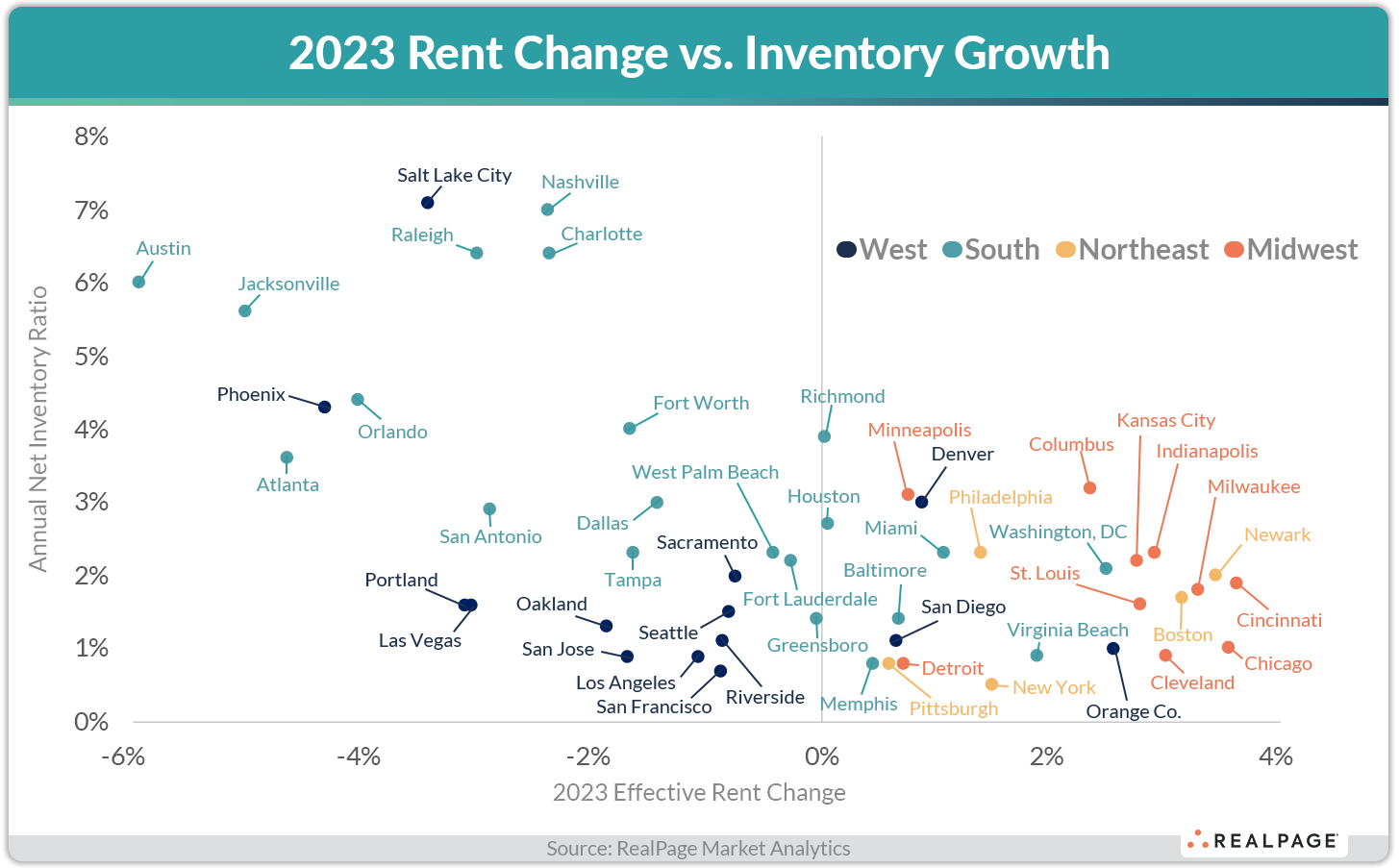

Data and Details on Rent Growth and Apartment Supply in 2023

RealPage: “Only three major markets managed to grow inventory at a faster rate than the U.S. average and post rent growth above the near-stagnant norm nationally. Those three markets – Columbus, Minneapolis and Denver – mark notable exceptions.”

- Apartment Vacancy Data for Each Market (Apartment List)

- Multifamily Permitting Falls 9% in January (RealPage)

- Young Adults Living with Parents: State Differences (NAHB)

Commercial Real Estate and the Macro Economy

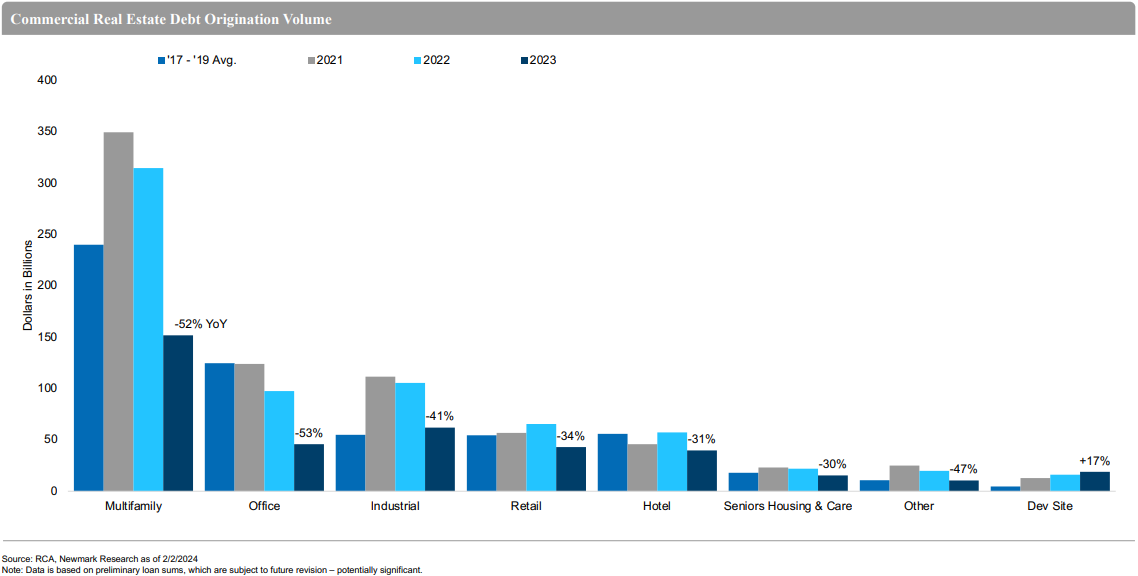

Capital Markets Report: Record Maturities in 2024 following Investment Sales Slowdown in 2023

Via Newmark: “Office and multifamily loans constitute most potentially troubled loans, particularly in the 2024-to-2026 period. The high office volume results from most loans being underwater. The distribution of LTV ratios for multifamily are more favorable overall, but the greater size of the multifamily market and the concentration of lending during the recent liquidity bubble drive high nominal exposure.”

- Fear and Greed Index: Cautious Optimism for CRE in 2024 (John Burns Research and Consulting)

- CRE Optimism, but too Much Focus on a Fed Pivot and Not Enough Acceptance of HFL (Cushman & Wakefield)

- The Case for Centralization of Corporate Real Estate (CBRE)

Other Real Estate News and Reports

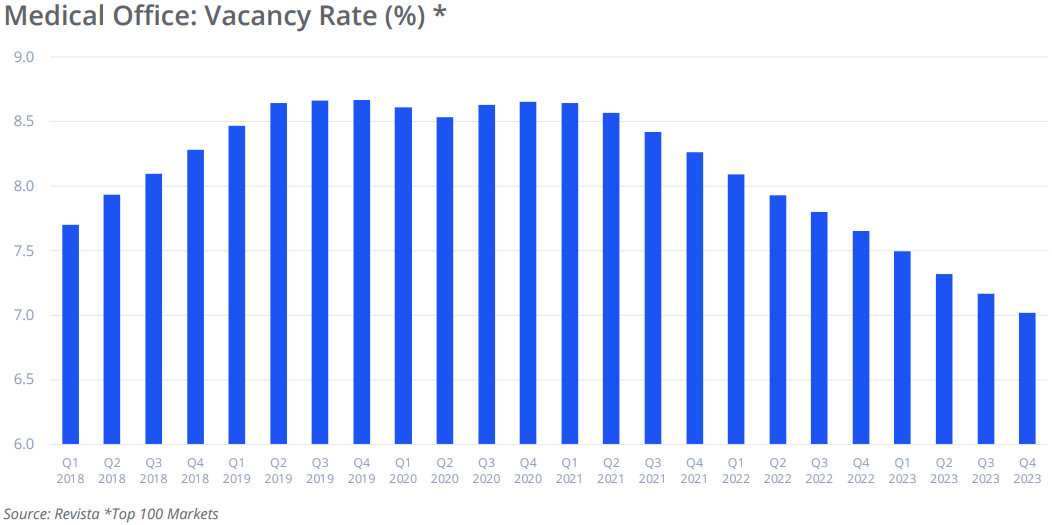

2024 Healthcare Marketplace Report

Via Colliers: “[S]ales volume declined noticeably in 2023, as higher cap rates and downward pricing pressure created a significant “bid-ask” spread. Despite these headwinds, the outlook for 2024 and beyond is bright. The demand for healthcare services should continue growing as the population grows and the youngest Baby Boomers turn 60.”

- Practical CRE (Moody’s Analytics)

- US CoreLogic S&P Case-Shiller Index Continues to Strengthen, With Annual Gain of 5.5% in December (CoreLogic)

- Experts: Commercial Real Estate Exposures Could Lead to Bank Failures (Florida Atlantic University)