Gray Report Newsletter: February 1, 2024

Are We Underestimating Apartment Demand?

The enormous amount of apartment supply expected this year should temper any expectations of apartment demand, but newly-published research on the topic argues that U.S. housing needs are far larger than can be addressed even with the historic amount of multifamily completions last year and forecasted for this year. On the capital markets side, recent data points to a substantial increase in CRE investment interest, but given the Federal Reserve’s recently-announced intentions to keep interest rates at their current levels past March of this year, the market may not thaw until later in the summer when financing conditions improve.

Multifamily, the Nation, and the Economy

Harvard Rental Housing Report: Demand Rising, and More Investment Needed

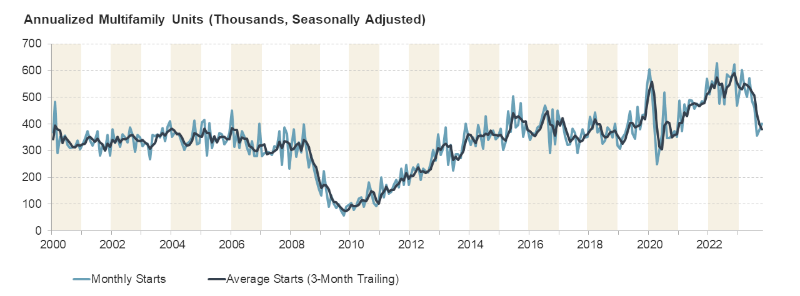

Via Harvard Joint Center for Housing Studies: The fall-off in apartment construction is just one of the continued pressures on rental housing affordability, and “the underlying age distribution of the US population also points to sustained rental demand going forward,” highlighting the continued need for additional apartment supply.

- One Good Year Does Not Solve America’s Housing Shortage (Moody’s Analytics)

- The Market’s Bottom Is Getting Closer (GlobeSt)

- Fed recap: Powell shoots down March rate cut (CNBC)

- Apartment Defaults To Double This Year, Fitch Predicts (Bisnow)

Multifamily and the Housing Market

2024 U.S. Multifamily Investment Forecast

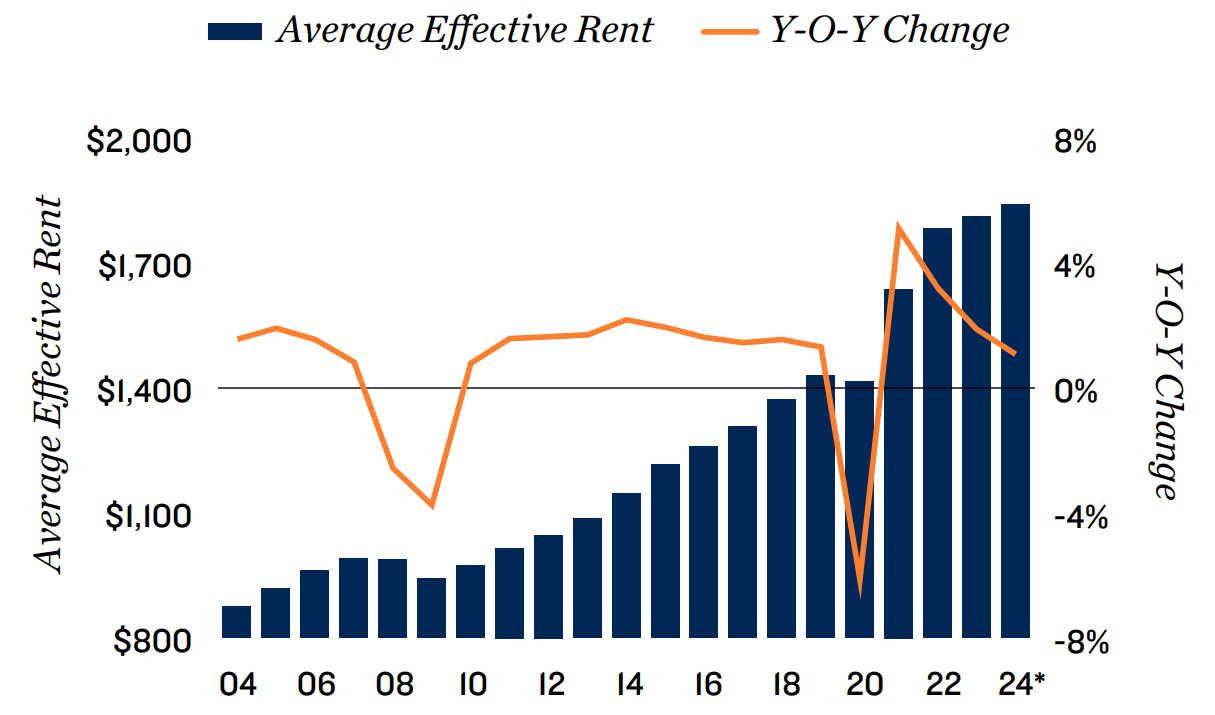

Marcus & Millichap: “Investors who came of age since the GFC have framed their strategies within the context of a 2.5 percent mean 10-year Treasury rate and rent growth ranging above 5 percent. Comparatively, investors active in the 90s and early 2000s operated with an average 5.5 percent 10-year Treasury and rent gains near 3.5 percent, which align closer to the anticipated investment climate going forward.”

- Estimating the National Housing Shortfall (Harvard Joint Center for Housing Studies)

- US CoreLogic S&P Case-Shiller Index Suggests Pivot Ahead, Up by 5.1% Annually in November (CoreLogic)

- Economic Growth Beat Expectations to End 2023; Home Sales Poised to Trend Upward (Fannie Mae)

Multifamily Markets and Reports

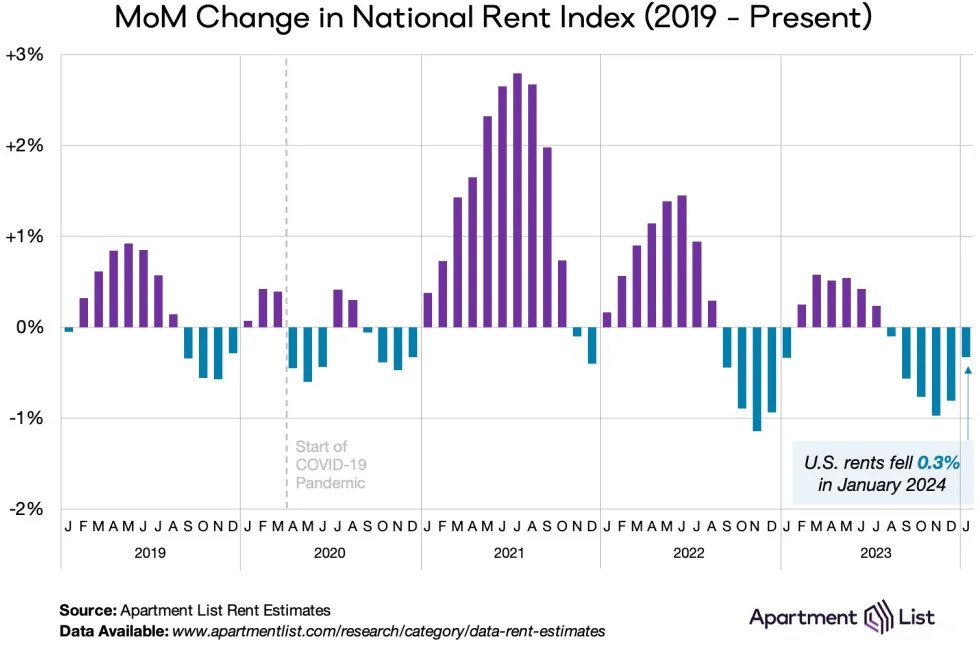

National Rent Report: January 2024

Apartment List: “January’s dip was relatively modest compared to the declines we’ve been seeing in recent months, indicating that we’re approaching the end of the market’s slow season.”

- Office-to-Residential Conversions: How to Capitalize on the $45B Stimulus (John Burns Research and Consulting)

- Markets Where 4Q Apartment Demand Outpaced Pre-COVID Norms (RealPage)

- January Rental Activity Report: Minneapolis Leads as the Most Sought-After City, West Rivals Midwest for Top Spots (RentCafe)

Commercial Real Estate and the Macro Economy

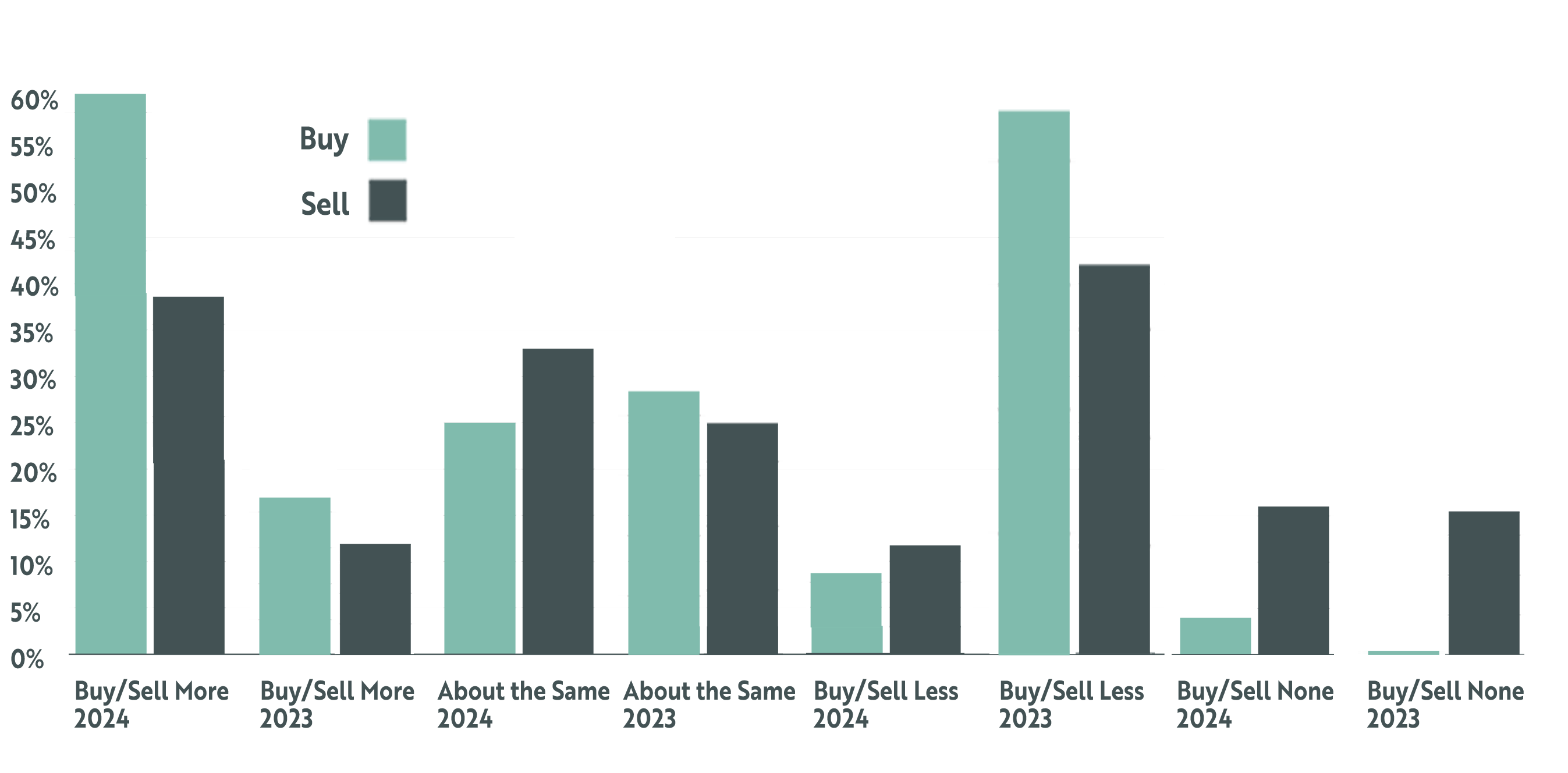

2024 U.S. Investor Intentions Survey: Are CRE Markets Ready to Thaw?

Via CBRE: In 2024, the results of the investor intentions survey are a near-perfect inverse of 2023. Whether this will result in more buying and selling remains to be seen, but last year’s intentions to buy/sell less were fairly accurate.

- CMBS Delinquency Volume Spikes by 47% Since End of 2022 (Trepp)

- CRE Sales Fell Flat in Q4 2023: Will They Pick up in 2024? (GlobeSt)

- US Commercial-Property Distress Swelled in 2023 (MSCI)

Other Real Estate News and Reports

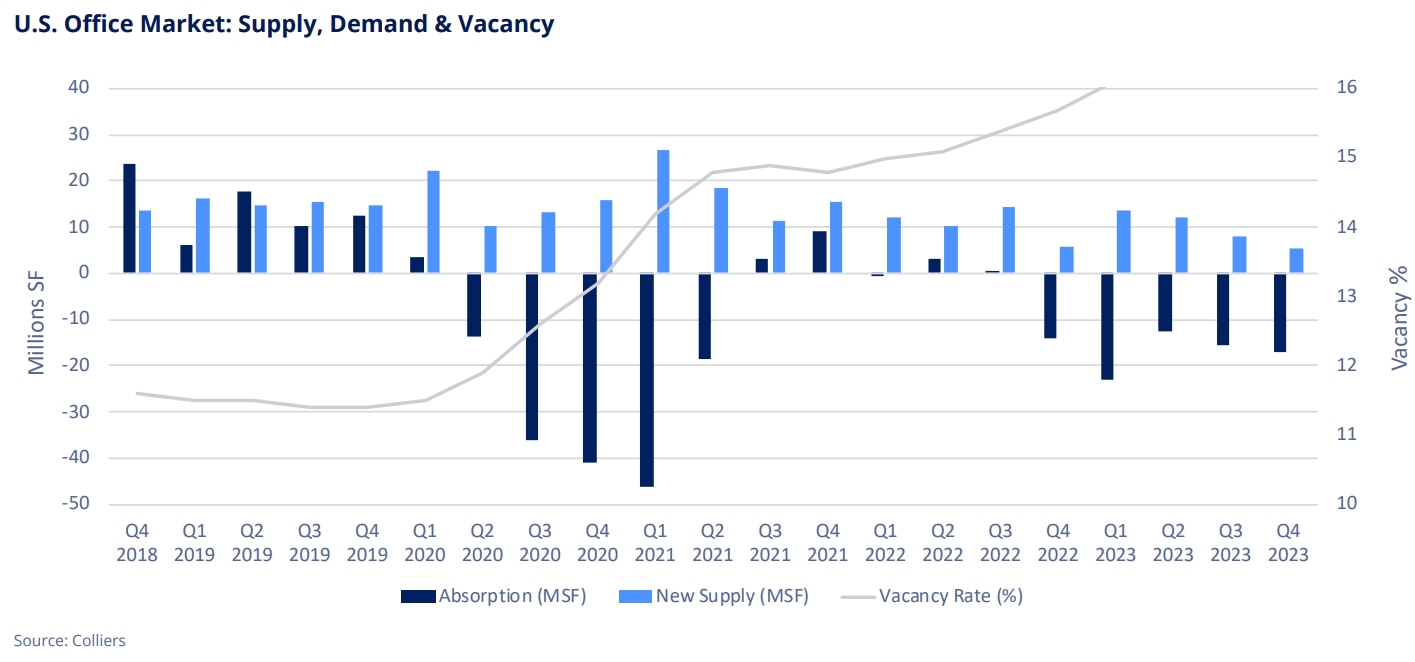

Report: U.S. Office Fundamentals Remain Weak at Close of 2023

Via Colliers: This report closes out year in which “the vacancy rate climbed 120 basis points, to 16.9%, easily surpassing the prior peak of 16.3% at the height of the Global Financial Crisis (GFC).”

- 2024 U.S. Office Investment Forecast (Institutional Property Advisors)

- The Bright Side of Office: Growth Opportunities in the Urban Core (Cushman & Wakefield)

- U.S. Industrial Market Report, Q4 2023 (Colliers)

- Jan. 2024 Industrial Market Report: 2024 – Industrial Sector’s Year of Normalization (Yardi Matrix)