Gray Report Newsletter: December 7, 2023

Chill Sets in for Multifamily Borrowers

With rent growth reports showing near-zero percent rent growth for the year, multifamily borrowers, investors, and operators face continuing challenges that will require active solutions rather than passively waiting for a more favorable interest rate environment. With the year-end approaching, apartment operators and asset managers will have a full reckoning of the significant expense increases in the multifamily space in 2023, which, unlike in 2022, will not be off-set by any meaningful rent growth for the year. Similarly, there is little reason to expect that last-minute deals will buoy the low sales activity in the multifamily market, but investors should look for opportunities to emerge in 2024 as these persistent challenges change the calculation for property owners unable to “survive until 2025.”

Multifamily, the Nation, and the Economy

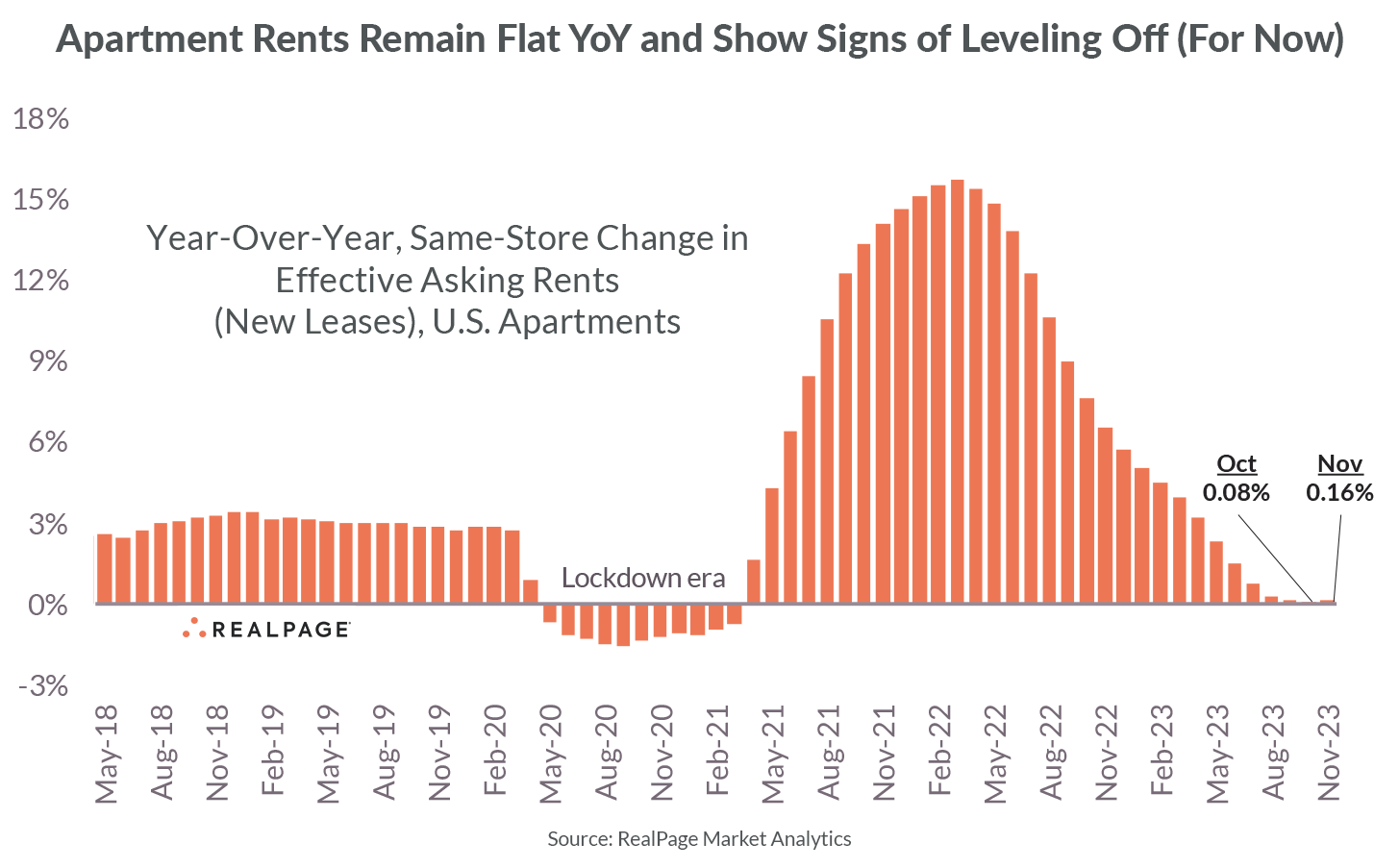

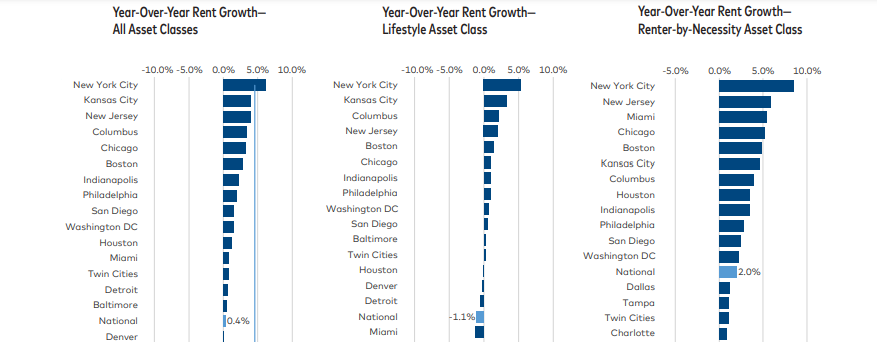

Apartment Rents Remain Flat, and Could Be for a While

RealPage: Apartment rent growth has been rapidly cooling off since peaking in March 2022. But that trend could be leveling off – at least for now,” but a 12-month-strong trend of wages outpacing rent growth—with little sign of abating—”could erase all of the rent-over-wage bump of 2021 and early 2022, and in turn help further widen the demand funnel.”

- Ares Banks $3.3 Billion to Buy Real-Estate Fund Assets (The Wall Street Journal)

- As Private Credit Surges, Banks and Alternative Asset Managers Turn Frenemies Rather Than Foes (Institutional Investor)

- Multifamily Maturities Weaken, While Office Improves (GlobeSt)

Multifamily Markets and Reports

Nov. 2023 National Multifamily Report: Rent Down Slightly while Occupancy Ticks Up

Via Yardi Matrix: “Multifamily rents dipped in November, with the short-term outlook clouded by inflation, cooling job growth and the Sun Belt’s heavy delivery pipeline. A longer view, however, is more bullish, due to extraordinary rent growth over the last three years and prospects that demand will continue to match supply.”

- Multifamily Monthly: Indianapolis is “A Hot Spot in the Midwest.” (Cushman & Wakefield)

- Forecasting 2024’s Top Apartment Markets (RealPage)

- Move Over Millennials, Gen Z Is Driving Rental Demand (Harvard Joint Center for Housing Studies)

Multifamily and the Housing Market

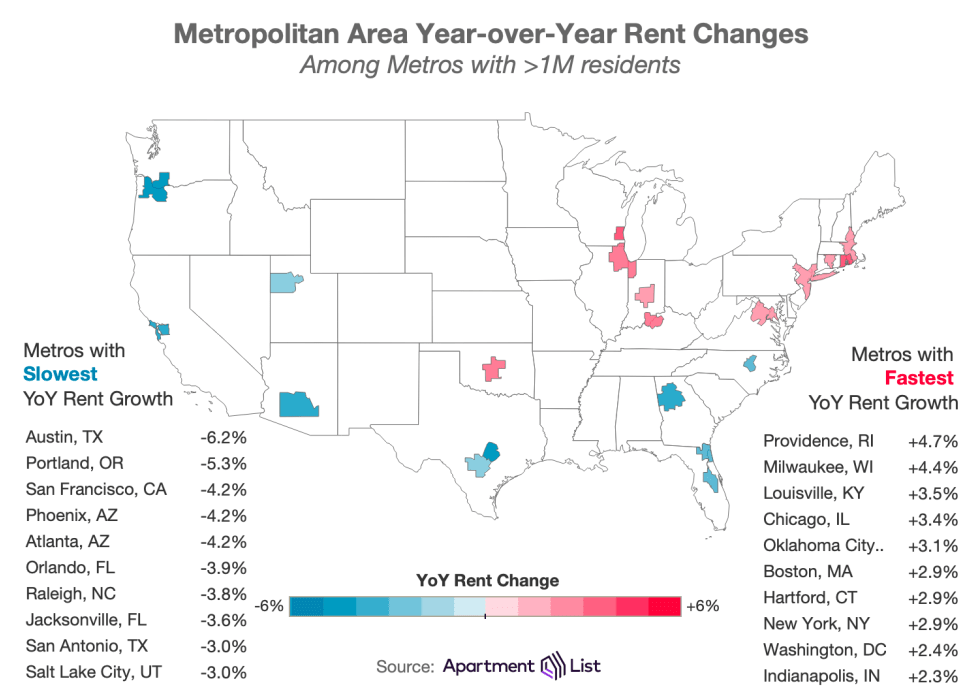

7 Predictions for the 2024 Rental Market

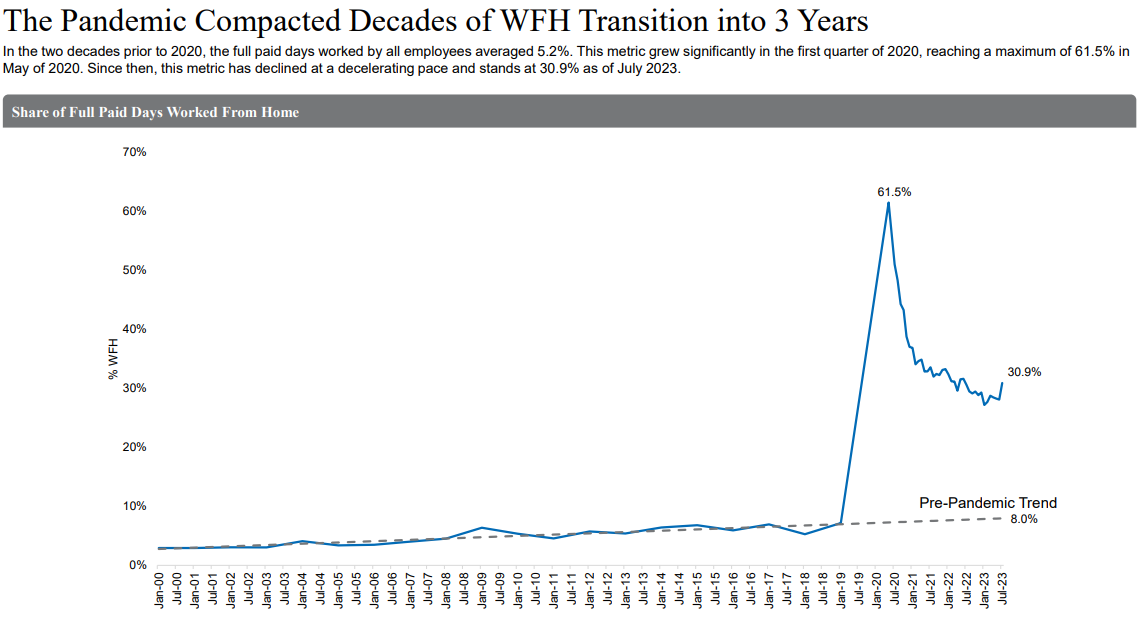

Via Apartment List: Even more apartment supply, “low single-digit rent growth,” expanding renter population due to high homeownership costs, persistent work-from-home conditions, and robust growth in the Sun Belt are among the trends to watch next year.

- The Four Types of Multifamily Development Projects That Can Still Work in 2024 (RealPage)

- How Renters Are Using TikTok, X To Defraud Landlords At Luxury Apartments (Bisnow)

- Amidst Housing Slowdown, Exurban Areas Post Largest Construction Gains (NAHB)

Commercial Real Estate and the Macro Economy

United State Office Market Overview

Via Newmark: “The United States office market continued to soften through the third quarter of 2023. Leasing activity slowed, nearing 2020 levels, as occupiers wrestle with a still uncertain economic outlook even as they right-size their portfolios for hybrid work.”

- Boosting Office Attendance: Selling & Delivering Workplace Value to Employees (CBRE)

- 2024 Global Investor Outlook (Colliers)

- Office Challenges Remain as Hotel and Retail Sectors Steadily Improve (Marcus & Millichap)

Other Real Estate News and Reports

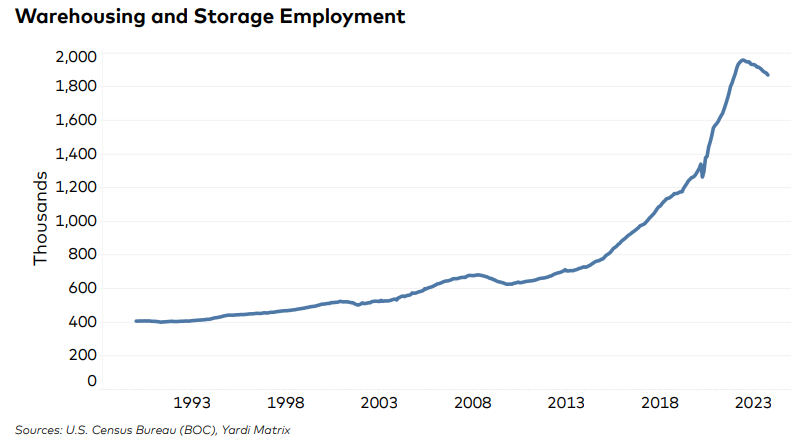

National Industrial Report, November 2023

Via Yardi Matrix: “Performance continues to be mixed by region, with close to an even mix between metros of year-over-year gains and losses. Among the Matrix top 30 metros, the Northeast and Midwest remain rent growth leaders, while Sun Belt and West metros lag.”

- Portfolio Optimization in Large-Cap Companies (CBRE)

- Surveying Subscription Lines of Credit in Private Funds (MSCI)

- Timing out the CRE Waiting Game (Moody’s Analytics)