Gray Report Newsletter: December 21, 2023

Bridge Loans and Soft Landings

News of potential interest rate cuts continue to dominate the conversation, but unlike the stock market’s rally, discussion in the CRE markets is more guarded and cautious about the potential opportunities and relief that might come in 2024. While the coming year may not include a full-blown recession, most of the predictions of soft landing for interest rates and the economy include a downturn next year. With this in mind, multifamily owners expecting continued rent growth stagnation and increasing expenses may decide to sell their properties, especially if they are facing rising debt costs as short-term bridge loans expire. At the same time, multifamily investors with a strategy to address 2024’s challenges can expect significant opportunities as the year progresses.

Multifamily, the Nation, and the Economy

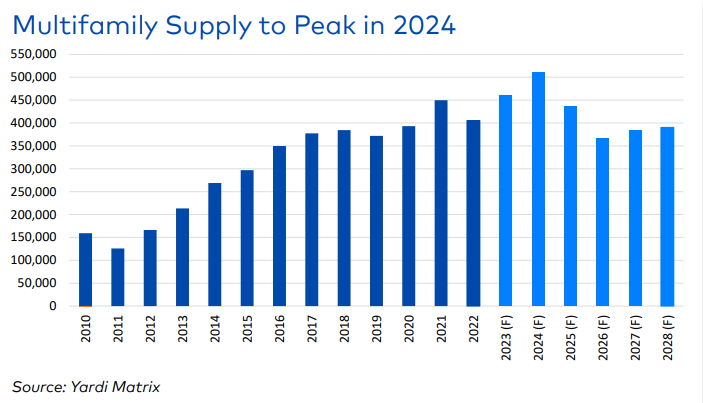

2024 Forecast: Multifamily Demand to Stay Positive, but Market Faces Hurdles

Yardi Matrix: “In particular, defaults will be concentrated in the cohort of value-add properties acquired with short-term loans between 2020 and early 2022. Those properties have not had the benefit of years of cash flow growth, and also face the steepest increase in mortgage rates.”

- Consumers Feeling More Confident, Inspiring Apartment Demand (RealPage)

- Economic, Housing and Mortgage Market Outlook – December 2023 (Freddie Mac)

- Kevin O’Leary Says New Bill That Would Ban Hedge Funds From Buying Homes ‘Is Very, Very Bad And Destructive’ (Yahoo Finance)

- Lennar Puts Massive, $4.5B Apartment Portfolio on the Block (GlobeSt)

Multifamily Markets and Reports

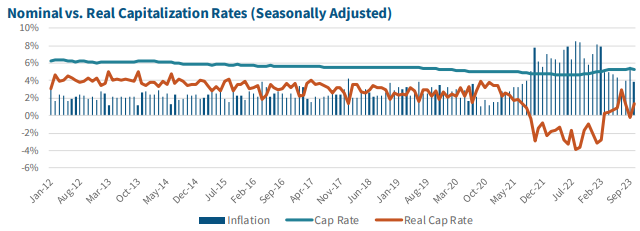

Multifamily Prices Remained Elevated After Adjusting for Inflation

Via Fannie Mae: Inflation-adjusted cap rates for multifamily properties are below historical averages, and they were even further in the negative during the peak inflation period.

- It’s The End Of 2023. Are We Where Experts Predicted We Would Be? (Bisnow)

- November 2023 Rental Report: Rent Prices Fall for Seventh Consecutive Month (Realtor.com)

- Why Maintaining Multifamily Occupancy Will be Tough Next Year (GlobeSt)

Multifamily and the Housing Market

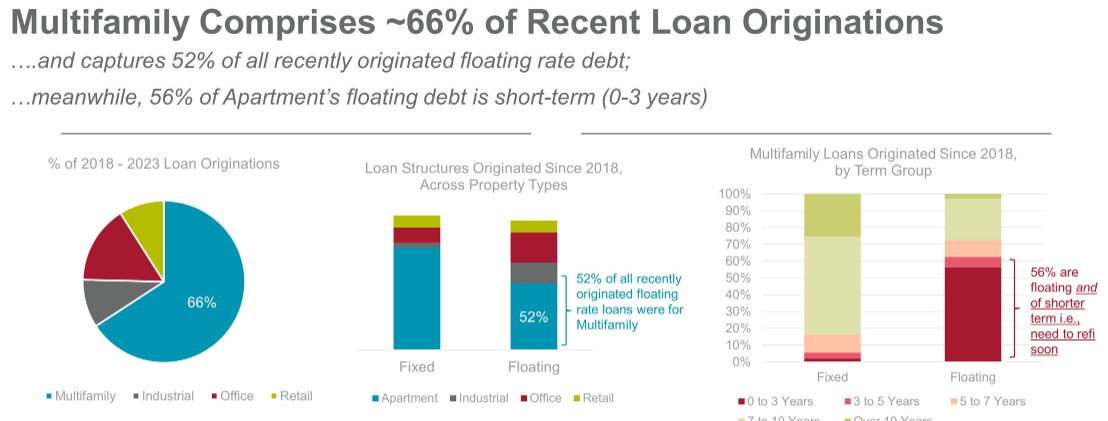

Opportunities for Rescue Capital Extend beyond the Office Sector (and into Multifamily)

Via Cushman & Wakefield: “From a comparative scale standpoint, Apartment floating rate loans reflect an additional segment of CRE (beyond Office) where elevated rescue-capital opportunities are expected to arise.”

- Understanding the investment opportunities of purpose-built student accommodation (CBRE)

- The State of Build-to-Rent (Cushman & Wakefield)

- Single-Family Starts Surge on Falling Interest Rates (NAHB)

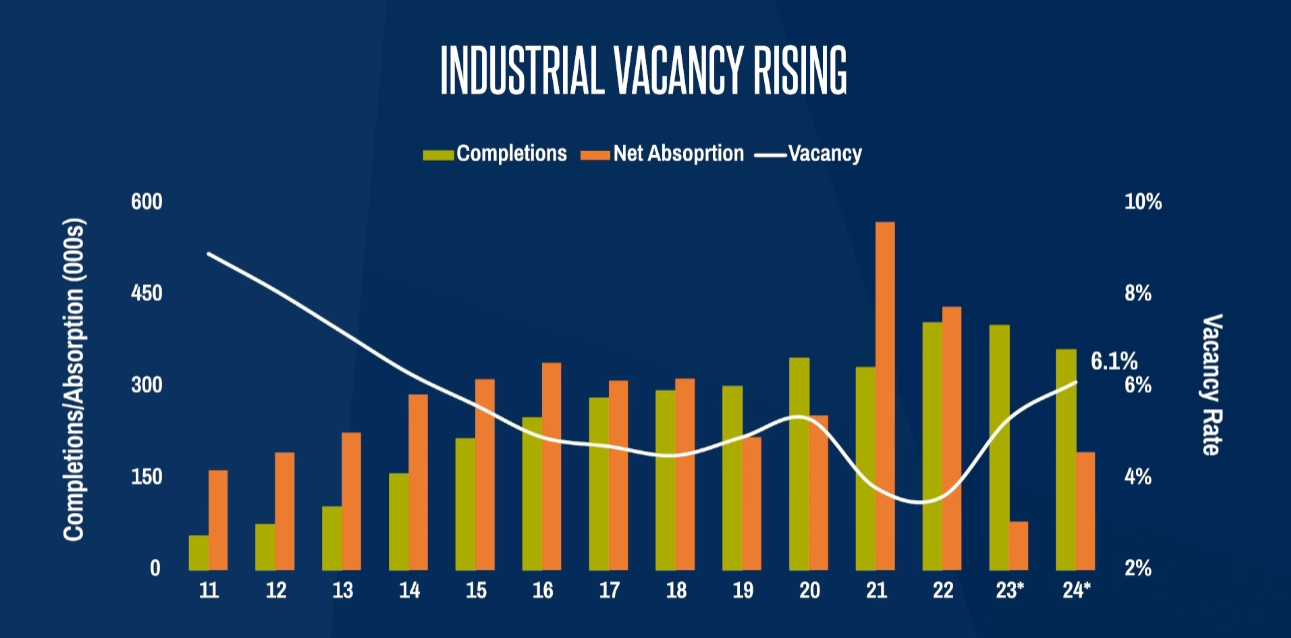

Commercial Real Estate and the Macro Economy

What to Expect for CRE in 2024

Via Marcus & Millichap: This report’s “baseline scenario is a soft landing,” with GDP growth at or near 0%, but apartment demand is expected to remain stable due to high homebuying costs.

- U.S. Seaports Outlook Report | 2023 (Colliers)

- The life sciences hotspot on investors’ radar (JLL)

- Pivot from the Committee: But Is it Enough to Turn the Faucet on? (Moody’s Analytics)

Other Real Estate News and Reports

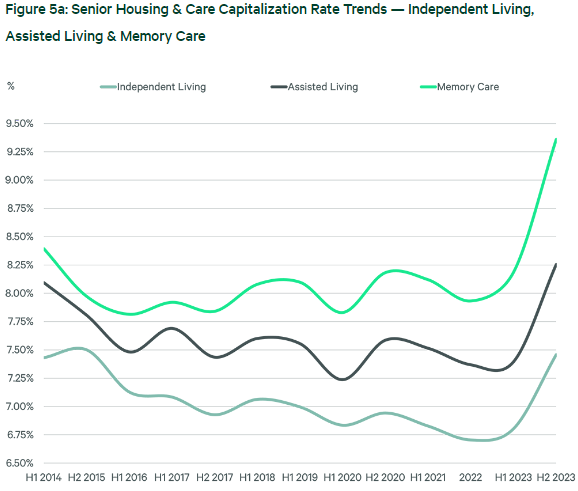

U.S. Senior Housing & Care Investor Survey H2 2023

Via CBRE: “Cap rates for Independent Living (IL), Assisted Living (AL) and Memory Care (MC) facilities increased by 73 bps on average over the past six months, with greater increases for Class C assets than Class A and for non-core markets than core. This is a reversal from the April survey, which reported the biggest increases for Class A assets and core markets.”

- US Home Investor Activity Steadily Increased in the Third Quarter (CoreLogic)

- How College Football Is Clobbering Housing Markets Across the Country (The New York Times)

- Commercial real estate a top threat to financial system in 2024, U.S. regulators say (MarketWatch)