Gray Report Newsletter: August 8, 2024

Stock Market Selloff = Rate Cut Certainty?

Weaker jobs numbers, rising Japanese interest rates, AI bubble fears, and election-year uncertainty are among the many factors posited as the cause of the stock market’s steep declines this week, and the lengthy period of elevated interest rates in the United States has helped create this fragile economic environment more vulnerable to recession. A major economic downturn would be keenly felt by apartment operators facing continued challenges with lower rent growth and higher expenses, but given the magnitude of housing demand, the proven resilience of apartment assets, and the likelihood of lower interest rates, many investors are anticipating more activity and opportunity in the multifamily investment market.

Multifamily, the Nation, and the Economy

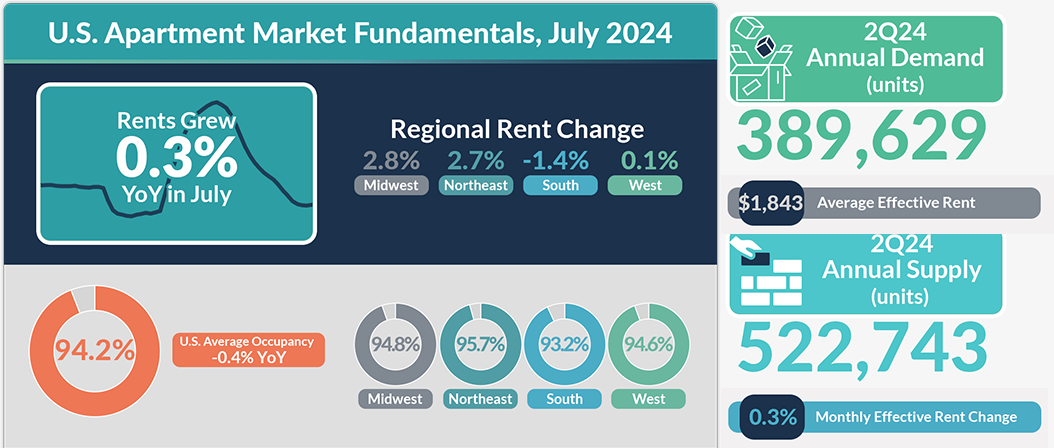

Via RealPage: “Effective asking rents grew 0.3% during the month of July. That was less than the typical July pace from the 2010s decade but represented a 10-basis point (bps) increase over the July 2023 figure. Year-to-date in 2024, rents expanded 2.2%, in line with the year-to-date 2023 pace.”

- Treasury Decline Unlocks New Multifamily Opportunities (GlobeSt)

- Fannie, Freddie Are Poised to Tighten Real-Estate Lending Rules (The Wall Street Journal)

- San Francisco Bans Multifamily Proptech Algorithms (GlobeSt)

Multifamily and the Housing Market

July 2024 National Multifamily Report: Rents Rise in July as Policy Debates Heat Up

Yardi Matrix: “The national average advertised asking rent rose $4 to $1,743 in July, with the year-over-year growth rate rising to 0.8%. Rent growth has been highest in gateway metros in the East and secondary markets in the Midwest.”

- Home Price Growth Continues, but Rate of Growth Weakens (CoreLogic)

- A September Rate Cut is Not Enough to Relieve the Housing Affordability Crisis (Moody’s Analytics)

- Home Sizes: Demand versus Supply (NAHB)

Multifamily Markets and Reports

Mid-Year Outlook: Better Than Expected Multifamily Performance

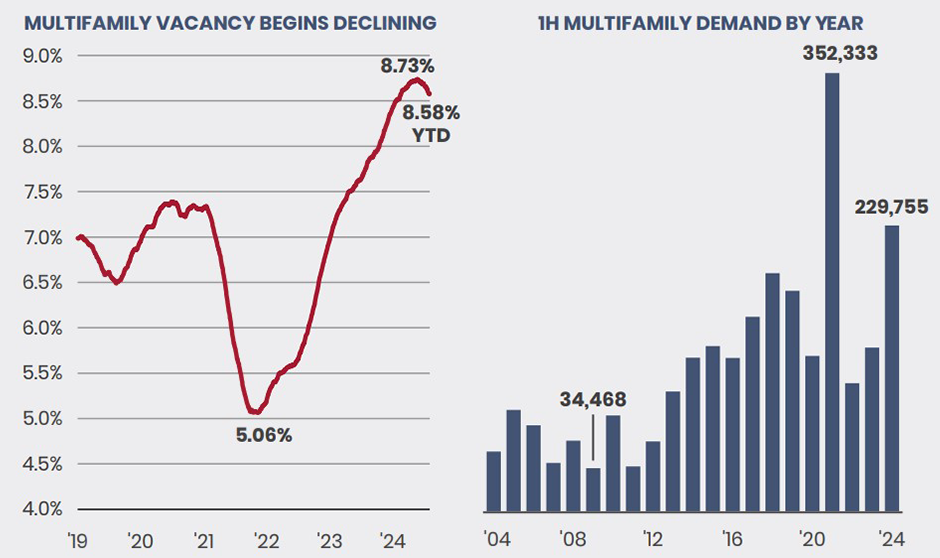

Via Greystone, Cushman & Wakefield: “Approximately 230,000 units were absorbed during the first half of 2024, which was 75% more than the first half of 2023. The second quarter saw the fourth most demand of any quarter since at least 2000.”

- New Apartment Construction to Reach Historic High of Half Million in 2024, Two Million Rentals to Open by 2028 (RentCafe)

- When Will The Fed Cut Rates? And By How Much? (Marcus & Millichap)

- Midyear Outlook: “We expect occupancy across all markets to begin recovering later this year driving accelerating rent growth heading into next year.” (CBRE)

Commercial Real Estate and the Macro Economy

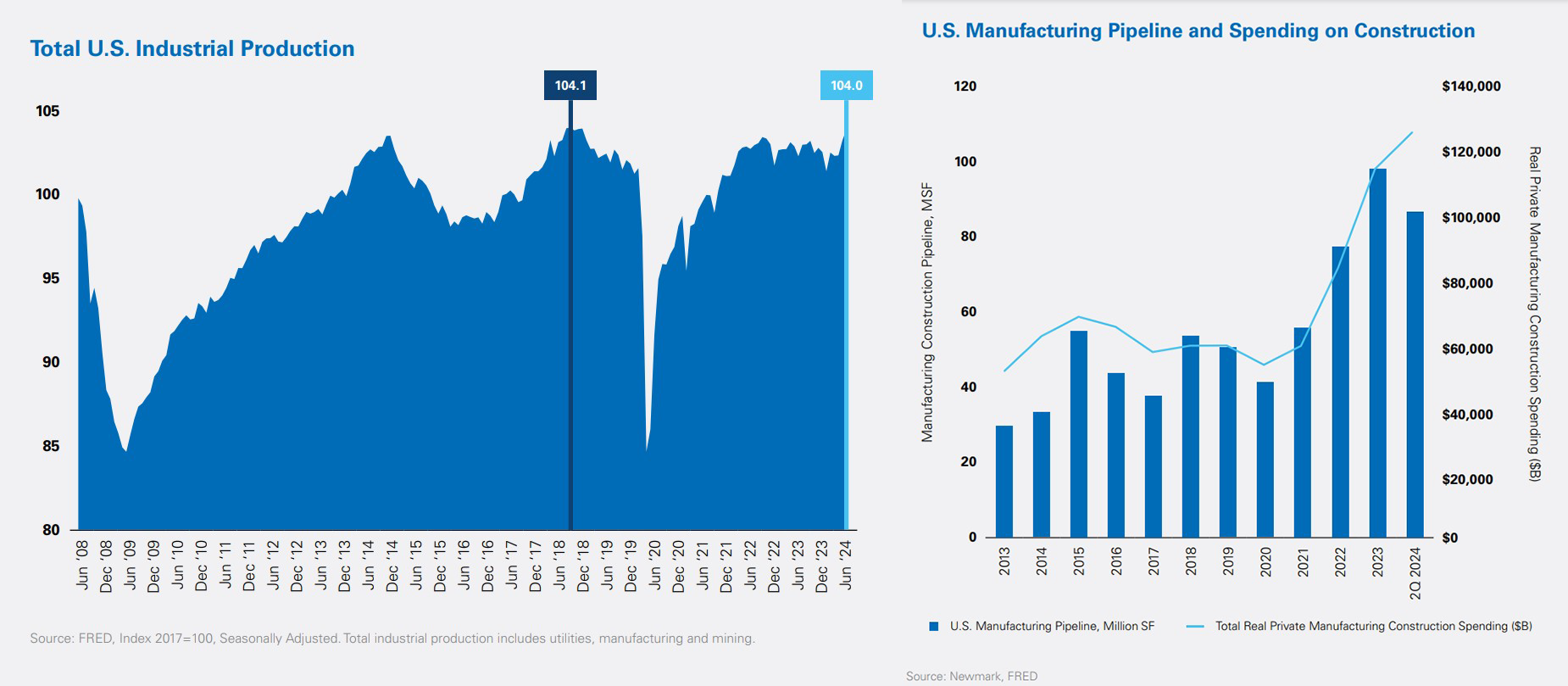

Report: Manufacturing Momentum: From Construction to Production

Via Newmark: “[T]he juggernaut trajectory of supply chain repatriation has continued. Active major manufacturing announcements made since 2020 now tally 400+ projects totaling $530 billion in investment, 270,000 new jobs and a minimum of 270 million square feet of new manufacturing space – all to come in the next decade.”

- KKR Says 2024 Could Be ‘Sweet Spot’ To Buy Real Estate (Bisnow)

- CRE Market activity set to strengthen despite varied economic performance (JLL)

- U.S. Hotels State of the Union August 2024 Edition (CBRE)

Other Real Estate News and Reports

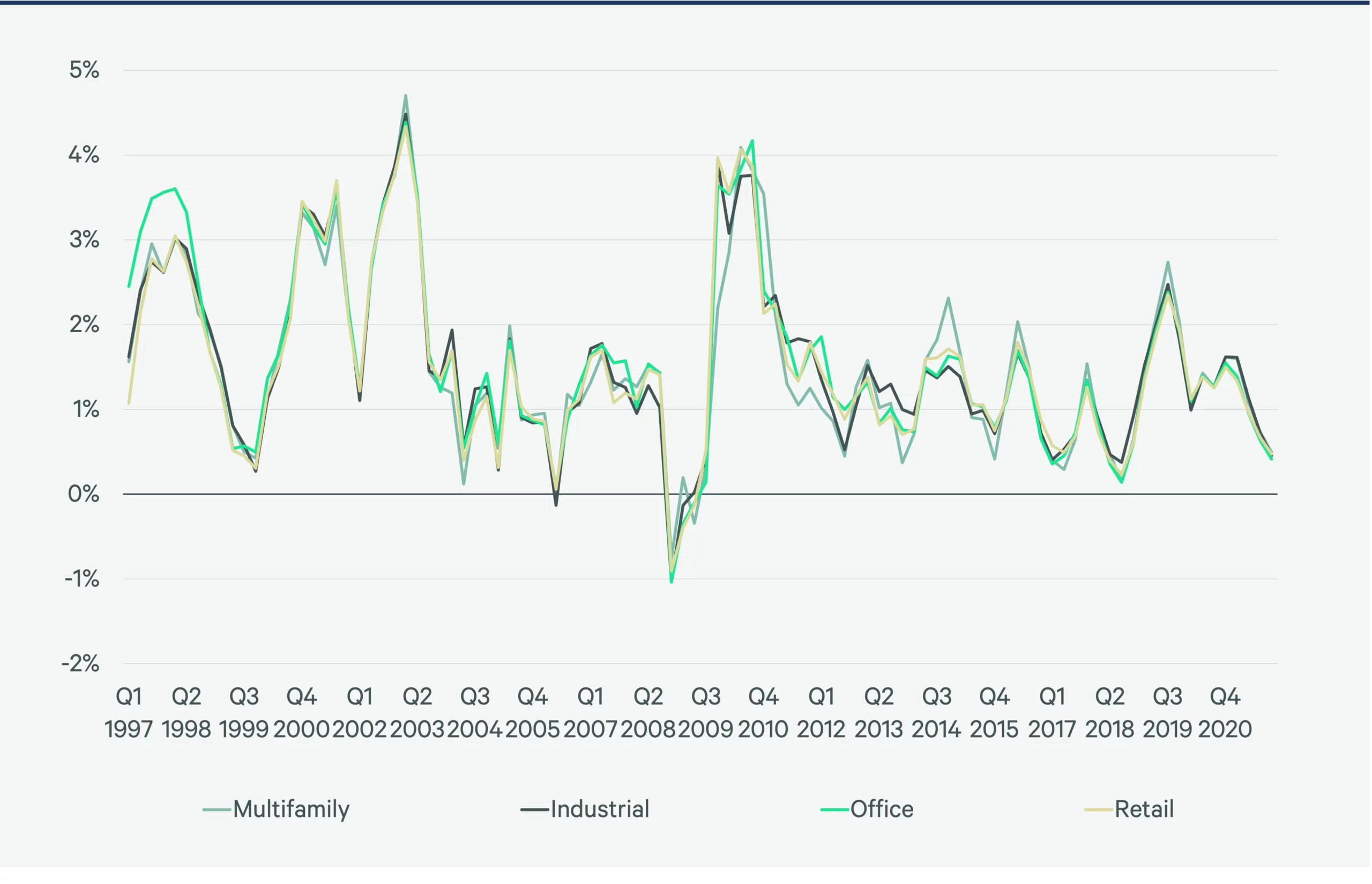

A Quadrant Approach to Commercial Real Estate Investing: Private Debt

Via CBRE: “[W]hen investing in senior mortgages, it is a good idea to keep an eye on BBB CMBS returns, but it is even more important to monitor the Baa-rated corporate bond return and the bond default premium. Both variables explain most of senior mortgage returns.”

- Small Investors Dominate the Residential Real Estate Market (John Burns Research and Consulting)

- Rising Joblessness Puts Pressure on the Fed to Stay on Course for a Soft Landing (Institutional Property Advisors)

- The rot in the commercial real estate market in one story (FXStreet)