Gray Report Newsletter: August 29, 2024

Near-Certain September Rate Cut: Multifamily Will “Survive Until 2025.”

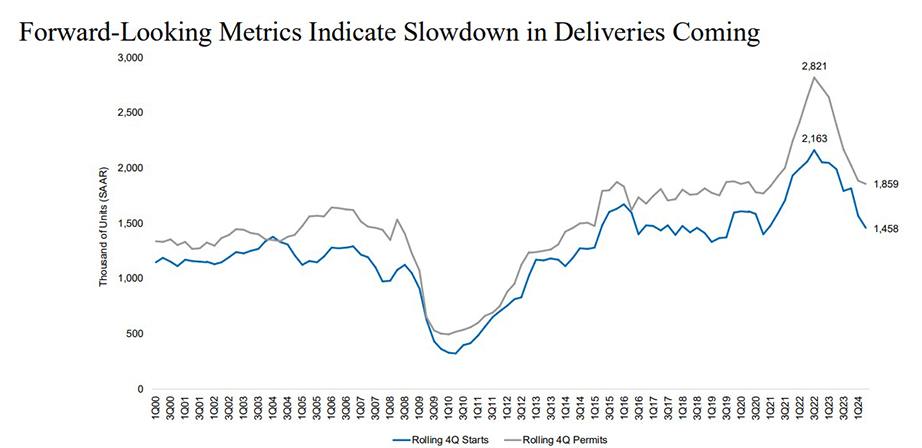

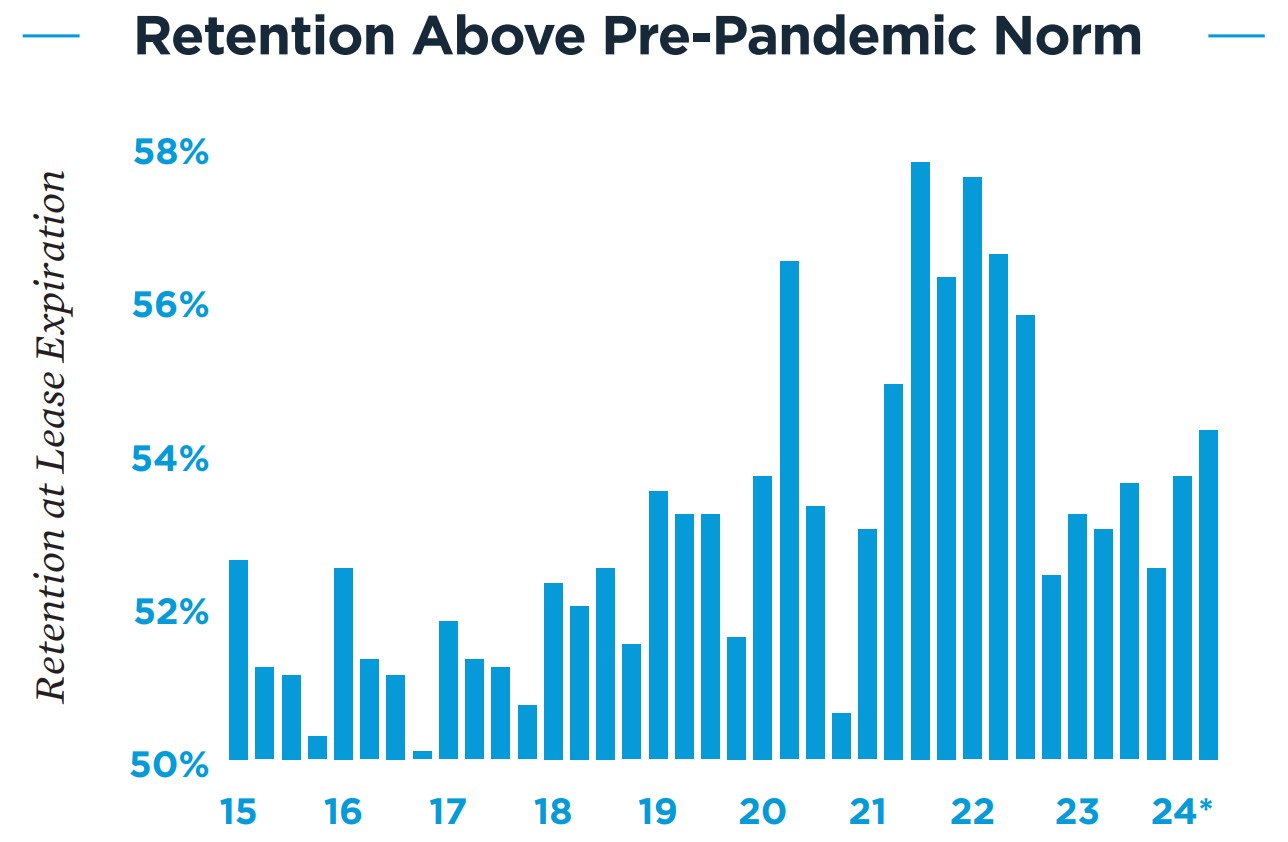

With a September decrease in the federal funds rate all-but-certain, the contrast between the current moment and future projections grows sharper. The multifamily market continues to work through historic amounts of new apartment supply as the end of peak leasing season approaches, and rent growth could remain below average through the end of this year. At the same time, cap rate estimates suggest higher investor demand moving forward, particularly when factoring in a more favorable debt environment, and persistent housing demand is expected to support a more active and competitive apartment market as the amount of newly-built apartments diminishes through the end of 2024 and into 2025.

Multifamily, the Nation, and the Economy

Cloudy Skies for Multifamily, Demographics Point to Long-Term Favorability

Via Fannie Mae: “The size of the nation’s age 20-34-year-old cohort is expected to remain elevated over the longer-term forecast. That is a very favorable trend for the multifamily sector in terms of ongoing demand, since this is the group of people most likely to rent a multifamily unit. Many multifamily investors are aware of this trend and continue to show interest in the sector.”

- Harris and Trump Agree On Lowering Housing Costs — But Their Plans Take Radically Different Paths (Bisnow)

- RealPage lawyer denies collusion with landlords to raise rents, ‘open to solutions’ to resolve DOJ lawsuit (USA Today)

- Distress: Not Widespread Yet But on the Rise (GlobeSt)

- Powell at Jackson Hole: ‘The time has come’ for the Fed to soon begin reducing interest rates (Associated Press)

Multifamily and the Housing Market

Homes Sales Are Down, So Why No Recession?

Via CoreLogic: “The housing market stands in sharp contrast to many other facets of the U.S. economy, and this relationship is counter to historical patterns. In 2023, U.S. unemployment remained at or below 4%, wages increased by 4%, and total U.S. GDP was up 2.5%.”

- Lower Mortgage Rates Nudge Up Buyer Demand While Potential Sellers Sit Tight (Institutional Property Advisors)

- The Movement for Improving and Expanding Home Repair Programs Enters a New Era (Harvard Joint Center for Housing Studies)

- Build Times for Single-Family Homes Continue to Trend Upward (NAHB)

Multifamily Markets and Reports

Top Markets for Rental Activity

RentCafe: “Millennials are already on pace to own fewer homes than previous generations, and with Gen Z approaching their home buying years in a historically unaffordable market, alternative measures like this one provide a well-rounded perspective on the current and future state of homeownership.”

- August 2024 National Rent Report: “[T]he busy season is officially over.” (Apartment List)

- Nearly One-Third of All Apartment Renter Households are Starting Out Singles (RealPage)

- Home prices hit record high in June on S&P Case-Shiller Index (CNBC)

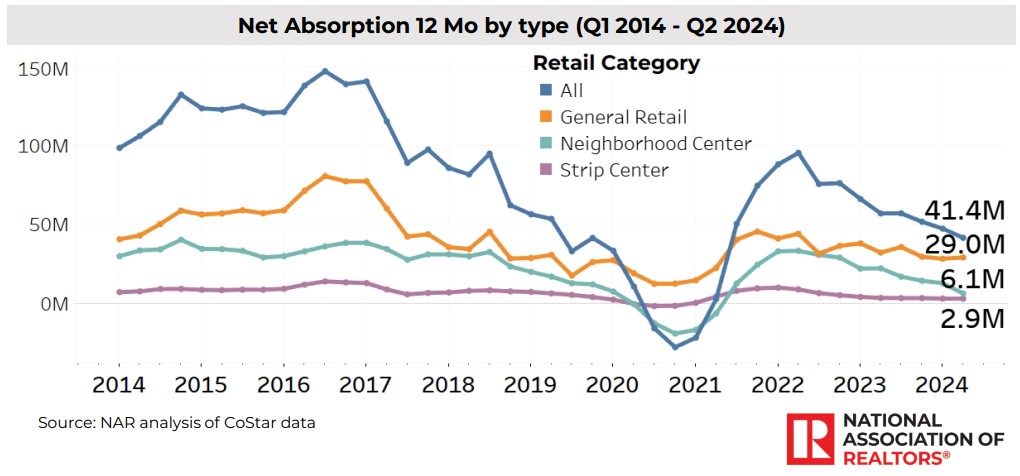

Commercial Real Estate and the Macro Economy

National Office Report, August 2024

Via Yardi Matrix: “Office-using sectors of the labor market combined to lose 25,000 workers in the month of July. Most of the losses were concentrated in the information sector, which lost 20,000 jobs in the month.”

- Top-Tier Office Effective Rents Rise as Concessions Fall in H1 2024 (CBRE)

- Q2 2024 Leading Office Markets Snapshot (Colliers)

- A $557 Billion Drop in Office Values Eclipses a Revival of Cities (Bloomberg)

Other Real Estate News and Reports

Q3 2024 Self Storage Report: Demand Poised to Improve Following Inflation-Induced Tempering

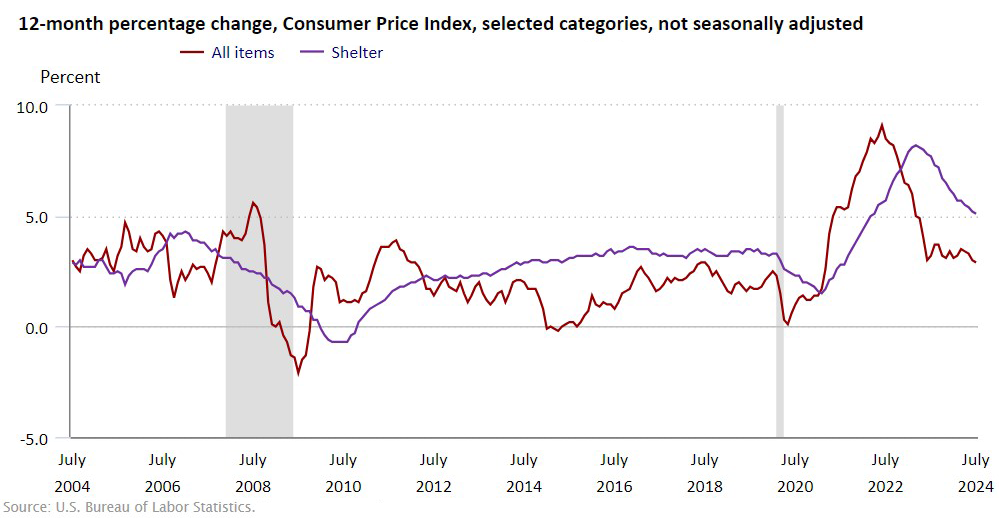

Via Marcus & Millichap: “The demand outlook for self-storage continues to rise as easing inflation pressures have allowed household formation to accelerate. After CPI increased nearly 9 percent year-over-year in June of 2022, the pace of household formation slowed by half and apartment absorption turned negative.”

- August 2024 National Industrial Report: Near-term Demand Tempers, But Outlook Stays Positive (Yardi Matrix)

- Construction Insights: “[C]osts have decreased from peak 2021-2022 levels,” but labor constraints remain (Cushman & Wakefield)

- Data Analysis: Rising CRE Exposure May Spur Bank Mergers (Florida Atlantic University)