Gray Report Newsletter: August 15, 2024

CPI Breakthrough Bolsters CRE Investor Confidence

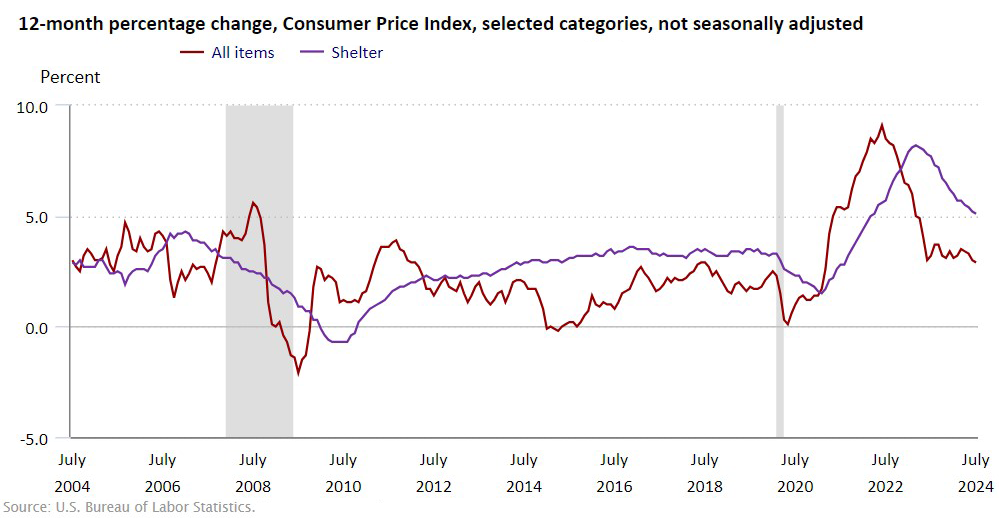

The Consumer Price Index recorded inflation at 2.9% year-over-year, the lowest amount since March 2021, which continues the long progress of decreasing inflation that many CRE investors are linking to a potential interest rate cut from the Federal Reserve in September. While recent stock market volatility brought about strident calls for relief from the Fed, longer-term trends like the steadily lower yields for Ten-Year Treasuries since May, consistently lower inflation numbers since March, and a slowing labor market are equally if not more persuasive indicators that an interest rate reduction would be appropriate. CRE sales remain subdued, but there are growing signs that investors are tracking similar trends and expect a more favorable environment for investment in the coming months.

Multifamily, the Nation, and the Economy

July 2024 CPI: Inflation Under 3% for the First Time in over 3 Years

Via Bureau of Labor Statistics: “Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment. The index for shelter rose 0.4 percent in July, accounting for nearly 90 percent of the monthly increase in the all items index.”

- DOJ is lowering the antitrust bar to go after RealPage, economist says (Legal Dive)

- Is a Weaker Economy Good News for CRE? (Marcus & Millichap)

- Office Loans Are Toxic, but Apartment Loans Are in Bad Shape Too (The Wall Street Journal)

Multifamily and the Housing Market

Multifamily Capital Markets Report: Surging Demand from Renters and Investors

Newmark: “Quarterly demand totaled 161,707 units in the second quarter of 2024, representing a 102.0% year-over-year surge . . . Sales volume rose to $38.8 billion in the second quarter of 2024, representing a 20.4% year-over-year increase in volume as a flurry of portfolio and entity-level transactions closed throughout the quarter.”

- Midyear Real Estate Forecast Reveals Major Change for Homebuyers (Realtor.com)

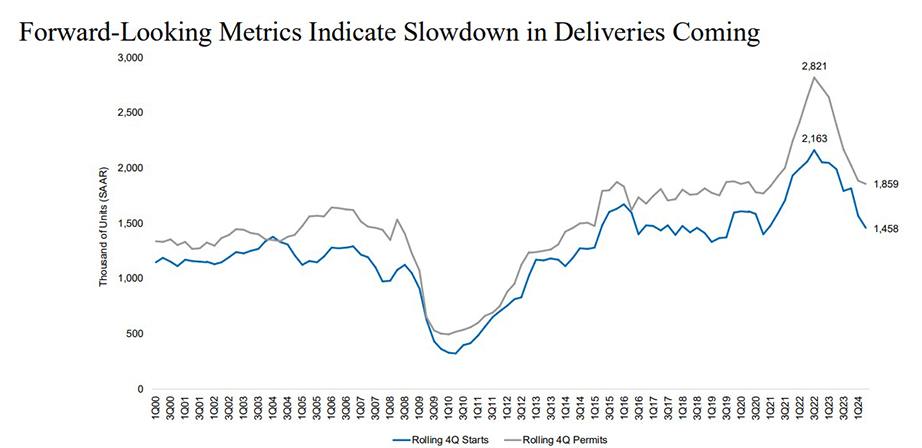

- Single-Family Permit Increase Moderates in June 2024 (NAHB)

- Kamala Harris’ Plans to Shake-up Housing Market (Newsweek)

- New Survey Captures a Surge in Renters Planning to Move (GlobeSt)

Multifamily Markets and Reports

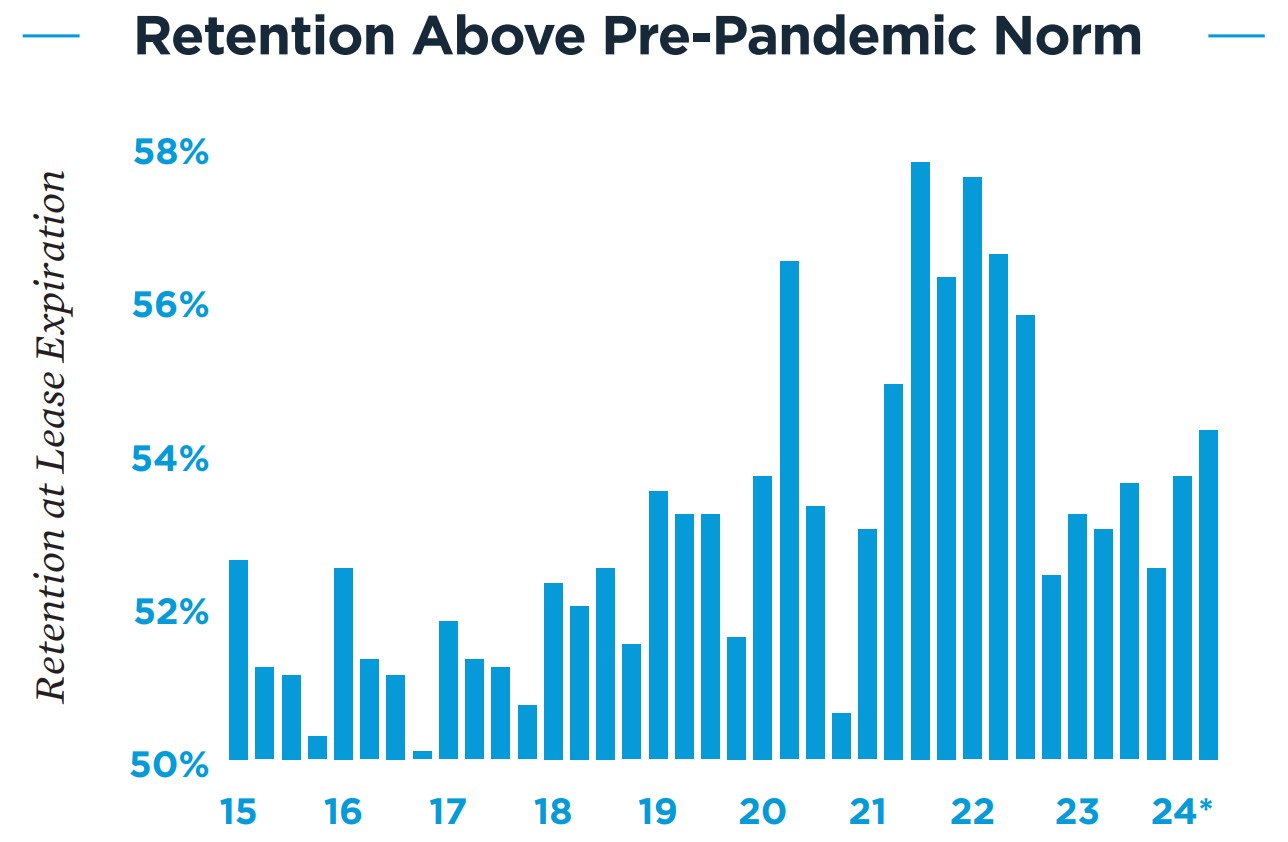

“Amid new supply pressure, renewal leasing sustaining rent gains.”

Via Institutional Property Advisors: “Among renters with leases that expired in 2024’s first half, 54.0 percent stayed and signed renewal lease agreements. This is a little above the 2015-2019 average of 52.2 percent.”

- Accessory Dwelling Units Gain Traction But Do Little to Help Housing Crisis (John Burns Research and Consulting)

- Renters Struggle with Competing Costs of Food, Energy, and Housing (Harvard Joint Center for Housing Studies)

- Multifamily Players Wait To Exhale As Clock Ticks Down On Expected Rate Cut (Bisnow)

Commercial Real Estate and the Macro Economy

Via MSCI: “A preliminary look at our global commercial-property price indexes (CPPI) suggests that as the declines in deal volume have moderated, so too has the retreat in prices. Price drops were still being seen in major markets worldwide in the second quarter, but fewer markets are experiencing an acceleration of these declines.”

- United States Office Market Overview: Decelerating Declines, but Challenges Remain (Newmark)

- Q2 2024 Office Market Outlook: Increased Leasing Activity, but “Metrics remained soft” (Colliers)

- Interest Rates Trend Lower, Paving Way for Invigorated Commercial Property Investment (Institutional Property Advisors)

Other Real Estate News and Reports

CRE in Q2 2024: Multifamily Momentum While Other Sectors Are “On Hold”

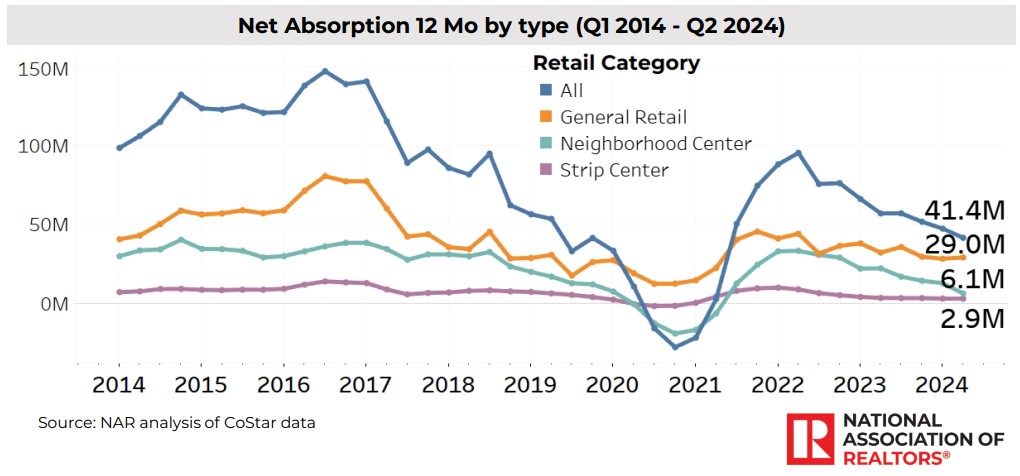

Via NAR: Alongside a 148% annual increase in multifamily demand, this overview of CRE markets describes a particularly tight retail market in which “only 4.7% of retail space is currently available for lease, marking the lowest level on record.”

- Office Occupier Sentiment Survey: one-third of respondents want more in-office attendance. (CBRE)

- Market Meltdown Leads to a Spike in Refinancings (Moody’s Analytics)

- Special Servicing Rate Reaches Higher in July 2024, Led by Office Surge (Trepp)