Gray Report Newsletter: August 1, 2024

Fed Rate Cut “On the Table” Next Month, Clear Path for Multifamily Rebound

Federal Reserve Chair Jerome Powell has opened the door to potential reductions in the Federal Funds rate in September, even though the Federal Reserve decided to keep rates steady at present. In the multifamily market, rents growth continues to be sluggish, but growing signs of apartment demand support the long-term health of the sector.

Multifamily, the Nation, and the Economy

Multifamily Turns a Corner with Consistent Trend of Higher Demand

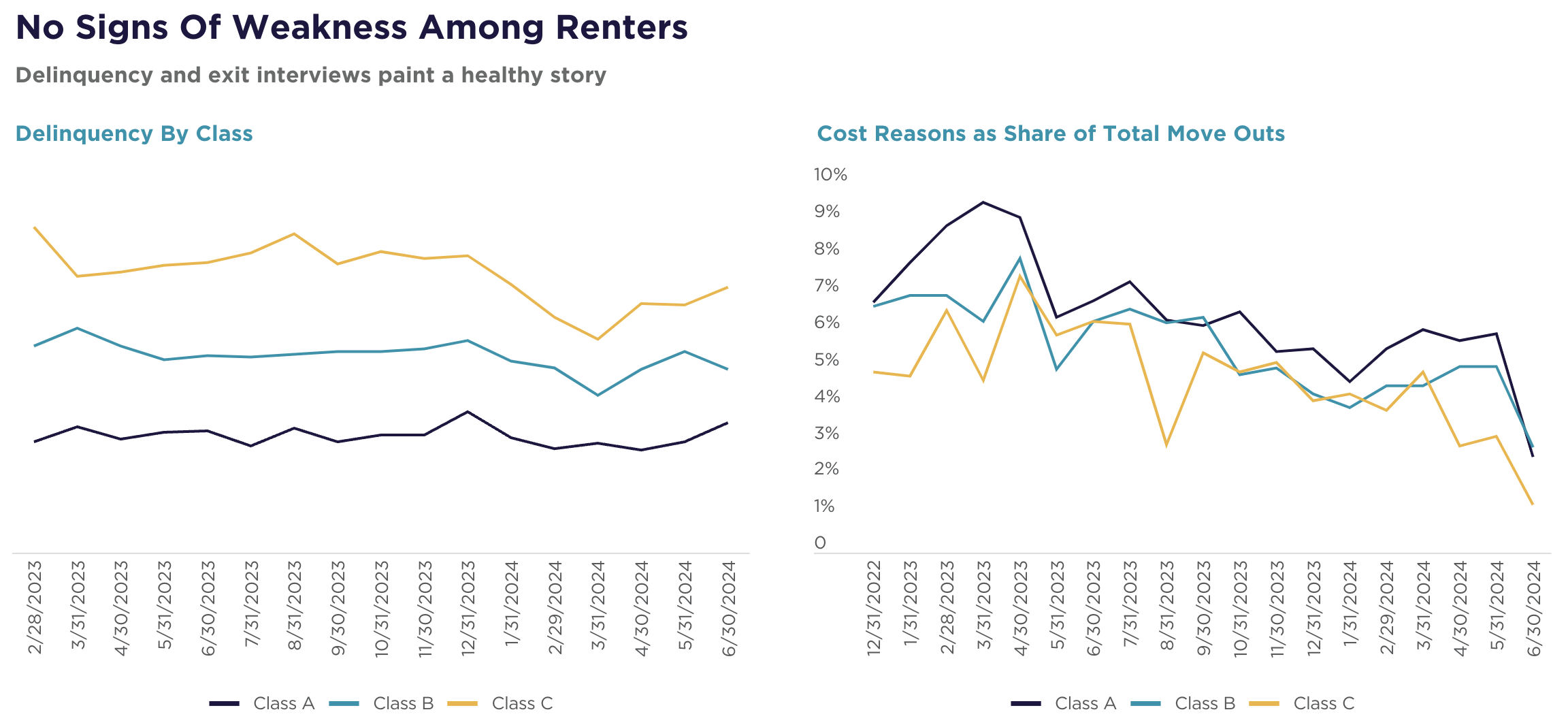

Via Cushman & Wakefield: “Within our portfolio, we see little indication that our residents are struggling to pay rent. Delinquency is down year-over-year (YOY) across all classes, and though we can’t share overall levels, it is safe to say it is hovering around pre-pandemic norms.”

- H1 2024 Cap Rate Survey: Most Respondents Believe That Cap Rates Have Peaked (CBRE)

- As Fed Rate Hopes Shift, So Too Does Real-Estate Sentiment (MSCI)

- Will Commercial Real Estate Distress Surge? (Marcus & Millichap)

Multifamily and the Housing Market

Lowest Homeownership Rate for Younger Householders in Four Years

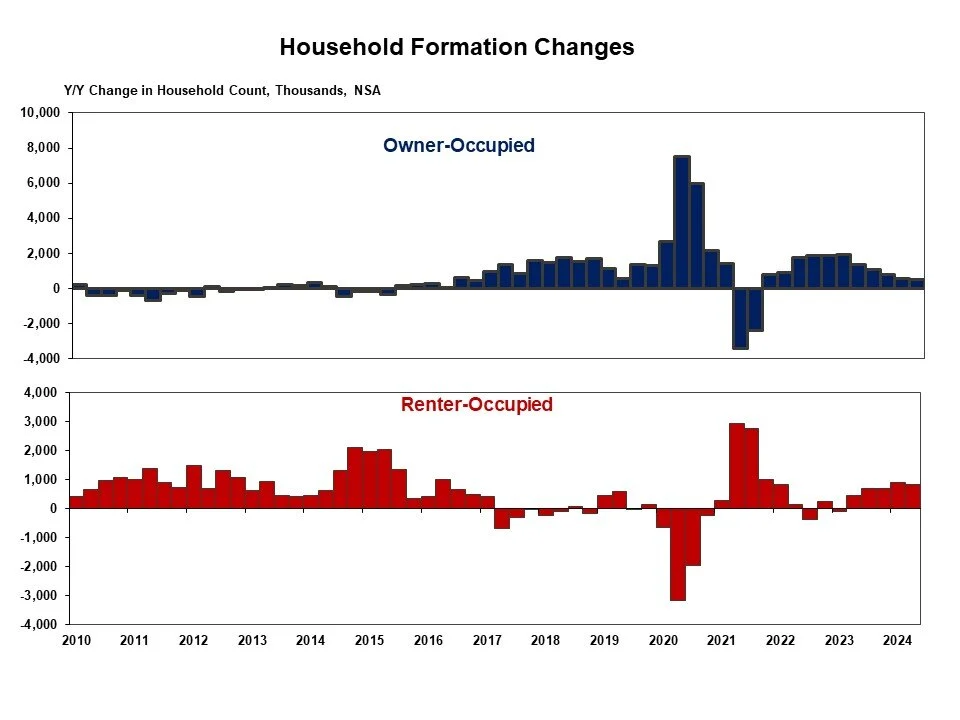

NAHB: “The homeownership rate for the head of households (householders) under the age of 35 decreased to 37.4% in the second quarter of 2024. Amidst elevated mortgage interest rates and tight housing supply, affordability is declining for first-time homebuyers.”

- How does Gen Z feel about homeownership (John Burns Research and Consulting)

- What Effects Will the Recent Surge in Immigration Have on Household Growth? (Harvard Joint Center for Housing Studies)

- More young adults now live with their parents than at any point since 1940 (Apartment List)

Multifamily Markets and Reports

July 2024 Rent Report: “sluggish, supply-rich rental market” persists

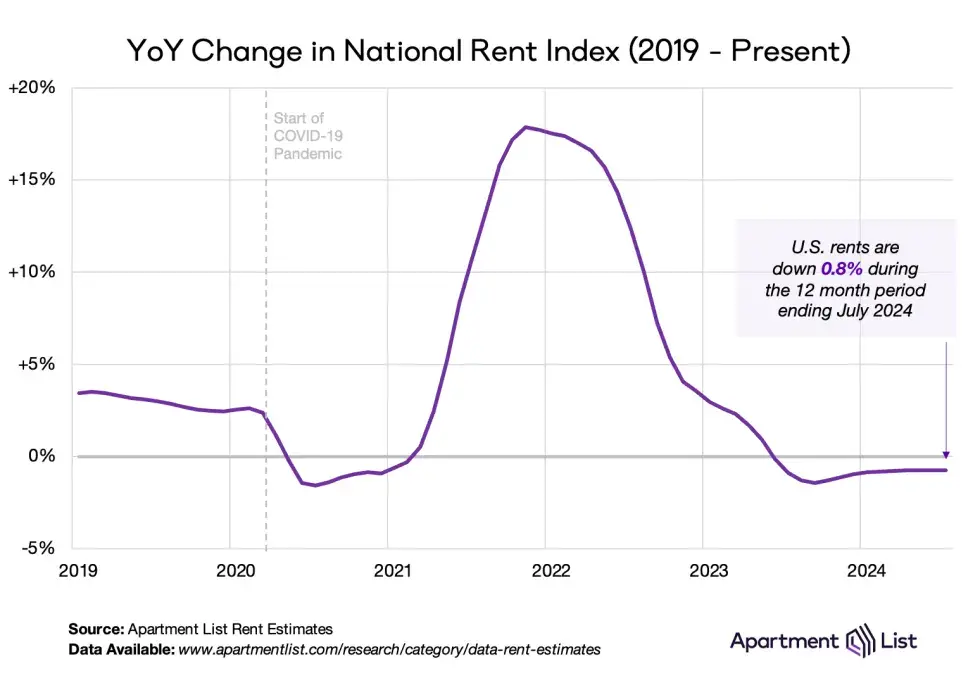

Via Apartment List: “In both 2023 and 2024, peak monthly rent growth occurred in March, two months earlier than in pre-pandemic years. Since March, rent growth has slowly decelerated, reflecting the sluggish, supply-rich rental market that has persisted since late-2022.”

- HUD Multifamily/Healthcare Lending Volume Remained Lackluster in Latest Quarter (Trepp)

- Quarterly Survey of Apartment Conditions, July 2024 (NMHC)

- Revisiting Apartment Market Forecast Profiles from 2024 (RealPage)

Commercial Real Estate and the Macro Economy

Office Market Statistics | Q2 2024

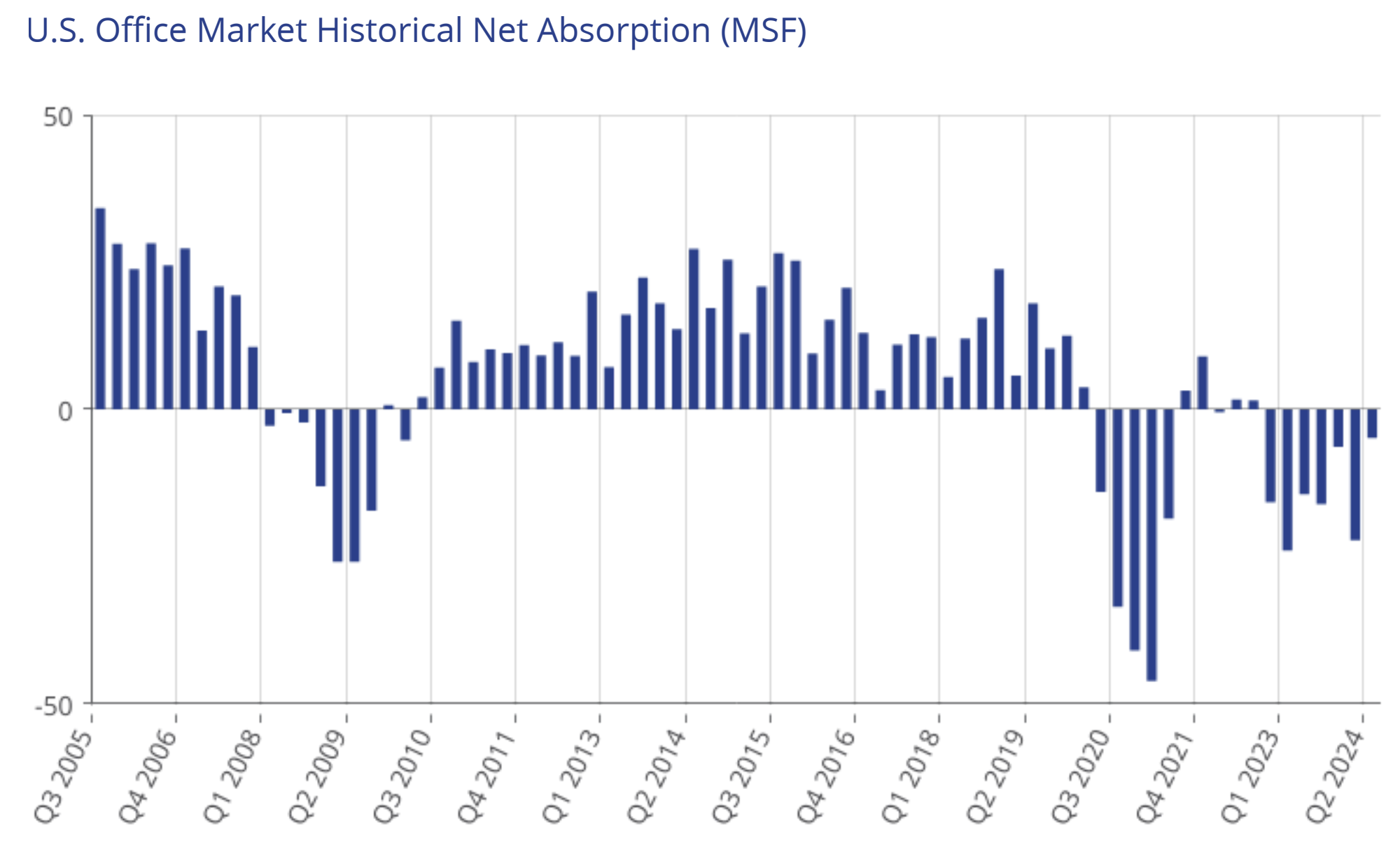

Via Colliers: “The U.S. office market continued to experience the post-Covid slowdown that started in 2020. Fundamentals remained soft, new construction starts stopped in most cases, and concession packages were at an all-time high.”

- Data on Global Real Estate Market Size (MSCI)

- Fed Chair Powell says September interest rate cut could be ‘on the table’ as inflation cools (AP)

- “Don’t Overlook the Upside Surprises in CRE Demand This Quarter” (Cushman & Wakefield)

Other Real Estate News and Reports

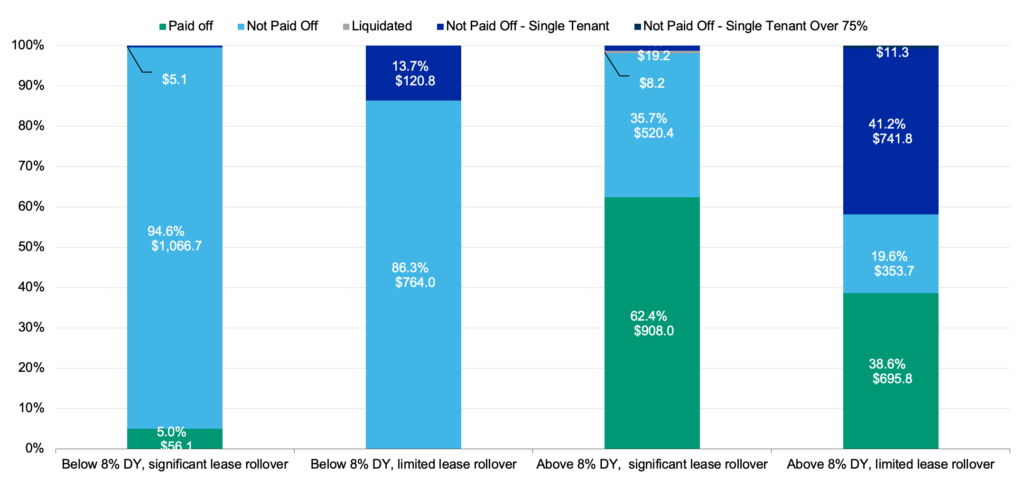

Office Loan Maturity Monitor: Mid-Year Update and a Peek at Future Maturities

Via Moody’s Analytics: “As we pass the halfway mark of 2024, it is easy to generalize that 2024 is just a repeat of 2023. The year-to-date (YTD) payoff rate currently sits at 31.5%, while 2023 finished at 35.9%. Not only that, but of all the loans that have matured so far in 2024, 29.1% were either modified or extended, mirroring 2023’s 29.4%.”

- Blackstone Reportedly In Talks To Acquire $2B Retail REIT (Bisnow)

- KKR Sees 2024 As ‘Sweet Spot’ for Real Estate Investing (CoStar)

- Surge in Commercial-Property Foreclosures Suggests Bottom Is Near (The Wall Street Journal)