Gray Report Newsletter: April 11, 2024

CPI Runs Hot and Multifamily Re-Ignites

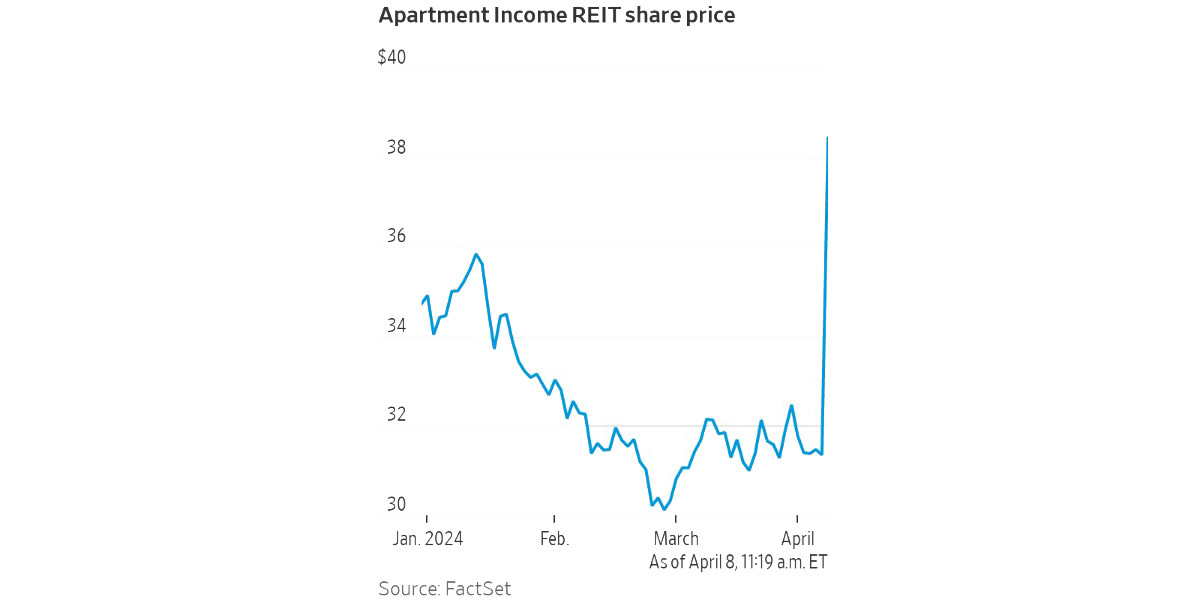

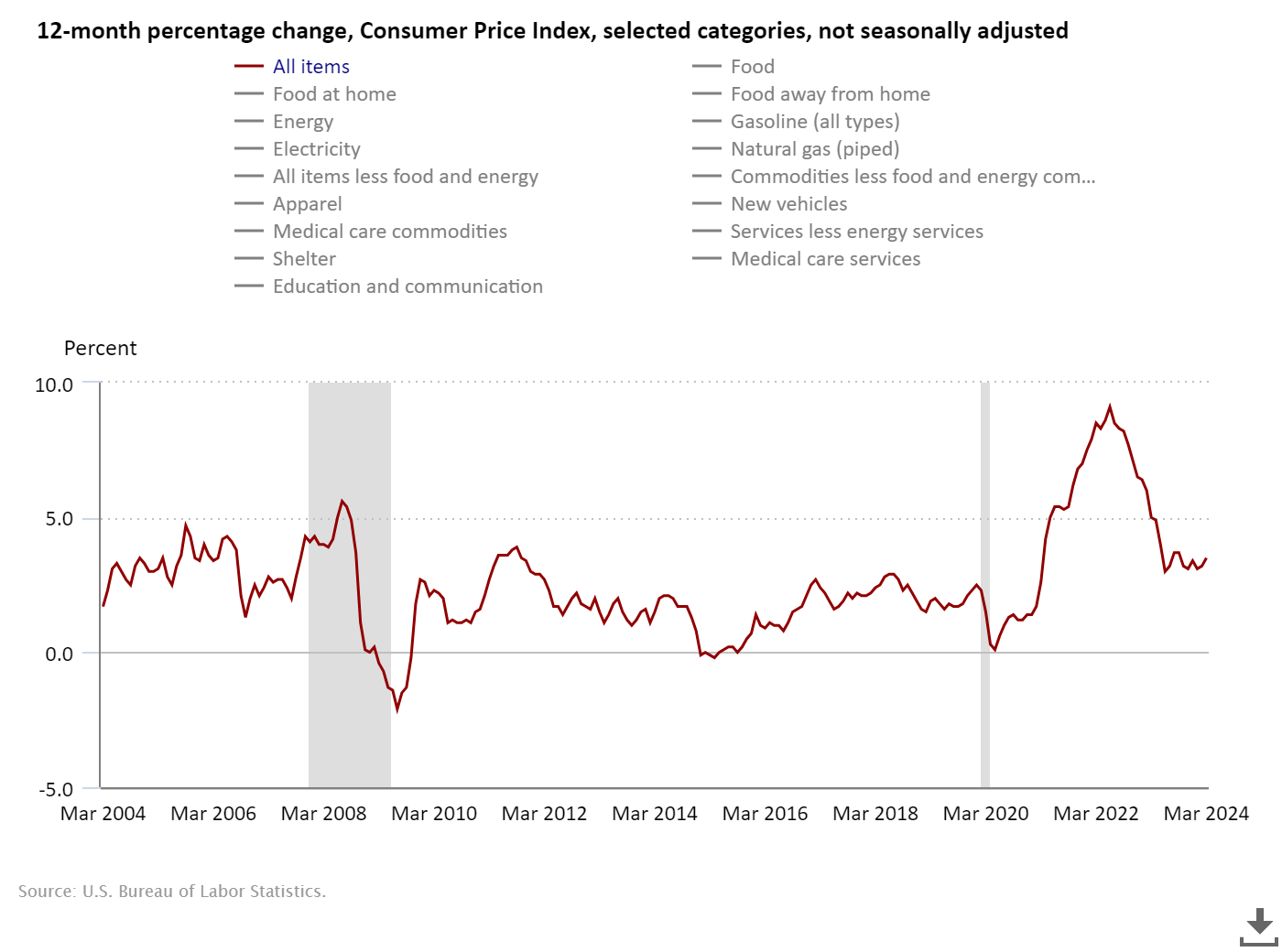

A 3.5% annual jump in CPI inflation numbers has led investors and experts to rethink their expectations of an interest rate cut in mid-year 2024, but Blackstone’s recent agreement to acquire Apartment Income REIT Corp. for $10 billion could spark greater investment activity in spite of elevated interest rates, especially given the improving fundamentals in the apartment market.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

Blackstone Making $10 Billion Multifamily Purchase, Going on the Real Estate Offensive

Via The Wall Street Journal: “Blackstone has agreed to acquire an owner of upscale apartment buildings for about $10 billion, signaling that one of the world’s largest real-estate investors is ramping up investments again after a period of moving more cautiously. “

- RealPage Slightly Strengthens Forecast in Most Apartment Markets Based on Economic Indicators (RealPage)

- Rent CPI remains elevated even as rents for new leases dip (Apartment List)

- CMBS Issuance During 1Q Skyrockets as Spreads Tighten (Trepp)

Multifamily and the Housing Market

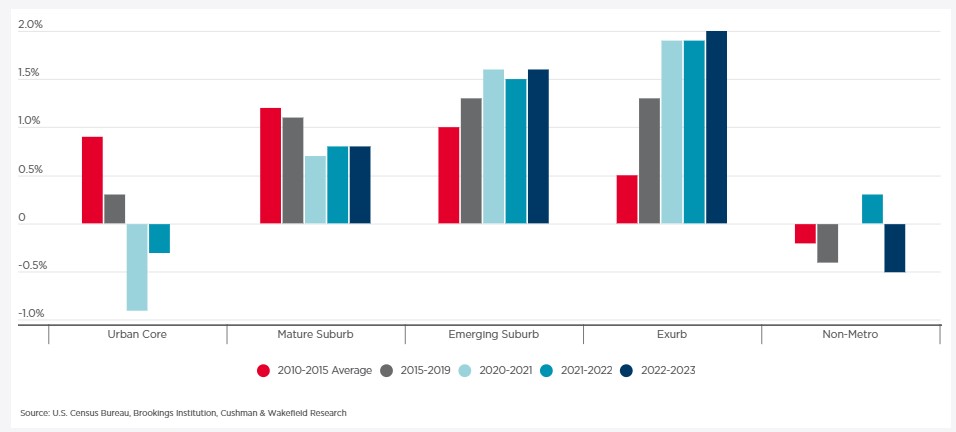

Census Data Breakdown: Where is population growing the most?

Cushman & Wakefield: “Unsurprisingly, every major market (population over 1 million) that grew by more than 1% in the U.S. was in the Sun Belt. However, for the first time in 12 years, Austin, Texas, no longer leads the nation in population growth on a percentage basis. The top market is Jacksonville, Florida, which grew at 2.2%—up from 1.5% a year ago and rank fourth at the time.”

- Immigration Fuels Largest 1-Year Population Increase in US History (John Burns Research and Consulting)

- Households May Finally Be Adjusting to Higher Mortgage Rates (Fannie Mae)

- Housing Snapshot: “[M]ost housing indicators suggesting a promising outlook for the remainder of the year.” (NAR)

Multifamily Markets and Reports

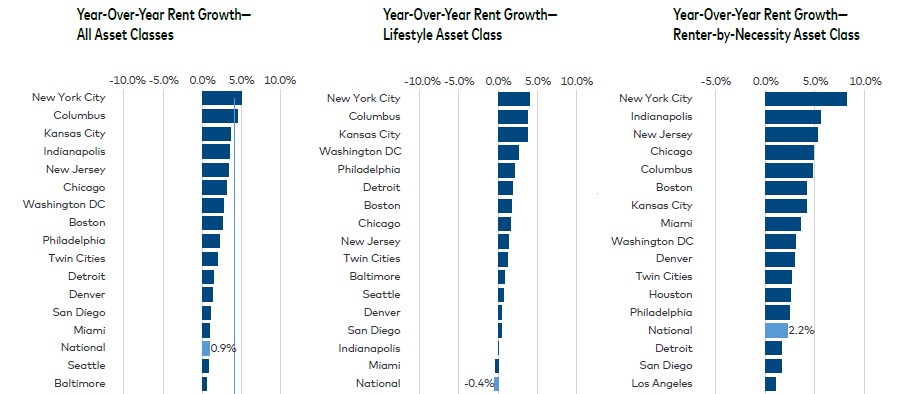

March 2024 Multifamily Report: Market Sets Strong Early Tone in 2024

Yardi Matrix: The multifamily market produced solid rent gains in March, its strongest performance in 20 months. The market appears to be settling into normal seasonal patterns, as demand is holding up despite challenges posed by the economy and heavy supply growth in the Sun Belt.

- Study: These Metro Areas Are Most at Risk for Pricing Corrections (Florida Atlantic University)

- As Back-Half of Pre-Lease Season Begins, Student Housing Occupancy Stays Strong (RealPage)

- A Look at Investor Activity Versus Home Price Appreciation: 2019 – 2023 (CoreLogic)

Commercial Real Estate and the Macro Economy

March Consumer Price Index: 3.5% Year-over-Year Price Increase

Via Bureau of Labor Statistics: “The index for shelter rose in March, as did the index for gasoline. Combined, these two indexes contributed over half of the monthly increase in the index for all items. The energy index rose 1.1 percent over the month. The food index rose 0.1 percent in March.”

- How Aging Baby Boomers Could Impact CRE (Marcus & Millichap)

- A Unique Opportunity for Trophy Office Development (CBRE)

- Early Signs Point to Improving Office Sector; Investment Trends Begin to Reflect Changes (Marcus & Millichap)

Other Real Estate News and Reports

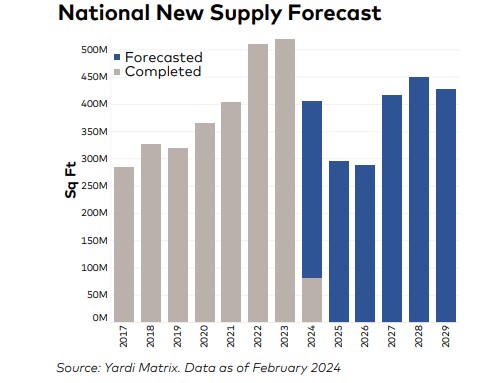

March 2024 National Industrial Report

Via Yardi Matrix: “National in-place rents for industrial space averaged $7.68 per square foot in February, a decrease of four cents from January but up 7.5% year-over-year.”

- Why more companies are opening office doors to dogs (JLL)

- GenAI and CRE Lending – Data Centers (Moody’s Analytics)

- Waiting for the End of Extend-and-Pretend (GlobeSt)