Gray Report Newsletter: May 4, 2023

The Federal Reserve increased the Federal Funds rate by 25 BPS, breaking the 5% barrier in a rate hike that was largely anticipated by the markets, but with comments by Fed Chair Powell indicating a pause in interest rate increases, the next meeting of the Federal Reserve could be a significant indicator of the Fed’s path going forward. As the FOMC anticipates economic decline, the multifamily market continues to see positive rent growth in the Northeast and Midwest, but growth has been slower in many previously-strong markets in the Sunbelt and West.

Multifamily, the Nation, and the Economy

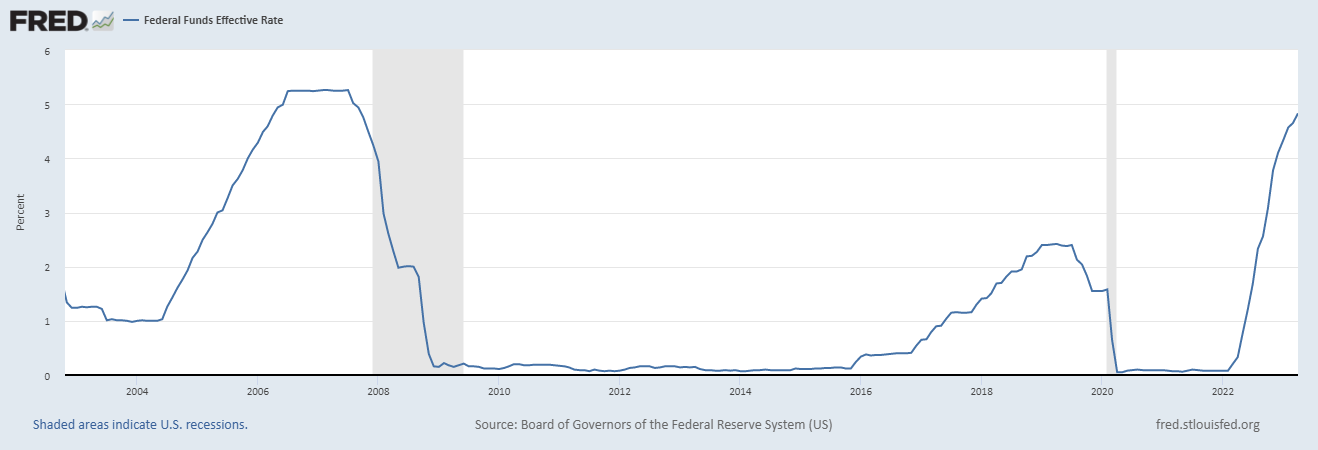

Federal Reserve pushes interest rates above 5% for first time since 2007

Via Yahoo Finance: A quick glance at the Federal Funds rate (above) over the past 30 years shows that rates above 5% aren’t unprecedented, but the speed of our current rate hike regime has clearly surpassed previous increases in this period.

- Apartment Operational Expenses Soar (RealPage)

- With Soaring Cost of Interest Rate Hedges, Property Owners May Soon Get a New Reason to Sell (The Wall Street Journal)

- Multifamily Fundamentals Are Beginning to Stabilize (GlobeSt)

Multifamily and the Housing Market

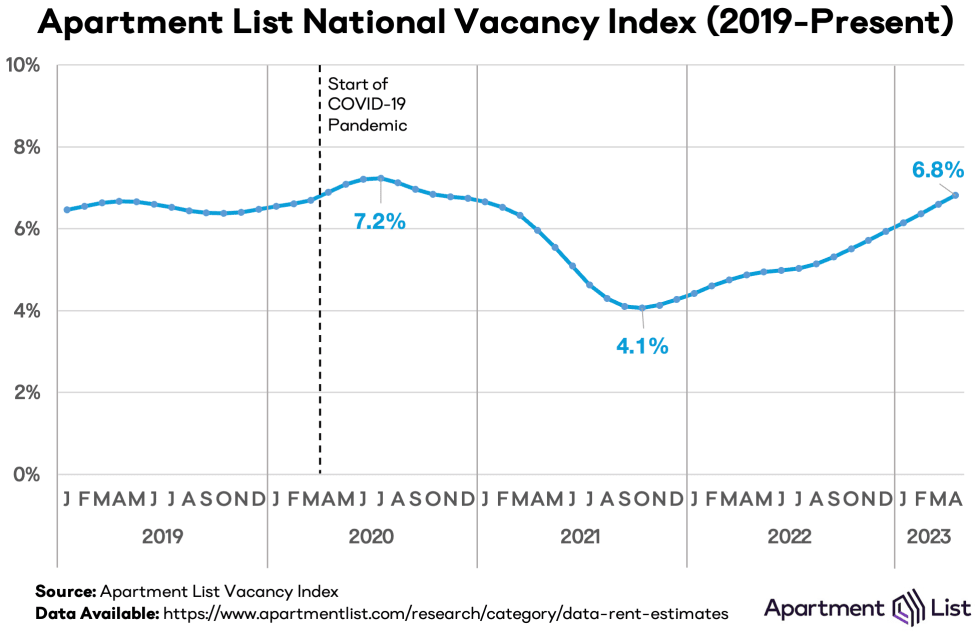

National Rent Report, April 2023

Via Apartment List: This month’s increase was also less than the typical April price change that we saw in pre-pandemic years. Even though prices are trending up again, a combination of sluggish demand and increasing supply is keeping rent growth in check.

- Institutional Ownership of Single-Family Rentals is Growing, but their Activity is Quite Sensitive to Market Conditions (Moody’s Analytics)

- Housing Policy: Is the Live Local Act A Solution for the Missing Middle? (JBREC)

- New Household Formation from 2020-2022 Spurred The Biggest Year For Multifamily Development In 36 Years (Bisnow)

Multifamily Markets and Reports

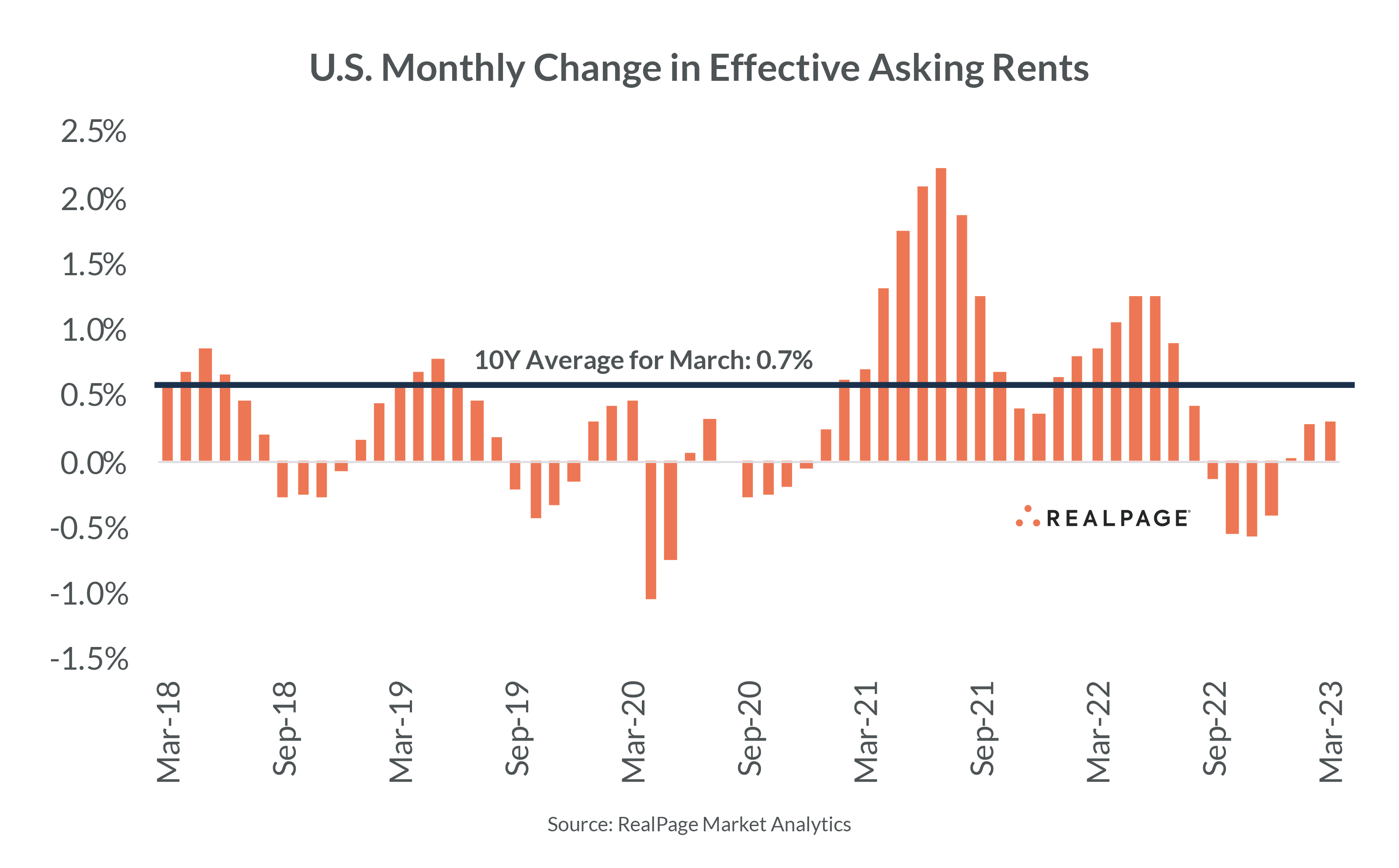

Reframing 1st Quarter’s Performance with Historical Perspective

Via RealPage: “It seems then that the 1st quarter results come down to a matter of perspective. An optimist may suggest that any positive movement should be seen as a win, while a pessimist can equally point towards relative underperformance in the 1st quarter stats.”

- As the Rental Market Cools, These Cities Are Cheaper Today than One Year Ago (Apartment List)

- Q1 Multifamily Forecast: 2.6% Rent Growth by Year End (Yardi Matrix)

- Pressure Is On For Property Managers Tasked With Challenge Of Maintaining Profits (Bisnow)

Commercial Real Estate and the Macro Economy

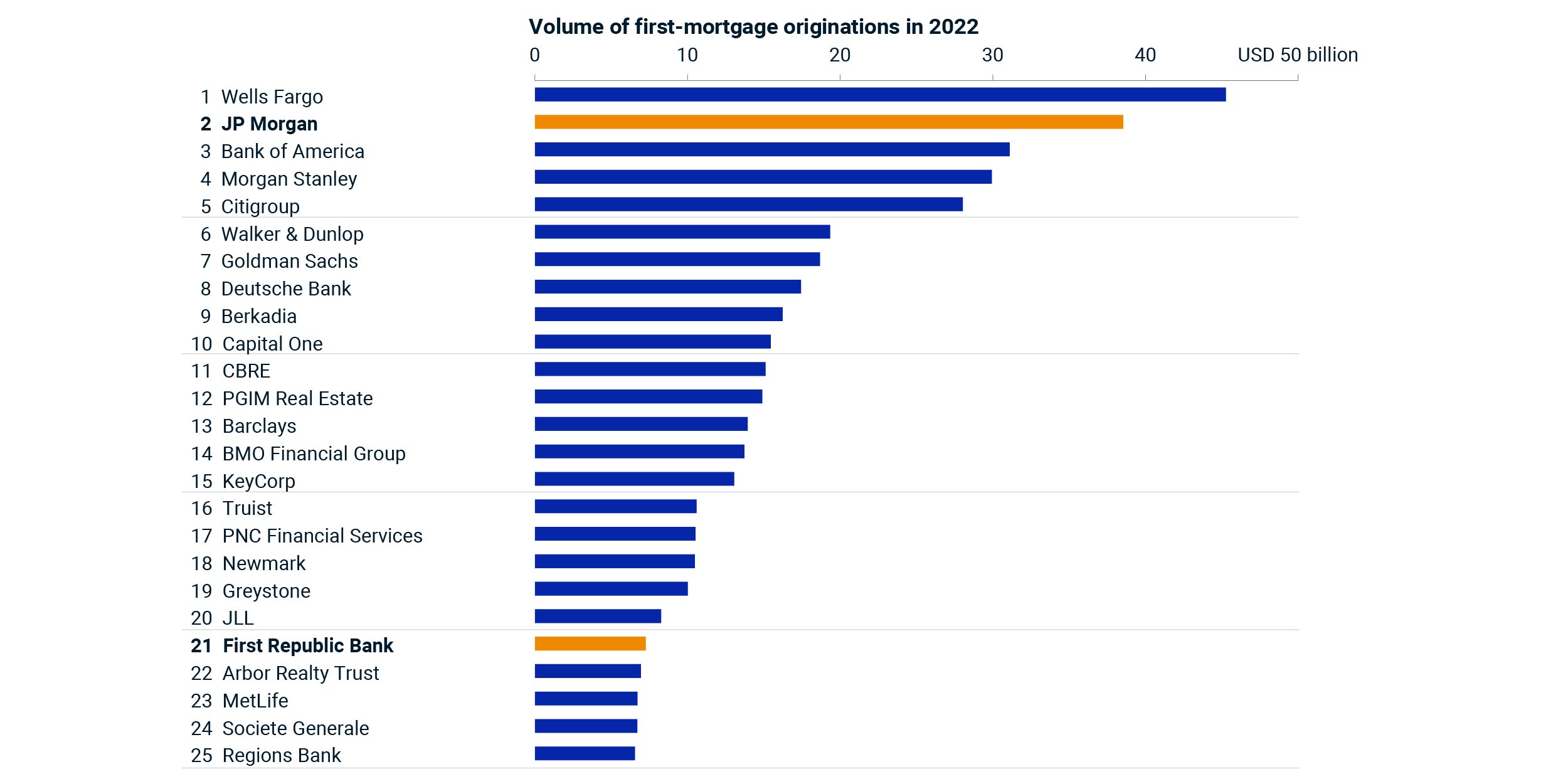

The Pool of US Commercial-Property Lenders Shrank (Again)

Via MSCI: “If one is shopping around for a loan and 20 lenders are competing for your business, the likelihood is you will get better rates and terms than if you have only, say, five lenders looking to work with you. The scale of the latest consolidation is not that extreme; nonetheless, remove First Republic — at #21 on our list of the top 25 loan originators for 2022 — and it points to a further thinning of the lender herd.”

- Report: April 2023 Commercial Real Estate Markets (NAR)

- Chart of the Week: CRE Fundamentals Still Matter (CBRE)

- Examining the CRE Perception Gap (Marcus & Millichap)

Other Real Estate News and Reports

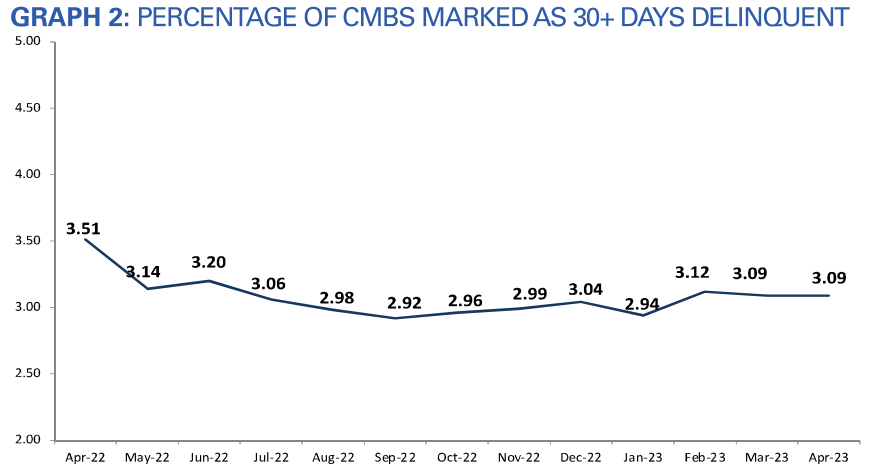

April 2023 CMBS Delinquency Report

Via Trepp: While multifamily, retail, and hotel delinquencies declined, office delinquencies increased and remain “the most heavily watched part of the market as firms look aggressively to reduce space.”

- 2023 midyear commercial real estate outlook (JP Morgan Chase)

- ULI Forecast Shows Economic and Real Estate Slowdown Likely in Near Term with Recovery Expected in 2025 (Urban Land Institute)

- Fire Sale: $300 Million San Francisco Office Tower, Mostly Empty. Open to Offers. (The Wall Street Journal)