Gray Report Newsletter: May 11, 2023

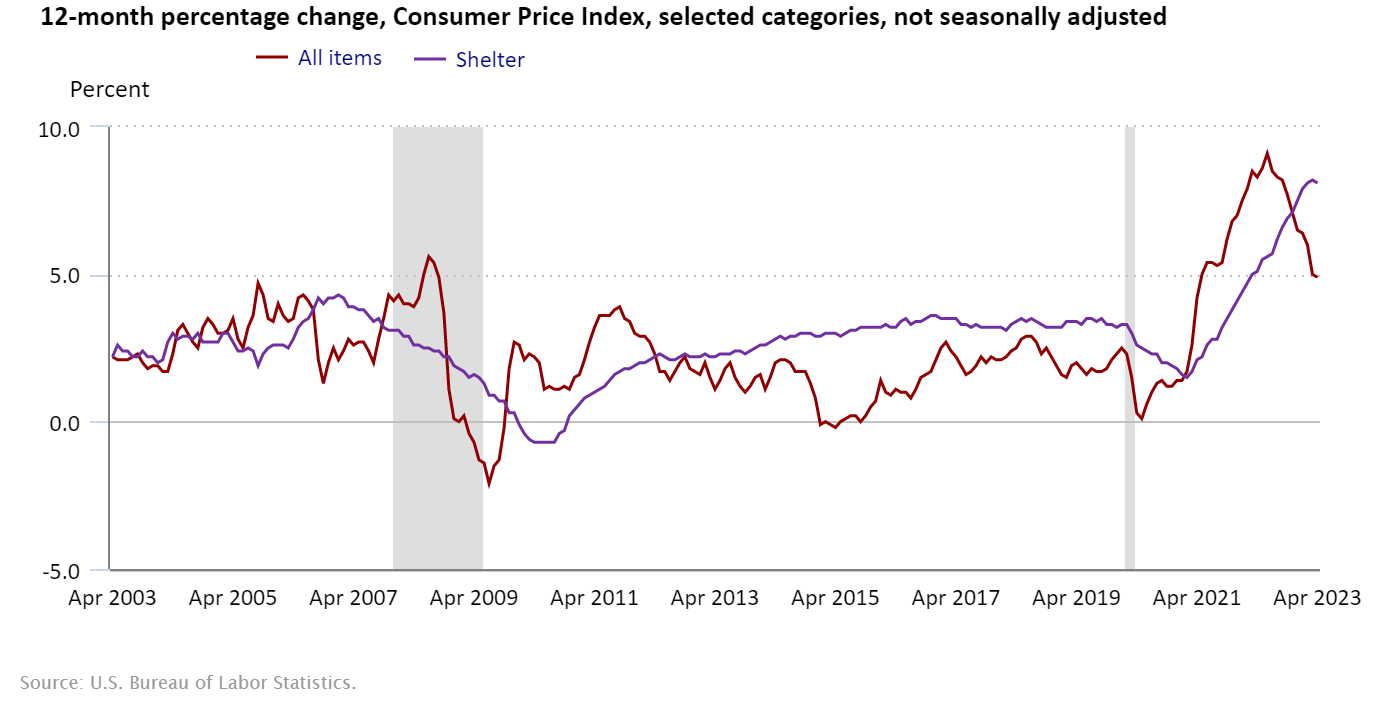

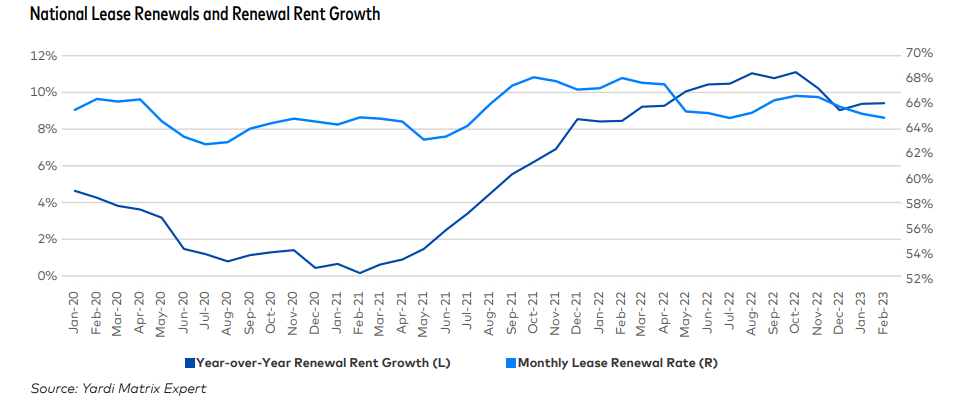

New rent growth data cements a robust positive trend, with four consecutive months of increasing monthly rent growth. Rents in Q1 were still recovering from the cooldown in the apartment market in late 2022, but we are in clear positive territory now, and Q2 rent growth could easily exceed pre-pandemic averages if current trends continue. On the other hand, the rent growth measured in the Consumer Price Index, (0.6% month-over-month and 8.8% year-over-year), continues to misrepresent the current state of the market and are a large part of the high year-over-year inflation number (4.9%) and the elevated monthly inflation (0.4%, up from 0.1% the previous month).

Multifamily, the Nation, and the Economy

Consumer Price Index, April 2023

Via Bureau of Labor Statistics: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in April on a seasonally adjusted basis, after increasing 0.1 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 4.9 percent before seasonal adjustment.

- Storm Clouds Gather As Apartment Owners With Floating Rate Debt Scramble To Pay Loans (Bisnow)

- Paper: Real Estate Private Equity’s Poor Performance Linked to Lower Scalability, Investor-Base Interested in Lower Volatility (SSRN)

- Financial Stability Report, April 2023: “CRE valuations remained high” (The Federal Reserve)

Multifamily and the Housing Market

National Multifamily Report, April 2023

Via Yardi Matrix: Multifamily rent gains remain positive year-over year everywhere but the Desert West metros Phoenix and Las Vegas, and while there is a rotation among the top-performing markets, Indianapolis continues to lead for year-over-year rent growth.

- Home Prices Fell in Third of the U.S. During First Quarter (The Wall Street Journal)

- Housing Confidence Rises amid Greater Optimism about Mortgage Rates (Fannie Mae)

- Has the Economy Locked in US Housing Market Price Stagnation? (CoreLogic)

Multifamily Markets and Reports

2Q 2023 Multifamily National Report

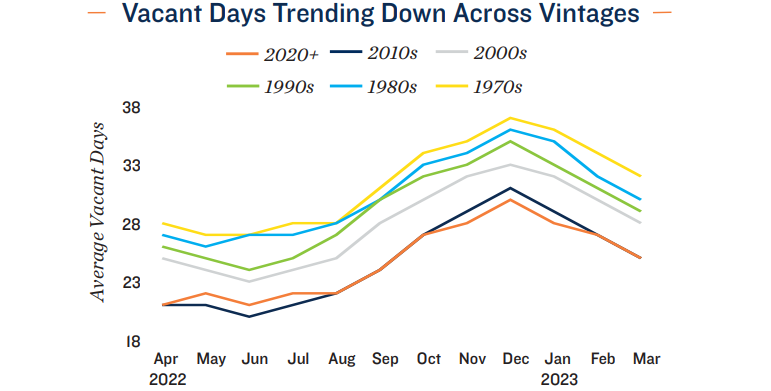

Via Marcus & Millichap: “Immense new supply over the remainder of this year will keep vacancy on an upward path near-term, while also lifting the average rent as new high-quality units come online. The potential for supply overhangs in select markets with large pipelines is likely, yet population and housing dynamics indicate that these deliveries are necessary longer-term.”

- Landlords Ask Supreme Court To Rule Rent Stabilization Unconstitutional (Bisnow)

- CoStar: Multifamily May Outperform Expectations in Q2 (GlobeSt)

- HUD Sees ‘Massive Drop’ In Multifamily Deal Volume, Slowing Housing Production (Bisnow)

Commercial Real Estate and the Macro Economy

April 2023 Commercial Real Estate Market Insights

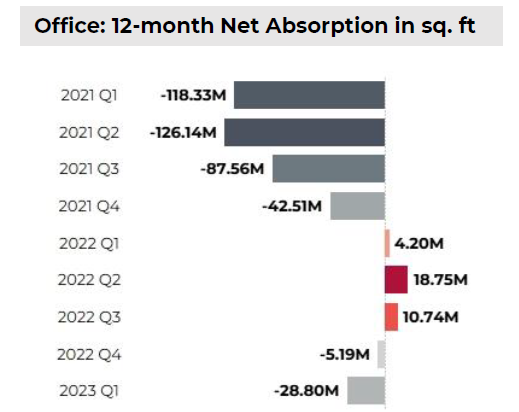

Via NAR: Continued troubling office performance (see graph above) contrasts with a resilient retail market and steadfast, strong performance in the industrial sector.

- April’s Jobs Report a Positive for Real Estate, but Signs for Caution Ahead (Institutional Property Advisors)

- CRE Distress Rose in Majority of 50 Largest MSAs in April (Commercial Observer)

- Fed Meeting & Banking News CRE Implications (Marcus & Millichap)

Other Real Estate News and Reports

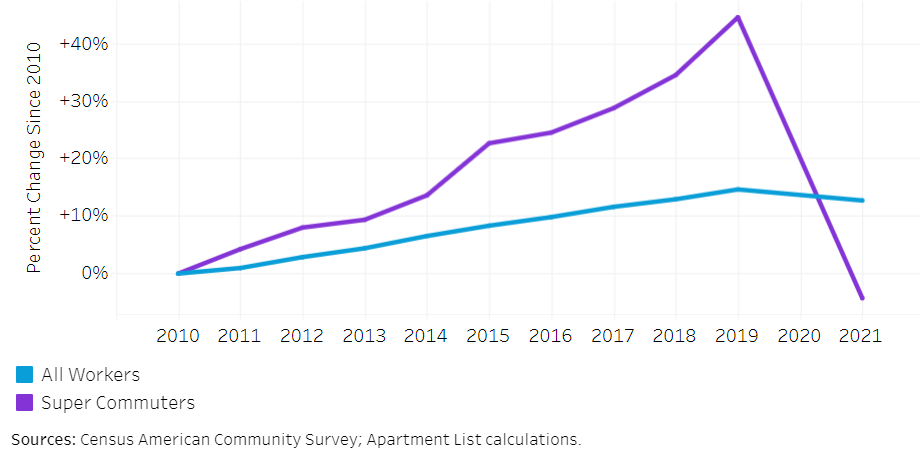

The Number of “Super Commuters” Has Fallen to the Lowest Level in Over a Decade

Via Apartment List: “This transformation in commuting patterns has an obvious source – the widespread adoption of remote work. The number of remote workers more than tripled from 2019 to 2021. In 2019, just 5.7 percent of Americans worked primarily from home, but by 2021, that share jumped to 17.9 percent.”

- Research Brief: Financial Markets and CRE (Institutional Property Advisors)

- Rates, Banking, Offices, and CMBS: A Q&A with CRE Economist Thomas LaSalvia (Moody’s Analytics)

- Bonds Backed by Apartments Are Under Stress as Housing Market Cools (The Wall Street Journal)