Gray Report Newsletter: March 30, 2023

Rising Concern about CRE Debt

Following the high profile bank crises earlier this month are worries regarding commercial real estate debt, but while multifamily investors continue to wait for distressed assets and buying opportunities that have yet to arrive in significant numbers, office properties are under greater stress, with growing concern of a crisis in the office real estate market that could contribute to a downturn in the larger economy.

Multifamily, the Nation, and the Economy

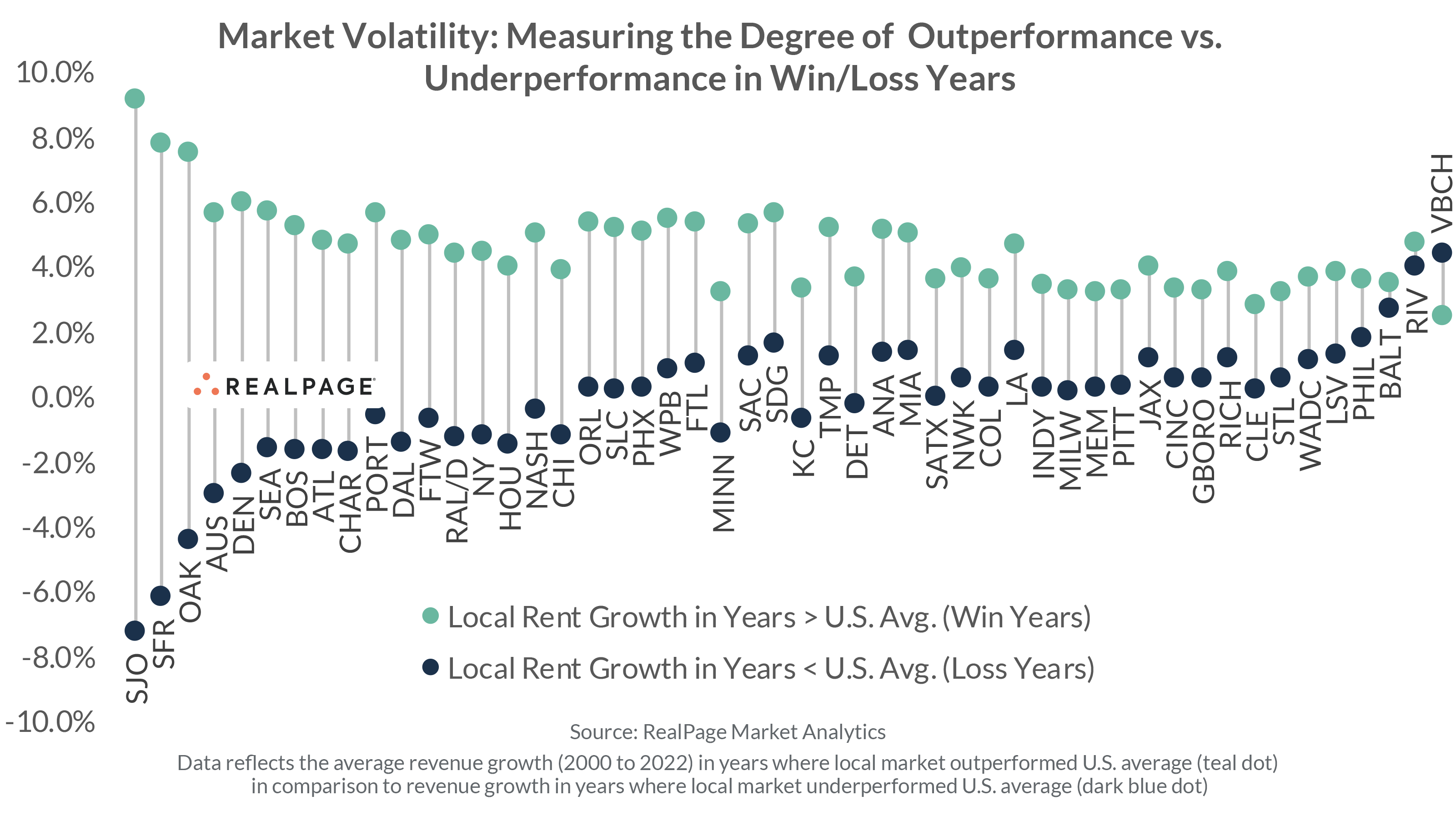

Which U.S. Apartment Markets are Low-Risk and Which are High-Reward?

Via RealPage: The uneven apartment supply and uncertain economic environment underscore the value of multifamily markets that perform well under volatile conditions.

- Commercial property risks rise up bank investors’ worry list (Financial Times)

- A Tale of Two Housing Markets: Prices Fall in the West While the East Booms (The Wall Street Journal)

- Research Brief: Scarcity of Starter Homes is Keeping Prices Afloat and Sustaining Barriers (Institutional Property Advisors)

Multifamily and the Housing Market

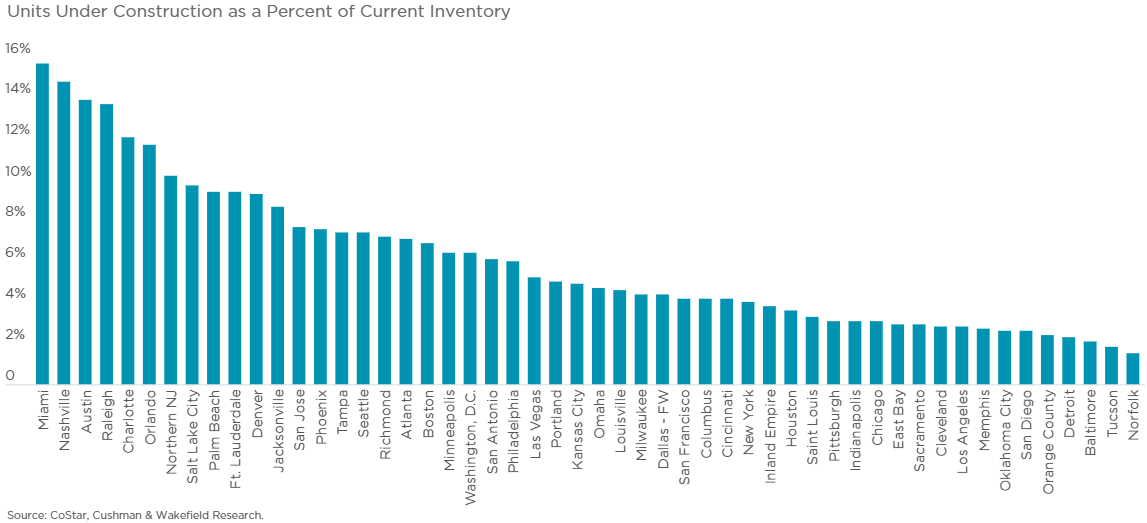

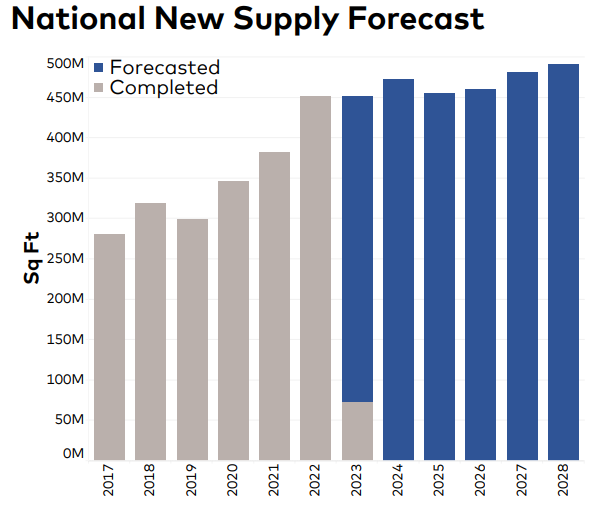

Report: Multifamily Construction Risks, Trends, and Forecasts

Via Cushman & Wakefield: “Sun Belt favorites, like Nashville and Charlotte, as well as Denver will face mounting supply-side pressure on fundamentals in the coming years, whereas markets like Indianapolis, Sacramento and Cleveland have much smaller construction waves.”

- Market Conditions for Multifamily Construction Begin to Improve, Though Costs and Delays Remain Significant (NMHC)

- Generational Trends in Home Buyers and Sellers (NAR)

- Housing Sentiment Uptick in the First Quarter of 2023 (Freddie Mac)

- A recession will determine the direction of the housing market. (Realtor.com)

Multifamily Markets and Reports

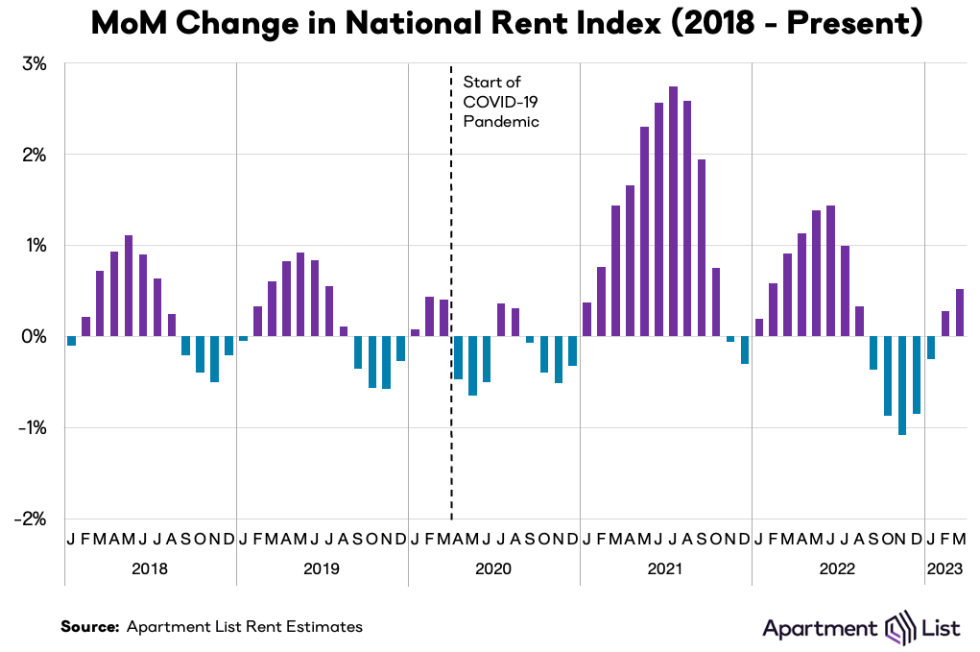

Via Apartment List: “This month’s data suggests that we’re beginning to see a mild rebound in rental demand, following a particularly slow off-season to close out 2022. That said, the surging rent growth that we saw in 2021 and the first half of last year is solidly behind us.”

- National Rent Report, March 2023 (Zumper)

- Supply-Rich Sunbelt Apartment Markets Face Headwinds (PGIM Real Estate)

- Is there a link between rents and resident satisfaction in the Build-to-Rent sector? (CBRE)

- As the Rental Market Cools, These Cities Are Cheaper Today than One Year Ago (Apartment List)

Commercial Real Estate and the Macro Economy

Apartments Led Steepening Drop in US Property Prices

Via MSCI: “Apartment prices experienced the largest annual decline of all property types, falling 8.7% from a year earlier, the largest drop for this segment since 2010. Even that annual rate of decline underplays the higher-frequency change: The monthly decline of 2.7%, when annualized, would be a fall of 28.2%.”

- Credit Tightening Moves CRE to Center Stage (Moody’s Analytics)

- Report: Multifamily, Retail and Hospitality Properties Could Feel

Impact of Resuming Student Loan Repayment (Marcus & Millichap)

- Working Paper: Inflation and Asset Returns (The University of Chicago)

- The Wall Streets Sharks Circling Opportunities Amidst Bank Failures (Insider)

Other Real Estate News and Reports

National Industrial Report, March 2023

Via Yardi Matrix: “Growth of in-place rents is highest in markets adjacent to shipping ports, led by the Inland Empire (15.6% year-over-year), Los Angeles (11.6%), Boston (10.7%), Orange County (9.2%), Bridgeport (9.0%) and New Jersey (8.7%).”

- 2023 Healthcare Marketplace Report (Colliers)

- Property Climate Risk Varied Across — and Within — Markets (MSCI)

- Could commercial real estate be the next shoe to drop at regional banks? (Marketplace)