Gray Report Newsletter: June 8, 2023

CRE Loan Worries Grow

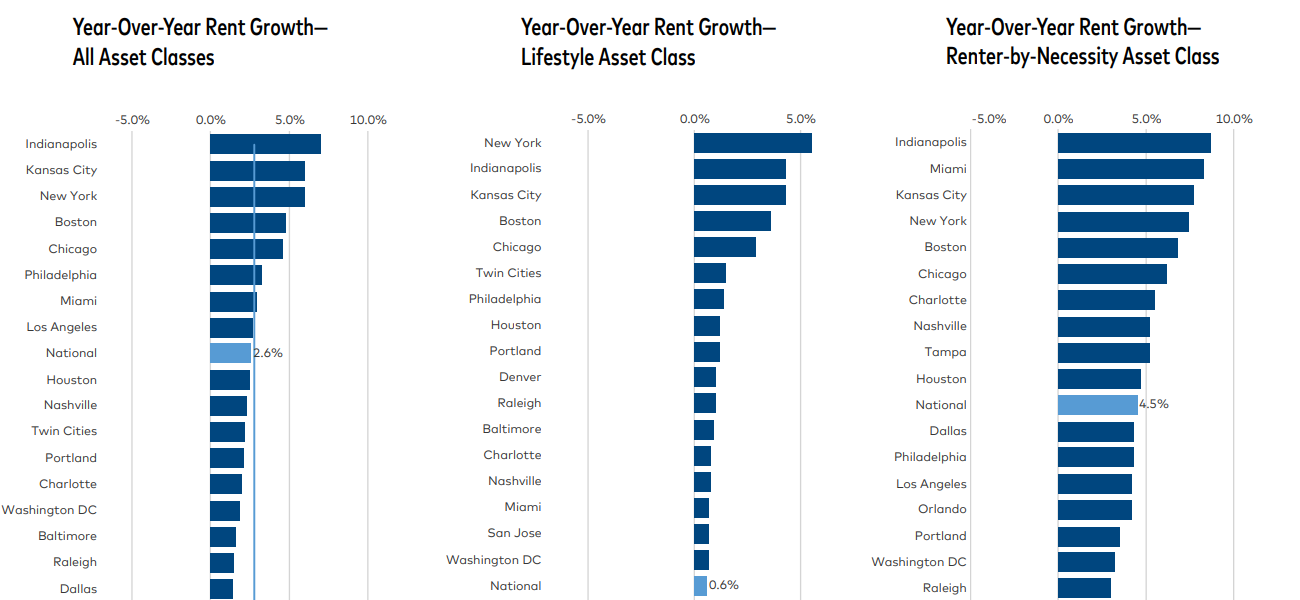

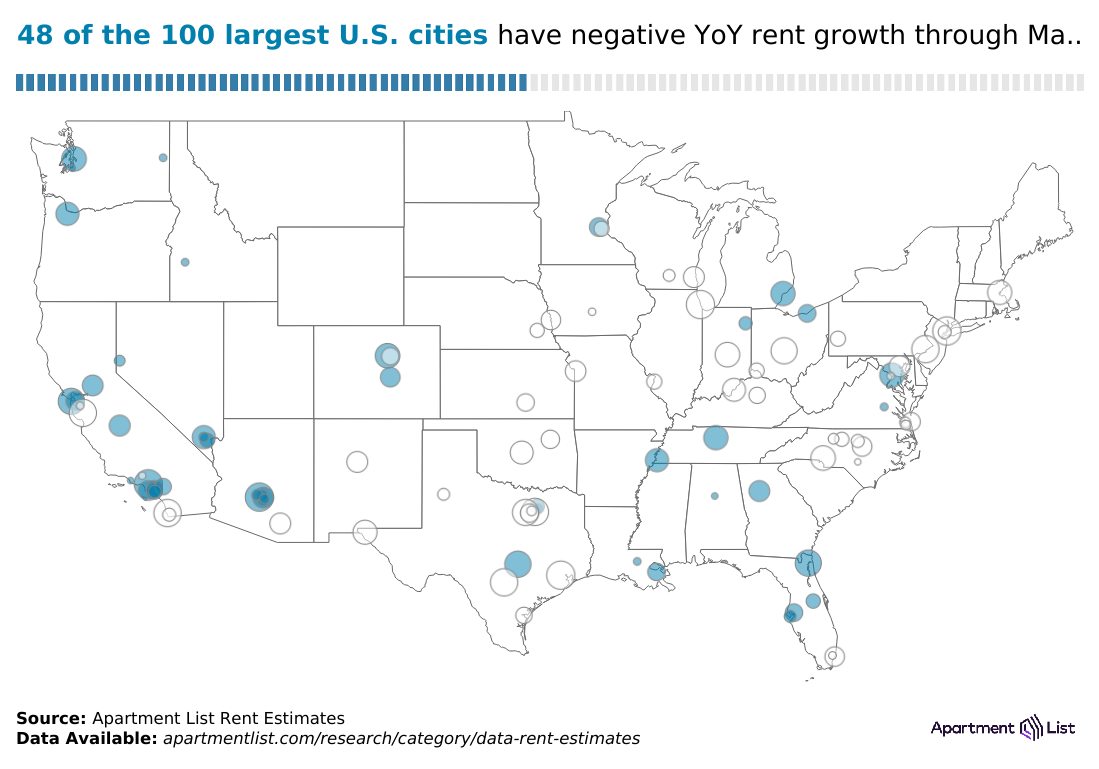

The drumbeat of coverage on commercial real estate loan trouble continues this week as strong jobs numbers fuel more uncertainty about inflation and economic strength, and while the multifamily market has shown stable rent growth, there is a high amount of regional variability. With the exception of Texas markets and the indefatigable growth of Miami, a number of Sunbelt markets have had negative rent growth, while markets in the Midwest and Northeast have much stronger rent growth as a group, especially more affordable markets with low rent-to-income ratios.

Multifamily, the Nation, and the Economy

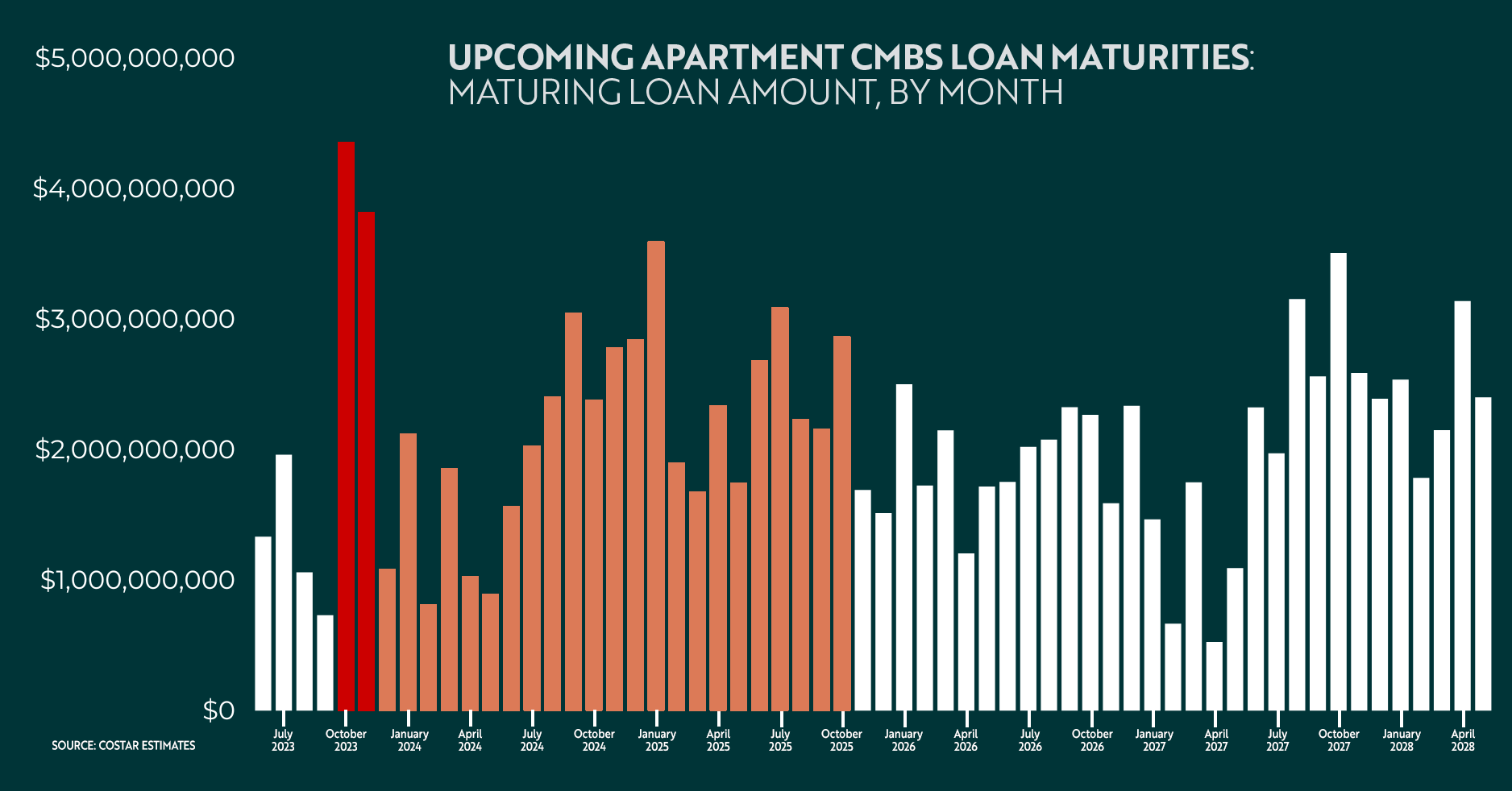

Loan Maturities and Distress in the Multifamily Market

Via Gray Capital: Gray Capital’s new report uses data on apartment sales, loan maturities, and interest rate projections to highlight Q4 of this year as a significant inflection point for apartment owners and investors.

- Labor Market Data Send Conflicting Signals as Economic Activity Generally Weakens (Fannie Mae)

- Interest-Only Loans Helped Commercial Property Boom. Now They’re Coming Due. (The Wall Street Journal)

- CRE Revenue Trends (Marcus & Millichap)

Multifamily and the Housing Market

National Multifamily Report, May 2023

Via Yardi Matrix: From the report: “While performance displays resilience, the data is not unambiguously positive as it has been for most of the last two years. Rent growth has turned negative year-over-year in several metros as occupancy rates weaken amid slackening demand and rapid growth in new deliveries.”

- Rural Single-Family Construction Stronger, Multifamily Building Strong Downtown (NAHB)

- US Home Price Insights – June 2023 (CoreLogic)

- Mortgage demand falls as lending rates remain elevated (MarketWatch)

Multifamily Markets and Reports

As the Rental Market Cools, These Cities Are Cheaper Today than One Year Ago

Via Apartment List: “As we enter 2023, some cities that saw rents skyrocket early in the pandemic are cheaper today than they were one year ago,” with much of the declining rents correlated with increased apartment supply.

- Northeast, Midwest Eclipse Sun Belt for Multifamily Rent Growth (CBRE)

- Sunbelt Construction Boom Threatens Top Apartment-Building Owners (The Wall Street Journal)

- Here Come the Long Office Loan Mods (GlobeSt)

Commercial Real Estate and the Macro Economy

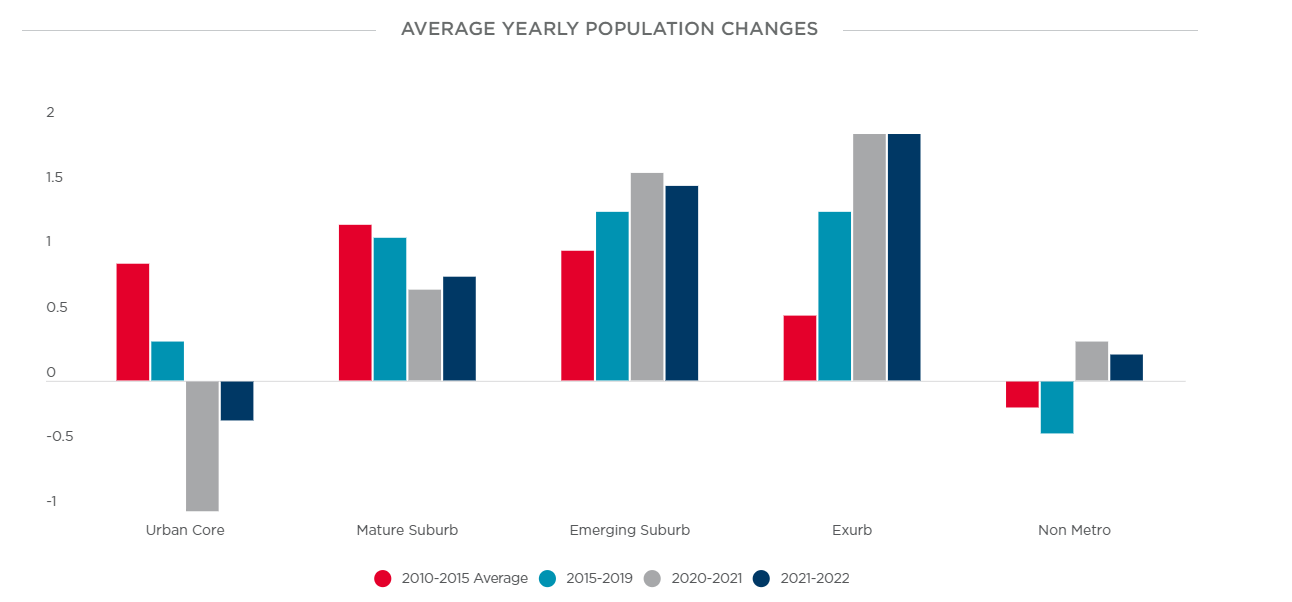

Five Fast Facts Analyzing the United States Census

Via Cushman & Wakefield: “All districts saw population gains with the exception of Urban Cores. However, with international migration making a big rebound in 2022, those counties saw the biggest change in population, stemming the tide of major population declines experienced from 2020-2021.”

- Global Retail Survey, Q1 2023 (Colliers)

- May Hiring Reflects Favorable Outlooks for Hotel and Industrial Properties (Institutional Property Advisors)

- Fed Beige Book was Surprisingly Unsurprising, but Provided Useful CRE Nuggets (Moody’s Analytics)

Other Real Estate News and Reports

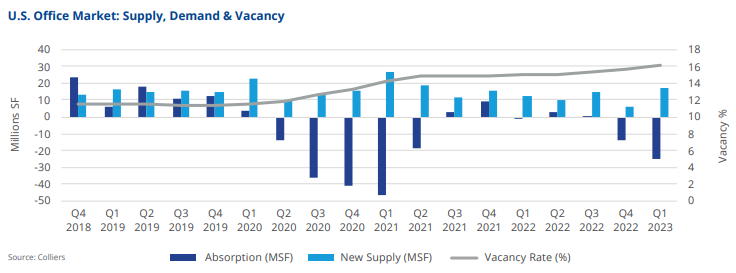

U.S. Office Outlook Report, Q1 2023

Via Colliers: “The softening in U.S. office market fundamentals accelerated in the first quarter of 2023. Occupancy losses increased, vacancy rose at a faster pace, and sublease space hit a record high.”

- The Perfect Storm: Increases in Office Subleasing and Delinquency Rates Will Not Play Well With the Growing Potential of Further Fed Tightening (Moody’s Analytics)

- Investing in commercial property: The accessible alternative to residential (CBRE)

- Looking for Loan Trouble (MSCI)