Gray Report Newsletter: June 29, 2023

A Happy Medium for Housing and the Economy?

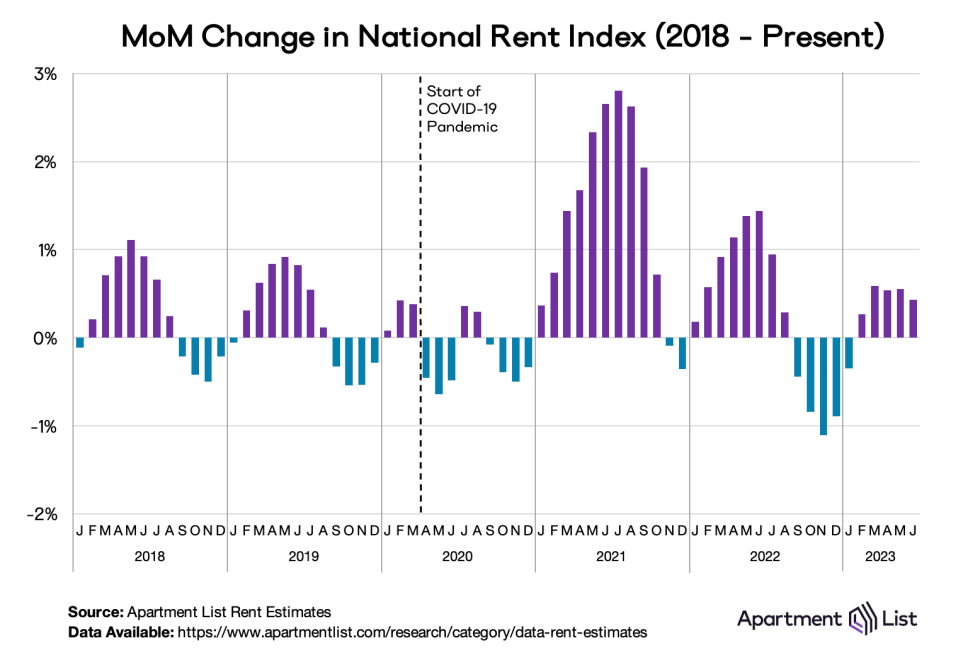

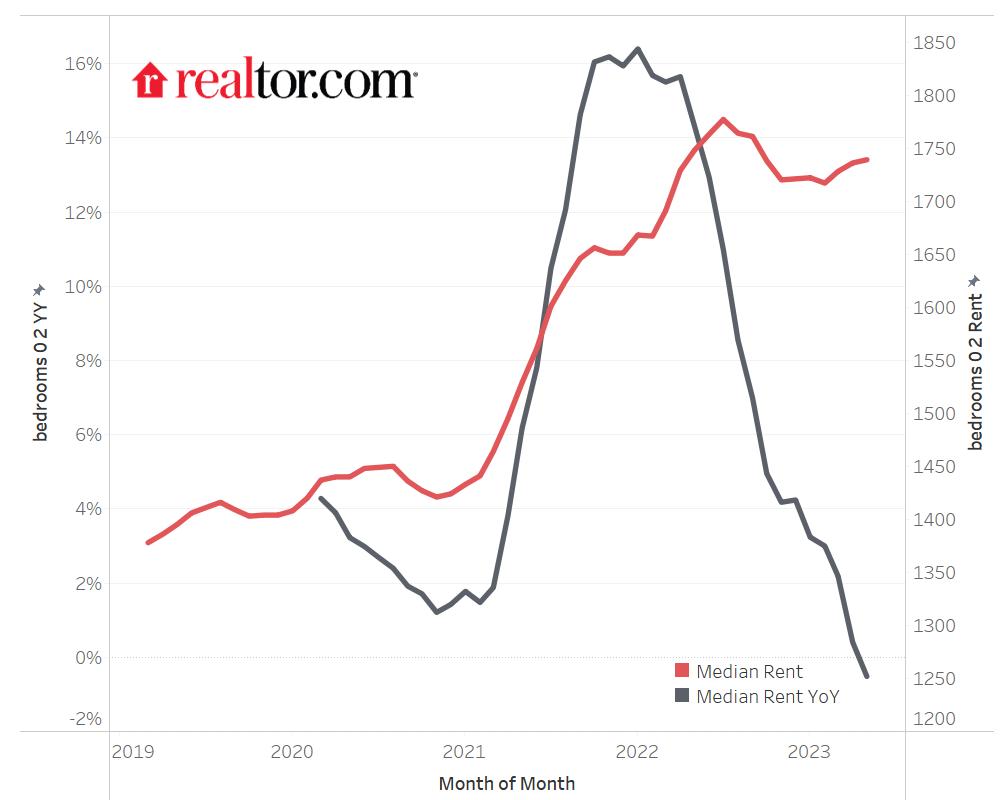

The multifamily market continues to steadily improve, with solid underlying fundamentals but softer demand in areas that have seen a major influx of supply, a situation that lines up with the mixture of positive and negative indicators for the broader housing market and for the economy as a whole. Both home prices and rents have recently shown negative year-over-year numbers, but they are increasing on a monthly basis and are showing greater strength as the summer months continue.

Multifamily, the Nation, and the Economy

Navigating Market Dislocation | U.S. Capital Markets Multifamily Report

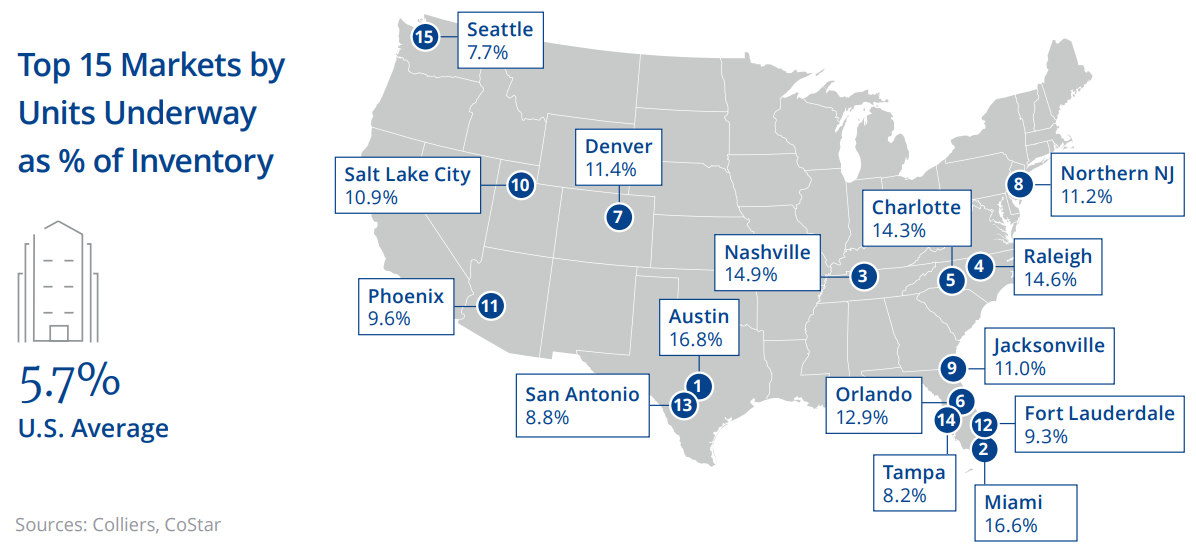

Via Colliers: This report highlights strong fundamentals and sluggish investment activity in the multifamily market while also pointing to the markets that may have more occupancy challenges due to sharply increasing apartment supply.

- Wall Of Multifamily Maturities Dead Ahead: $4B In October Alone (Bisnow)

- Rental housing could benefit from a softer for-sale market (CBRE)

- Mixed Data Muddles Macroeconomic Forecast (Fannie Mae)

Multifamily and the Housing Market

National Rent Report, June 2023

Via Apartment List: Key passage from the report: “With a record number of multi-family apartment units currently under construction, this vacancy rate will remain elevated and for the first time since the early stages of the pandemic and put pressure on property owners to find tenants, rather than the other way around.”

- US CoreLogic S&P Case-Shiller Index Posts a Small Annual Decline, Down by 0.2% in April (CoreLogic)

- Realtor’s Confidence Index (NAR)

- Rethinking the American Dream: Small Multifamily Housing Remains Popular among Immigrant Owners (Harvard JCHS)

Multifamily Markets and Reports

May 2023 Rental Report: Rents Start to Decline and the Trend is Expected to Continue

Via Realtor.com: While this report records lagging rents nationally, it includes crucial information about how different regions are performing better than others: “As the Midwest markets tend to have greater affordability, the stronger growth in these markets likely results from this benefit even as it may reduce existing affordability.”

- Airbnb Revenue Collapse: Is Housing Next? (Newsweek)

- Student Housing Supply Enters New Baseline (RealPage)

- Study: Rent Increases Stabilizing, Still Largely Unaffordable for Many (Florida Atlantic University)

Commercial Real Estate and the Macro Economy

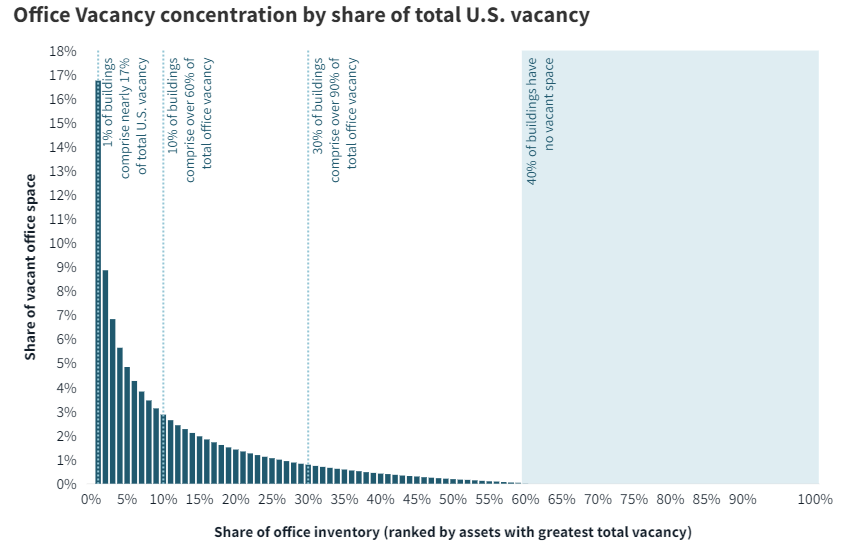

More than 60% of office vacancy concentrated in 10% of buildings

Via JLL: “Offices built in the 1980s and 1990s have been particularly impacted by the pandemic and cyclical headwinds of 2022, comprising more than 50% of the new vacancies that have emerged since 2020, despite comprising less than 40% of total office inventory.”

- REPORT: Office Values Unlikely To Recover Before 2040 (Bisnow)

- Impact of the gross imports and exports of goods on warehouse demand (CBRE)

- Artificial Intelligence: Real Estate Revolution or Evolution? (JLL)

Other Real Estate News and Reports

National Office Report, June 2023

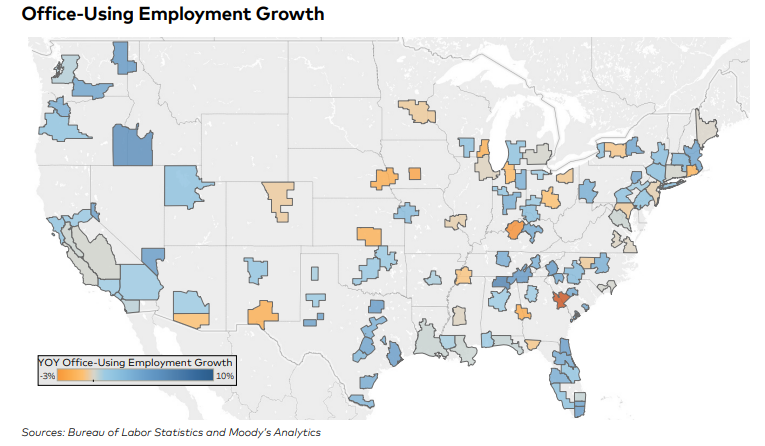

Via Yardi Matrix: This excellent report outlines the dramatic trends in the office market that are still progressing, with remote work as a persistent, powerful force such that “markets with the largest share of remote work are also those that have seen the highest spike in vacancies.”

- Why Investors Should Look Below the Surface (Marcus & Millichap)

- Getting to ‘Yes’ on Housing through ‘YIMBYism.’ (John Burns Real Estate Consulting)

- Retail National Report, 2Q 2023 (Institutional Property Advisors)