Gray Report Newsletter: June 22, 2023

Will a sinking office market bring down multifamily?

With office real estate suffering as remote working arrangements persist and drive down demand for office space, there is increasing attention on the broader impacts and knock-on effects related to the shift away from the office. Commercial real estate lenders have yet to panic, even in this environment of high interest rates and low transaction volumes, and while multifamily valuations have also suffered due to high rates, the same work-from-home factors that are hurting office CRE performance could support more consistently elevated values for residential real estate.

Multifamily, the Nation, and the Economy

Will the strongest housing demand surge in 20 years continue?

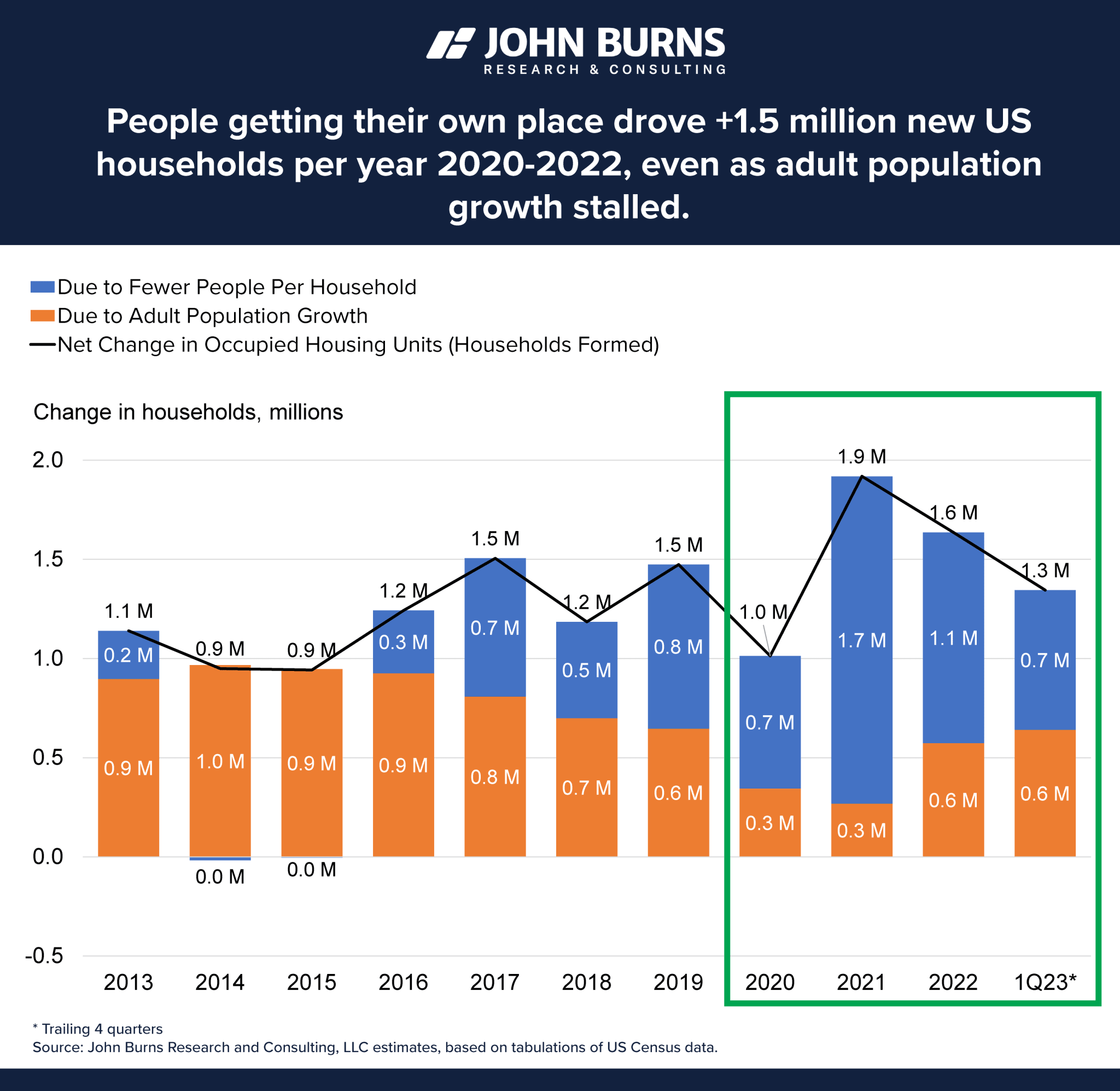

Via John Burns Research and Consulting: Growing household formation is expected to drive housing demand “through at least 2030,” with a “permanent work from home boost” as a major factor.

- CRE Lenders Conference Panelist: “Private credit will take the banks’ 50 percent share” (Commercial Property Executive)

- Return to Office Enters the Desperation Phase (The New York Times)

- Fed’s Updated Forecast Shows More Optimism Than It Did in March (The Federal Reserve Bank of New York)

Multifamily and the Housing Market

The State of the Nation’s Housing, 2023

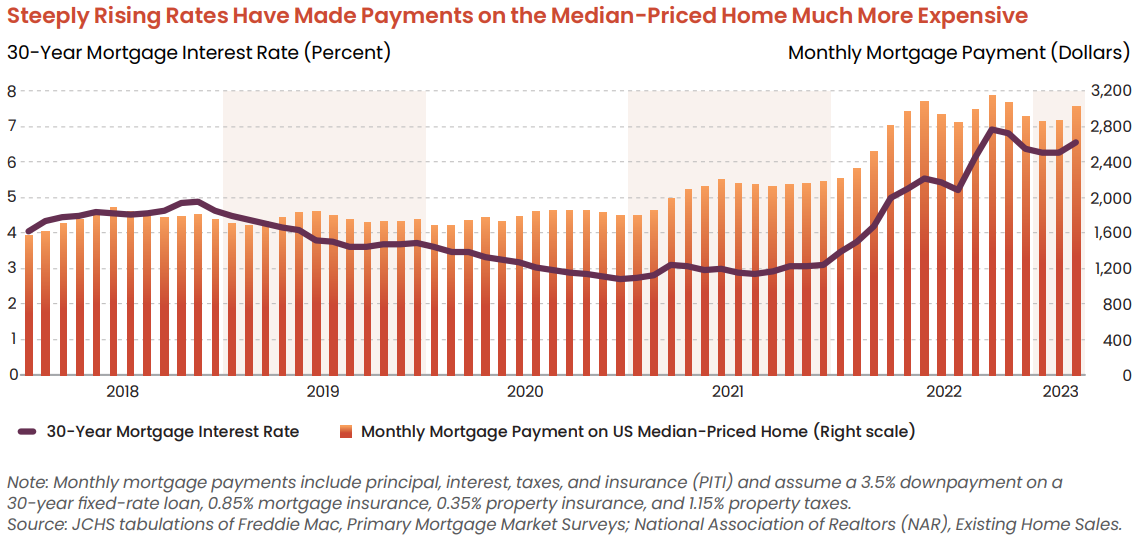

Via Harvard JCHS: Key conclusion from this thorough 52-page report: “Thoughtful reinvestment in the housing stock and in neighborhoods is critical to meeting future needs while reducing long-standing inequities and helping communities recover from natural disasters.”

- Best Places for Renters to Live in 2023: Charleston Ranks 1st, South Dominates List (RentCafe)

- America’s housing shortage is keeping home prices high (Axios)

- Q2 Housing Sentiment: Stable from Q1, but still quite low (Freddie Mac)

Multifamily Markets and Reports

Uncertainty in the national real estate market

Via Indiana Business Review: “[T]here is no question that the market will heat up again because, while psychology has played a major role in cooling off the market, the purely mathematical problem of not having enough new housing is not going away anytime soon.”

- Higher Vacancy Expected in Former High-Growth Multifamily Markets (CBRE)

- Despite Slowing, Metro Job Gains Remain Robust (RealPage)

- Expenses Rising Faster Than Revenues for Many Apartment Owners (GlobeSt)

Commercial Real Estate and the Macro Economy

Office Real Estate Global Capital Markets, June 2023

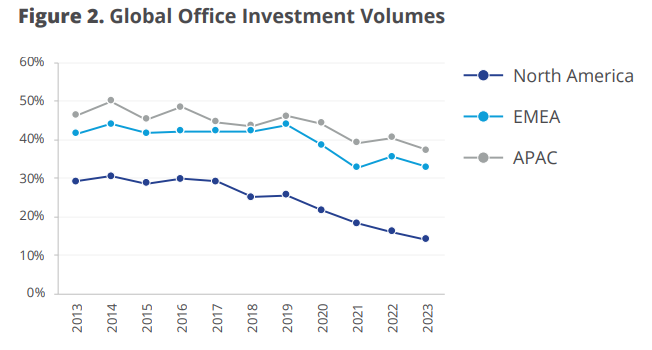

Via Colliers: “The office sector has been the most prominent global real

estate investment capital recipient over the last 15 years[, but i]nvestment in the North American office sector has declined for several years, falling to 15% of all activity.”

- Wall Street Sours on America’s Downtowns (The Wall Street Journal)

- What Does It Take to See a Peak-to-Trough Office Value Decline of 40%? (Moody’s Analytics)

- Construction Lawsuits Are Spiking As Pressure Rises To Accelerate Projects (Bisnow)

Other Real Estate News and Reports

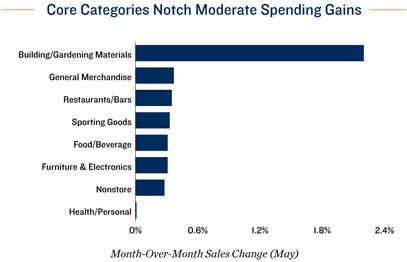

Retail Sales: Widespread Spending Gains, While Moderate, Highlight Shoppers’ Resilience

Via Marcus & Millichap: “Households increased their spending across a broad spectrum of stores in May, supporting a 0.4 percent rise in core retail sales. For the second straight month, eight categories registered sales growth, a testament to consumers’ spending power.”

- Once A Pioneer In Remote-Friendly Work, Tech Gets Strict About RTO (Bisnow)

- Looking for an Affordable Rental or Home for Sale? You Might Want To Ask Your Employer (Realtor.com)

- The Scariest Thing CRE Investors Might Hear: Recourse Loans Only (GlobeSt)