Gray Report Newsletter: June 15, 2023

Rate Hikes: Paused. Inflation: Lower. Rents: Growing.

With the Consumer Price Index showing declining annual inflation, (from 4.9% in April to 4% in May) and low, 0.1% month-over-month inflation, the Federal Reserve’s decision to keep interest rates level is understandable, but Jerome Powell’s remarks did not indicate that rates will go down any time soon. Even as these paused interest rate increases bring a glimmer of hope that CRE capital markets might improve, stories of looming office property foreclosures, lower property valuations, and interestingly-timed sales activity suggest that a more buyer-friendly CRE sales environment is forming, which will create opportunities for multifamily investors in resilient apartment markets.

Multifamily, the Nation, and the Economy

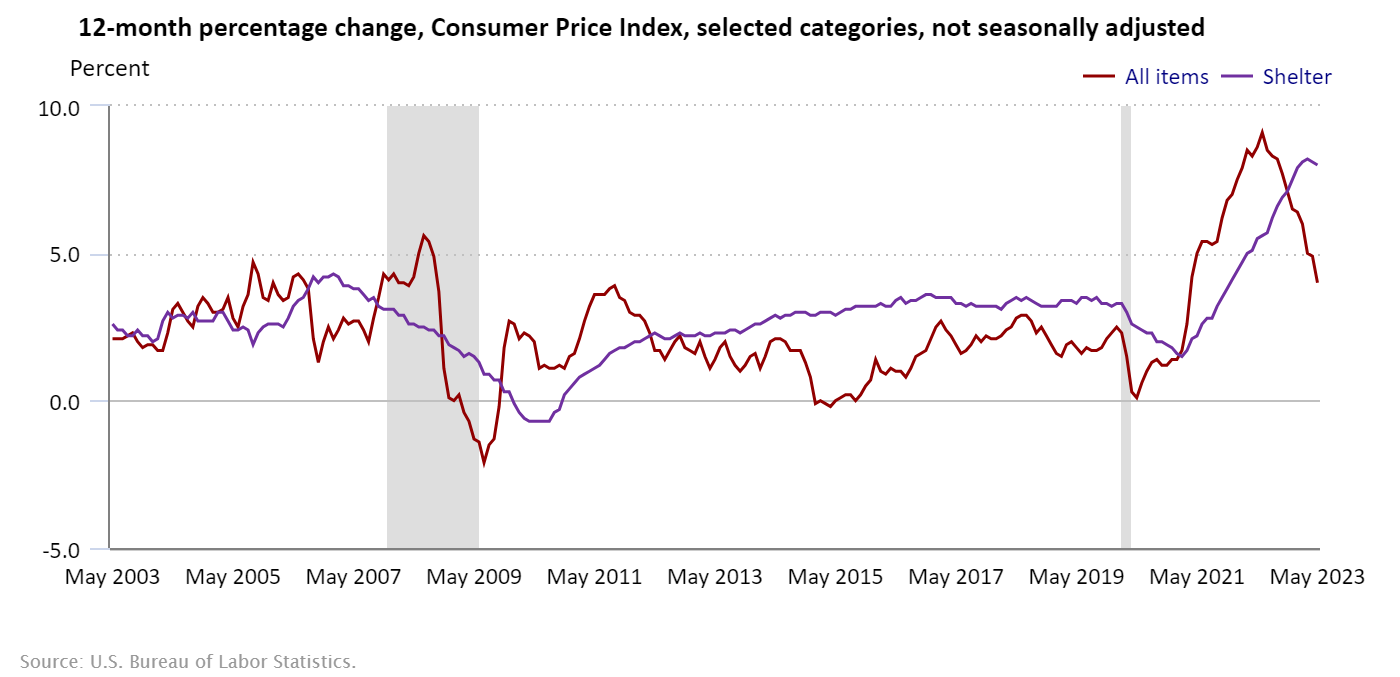

CPI: Year-over-Year Inflation Drops from 4.9% to 4%

Via United States Bureau of Labor Statistics: Shelter was the biggest contributor to inflation in May, but given that CPI rents have not yet recorded the rent growth downturn of late 2022, there is room for inflation to fall further.

- Federal Reserve pauses interest rates after 15 months of hikes (ABC News)

- How the Fed’s Pause on Interest Rates Impacts Multifamily (Multi-Housing News)

- This Multifamily Developer Had to Approach 48 Lenders About One New Project (GlobeSt)

Multifamily and the Housing Market

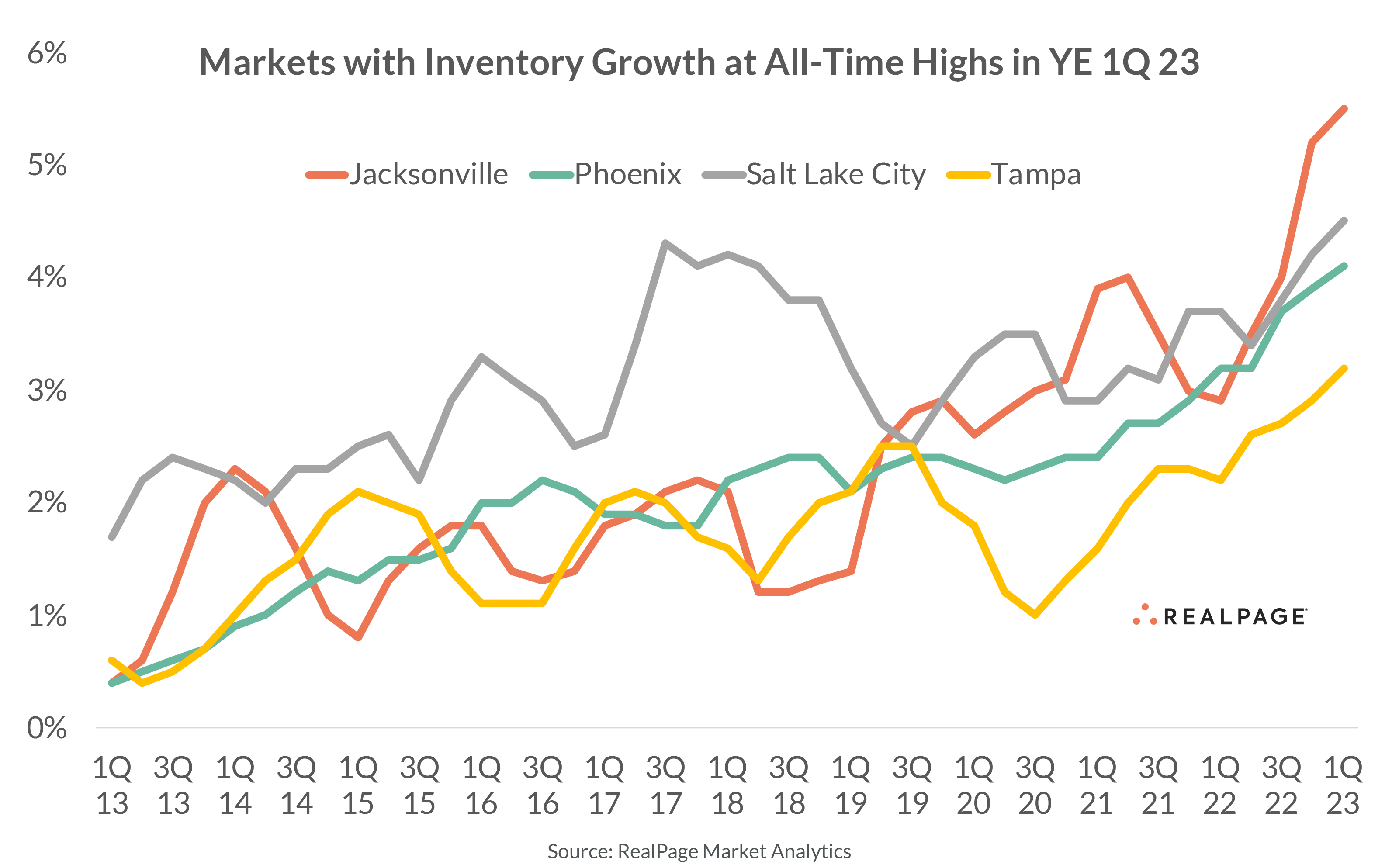

Four Apartment Markets with All-Time High Inventory Growth

Via RealPage: “Among the nation’s 50 largest apartment markets, 10 saw inventory growth of 3% or more in the year-ending 1st quarter 2023, according to data from RealPage Market Analytics.”

- Starwood Capital considers selling more than 2,000 single-family rental homes – report (Seeking Alpha)

- Answering build-to-rent supply questions (John Burns Research and Consulting)

- Foreclosures Are Spiking—How Bad of an Omen Is This for the 2023 Housing Market? (Realtor.com)

Multifamily Markets and Reports

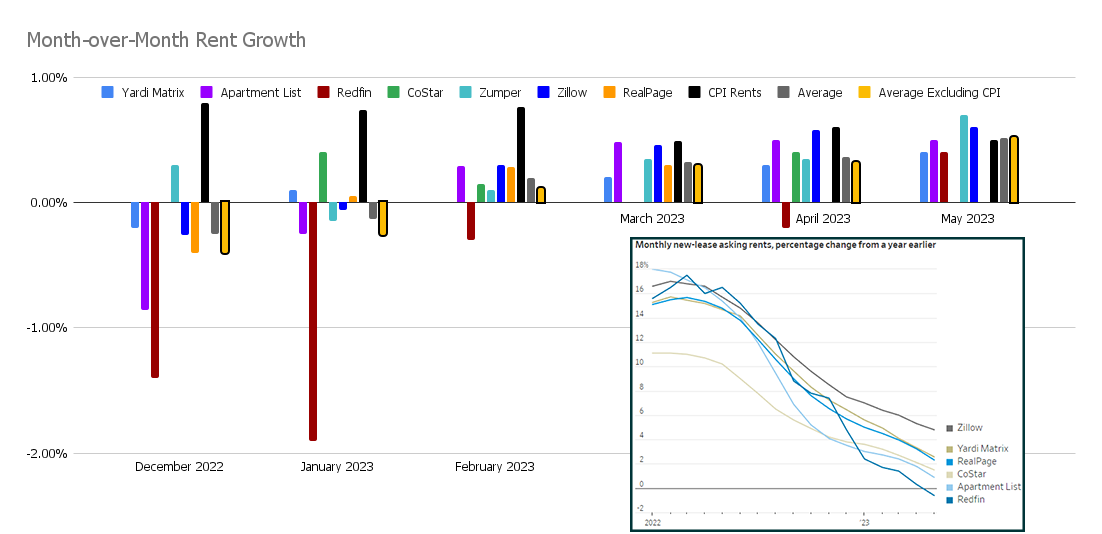

Renters Are About to Get the Upper Hand [But Are They Really?]

Via The Wall Street Journal: This Wall Street Journal article is an important example of rent growth coverage that misrepresents current market trends: Year-over-year rent growth (above, inset) is going down, but month-over-month rent has been steadily growing and could lead to stronger performance than year-over-year numbers would otherwise indicate.

- Rental Market Tracker: Asking Rents Fall 2% in the West But Rise 5% in the Northeast, Midwest (Redfin)

- Rent Growth Below Average as Subdued Spring Leasing Season Persists in May (Zillow)

- June Rental Activity Report: Kansas City Is Most In-Demand City, With Suburb Overland Park Coming in 2nd (RentCafe)

Commercial Real Estate and the Macro Economy

Via Moody’s Analytics: “A prominent characteristic of conversions? They tend to be older. First because the stringent zoning laws for conversion favor older buildings, but also because the price per square foot tends to be lower.”

- Goldman Sachs To Write Down Value Of Commercial Real Estate Loans, Equity (Bisnow)

- Labor Market’s Impact on The Economy and CRE (Marcus & Millichap)

- Global Real Estate Perspective May 2023 (JLL)

Other Real Estate News and Reports

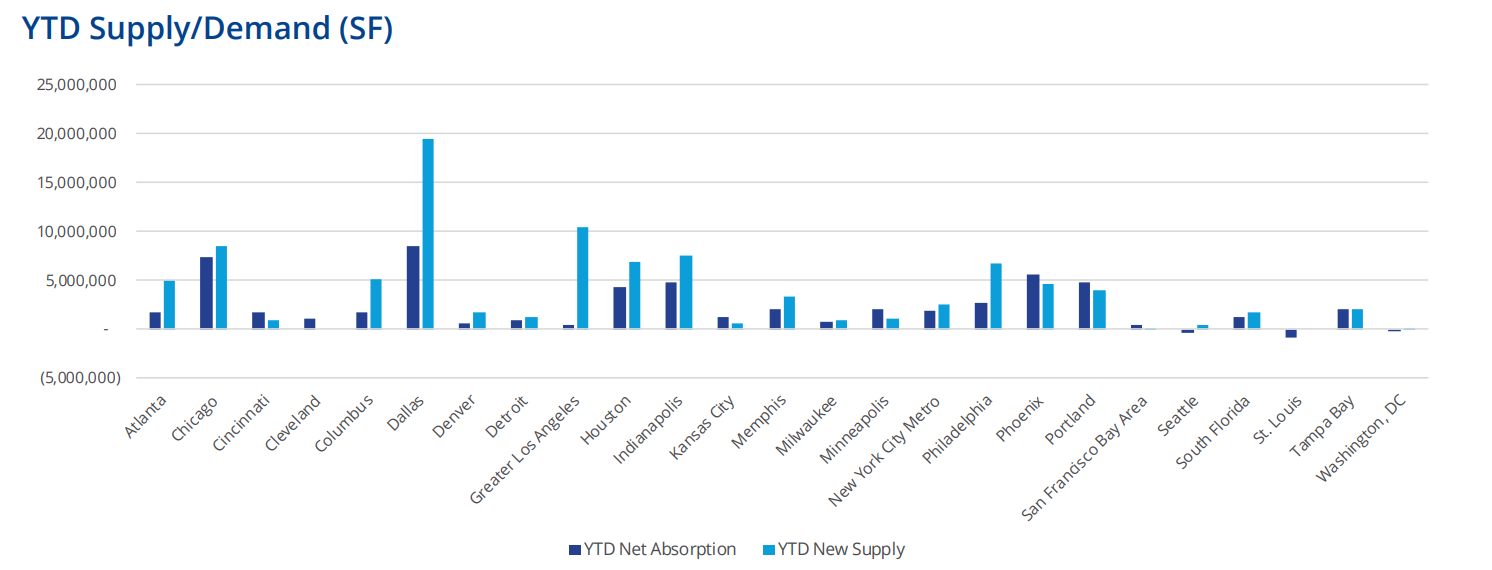

Top 25 Industrial Markets, Q1 2023

Via Colliers: “An increase in speculative development will pressure occupancies and rental rates in the near term, but the Top 25 industrial markets covered in this report are expected to remain resilient.”

- Industrial Emerging Markets by Tenant Type (Cushman & Wakefield)

- Property Metrics Highlight Durability as Retailers Expand into Healthcare Spaces (Institutional Property Advisors)

- ‘The Writing Is On The Wall’: Office Lenders May Have To Go All-Out Ahead Of Mass Surrenders (Bisnow)