Gray Report Newsletter: July 13, 2023

What Will Move Renter Demand in 2023?

The CPI recorded another substantial drop in inflation, which should ease some financial burdens for renters and could act as a signal to the Federal Reserve Bank that interest rates need not increase any further. The resumption of student loan repayments this August could have a more direct impact on apartment demand, and three separate reports this week review the implications of student loan repayment on the multifamily market, housing, and the economy more broadly.

Multifamily, the Nation, and the Economy

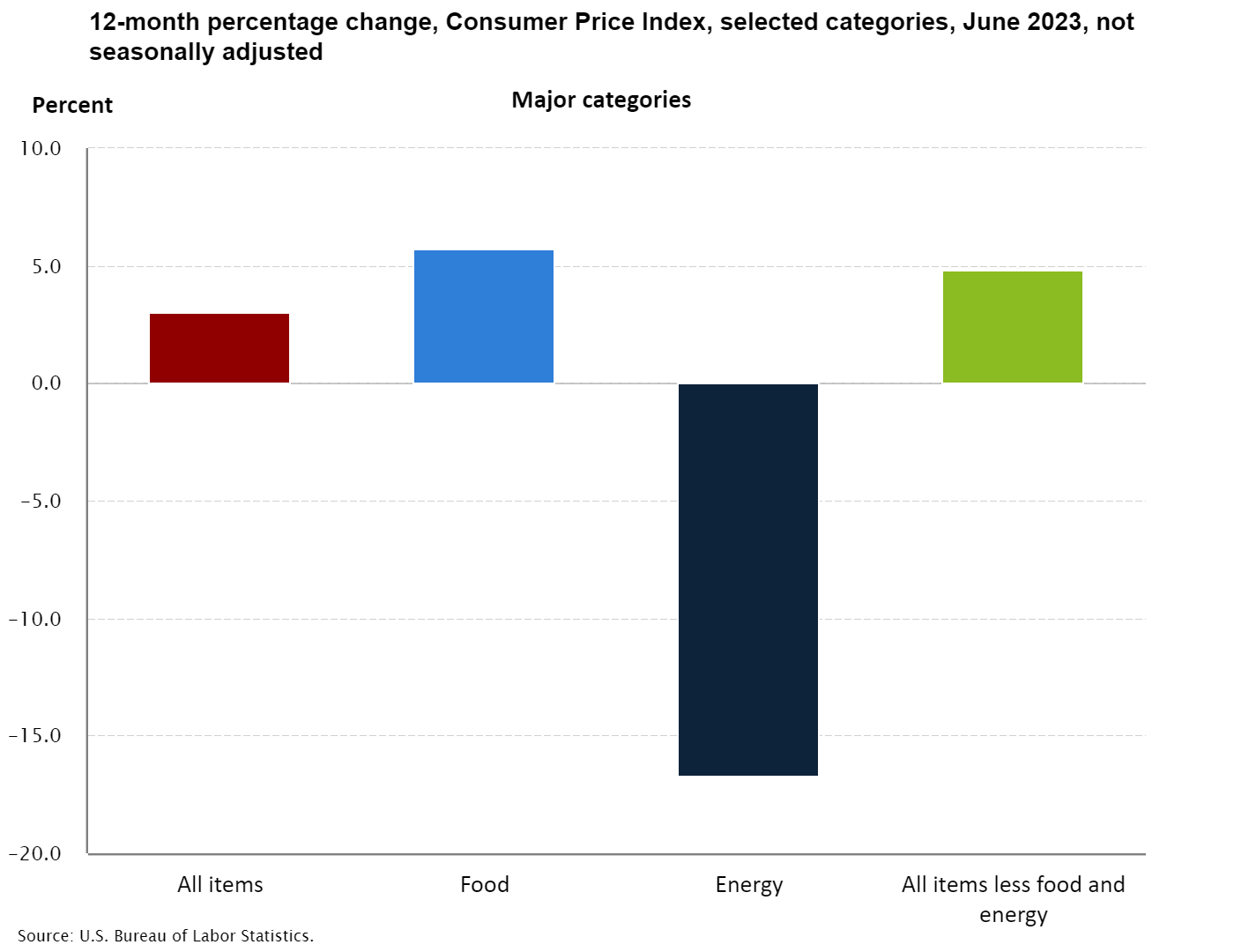

Consumer Price Index, June 2023

Via U.S. Bureau of Labor Statistics: Topline inflation is at 3% year-over-year, falling over a full percent since the previous month and on track to fall even further as CPI-measured rent growth is projected to cool as the year progresses.

- Where Is Inflation Persistence Coming From? (Federal Reserve Bank of New York)

- Q2 2023 CRE Trends: Apartment holding strong, Office bumping along, and Retail in it for the long haul (Moody’s Analytics)

- Analyzing Multifamily Financial Performance Across the US: A Deep Dive into NOI Growth (Trepp)

Multifamily Markets and Reports

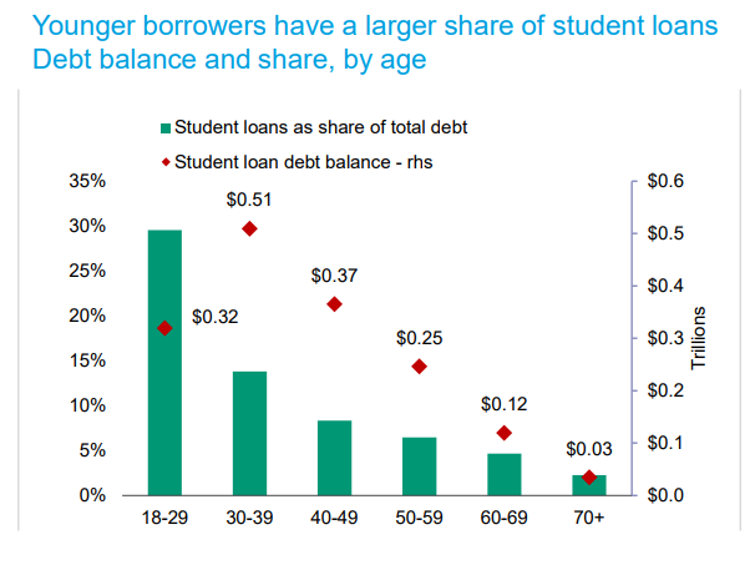

What Does the End of Student loan Moratorium Mean for Commercial Real Estate?

Via Moody’s Analytics: “Resuming student loan payments will slash any financial buffers, forcing households to cut back on discretionary spending or face difficult housing decisions such as trading down from Class A to Class B/C rental units, or even having to share a unit with family or friends to avoid homelessness.”

- Student Loan Restart Will Drag on Economy (John Burns Research & Consulting)

- Research Brief: Student Debt (Marcus & Millichap)

- Apartment Demand Reaches Recent High, But Still Below Long-Term Norm (RealPage)

Multifamily and the Housing Market

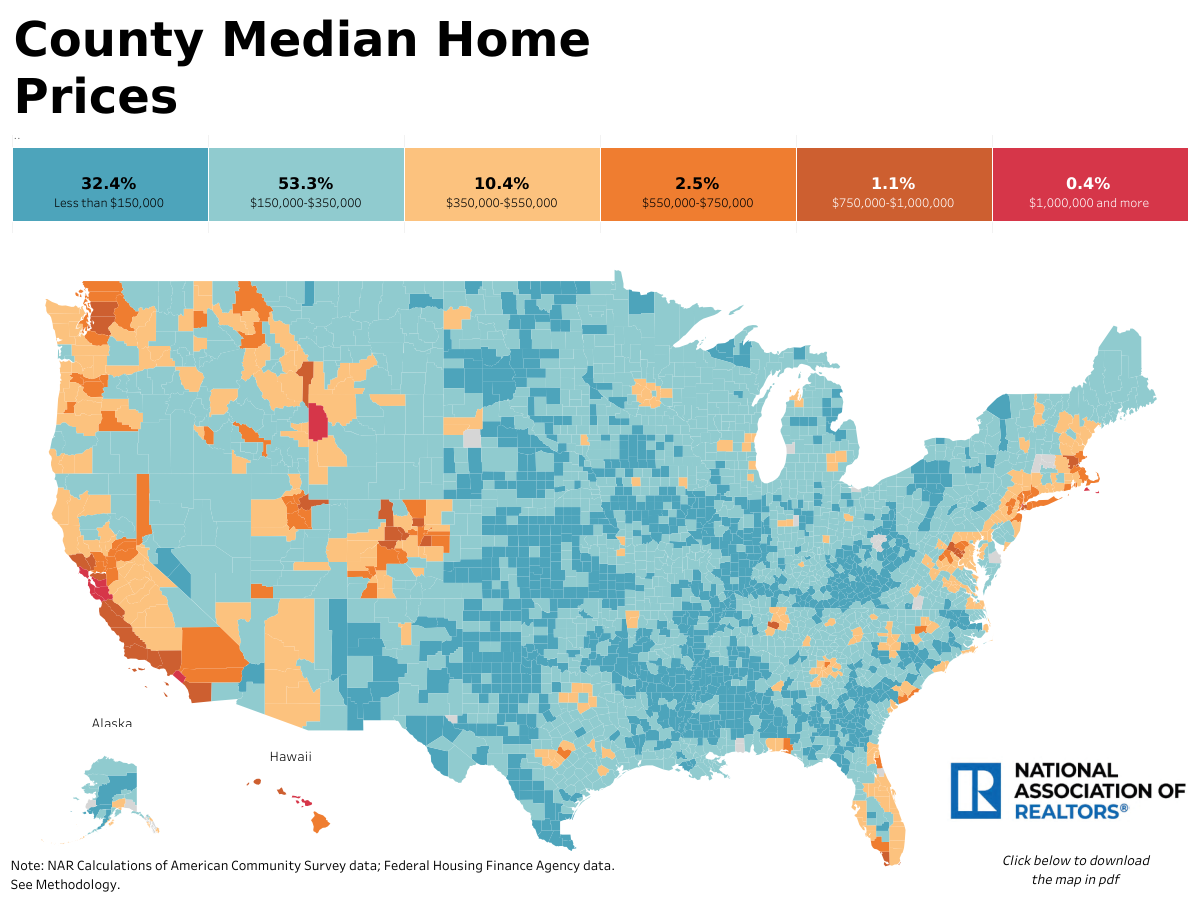

County Median Home Prices and Monthly Mortgage Payment

Via NAR: Along with an interactive map showing the median home price for each individual county, NAR provides information here on how much the average mortgage payment has changed for each county.

- Affordability Expiring On Nearly 200,000 U.S. Housing Units In Next 5 Years (Bisnow)

- US Home Price Insights – July 2023 (CoreLogic)

- Larger investors influence the single-family rental sector (Scotsman Guide)

Commercial Real Estate and the Macro Economy

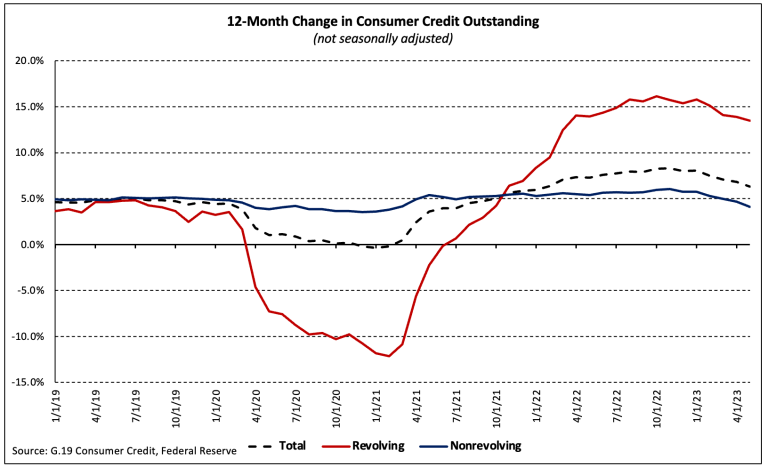

Consumer Credit Growth Slows to 30-Month Low

Via NAHB: While revolving credit remains markedly elevated compared to pre-pandemic conditions, total consumer credit is slowly trending downwards, and even revolving credit is easing somewhat from its peak in late 2022/early 2023.

- Research Brief: Sturdy Labor Market Sustains Positive Momentum for Multifamily and Retail (Institutional Property Advisors)

- Tracking CRE Price Discovery Though Auction Activity (GlobeSt)

- US borrowers look for bank replacements (PERE)

Other Real Estate News and Reports

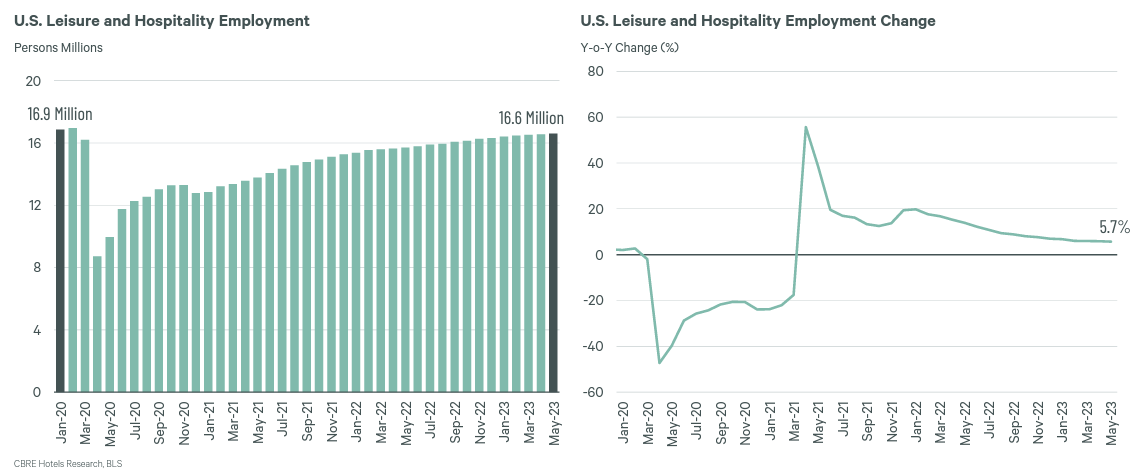

U.S. Hotels CRE Report, June 2023

Via CBRE: From the report: “International travel continues to improve in May relative to 2019. Despite growth being slower than anticipated, travelers from China and Japan are likely to fuel increases in hotel demand going forward.”

- Bosses Push Back on WFH Die-Hards: ‘They Will Need to Show Up’ (The Wall Street Journal)

- The Big City Rebound and Its CRE Implications (Commercial Search)

- As Challenges Mount For Cities, Localities Step Up Rezoning Efforts (Bisnow)