Gray Report Newsletter: July 27, 2023

25 BPS Fed Rate Hike: Predicting the Economy for H2 2023

The Federal Reserve raised the federal funds rate by 0.25%, and while Federal Reserve staff “are no longer forecasting a recession,” others are more confident in a recession as the inevitable product of this lengthy period of elevated interest rates. Amidst this continuing economic uncertainty, the multifamily market has shown solid demand. That being said, nationwide rent growth projections are more subdued compared to historical averages, but Northeast and Midwest markets continue to outperform.

Multifamily, the Nation, and the Economy

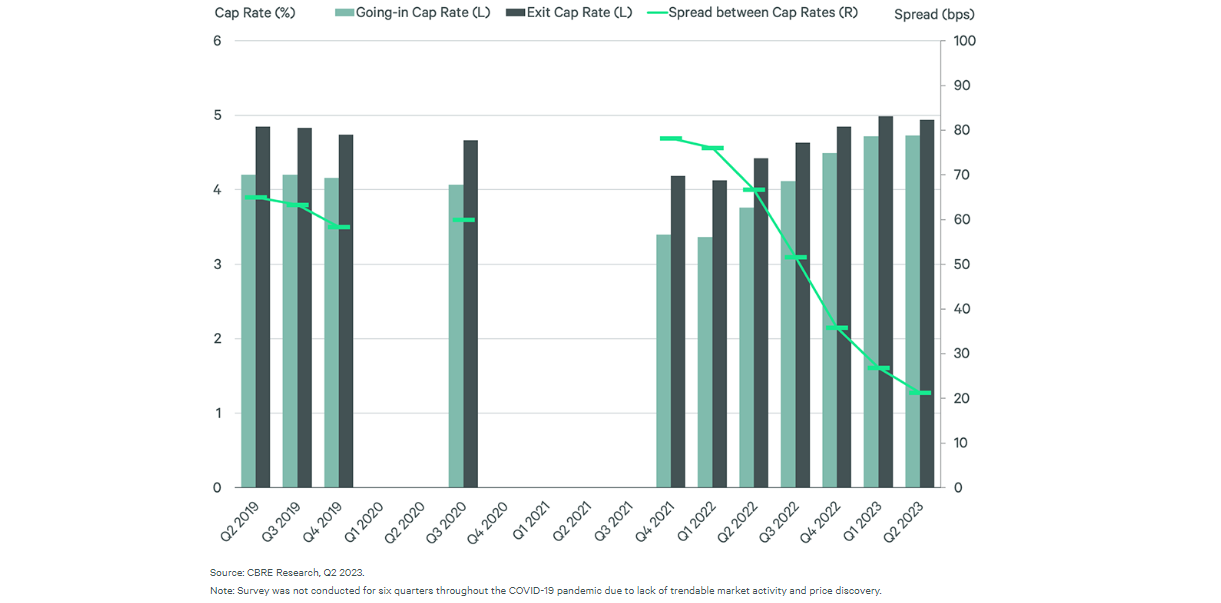

Spread between Entrance and Exit Cap Rate Shrinks to Record Low

Via CBRE: “Multifamily cap rates likely will see some additional modest expansion. However, we expect that cap rates will expand more slowly than interest rates will rise, meaning that cap rates are very near their peak.”

- Fed staff drop US recession forecast, Powell says (Reuters)

- ‘No chance we’re having a soft landing’: Stock-market strategist David Rosenberg gives Powell’s Fed no credit — and no mercy (MarketWatch)

- U.S. Cap Rate Survey H1 2023 (CBRE)

- Multifamily Syndicators Come Under Scrutiny – Everything to Know About Exposure to CRE CLOs & Floating-Rate Debt (Trepp)

Multifamily Markets and Reports

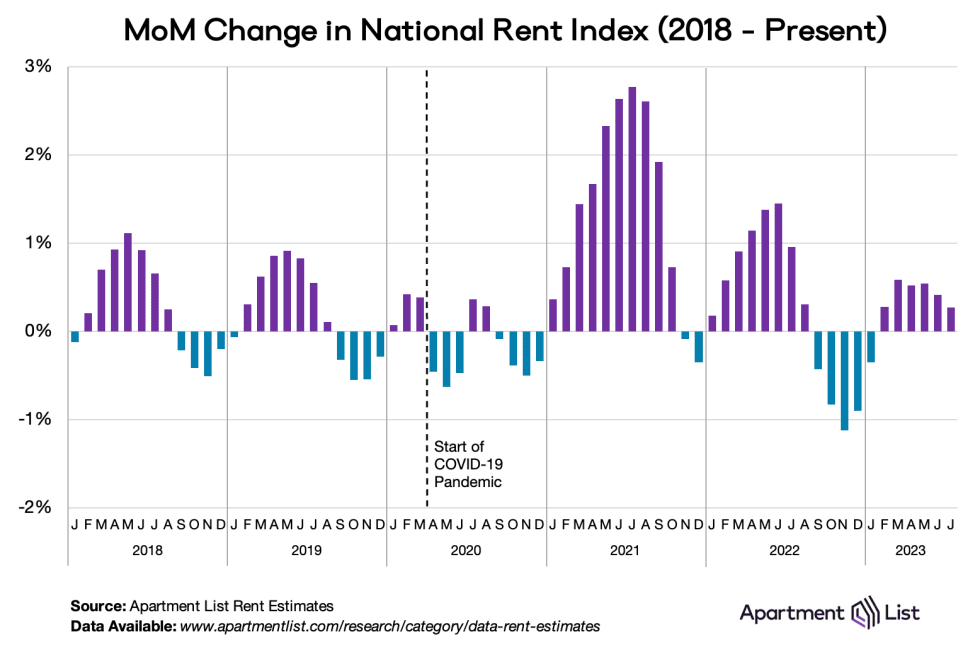

Apartment List National Rent Report, July 2023

Via Apartment List: From the report: “The fastest annual rent growth has been occurring in metros across the Midwest and Great Lakes regions. Six of the top 10 are found here, topped by Chicago where prices are up 4 percent year-over-year.”

- Apartment Demand Finally Matching Up with Job and Income Growth (RealPage)

- June 2023 Rental Report: Rents Continue to Decline Year Over Year (Realtor.com)

- National Rent Report, July 2023 (Zumper)

- Student Housing Report, Q3 2023 (Yardi Matrix)

Multifamily and the Housing Market

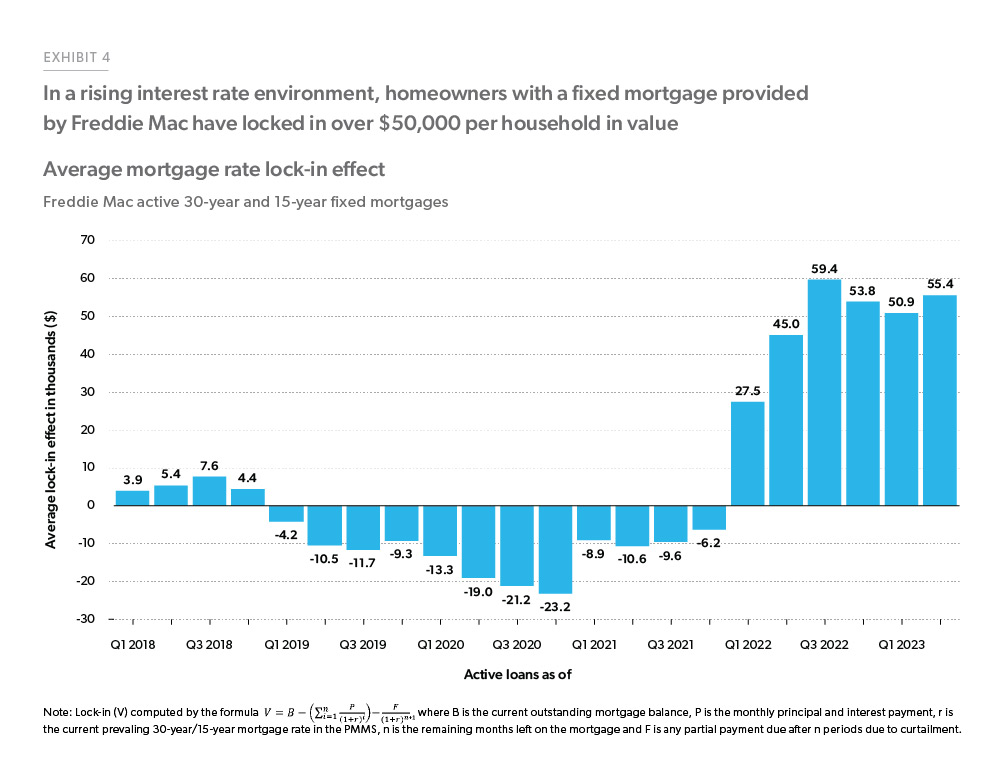

Economic, Housing and Mortgage Market Outlook – July 2023

Via Freddie Mac: “The mortgage rate lock-in effect is already having a significant impact on the U.S. economy and will likely continue to do so for years to come. One of the major challenges to the current U.S. housing market is a lack of available-for-sale inventory.”

- US CoreLogic S&P Case-Shiller Index Down by 0.5% Year Over Year in May, but a Turning Point May Be Ahead (CoreLogic)

- Interest for New Homes Strengthens (NAHB)

- Apartments From Adaptive Reuse Projects to Exceed 120,000 in Upcoming Years, Despite Recent Slowdown in Office Conversions (RentCafe)

- Builders Thrive in 1H23: A Mid-Year Review (John Burns Real Estate Consulting)

Commercial Real Estate and the Macro Economy

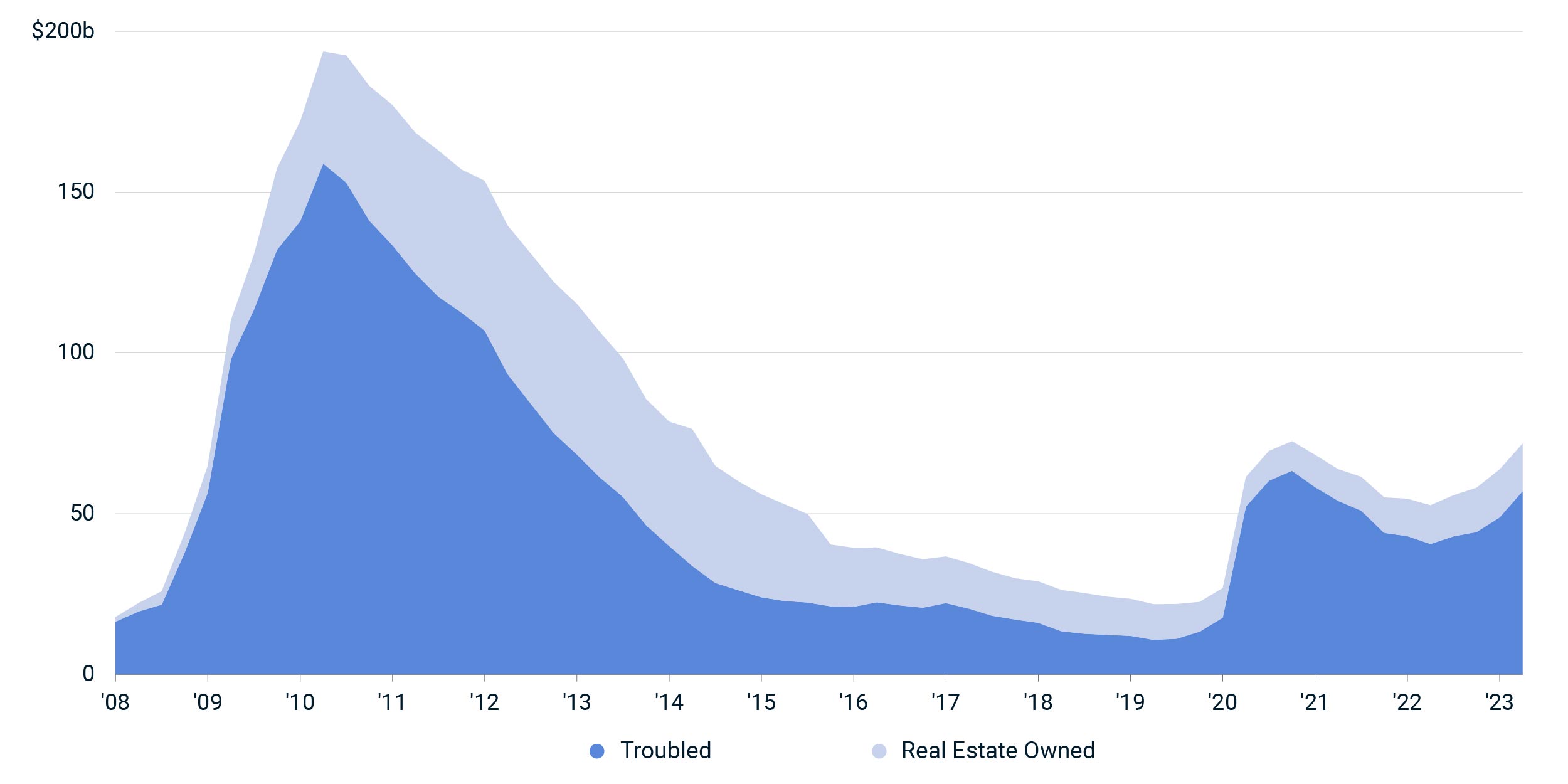

Distress in US Commercial Property Increased Further

Via MSCI: “Offices constituted more than 80% of the distress added during Q2 2023, with USD 6.7 billion of net inflows. By the end of June, the office sector was responsible for the largest share of marketwide distress, making it the first time since 2018 that neither the retail nor hotel sector was the biggest contributor.”

- Retail Sales Research Brief, July 2023 (Marcus & Millichap)

- MA CRE Office Loan Maturity Monitor: Single Tenants Stress Payoff Rate (Moody’s Analytics)

- Banks Double Down on CRE Loan Reserves (GlobeSt)

- Review, Global Real Estate Market Size for 2022 (MSCI)

Other Real Estate News and Reports

National Office Report, July 2023

Via Yardi Matrix: Offices constituted more than 80% of the distress added during Q2 2023, with USD 6.7 billion of net inflows. By the end of June, the office sector was responsible for the largest share of marketwide distress, making it the first time since 2018 that neither the retail nor hotel sector was the biggest contributor.

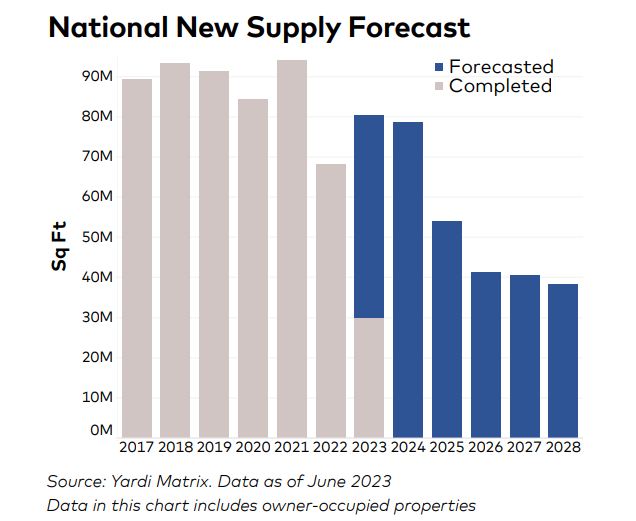

- National Self Storage Report, July 2023 (Yardi Matrix)

- The Best Place To Buy a Home Right Now May Be This Unassuming State (INDIANA) in Middle America (Realtor.com)

- What is the Impact of Household Savings on CRE? (Marcus & Millichap)