What will the pullback in multifamily construction permitting mean for the rental market?

“Following a period of record-setting rent growth, the national median rent has since dipped slightly from its late 2022 peak.”

- This is an interesting framing that kindof made me do a double-take: Rent, not rent growth has dipped slightly. At the late 2022 peak, the national median rent was a little under $1,450, and now, the national median rent is a little over $1,400. That’s roughly a 2.6% difference, according to Apartment List.

- Rent growth is what I thought they were talking about at first. Rent growth has done more than “dipped slightly,” maybe plunging, careening, plummeting, dropping—all of these words get at what it’s felt like for apartment operators and owners. Instead of a 2.6% difference, year-over-year rent growth is about 16% different in that same time frame, which is to say, rent growth has fallen from around 15% year-over-year in late summer 2022 to -0.8% today, and if we’re measuring from the 18% peak in late 2021, that’s about a 19% drop. However you slice it, the strength of rent growth has changed significantly.

- So, yeah, I did a double take when I glossed over that “dipped slightly” statement, but from the perspective of renters, they’re might pay a little more attention to the nominal median rent, and even though rent growth has gone from 18 to negative 0.8% in that time span, the rents they’re paying only ticked down by $50. That’s like, half a big mac meal according to my inflation metrics.

- Looking at the chart from Apartment List’s most recent rent report, you can see how rent growth has trended down for the past two years, and if they remain consistent, these trends could wipe out all of the rent growth gains of 2022, essentially beginning 2025 with rents the same as they were in early 2022.

- Worth noting, however, is that these trends are neither inexplicable nor infinite—we know what’s causing rent growth to go down, and that cooldown is expected to cease as 2025 progresses.

- With that in mind, it seems very unlikely that rents will fall much further. Looking back at that Apartment List chart, the 2022 spike in rent growth followed a much bigger spike in rent growth in 2021.

- If you extended the pre-pandemic rent growth trends through the end of this year, you’d likely end up with a national median rent that’s below where rents could end up at the end of the year if this cooling cycle continues, but not by much, which is why these subsequent years, really moving from mid 2025 into 2026, there should be some normalization in the apartment market and accelerating rent growth.

- I’m in no way expecting a rent growth surge. A more gradual normalization seems far more likely, and frankly, more predictable and sustainable than the upswings and downswings of the past 4 years.

This Apartment List article gets at the apartment supply trends that are the specific cause of the dramatic downswing in rent growth, and it’s in the decrease of construction activity and permitting that we might see this change.

The data points often bandied about in these kinds of discussions—supplied by the US Census Bureau New Residential Construction Survey—are permits, starts, and completions. Permits happen first. It’s good manners to start building only after you get permission! Then there’s the actual start of construction, and finally, of course the completion, if everything goes as planned. Projects could be halted or abandoned, which is more likely to happen during between the permit and the start of construction—maybe there’s a traffic study or environmental remediation that you didn’t go your way, or maybe funding fell off. That last one, with the sharp increase in interest rates between the start of 2022 and now, that’s the one that’s putting pressure on developers and apartment construction projects across the country as they determine if it’s feasible to begin an apartment development project, delay, or cut losses due to increased lending costs.

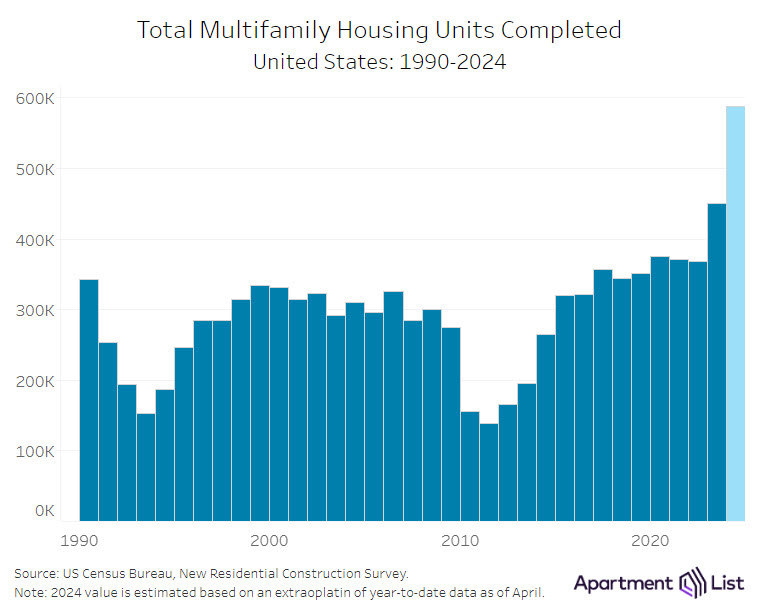

That being said, the change in apartment construction and the eventual change in apartment completions, it’s not going to look anything close to a drop-off. I was looking at CoStar data, and they are projecting a steep dropoff from Q2 2024 to Q3 2024, from 160,550 units delivered to 111,059 net deliveries. That’s huge, I am curious how CoStar arrived at such a massive dropoff in their projection, and I have already emailed CoStar to request that a member from their team make a guest appearance on the Gray Report.

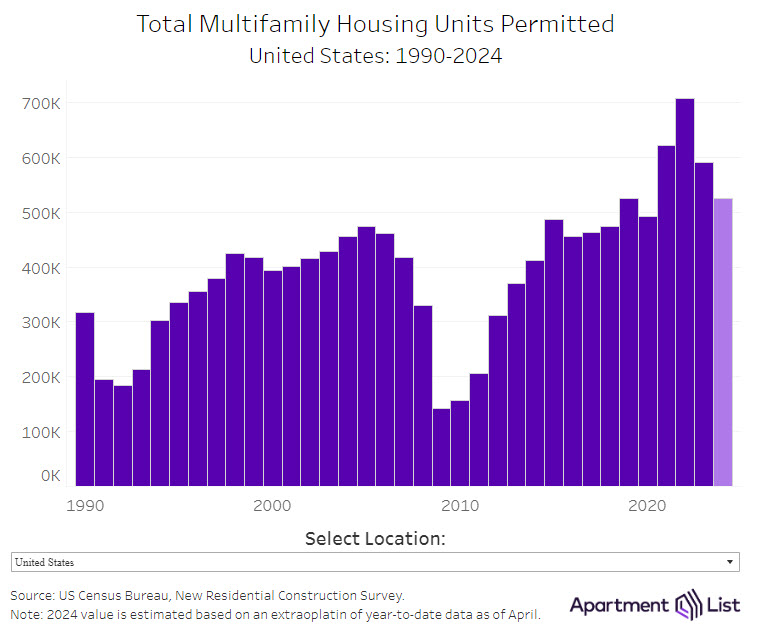

I don’t agree with the projection from CoStar though. It’s far too dramatic a movement. Apartment List notes that “On one hand, we’ve seen an abrupt slowdown in apartment construction activity. But on the other hand, when viewed over a longer horizon, current permitting levels remain fairly robust even after the decline. If 2024 does end with 525 thousand units permitted, as the year-to-date trend suggests, that level would be 26 percent below the 2022 peak, but it would still be 9 percent higher than the 2015 to 2019 average and higher than any year from 1987 to 2022.”

Permitting is not falling enough, nor did it fall quickly enough 2 years ago to justify such a steep downturn in the projected deliveries from CoStar.

- Earlier this year, I took a look at how useful it is to project future completions from the permits and starts data. I took the quarterly data for apartment completions and apartments under construction since 2000.*

- I couldn’t nail down the time frame with any degree of confidence, but I did find that for construction starts, about 1% of them don’t turn into deliveries.

- For permits, it’s closer to 30% or more. You can see this in the charts in this Apartment List report here as well. There were 706,500 units permitted in 2022. There is no way that all of these units are going to turn into completions.

Apartment List also has a chart of completion times for multifamily projects, the total amount of time between a construction start and its completion, and as of 2022, it was at 17 months. It’s possible that this completion time has gone down since then, but likely not dramatically. As an aside, Apartment List says that the time between permitting and construction start is about 3 months, so we’re looking at 20 months, on average to build an apartment building.

- My guess here is that this data groups all apartment buildings 5 units in size or larger. This, to me, is a little bit of a shame. I wonder if this average completion time is based on the average for each building or if they weight it all based on the number of units being built at a particular property. I have contacted someone from the Census Bureau with a request for a guest appearance on the Gray Report and will also be following up with that specific question on the Census data for residential construction.

So, given that permitting hasn’t fallen off dramatically and is still above pre-pandemic levels, I think that the upshot of all of this really excellent data and analysis here is that the apartment market’s supply and rent growth trends will not be making any hugely volatile moves, but rent growth should trend meaningfully in a positive direction as this supply wave tapers in the next several years.