Unlocking single-family rental (SFR) trends early and accurately

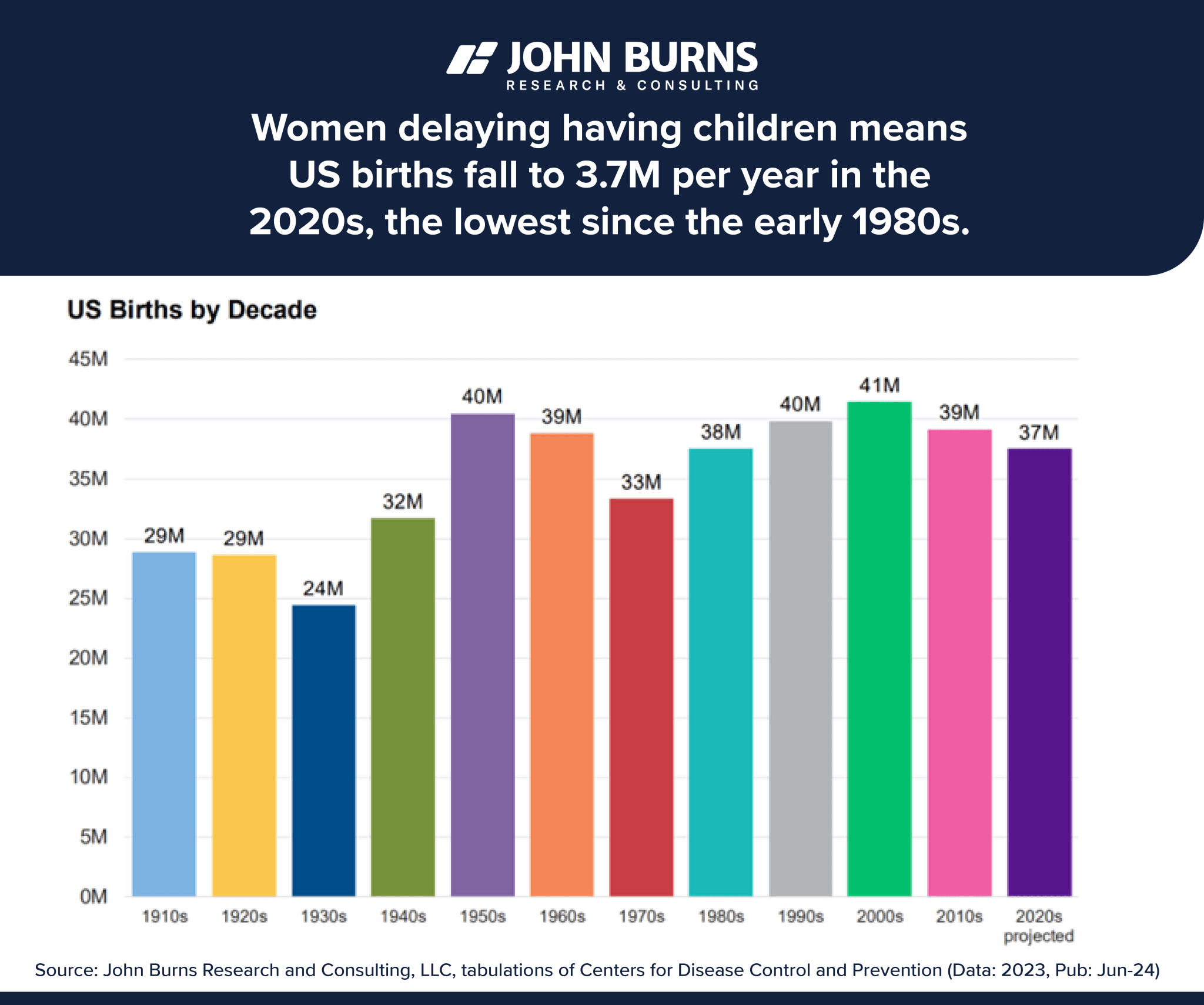

A month ago, we covered a brief post from John Burns Research and Consulting about birth rate, population trends, and different life stages as a factor in housing trends, specifically looking at how these might impact a decision to move from a smaller house to a bigger one.

In our conversation, Spencer mentioned the potential impacts on the single-family rental market, and this new article lays out the rent growth trends for single-family rentals nicely. I’m thinking about this low-sales-volume, high-cost housing market for homebuyers, and for a population (of millennials) that are starting families maybe or maybe just wants more space (and maybe can afford more) then the single-family rental space would seem to have promising prospects.

But so does the apartment market. Granted, making this link between life stages and housing preferences, it’s worth acknowledging that for millions of people, buying a home is out of the picture no matter how old they are, whether that’s because of where they live or how much they can afford, but that being said, thinking about how housing preferences can shift throughout one’s lifetime can be a helpful tool for thinking about how housing demand can shift over time.

With this in mind, I would say that in your 20s, you’re most likely to be an apartment renter. Then, looking at the birth rate chart from the earlier John Burns article, you’ll see that, twenty years ago, the 2000s were actually a very strong year for the birth rate, as was the following decade. That leaves a large population of people who are in an apartment-renting stage of life over the next decade-and-a-half, these Gen-Z folk.

But to turn back to the Millennials, a big population itself, and one that’s well within the time when people, typically, historically, have bought their first home. But even as I write this, it’s hard for me to say “typically” at a time in which homebuying costs have been so persistently high without letting up. Sales go down a bit maybe, but base price. Still the same base price. So with interest rates this high and home prices not coming down, renting a single family home (instead of owning) would seem to make sense, but I’m still waiting on data. Is there data available that records how home buying and renting trends change in different interest rate environments? I remember that Matt Vance of CBRE had at one time mentioned some forthcoming research about 4 months or so ago. I have not yet seen that report.

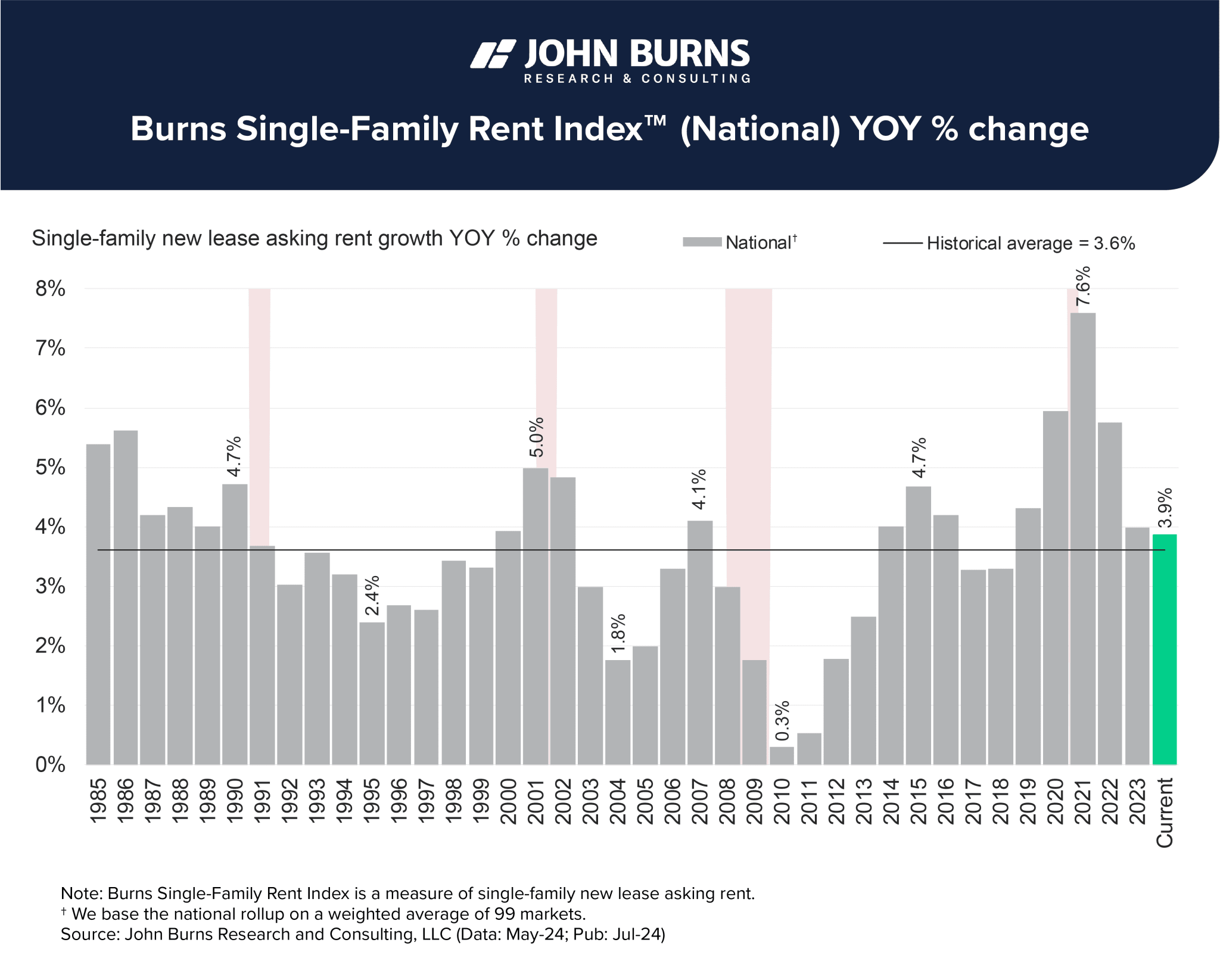

What this report says is that single family rents have been well above the 3.6% historical average throughout the pandemic. At a time in which apartment rental prices have been zero and sometimes negative, prices for single family rentals have been above average. Rent growth for single family homes did not get to the mid-to-upper teens like it did for apartments, but it did get to 7.6%.

One big answer for this difference between apartment and single family rent growth is that apartment construction surged significantly, which has dampened rent growth for over a year.

Compared to single-family construction, multifamily construction starts grew more quickly from the period between mid-2021 to mid-2023, and only in the past year has single-family starts grown more quickly. We’ve just crested this generation-high record for apartment deliveries now, 2-3 years after all of these apartment construction starts, and if the chart (below) is any indication, apartment deliveries should go down as single family deliveries go up next year.

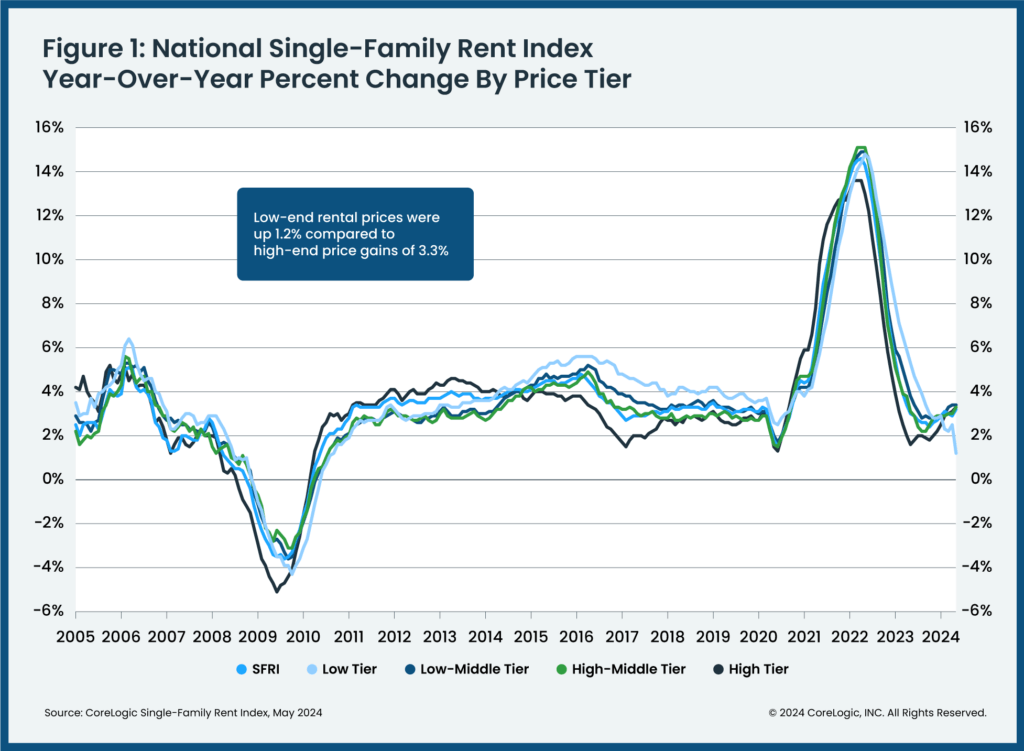

Another answer is, well, maybe single family rent growth DID grow that much! CoreLogic data has single family rent growth at 3.2% now, just a little under what NAR’s figures are, but CoreLogic’s peak rent growth was around 14% in early 2022.