Multifamily Crash in 2024? Probably Not.

Source – BiggerPockets: Multifamily Is at High Risk of Continuing Its Historic Crash in 2024—Here’s Why

I do appreciate that the topic of this guy’s article last year was the same as it is this year, tracking the same subject, so to speak, and it’s worth digging into each of these points. And the author, Biggerpockets CEO Scott Trench, does mention that he wrote something similar in 2023. He calls it his “thesis,” which is fairly apt, but the English teacher in me is like “isn’t this the same term paper that you wrote last year?”

But just because the topic is the same doesn’t mean his argument is invalid, and clearly he’s been tracking things from this perspective for a while now.

- Just to clear the air before we dig into this—a lot of the points we’ll review here could easily be sensitive to one’s initial position, perspective, bias, etc., —and again, I want to be clear about my own perspective and bias and say that I typically fall on the more optimistic side, and you can track this through our many episode of the Gray Report, but thinking back to 2023, I wasn’t anticipating a multifamily crash as much as I was uncertain and frustrated at the inactivity in the multifamily sales market.

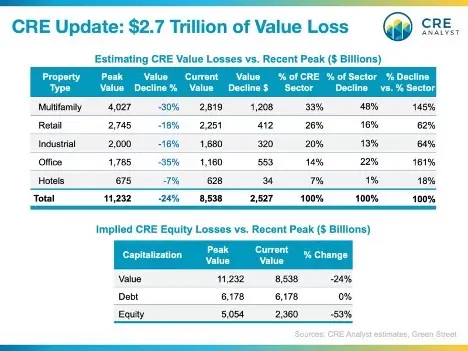

- Valuations did go down in 2023, but I really didn’t think of it as a crash, and honestly, we were waiting for buying opportunities that didn’t materialize because valuations and cap rates, on the whole, did not make sense in that interest rate environment.

- So that’s my own bias: Where others might see certain doom, I see frustrating uncertainty, at least I did in 2023. I’ll get to my thoughts on 2024 in a second.

To return to BiggerPockets CEO Scott Trench and his article on a continued multifamily crash in 2024:

- “Unfortunately, I don’t think 2024 is going to be much more fun for current owners of multifamily and commercial real estate. There’s still a lot of room for this bear market to run and little reason to believe in income growth or valuation growth in U.S. multifamily at the national level.”

- “In this article, I’ll walk through my updated thesis for 2024, outlining the continued threats to multifamily valuations.” – I am not the CEO of a large real estate website like BiggerPockets, and this is very petty, but in my eight years of grading college english papers, whenever I saw I sentence like this, I would cross it out and write “too announce-y”—you don’t need to say that you’re going to say something, you can just say what you are going to say. By the way, BiggerPockets CEO Scott Trench did invite criticism and rebuttal to his thesis!

- And to get back to that, I give him credit for a very well-organized article here! Makes his claims, gathers his evidence, and ties it all together to make an argument! WHICH IS:

- Trench sees a further downturn in the multifamily market for 4 specific reasons:

- It Just Doesn’t Make Sense to Buy Apartment Complexes at Current Valuations

- The Outlook for Rent Growth Is Poor in 2024

- Expenses Eat Into Multifamily Profit

- Interest Rates Will Not Come to the Rescue

1: Valuations Claim

This one here is a little bit of circular logic, but I’ll get back to that in just a moment.

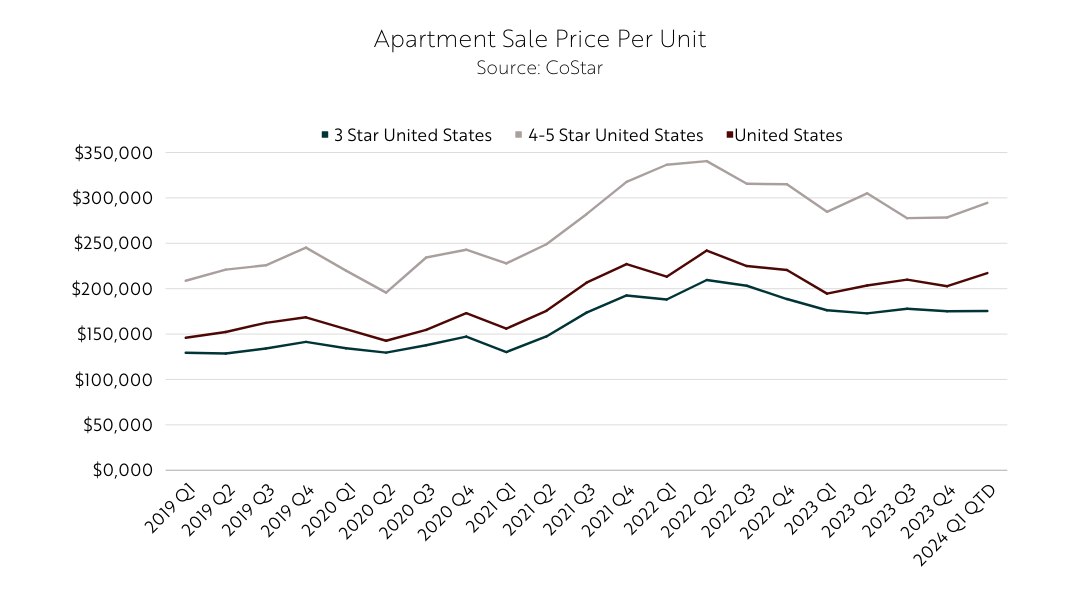

The evidence for this claim about low, unattractive valuations is valid: Cap rates for prime MF assets are around 5.06% (CoStar has them at 5.38%) but yeah, that does not match up with current interest rates. Yes, I know that cap rates are not exactly the same as returns, but IN GENERAL, if you’re buying a 5.06% property and want to use a loan for it, you could easily be paying a higher interest rate for the loan than the cash flow you generate from the property.

Also, there’s the idea that MF investments at current cap rates may not have as attractive risk-adjusted returns as putting money into Treasuries.

Rebuttal: Look at the future and not the present, which is going to be a theme. High interest rates are driving cap rates this high. Interest rates will not stay as high as they are now forever. We may have a higher interest rate than we had in the 2010s, but it’s going to get lower than it is right now, and this is a thought that people are thinking right now when they are buy/selling MF real estate.

2. Rent Growth Claim

Not necessarily set in stone here, but sure, it is expected that rent growth will continue to stagnate in 2024.

“The only word I have for this mass of supply is an onslaught.”

Trench argues that the “construction boom . . . is accelerating.”

As Trench puts it, with this supply driving rents down, and the potential for renting preferences to shift toward single family homes, rents could fall further in 2024. He also argues that high interest rates could be a drag on apartment demand because people will stay in their homes and not sell, and then not rent?

Rebuttal: High interest rates impact on rental demand is not a straightforward or common claim and lacks supporting evidence, yes, we are in the midst of a historic amount of new apartment consdtruction which will be a drag on rents. But the crux of my rebuttal is the same as it was on valuations: Look to the future, not the present. Construction is actually decelerating. Investors are factoring this into their expectations, and this could be a big reason why so many investors intend to get back into the market this year. Not because of this year, but they foresee a dip in apartment supply in later 2025 and beyond.

3. Expenses Claim

This one isn’t as lengthy in terms of evidence, and I don’t have as much insight into this from my own perspective, but I am well, well aware that expense growth soared in 2023.

Insurance premiums, tax increases due to newly-assessed value increases are two major expenses that BP CEO Scott Trench cites as evidence here.

Rebuttal: Again, look to the future and look at the trend rather than a snapshot in time. This is out of my depth, but what I’ve heard is that expense growth is not as sharp as it used to be. Also, to be a little more nit-picky, to cite valuation increases, even if they’re in the context of rising tax expenses, to cite valuation increases as part of an argument for valuation DEcreases, that’s not the best evidence there.

4. Interest Rates Claim

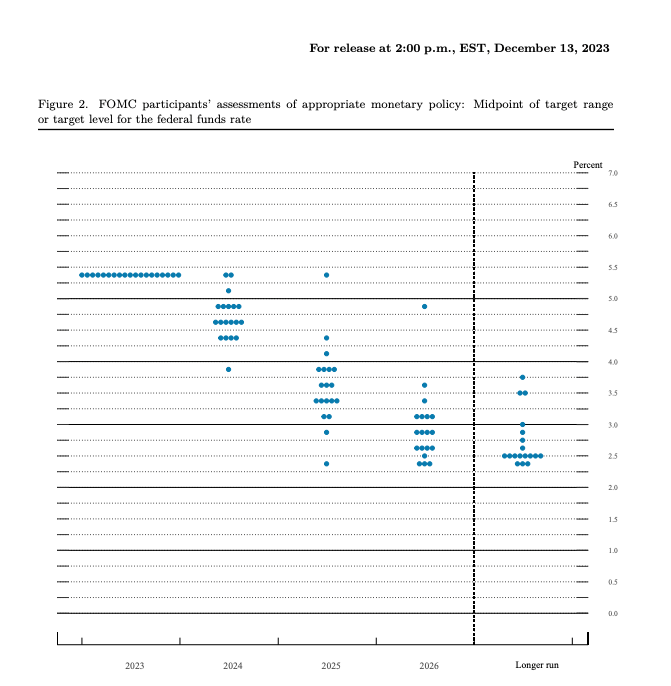

The only way rates come down is if it’s a recession.

Spencer, I’d like you to tackle this one, because it deals with forecasts for the 10YT, but from what I gather, BP CEO Scott Trench seems to claim here that the Fed is going to take rates to 4.5% for Fed funds and keep them there.

Rebuttal: Again, this looks at the present and not enough at the future. I am in now way a Pollyanna on this topic, but rates will get lower than 4.5%. Look at the Fed dot plot!