Gray Report Newsletter: August 31, 2023

“Secret” Distress, Quiet Capital Markets, and a Rent Growth Reality Check

While low CRE sales activity has some looking for hidden distress, reports on the apartment market are showing decelerating rent growth in recent months that could erode the steady month-over-month gains in the first half of the year. Given the close correlation between the cooling rent growth and quickly-growing apartment supply, there are many multifamily markets performing better than others, but continued signs of strong housing demand broadly support ongoing confidence in apartment fundamentals.

Multifamily, the Nation, and the Economy

National Rent Report, August 2023

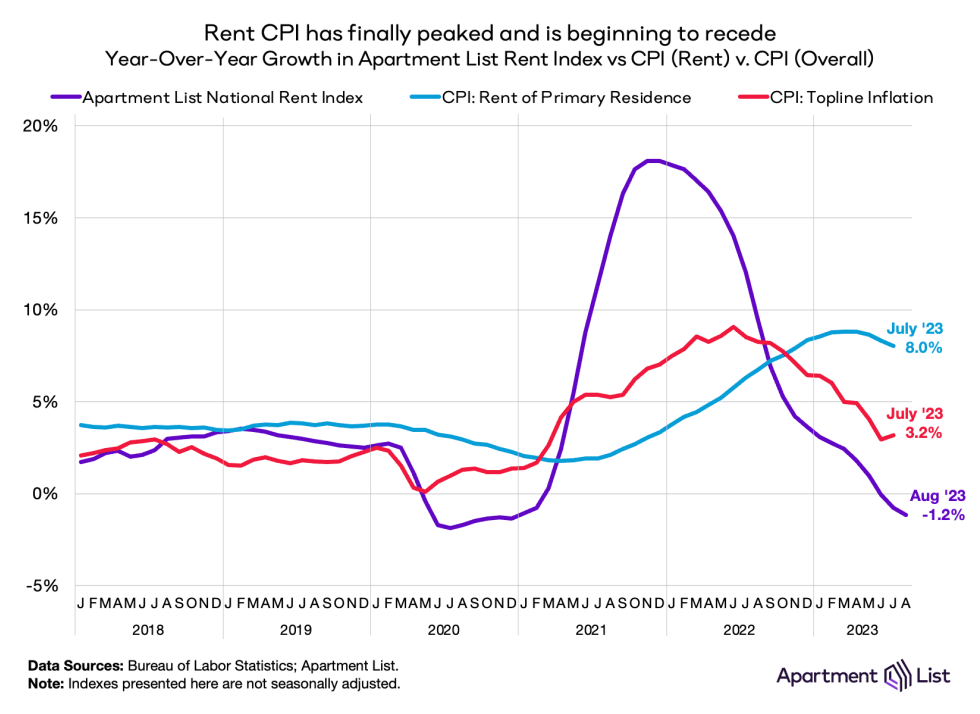

Via Apartment List: The substantial increase in apartment supply continues to impact rent growth: “A massive shortage of vacant units helped drive tremendous rent growth in 2021 and 2022, and today the opposite is true.”

- Maybe Secret Distress Is Behind CRE Market Performance (GlobeSt)

- Apartment Rent Growth Slows Most in Class B and C (RealPage)

- Are CRE Prices Still Too High? (Marcus & Millichap)

Multifamily Markets and Reports

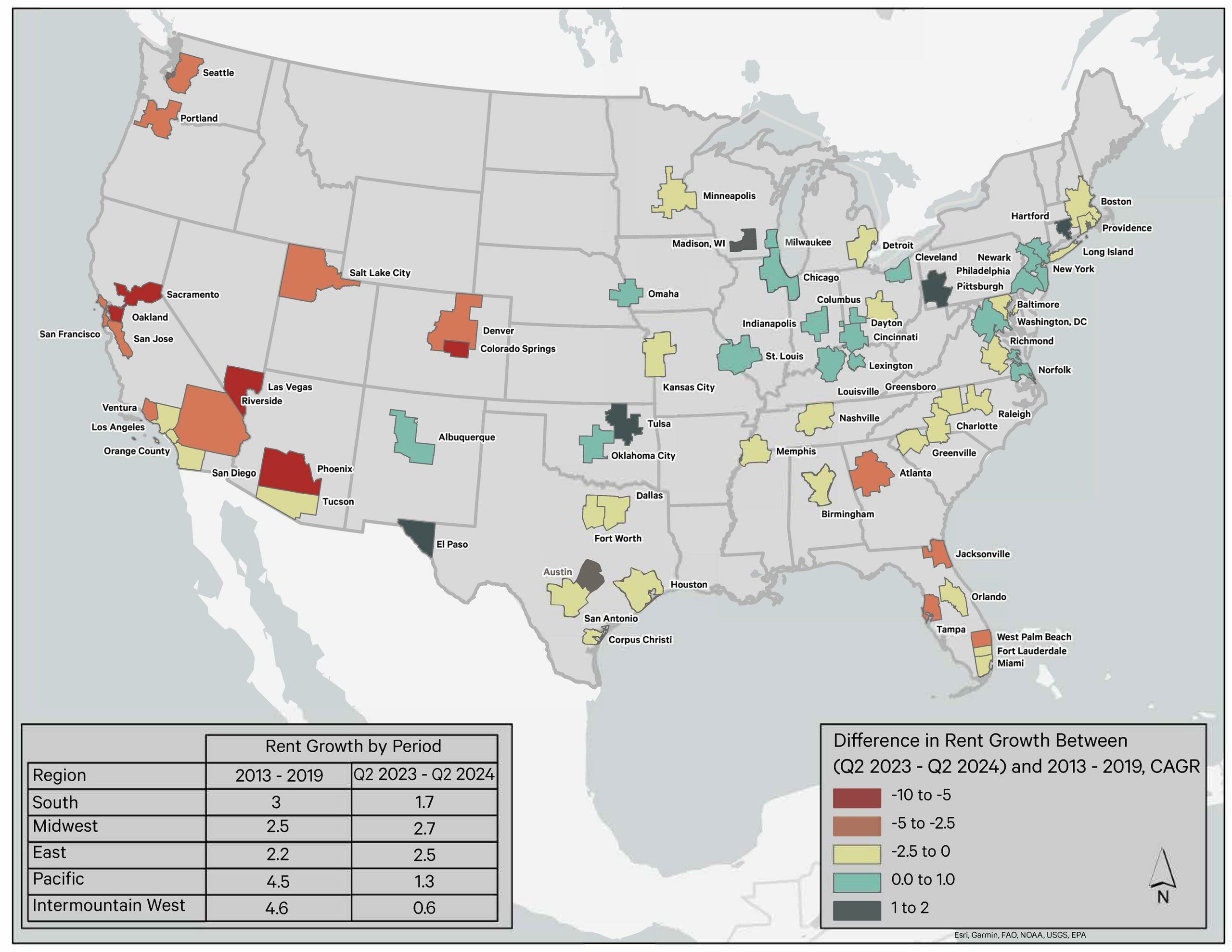

Multifamily rent growth to persist where least expected

Via CBRE: “We expect rent growth to remain stable in typically slow-growth markets across the Midwest and Northeast. Many do not attract significant development activity and the lack of new supply is now a tailwind. Multifamily here will also benefit from the illiquid for-sale market nationwide.”

- Investors Pour Billions Into Student Housing As Rent Growth Outpaces Apartment Market (Bisnow)

- Study: These Rental Markets Are Most Favorable Based On Pricing Trends (Florida Atlantic University)

- Real-Time Migration Data—30 Migration Winners and Losers (John Burns Research and Consulting)

Multifamily and the Housing Market

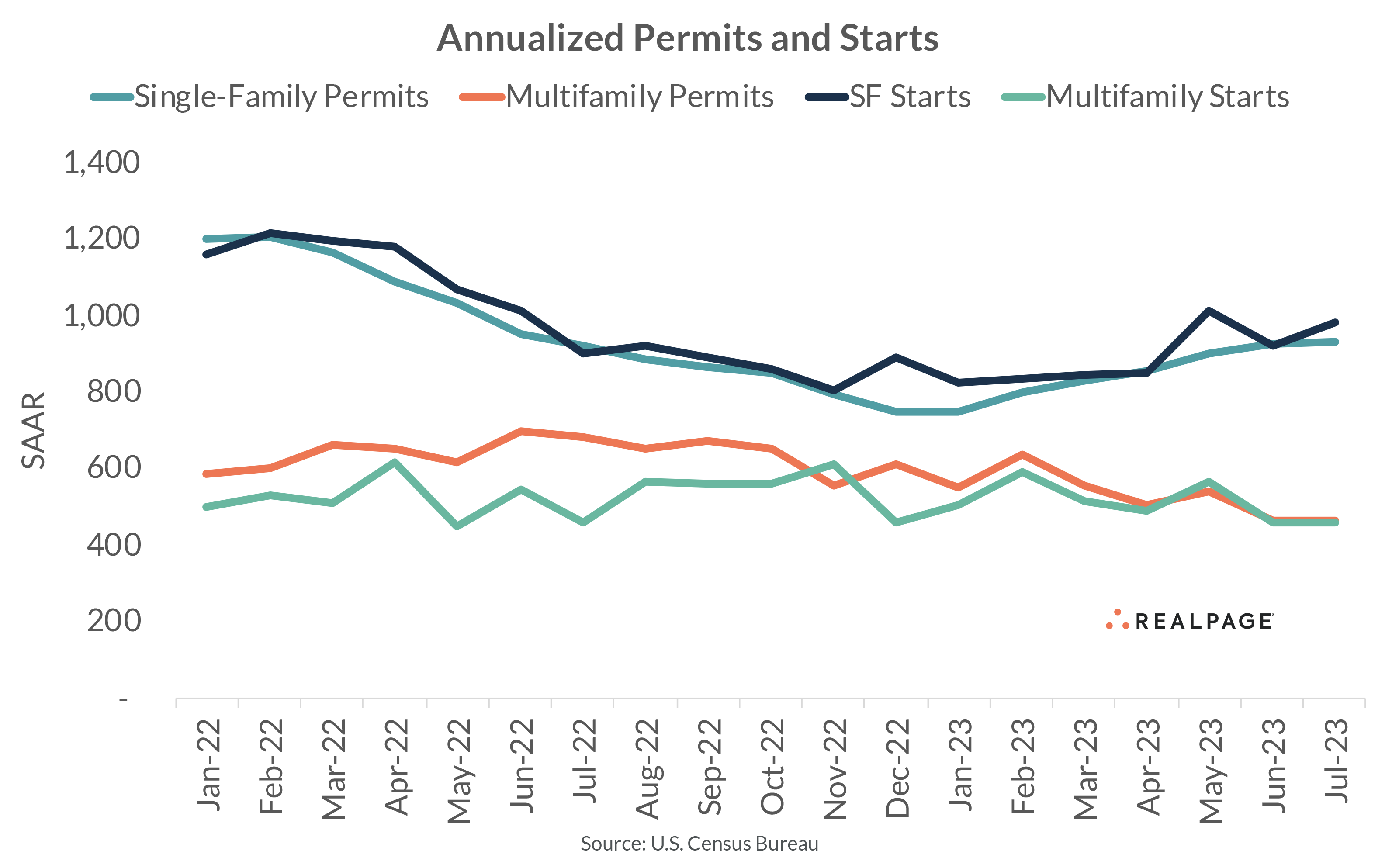

Multifamily Permitting Down by Almost One-Third

Via RealPage: “With slowing multifamily permitting, the number of multifamily units under construction (986,000 units) was only slightly higher than last month’s figure, but it continues to exceed that of single-family (678,000 units).”

- US CoreLogic S&P Case-Shiller Index Was Even Year Over Year in June, Signaling a [Positive] Market Shift (CoreLogic)

- Single-family debt costs eclipse long-standing high point (Institutional Property Advisors)

- Record Gap Forms Between Home Affordability and the Cost of Renting (GlobeSt)

Commercial Real Estate and the Macro Economy

Spiking 10-Year Treasury Rate Signals Caution for Commercial Real Estate

Via CBRE: CBRE’s earlier economic pessimism has softened to include “weak economic growth or recession,” instead of recession alone, and while they frame their interest rate forecast as lower than “what some economists envision,” their 10-year Treasury rate prediction of a gradual glide to 3.5% by 2028 is still relatively “higher for longer.”

- Global Retail Survey, Q2 2023 (Colliers)

- How the Retail Landscape is Evolving (Marcus & Millichap)

- National Industrial Report, August 2023 (Yardi Matrix)

Other Real Estate News and Reports

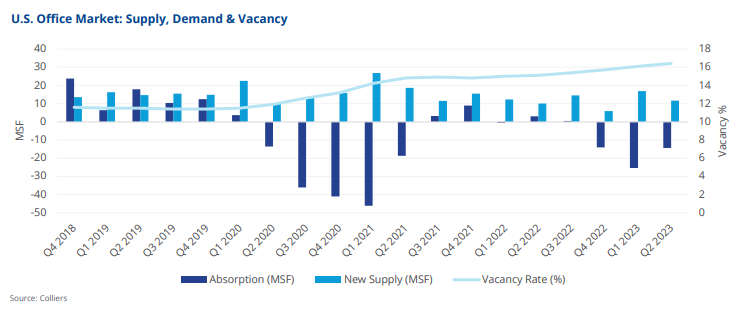

Office Outlook Report, 2Q 2023

Via Colliers: Nationally, “vacancy and sublease space hit new record highs[, and] . . . “Houston has the highest metro vacancy rate at 22.1%, followed by Indianapolis (21.1%) and Greater Los Angeles and St. Louis with both at 21%.”

- United States Office Market Overview, Q2 2023 (Newmark)

- Remote Work Will Persist, Goldman Forecasts, Bringing More Pain For Office Landlords Through 2030 (Bisnow)

- How the ‘urban doom loop’ and office real estate ‘apocalypse’ could pose the next economic threat (Washington Post)