Gray Report Newsletter: August 3, 2023

Apartment supply is growing. What’s next?

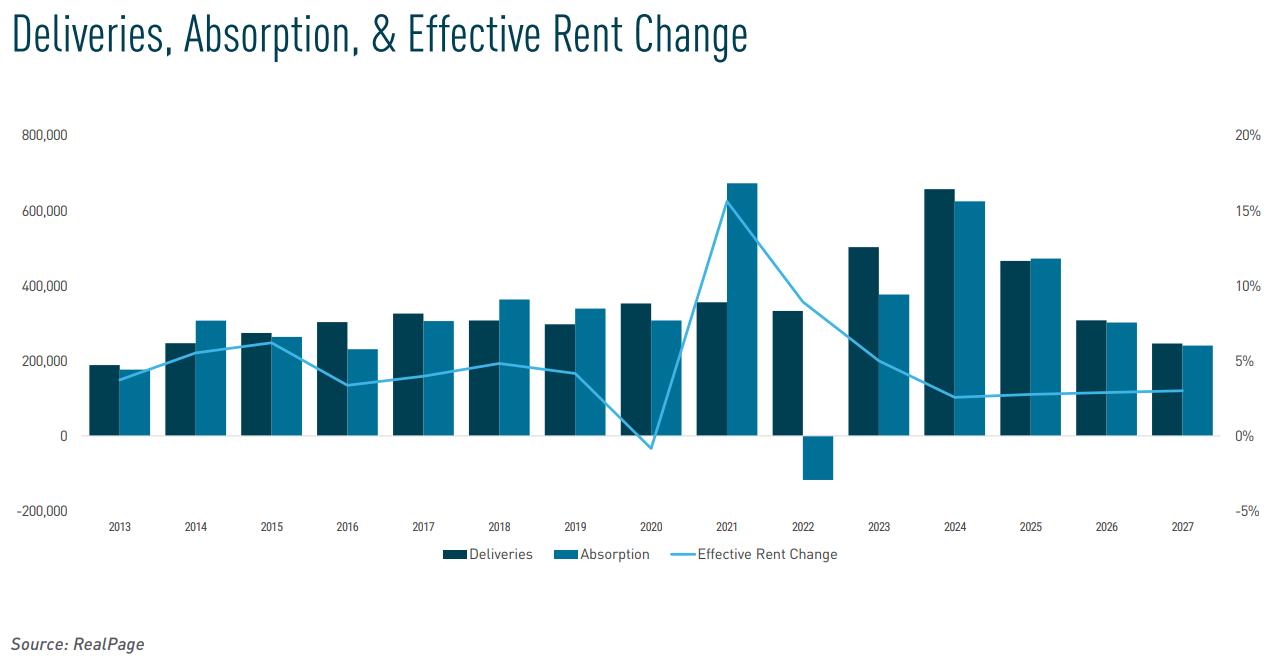

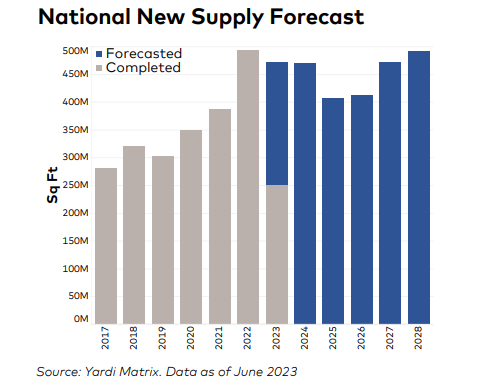

As multifamily developers work through the construction backlog resulting from pandemic-era supply chain disruptions, projections for new apartment supply are being revised upward. Rent growth trends continue to moderate from last year’s historic peak, and many of the top markets of last year have seen much lower rent growth due to the influx of apartments. Strong GDP numbers and a healthy job market, however, support continued housing demand and economic stability despite the elevated interest rate environment.

Multifamily, the Nation, and the Economy

Near-Term Multifamily Supply Forecast Increased

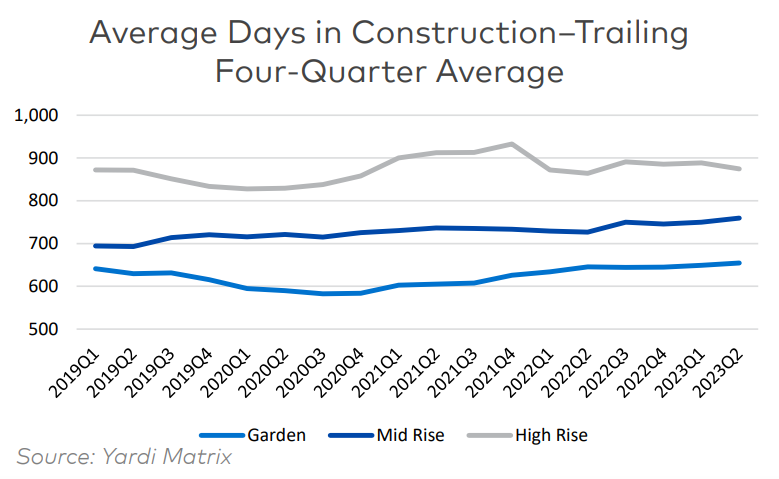

Via Yardi Matrix: “Construction completion times remain elevated, with both garden and mid-rise days in construction at or near record levels, [but] the near-term forecast was increased as the under-construction pipeline continues to expand.”

- Biden-Harris Administration Announces Actions to Lower Housing Costs and Boost Supply (The White House)

- Stellar 2Q Apartment Demand in Key Markets (RealPage)

- JLL unveils first GPT model for commercial real estate (JLL)

Multifamily Markets and Reports

National Multifamily Report, Mid-Year 2023

Via Berkadia: “The start of this year showed signs of a positive shift as economic conditions remained favorable. During the first half of 2023, renters moved into more than 98,800 units than moved out.”

- Student Housing Developers Are Running Out Of Viable Markets (Bisnow)

- Breaking Down Multifamily Property Operating Expenses Across the US: Part 3 – Property Insurance (Trepp)

- Study: South Florida Housing Market Grows More Overvalued (Florida Atlantic University)

- Ranking U.S. Job Growth by Geographic Region (RealPage)

Multifamily and the Housing Market

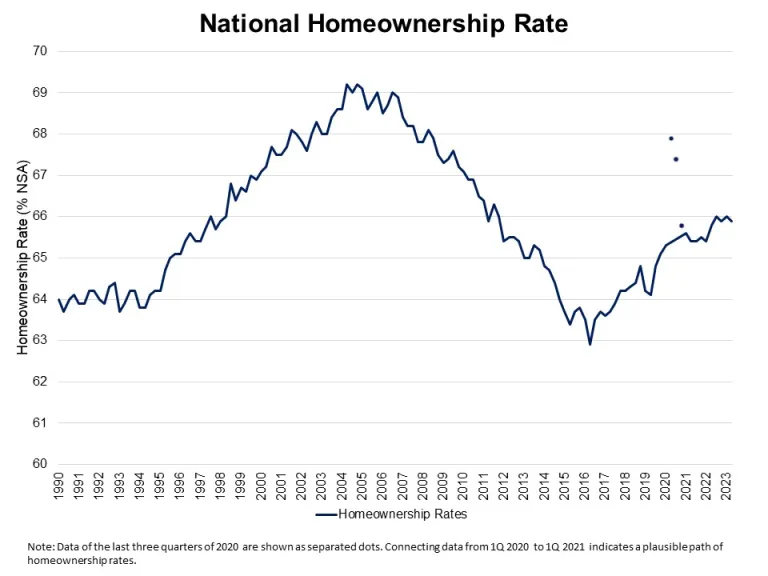

Homeownership Rates for Households Aged Under 35 Fell to 38.5%

Via NAHB: “The housing stock-based HVS revealed that the count of total households increased to 130.1 million in the second quarter of 2023 from 128.2 million a year ago. The gains are largely due to strong owner household formation (1.4 million increase), while renter households increased 471,000 as well.”

- Annual Home Price Gain Near 11-Year Low in June but Should Rebound (CoreLogic)

- Temporary Mortgage Rate Buydown Activity Spiked in Late 2022, Now Becoming Less Common (Freddie Mac)

- International Transactions in U.S. Residential Real Estate (NAR)

- Multifamily Development is Definitely Slowing (RealPage)

Commercial Real Estate and the Macro Economy

National Industrial Report, July 2023

Via Yardi Matrix: More stable prices should allow occupiers to consider expansions and new leases that may not have been feasible when inflation was running hot.

- Supply Chain State of the Industry Report Q2 2023 (Colliers)

- Most U.S. Office Buildings More than 90% Leased (CBRE)

- GDP Reaffirms Resilience in the Economy, Boosts Prospects of a Soft Landing (Institutional Property Advisors)

Other Real Estate News and Reports

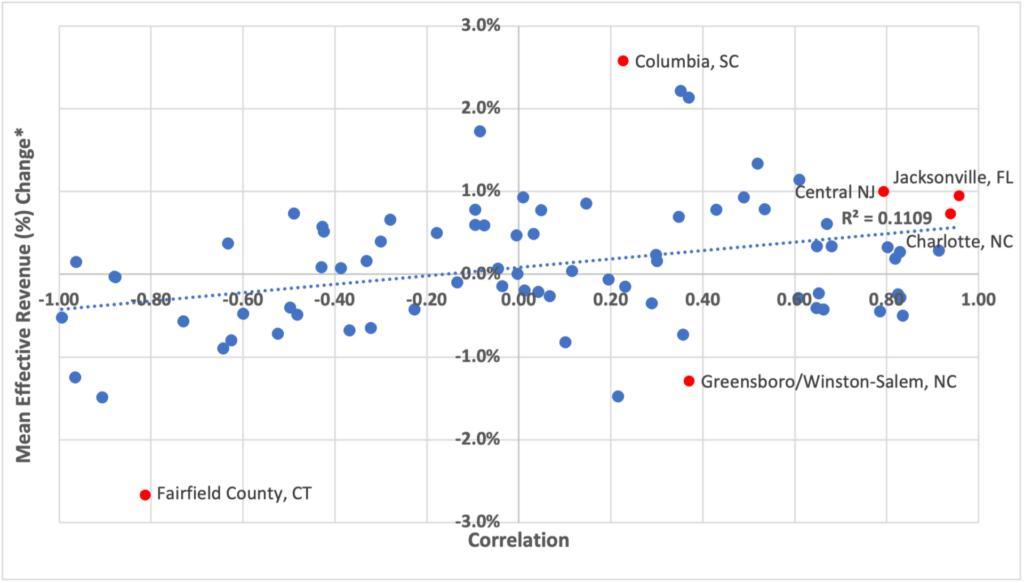

Correlation between Retail and Multifamily Real Estate Performance

Via Moody’s Analytics: “As more people locate to a new area to live, it consequently makes the surrounding retailers more desirable due to their proximity and vice versa, popular retailers that provide entertainment and the necessities to live make nearby apartment complexes more sought after.”

- Three Trends Impacting the Future of Retail (CBRE)

- ‘Sentiment Around Office Is Worse Than The Reality’: Boston Properties Stock Up On Q2 Earnings (Bisnow)

- Proposed rule on bank capital requirements “will increase borrowing costs and reduce credit availability” (Mortgage Bankers Association)