Gray Report Newsletter: April 6, 2023

High home prices were a prominent subject two years ago, and despite a dip in values, still-elevated home values and high mortgage rates have kept the topic in conversation. While multifamily investors are familiar with these issues for homebuyers and their implications for the rental market, the enduring nature of this buyer-renter gap will lead even more families and individuals priced out of homeownership to seek apartments instead.

Multifamily, the Nation, and the Economy

New Mortgage Payments Now Well Above Multifamily Rents

Via CBRE: U.S. homebuyers face average monthly mortgage payments that are 37% higher than apartment rents and would need to decrease an additional 24% this year to align with forecasted rental rates, assuming no further rise in interest rates.

- Scarcity of Starter Homes is Keeping Prices Afloat and Sustaining Barriers (Institutional Property Advisors)

- What’s the Real Situation with CRE and Banks: Doom Loop or Headline Hype? (Moody’s Analytics)

- Could CRE Disrupt the Banking System? (Marcus & Millichap)

- CMBS Dominates First Wave of Commercial Property Debt (MSCI)

Multifamily and the Housing Market

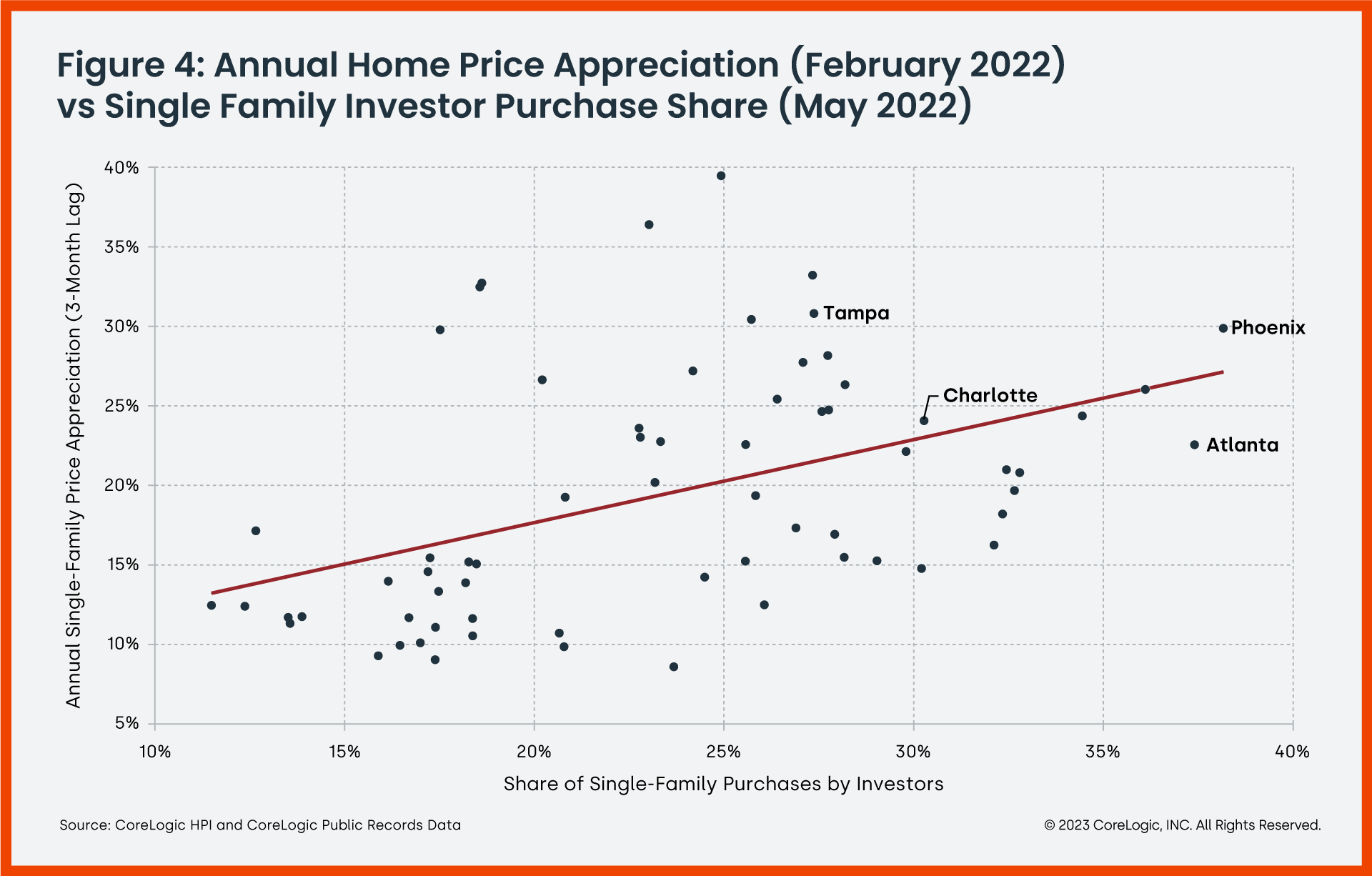

Single-Family Investors Chased Higher Rents. They Didn’t Cause Them

Via CoreLogic: Investor activity in the single-family rental market reached record highs amid rising home prices and rents, with data suggesting that investors came after rising rents and prices rather than causing them.

- This younger cohort could create a demand for apartments that could overwhelm supply (GlobeSt)

- Millennials are desperate to buy a home — but cash-flush boomers are standing in their way (Business Insider)

- 64.8 Million Households Cannot Buy a $250,000 Home (NAHB)

- The Cities Where Homes Are Still Selling at Breakneck Speed—and the Ones Where Sales Have Slowed Down Most (Realtor.com)

Multifamily Markets and Reports

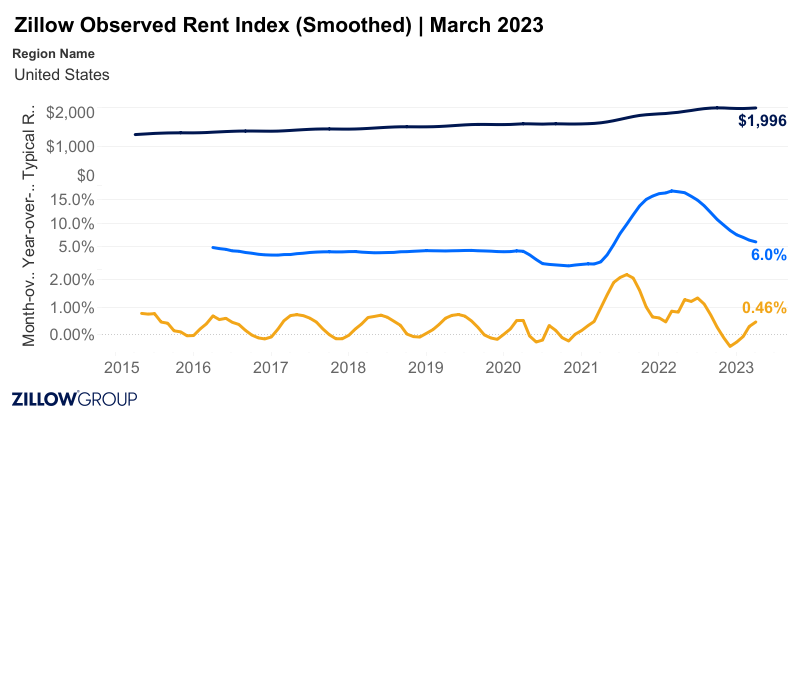

March 2023 Rental Market Report

Via Zillow: “Asking rents climbed by $9, or 0.5%, from February to March, according to the latest reading of the Zillow Observed Rent Index (ZORI). That builds on February’s 0.3% increase, when monthly rent growth turned positive after a 4-month slide.”

- Unlocking the Secrets of Seasonal Rent Trends in 2023 (Apartment List)

- Apartment-Building Sales Drop 74%, the Most in 14 Years (The Wall Street Journal)

- Multifamily Permits and Starts Rebound in February (RealPage)

Commercial Real Estate and the Macro Economy

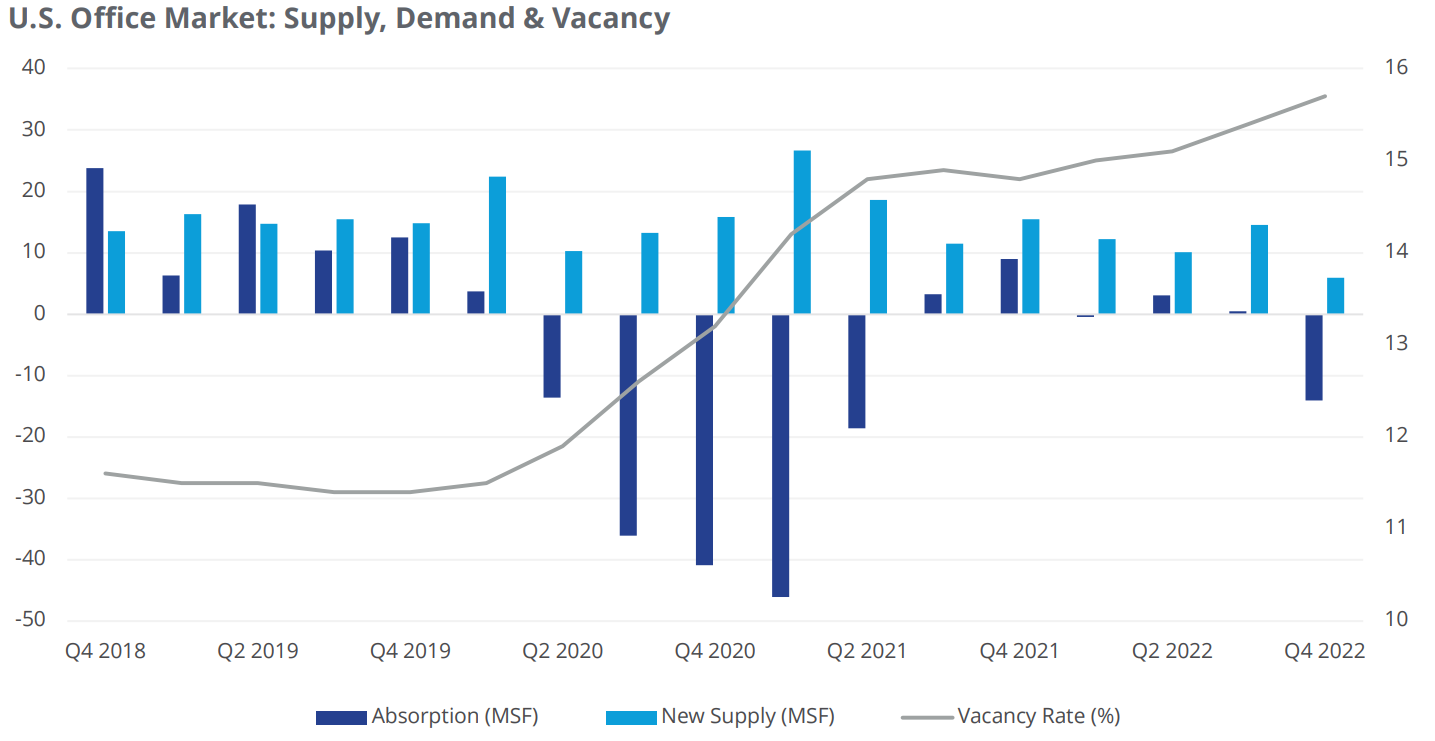

Top U.S. Office Markets: Performance and Prospects

Via Colliers: “As companies continue to

assess real estate needs post-COVID, sublease space will remain an attractive, short-term, cost-competitive option until there is greater clarity on future business direction.”

- Will Retail Bail on Downtowns With Empty Offices? (GlobeSt)

- Outlook Bright for Border-Town Industrial (Marcus & Millichap)

- Sustainability and ESG Adoption in the Hotel Industry (CBRE)

- CRE is Vulnerable, but Please Don’t Overlook the Details (Moody’s Analytics)

Other Real Estate News and Reports

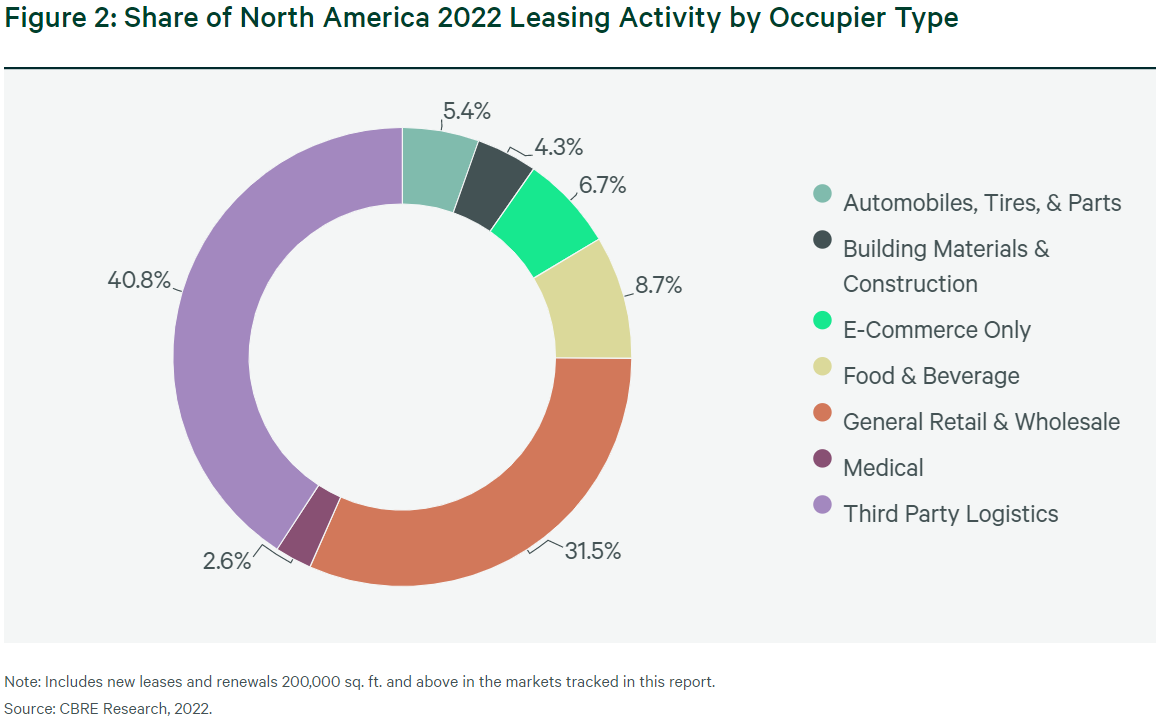

2023 North America Industrial Big Box

Via CBRE: “In 2022—despite widespread macroeconomic concerns—North American big-box industrial facilities saw record-low vacancy, unprecedented rent growth and significant new construction.”

- U.S. Self-Storage: Market Trends and Sector Outlook (Cushman & Wakefield)

- Nearly $39B In CMBS Office Loans Will Default, J.P. Morgan Predicts (Bisnow)

- Commercial Real Estate Market Exposure (J.P. Morgan)