Gray Report Newsletter: April 13, 2023

The latest numbers from the Consumer Price Index showed lower-than-expected inflation, but uncertainty (or pessimism) regarding the Federal Reserve’s interest rate path has dampened some of the enthusiasm about the inflation news. This uncertainty is keenly felt in the still-stagnant apartment sales market, but when it comes to apartment demand, solid positive rent growth trends are a clear highlight amidst the anxious unknowns elsewhere in the multifamily market and the economy as a whole.

Multifamily, the Nation, and the Economy

Consumer Price Index – March 2023

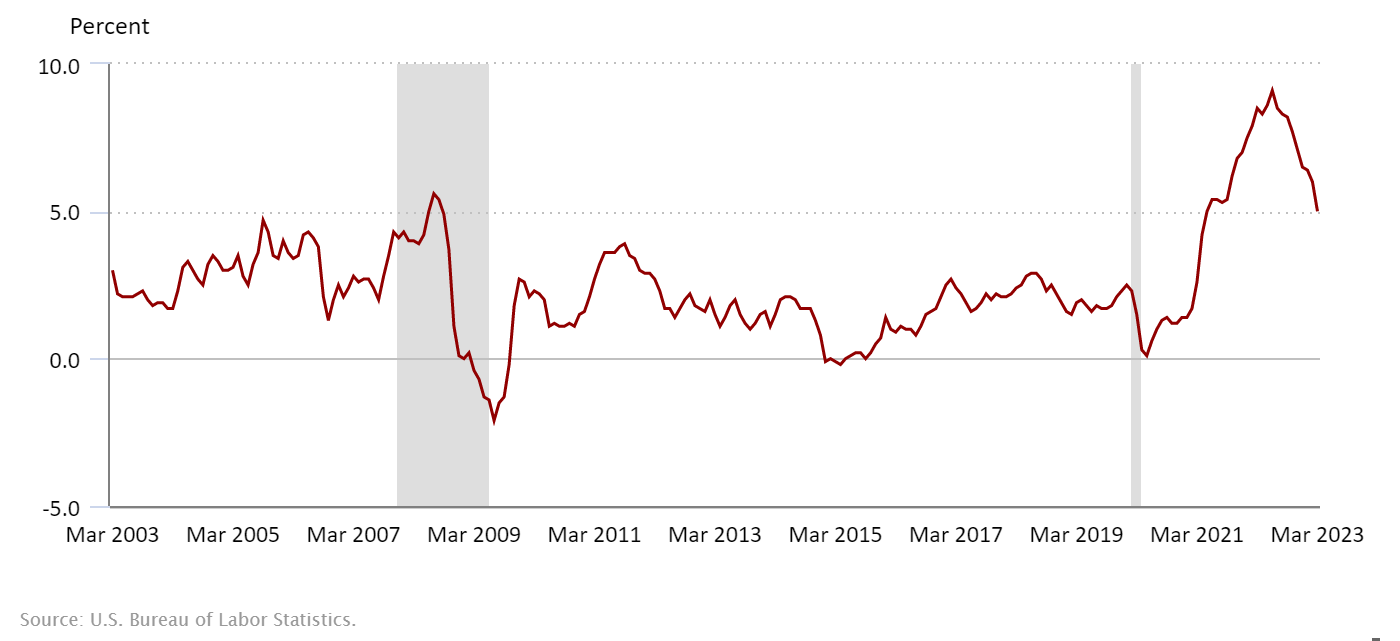

Via Bureau of Labor Statistics: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a seasonally adjusted basis, after increasing 0.4 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 5.0 percent before seasonal adjustment.

- Apartment Demand Rebounds in Q1 After Weak 2022 (RealPage)

- More Cities Giving Away Money For Office-To-Resi Projects As Threat Of Obsolescence Grows (Bisnow)

- Houston Apartment Owner Loses 3,200 Units to Foreclosure as Multifamily Feels the Heat (The Wall Street Journal)

- U.S. Cap Rate Survey H2 2022 (CBRE)

Multifamily and the Housing Market

National Multifamily Report, March 2023

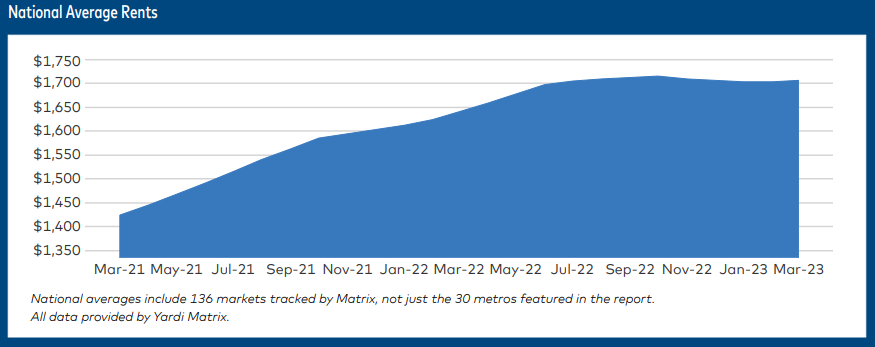

Via Yardi Matrix: While they’ll constrain capital conditions for property owners, the good news is that multifamily fundamentals performance remained strong and U.S. asking rents increased in March for the first time since the fall of 2022.

- The Cap Rate Spread’s Underlying Message (Multi-Housing News)

- Lower-Income Renters Have Less Residual Income Than Ever Before (Harvard JCHS)

- First-Time Homebuyer Share Bounces Back Despite Affordability Challenges (CoreLogic)

- The Janus Face of Multifamily Real Estate (Commercial Observer)

Multifamily Markets and Reports

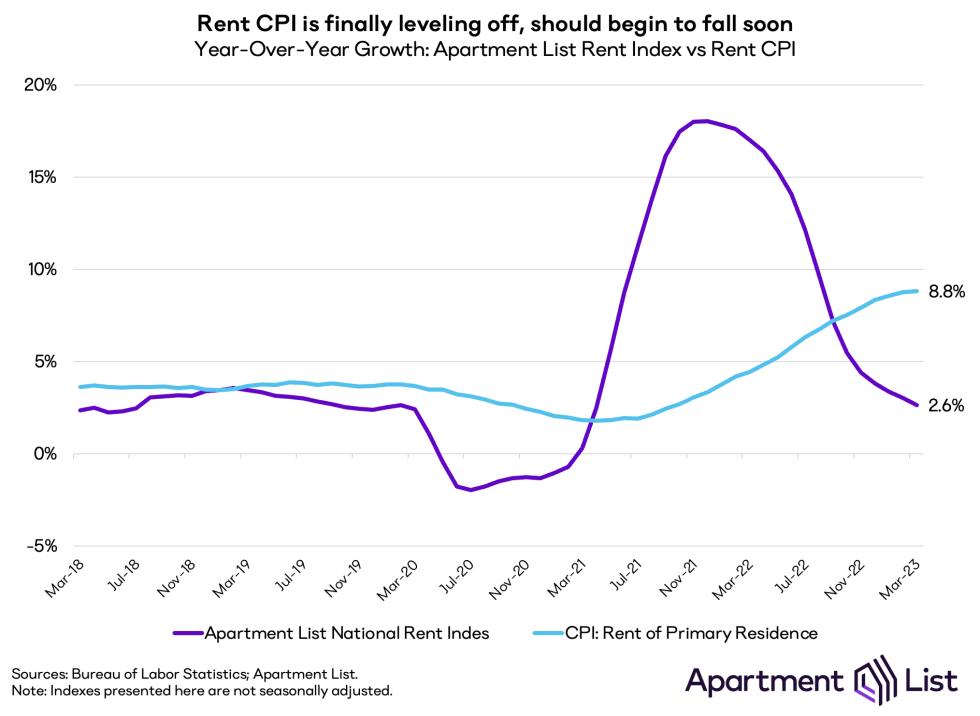

Via Apartment List: This month represents the start of a turning point for shelter CPI, representing a major milestone in the comedown from this inflationary cycle.

- Apartment Construction at 50-Year High? Yes, But … Not Really (RealPage)

- Apartments.com Q1 Multifamily Report (CoStar)

- Student Housing Report, Q2 2023 (Yardi Matrix)

Commercial Real Estate and the Macro Economy

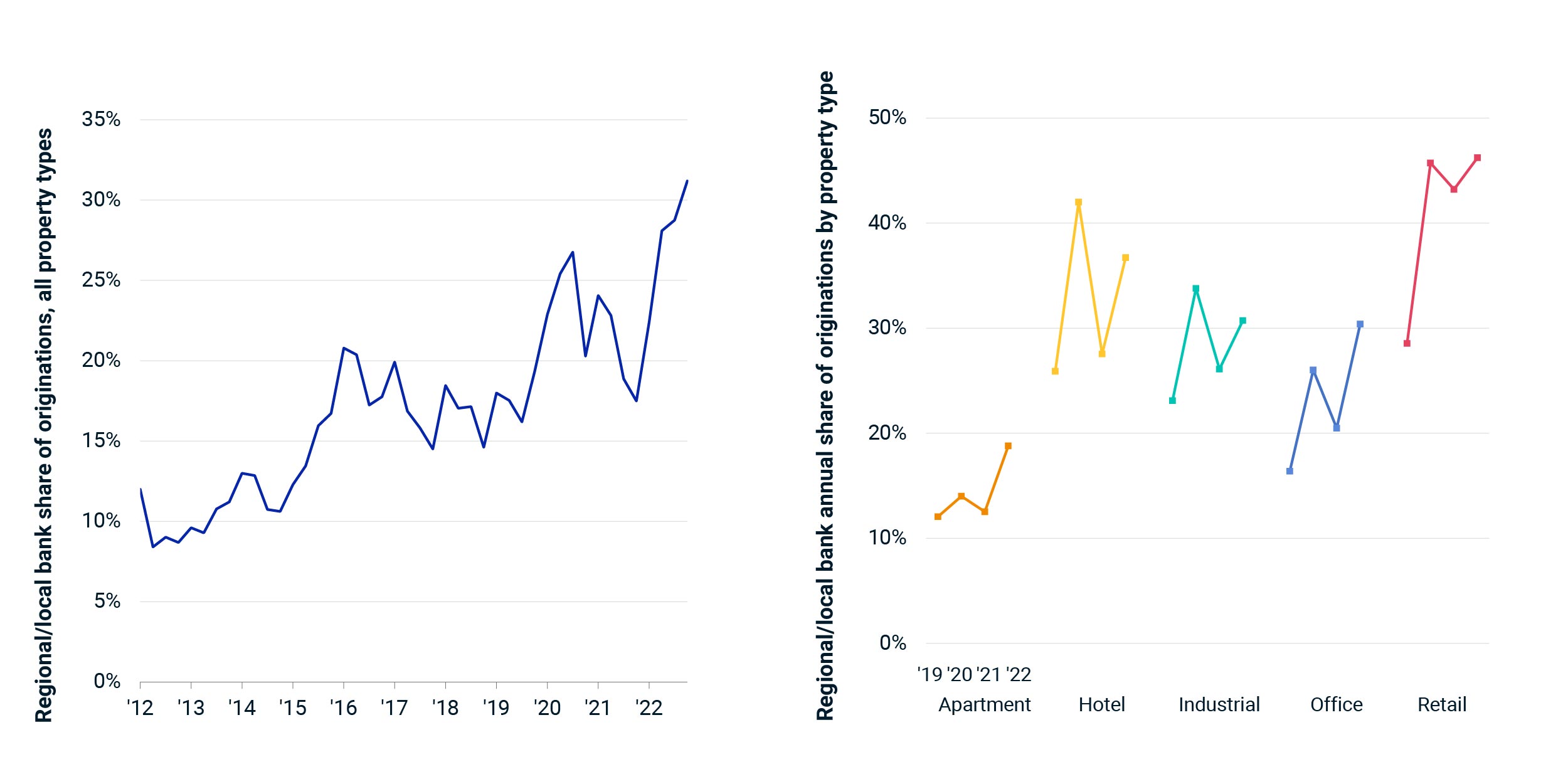

Commercial-Property Debt Is Not Just a Small Bank Story

Via MSCI: Besides banks, lender groups active in commercial real estate include debt funds, life-insurance companies and originators of commercial mortgage-backed securities and collateralized loan obligations.

- hipping Routes Shift to the Atlantic, Posing Implications for the Industrial Sector (Marcus & Millichap)

- Construction Claims – April 2023 (CoreLogic)

- Food & Beverage Report (JLL)

- Real Estate Entrepreneur’s Latest Move Eyes $3 Trillion US Farmland Market (CoStar)

Other Real Estate News and Reports

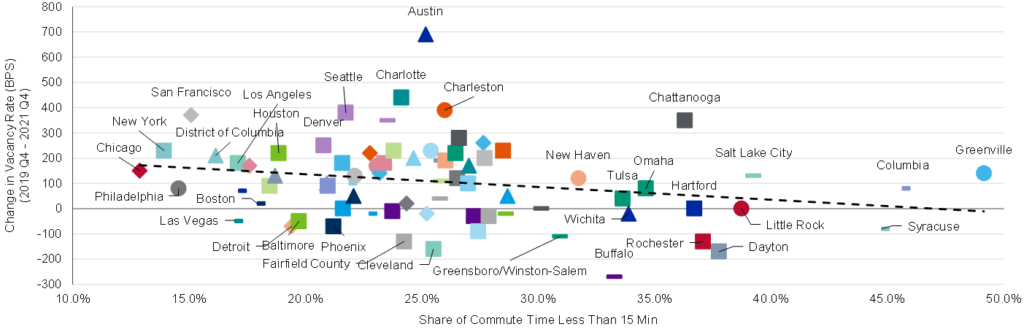

Commute Times and Office Vacancy Rates

Via Moody’s Analytics: The 75 metros charted averaged a vacancy growth of 100 basis points with 25% of the worker’s commute being under 15 minutes.

- A New Way to Push People Back to Offices: Tying Pay to Attendance (The Wall Street Journal)

- 10 Emerging U.S. Industrial Markets to Watch in 2023 (Colliers)

- North American CRE Market Survey, 1Q2023 (Newmark)

- Warren Buffett on commercial real estate: People who lend too much money should take losses (CNBC)