Gray Report Newsletter: May 2, 2024

Fed Declares: “Interest Rates Stay High”

The latest meeting of the FOMC, in which the Federal Reserve affirmed its continued commitment to high interest rates, was not surprising given the bumps along the road to target inflation. In the multifamily market, even as apartment operators continue to navigate the occupancy and rent growth challenges associated with so much new apartment supply entering the market, substantial apartment demand and greater clarity on the limits of the current apartment supply wave continue to support the long-term investment prospects for apartment assets.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

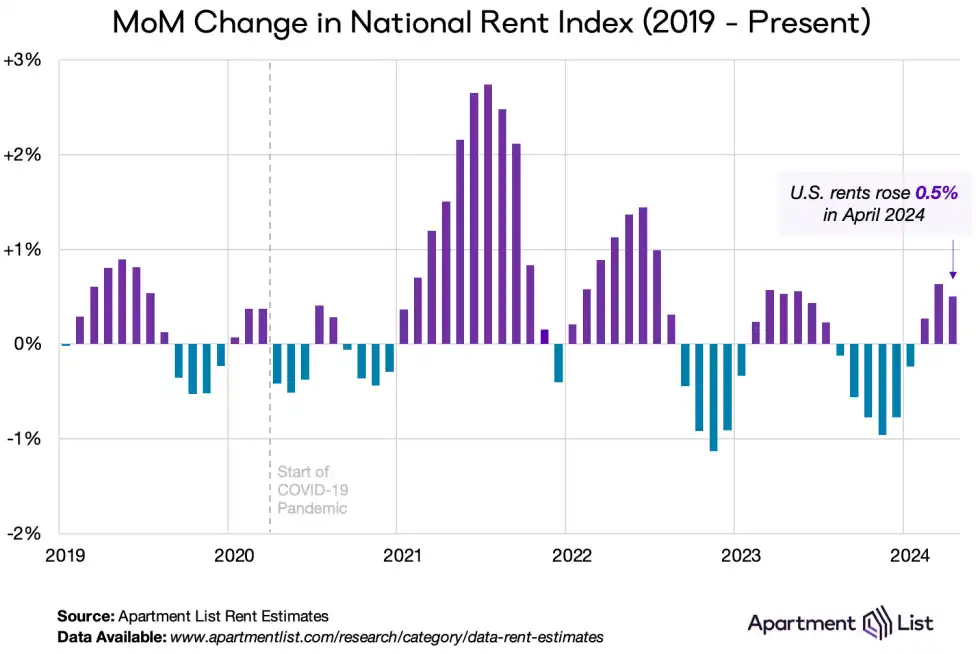

National Rent Report, April 2024: Rent growth dips in shaky start to leasing season

Via Apartment List: “While last month’s data seemed to reflect the start of a bounceback, this month’s estimate is signaling that the sluggishness which has characterized the rental market since late 2022 may be persisting.”

- Multifamily’s Tough Times Will Be a Boon for Bargain Buyers (GlobeSt)

- Fed keeps rates steady as it notes ‘lack of further progress’ on inflation (CNBC)

- The Past May Still Be Prologue in Multifamily Markets (CBRE)

- Yardi To Become WeWork’s Majority Owner In $450M Bankruptcy Exit Plan (Bisnow)

Multifamily and the Housing Market

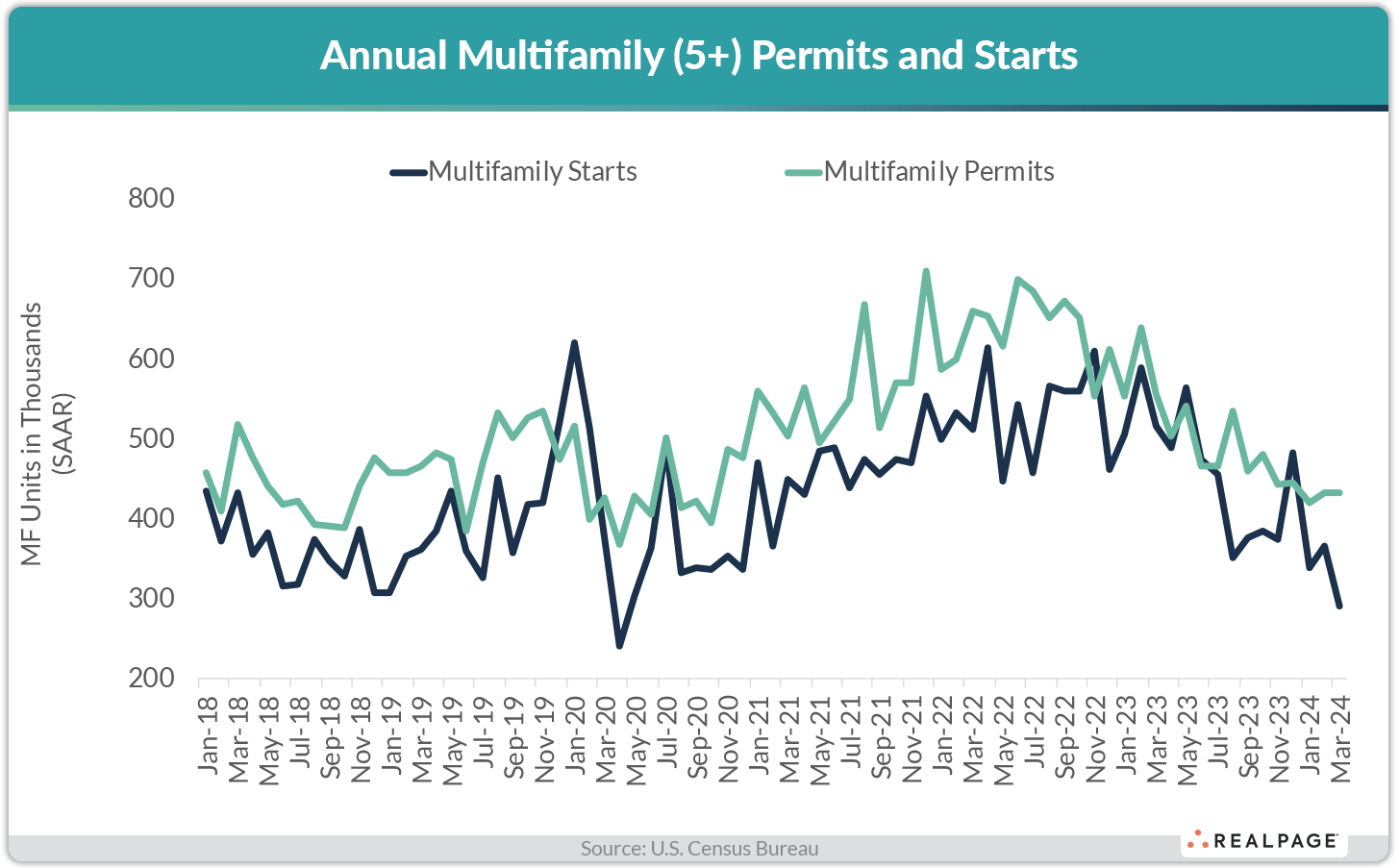

Multifamily Starts Plunge in March, Indicating When Supply Wave Could Taper

RealPage: “March’s annual rate of 290,000 units was down 20.8% from February’s revised rate of 366,000 units and 43.7% below the year-ago rate. Multifamily permitting was unchanged from last month but the SAAR of 433,000 units permitted was 22.1% less than last March.”

- Lowest Homeownership Rate for Younger Householders in Two Years (NAHB)

- Can New Suburban Housing Make Urban Areas More Affordable? (Harvard Joint Center for Housing Studies)

- The housing market feels like it’s in a time machine — but that doesn’t mean a crash is coming, experts say (MarketWatch)

Multifamily Markets and Reports

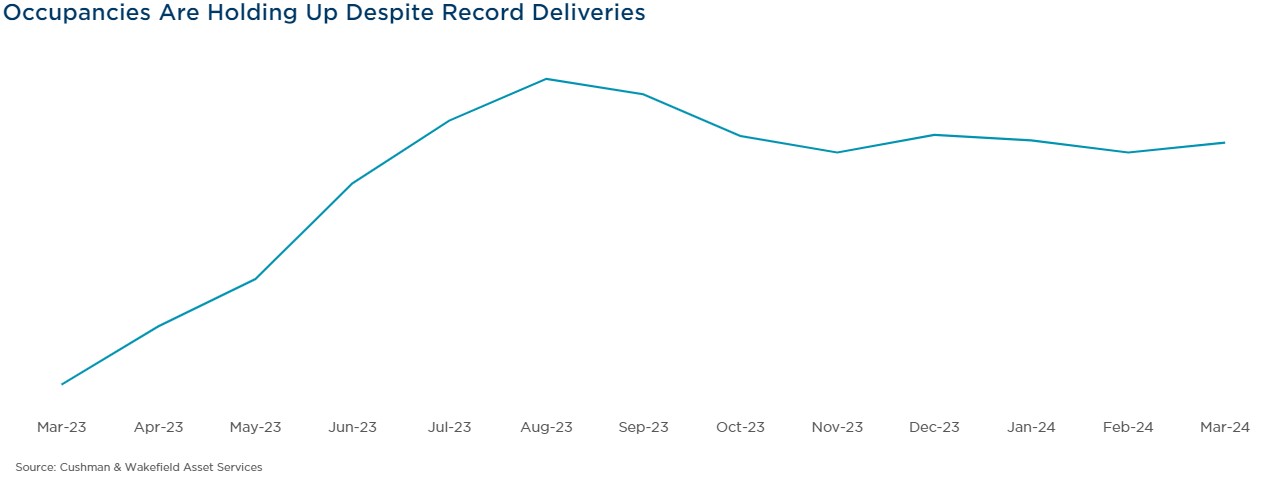

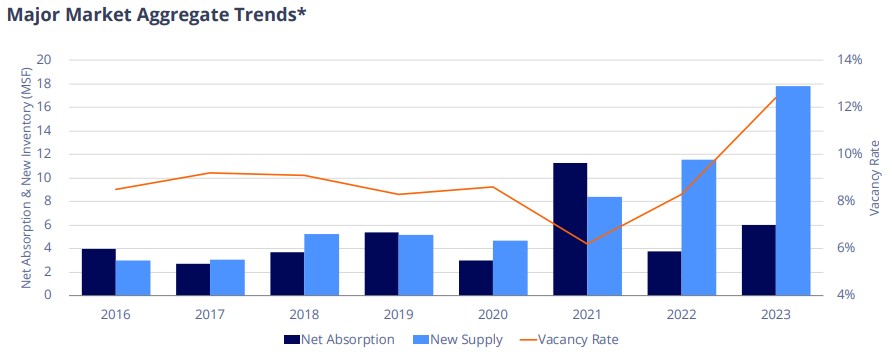

Multifamily Trends: Despite Elevated Supply, Occupancies Are Holding Up

Cushman & Wakefield: “At the national level, the U.S. has seen occupancy continue to degrade—overall occupancy is down 130 basis points (bps) over the past year, but within Cushman & Wakefield’s managed portfolio, occupancy has improved by 176 bps over the past year. Occupancies peaked in August of last year, but they remain down just 40 bps from that peak.”

- How are apartment markets comparing with pre-pandemic performance? (RealPage)

- The Differences Between SFR and Multifamily Renters (GlobeSt)

- Student Housing Report, April 2024: Student Housing Fundamentals Outpace Historical Average (Yardi Matrix)

Commercial Real Estate and the Macro Economy

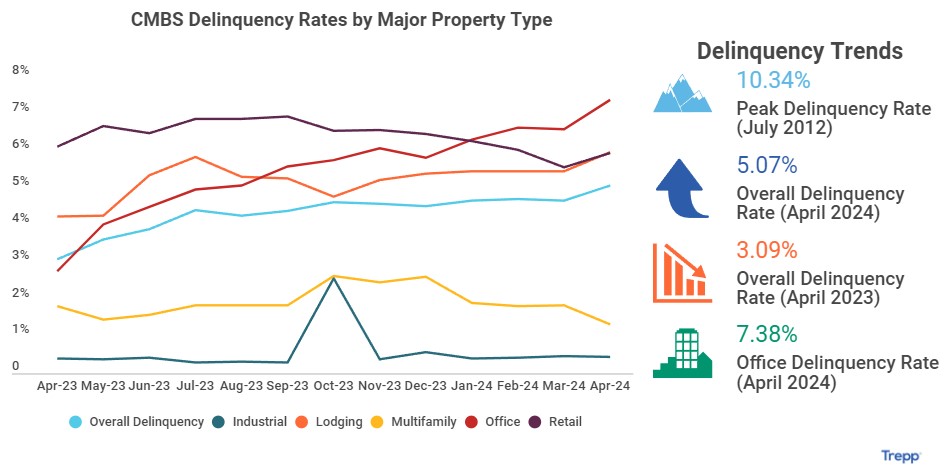

CMBS Delinquency Rate Spikes in April to above 5%, First Time Since September 2021

Via Trepp: “The Trepp CMBS Delinquency rate surged in April 2024 after posting a slight decline the month prior[,] . . . driven by spikes in the office, lodging, and retail sectors, with more than a dozen loans with outstanding balances greater than $100 million becoming delinquent during April.”

- Amid discouraging interest rates and inflation, “buyers/sellers/lenders are finally getting conditioned to the higher cost of capital environment.” (Cushman & Wakefield)

- Real Assets in Focus: Senior Debt on Top; PE Distributions Up, Real Estate Lags Behind Infrastructure, Natural Resources (MSCI)

- Consumer Resilience Offers Benefits and Drawbacks for Commercial Real Estate (Institutional Property Advisors)

- Global Hotel Investor Intentions Survey 2024: Investors Plan to Buy More Hotels This Year (CBRE)

Other Real Estate News and Reports

Life Sciences Report, 2024: Near-Term Financing Headwinds, Strong Long-Term Fundamentals

Via Colliers: “Elevated interest rates have placed downward pressure on business investment and on company values, . . . [but] funding conditions could perk up in 2024 and help give companies the confidence and ability to lease space.”

- Investor Opinions on CRE Pricing: Institutions cautious, private investors see discounts and opportunity (Marcus & Millichap)

- Retail Outperforms, But for How Long? 2024 Forecast (Colliers)

- Off With The ‘Handcuffs’: How A Noncompete Ban Could Change CRE (Bisnow)