Drastic Differences Grow Among Multifamily Markets

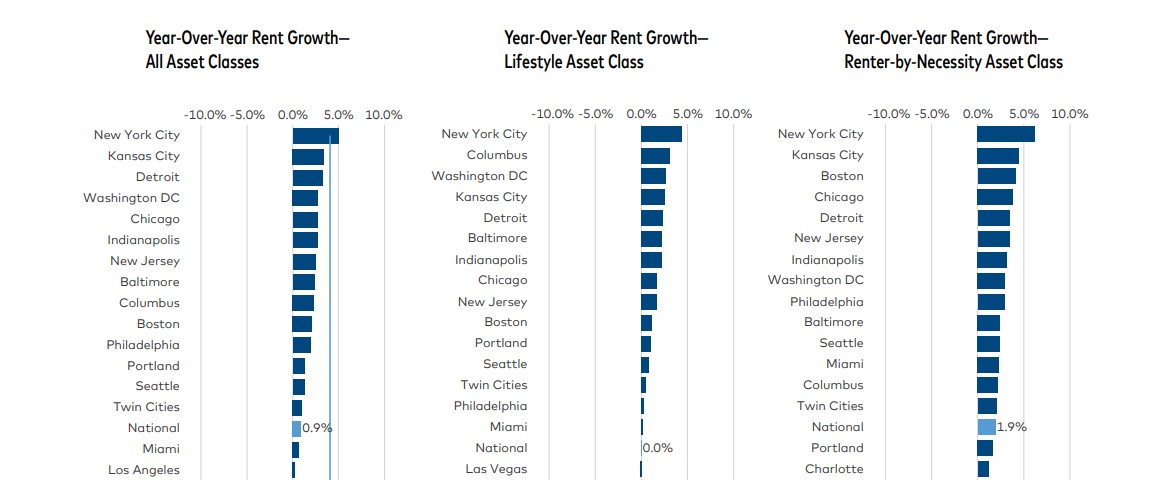

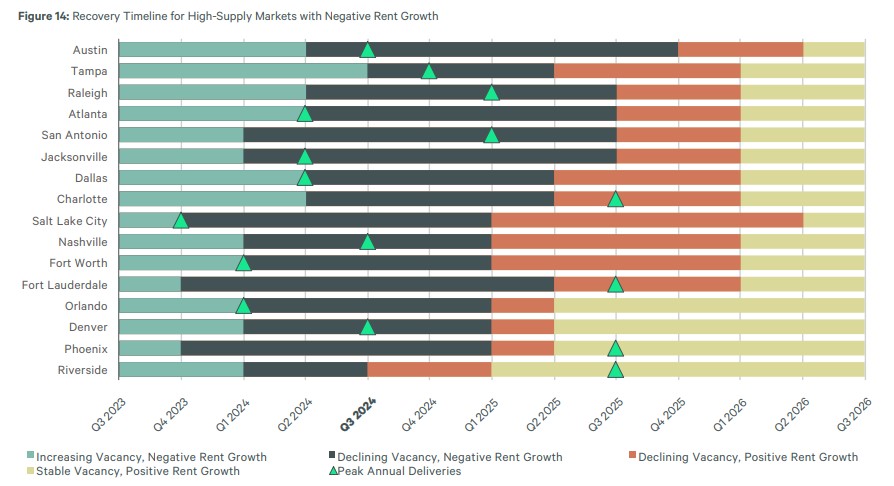

The timeline of construction activity, which has dominated the face of the multifamily market for the past 2 years, has varied substantially among different regions and specific markets. Many of the markets that have seen the most amount of new apartment supply in the past 2 years are expected to continue to be apartment supply leaders in 2025, with some cities on course to deliver even more new supply in 2025 than they did in 2024. In contrast, for most of the markets that saw moderate amounts (relative to the current supply wave) of newly-built apartments delivered in the past 2 years, apartment supply is not expected to catch up to the previous market leaders. This could help explain recent projections of so many Midwest markets as rent growth leaders, but as the current apartment supply wave recedes, these regional differences may also subside.

Multifamily, the Nation, and the Economy

Nov. 2024 National Multifamily Report: Regional Rent Growth Variations Persist

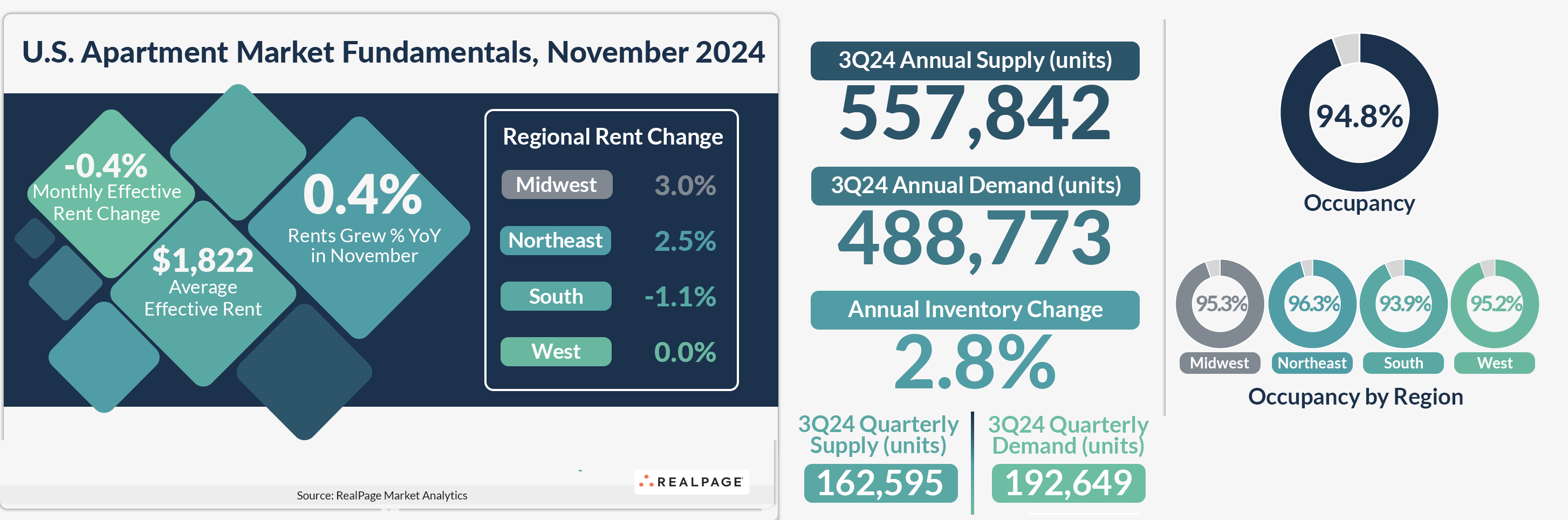

Yardi Matrix: “Multifamily advertised rents dropped $5 nationally in November to $1,744, as a rapid influx of supply continues to counteract strong demand in high-growth Sun Belt markets. Year-over-year rent growth fell 10 basis points to 0.9%.”

- CPI Inflation Posts Small, Expected Increase, but Rental Housing Inflation Continues to Drop (BLS)

- 2025 Could Bring First Balanced Housing Market in 9 Years (GlobeSt)

- 2024 Year-End Report: Miami’s Competitiveness Wanes With Suburban Chicago and Milwaukee Closing In (RentCafe)

- Setting the Stage for 2025 Housing: “Inventory trends are diverging across the nation.” (CoreLogic)

Multifamily and the Housing Market

U.S. Real Estate Market Outlook 2025: Watch the Timeline for Multifamily Supply

Via CBRE: “For all the short-term negative effects brought on by rising interest rates and record levels of new supply, strong renter demand will drive improving occupancy and accelerating rent growth. This in turn will lead to increased multifamily investment activity.”

- Affordable Housing Report | 2024 (Colliers)

- The Insurance Crisis Continues to Weigh on Homeowners (Harvard Joint Center for Housing Studies)

- Top Housing Markets for 2025: Cities Where Home Sales Are Set To Soar (Realtor.com)

Multifamily Markets and Reports

More Evidence of Regional Differences in Multifamily Supply and Market Performance

Via RealPage: “Regionally, the highest supply area of the country, the South region, again claimed the lowest apartment occupancy at 93.9% in November. As usual, the Northeast claimed a characteristically high occupancy rate of 96.3% in November. In the Midwest and West, occupancy stood at 95.3% and 95.2%, respectively.”

- Tracking the Apartment Market with the “Time on Market” Metric (Apartment List)

- Consumer Housing Sentiment Up Significantly Year over Year (Fannie Mae)

- Asking Rents Fall 0.7% to Lowest Level Since March 2022 (Redfin)

Commercial Real Estate and the Macro Economy

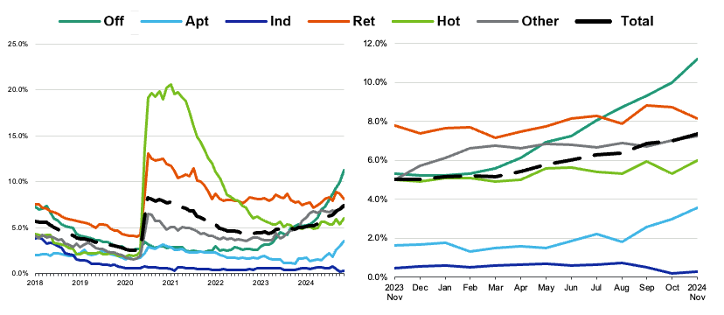

Office delinquencies more than double in the past year

Via Moody’s Analytics: “While the interest rate environment may be more favorable in the future for these loans, the sheer dollar amount of maturities and the availability of credit will still be a cause for concern.”

- Resilience & Recovery: The Future of CRE in 2025 (Colliers)

- Office-to-Residential Conversions: Trepp’s Criteria and a List of Potential Candidates (Trepp)

- Credit Still Tight, But Builders Finally Get Some Relief from Interest Rates (NAHB)

Other Real Estate News and Reports

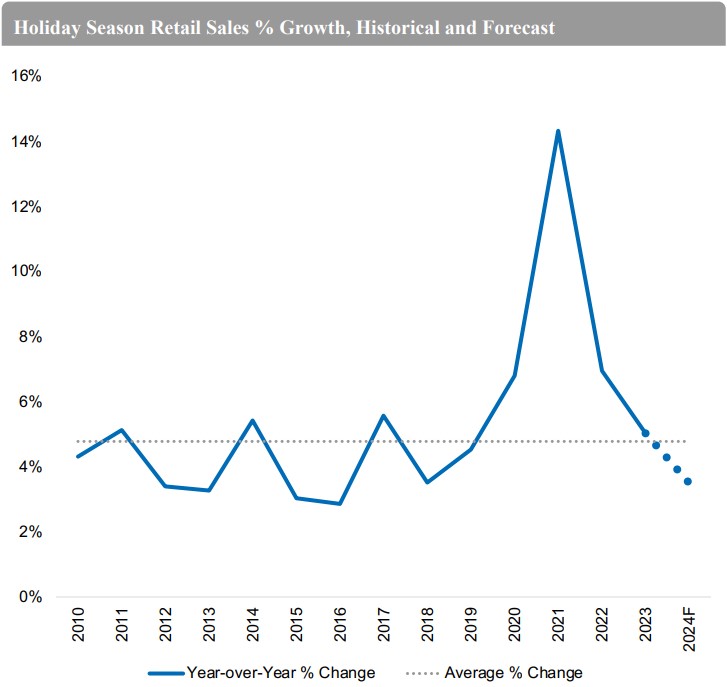

Via Newmark: “Forecasters estimate an increase in retail sales of 2.4% to 3.6% over last season—a solid, if below-average, performance amid lingering inflation.”

- The Structural Shift That Could Transform Real Estate (Marcus & Millichap)

- Global Real Estate Outlook: Five predictions for 2025 (JLL)

- Insurance Has Bigger Bite of Commercial-Property Income (MSCI)