What’s More Likely: A Less Hawkish Fed or a Wave of Multifamily Distress?

WTHR: “Bill holding landlords accountable passes Indiana House”

HB 1075 states the attorney general may take action against a company if they fail to fix needed problems within 45 days of receiving a written notice. Just fair warning, the IN government website does not classify this bill as a rental housing, tenant, or landlord issue. It is described as relating to non-profit organizations.

Whatever its number is, the bill also states the courts could appoint someone to manage the corporation or property of the corporation. For example, when an owner isn’t paying the bills, the property could go into foreclosure or utilities could be shut off.

As Representative Justin Moed says, “The attorney general can intervene early and try to ask a judge to make sure that we set aside funds to pay the bills to make sure that people’s homes are preserved and that they’re not put out on the street,” he said.

I don’t think that this should be a huge issue to adequately-run apartment properties in the state. A landlord doesn’t address a problem in 45 days? The government is going to knock on that landlord’s door. This isn’t rent control or an eviction ban, and this does seem to be codifying things that were already sensible ethical rules people were following, like, fix a thing if you’re supposed to fix a thing. I get that you could have someone call you every night at 3 AM to fix a flickering light that really is NOT flickering, or maybe there’s a slight buzzing noise in the AC unit every time it clicks on? Could you fix that? There is some language in the bill that refers to a “reasonable written interrogatory,” which I take to mean that you can’t get the government to step in if you make an unreasonable request to fix a squeaky door.

What’s interesting to me, as a non-follower of state-level legislation, is that this bill is neither classified as a renter/landlord issue, nor does it refer to disputes or actions in the bill itself as those that would be taken by a landlord or renter. It is purely the language of a corporation. It would be interesting to find out why the subject is not named in the bill but is being reported on in the media as pertaining to renters. There are many renters bills that are being heard or have been heard by the Indiana state legislature, and they are explicitly labeled as renter or landlord or tenant bills. This one, I wonder if there was some kind of omnibus or budget reconciliation or something where, for the sake of expediency, the legislative intent of a renter’s rights bill somehow found its way into a bill about non-profit organizations.

Bureau of Labor Statistics: “Employment Situation Summary, January 2023”

A jobs report that’s 2.5 times as big as expected—yeah I’m going to want to talk about it!

And, if you want to keep thinking about this as good news and not as the inverted way where it’s just fuel for more inflation and interest rate increases, you can justify your optimism by thinking about the relatively slow wage growth which, at .03% month-over-month is lower than inflation! Jobs without wage growth, what could be better!

Or maybe you think that jobs and wage growth won’t lead to inflation! There’s at least one writer at Vox that agrees with you! Unfortunately, that writer is not a member of the Federal Reserve bank with the power to make decisions about interest rate increases, but you wouldn’t be completely alone in thinking that.

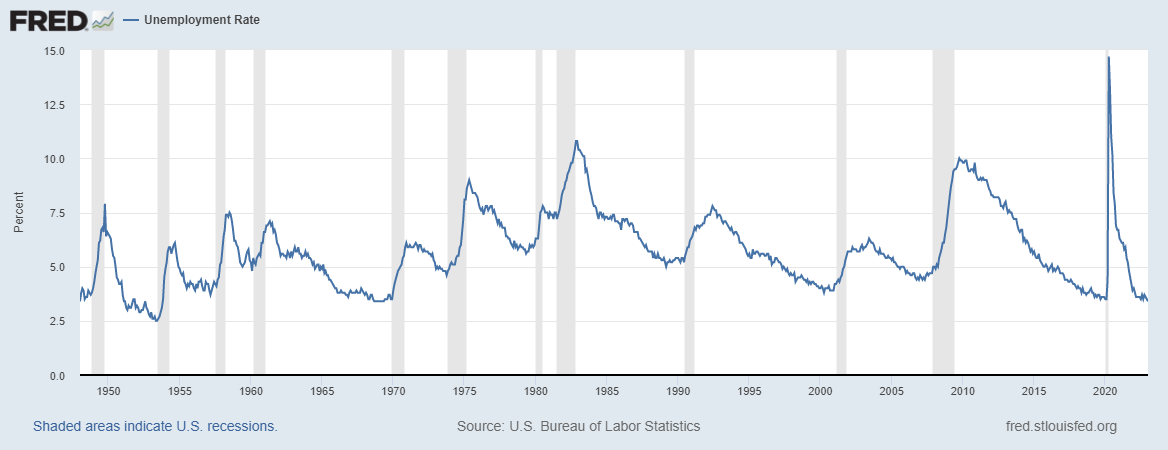

To summarize the Vox article, it’s an interview with economist Skanda Amarnath, who challenges the doctrine of the Phillips curve, which says that inflation goes up as unemployment goes down. She says that the correlation still could hold true but there are some times where it doesn’t, and what really matters is the speed at which the unemployment rate goes up or down. A steep, fast drop in unemployment makes sense as a kind of accelerating force behind inflation, but I am a little wary of perspectives that push back so forcefully on efforts to control inflation.

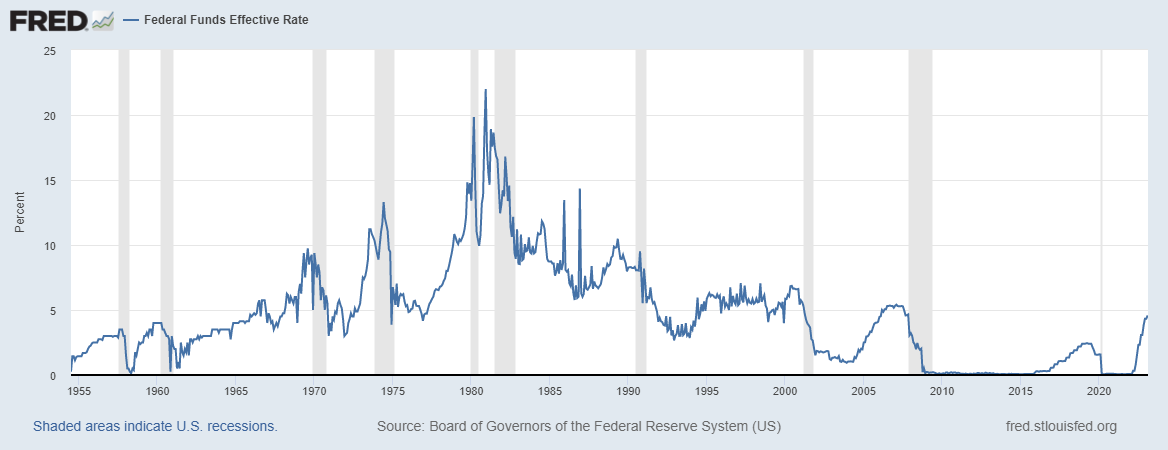

I’m by no means hawkish on interest rate hikes, but I also think that the fear of inflation has a tight grip on the minds of financial rule makers because it could get out of control in a way that we just aren’t used to like we are used to recessions. It’s not really the case where you can just lower interest rates and unemployment goes away, but that seems like a more palatable scenario than a situation where inflation is super high, the Fed raises interest rates a whole lot, and we have an extended period where we’re dealing with stagflation.

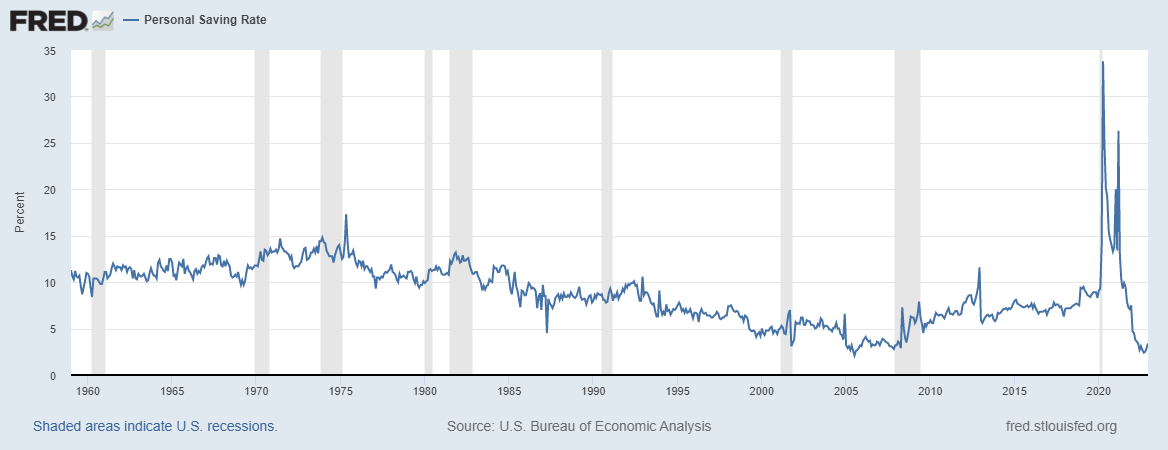

Honestly, the news I’ve heard about people starting to draw down on their savings lines up with lower consumer confidence, and for goodness sakes, if I have to hear one more comment about how egg prices are destroying America, I am going to just add one more egg to my omelet.

Oh the price of eggs is emblematic of the high grocery prices that are sapping the wallet of the American consumer? No! Last month, the food at home category of inflation was up .2% over the last month, which comes to 2.4% annualized. That’s very normal, and that directly contradicts the argument that grocery prices have kept going up. Yes. Grocery prices have gone up to the tune of nearly 12% year-over-year, but they’re not going up. Not in any meaningful way relative to overall inflation.

Also, just to put some hard numbers behind a lot of comments I’ve been reading about declining savings rates. The personal savings rate spiked up enormously in the first year of the pandemic, and then it went way down. But for anyone saying that there’s a trend towards saving less and less, that’s not really the case. The personal savings rate has gone up each consecutive month since last September, not by a lot, but certainly by enough to at least make it a reasonable conjecture that the low savings rate last year was a kind of equal-but-opposite-reaction from the previous year’s highs. If you look at the graph of the personal savings rate, there are more than a few times where an upward spike in savings is followed by a low point and slower climb back up, and these spikes in savings do not always coincide with recessions.

Just to make sure my tangent tacks back into the topic of the multifamily market, these strong employment numbers are very good news for apartment fundamentals. Sure, high interest rates are no fun at all, but struggling with rental delinquencies seems much worse to me. I’ll be paying attention to things like personal savings rates and wage growth, the current situation would seem to bode well for apartment demand in the immediate future.

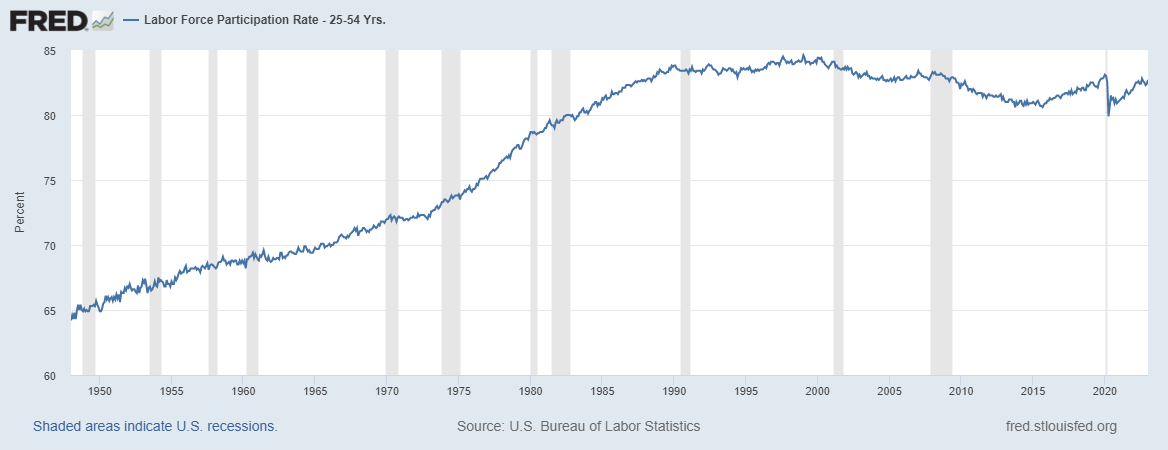

An unemployment rate as low as it’s been since 1969 also, is… it’s historic enough that it leaves me looking for qualifiers. And in this case, you could point to a low labor force participation rate, but honestly, labor force participation rate trends have followed the baby boomer generation. For the full population, we’re .9% under the pre-pandemic average. For the 25-54 demographic, we’re only .3% under the pre-pandemic average. So I wouldn’t even say that the labor force participation rate really counts as a qualifier.

If a jobless recovery is possible, are we seeing its opposite? A job-full non-recovery?

Without directly contradicting the many ways in which I think the recent jobs report was good news, a powerful rejoinder to all of this optimism is to just look at the dang employment graph. Lowest unemployment since 1969? Well what happened right after that? Oh. Recession. The pattern, and I’ll start with recession here, is that you start with high unemployment, you gradually get to lower unemployment, and then it shoots back up again. It would be great to predict exactly how low unemployment could go before the next recession, but the lower it gets, the riskier it feels. To repeat, the chart of U.S. unemployment rate shows that unemployment is most often at its lowest point in the months preceding a recession. We’re at a multi-decade low right now. Will we buck the pattern due to the ahistorical disruption of the pandemic?

Yahoo Finance: “Fed Chair Powell says ‘disinflationary process has begun’ in the US economy”

Powell touts the inflation declines for goods and he accurately points out that wage growth is not getting out of control. Now, unmentioned in this article is that the service sector saw some of the biggest employment gains and there could be some inflation there as spending starts to shift away from the goods-heavy purchases during the pandemic to include more services.

Essentially, Powell indicated that rate increases will continue, but he did not indicate that these increases would be extreme.

This stance has its fair share of detractors, but hey, heavy lies the crown! The article cites an economist calling Powell’s thinking “a stale outlook” and saying that he

“had an opportunity to lean against [the jobs report] and he took a pass.” All the commenters are like “boo! Give us more rate hikes! We want more eggs!”

So, again, to bring this back to the multifamily market, I wanted to pair the jobs report with Powell’s comments because it looks like the strong employment numbers may not be a huge impetus for Powell to change his declining rate hikes with a sharp corrective spike. Multifamily buyers, many of which are sitting on the sidelines just waiting for some predictability, should at least be comforted by Powell’s comments about disinflationary areas of the economy. If he spent all of his time talking about how important it was that his eggs benedict was as cheap as possible, that would be a more troubling indication of sharp rate hikes, and it would also be another mention of eggs, which would be so cliche.

GlobeSt: “Here is Where You Will Find Distress in Multifamily”

We have talked about this for the past three weeks, and I promise I am trying to cover new ground here. Look, GlobeSt published an article just two weeks ago titled “Expiring Interest Rate Caps to Fuel Distressed Property Sales,” so the whole industry is ruminating over this.

Funnily enough, I watched as this article went from the bottom of GlobeSt’s trending stories sidebar all the way to the top. People are looking for this distress! They really want to find it!

I’m going to spoil the clickbait title a little bit by saying that GlobeSt does not tell you where distress is going to be. If anything, they build up a speculative situation that is going to be a pretty rare occurrence in real life: “The property has likely remained stable and the owner probably borrowed at a 3.5% rate. Then they put in mezz debt and leveraged up to 80% basically taking out their equity. Now it’s coming due and the refinance rate is, say 7%. The owner must put the equity back in but the market won’t allow them to finance the property at the level anymore. So they will either have to come up with the cash or put the property on the market.”

I’ll say it again, if we had enough distress in the market to meaningfully impact the market, it would be a far bigger tragedy than a triumph. It would have to be widespread distress, and it would almost certainly entail a bunch of negative ancillary effects.

It’s not going to be the case where the market all of a sudden makes it easier for buyers again and nothing else bad happens.

It’s almost as if—you know what would be nice? If just one supermassive multifamily owner-operator had all the distressed properties coming onto the market. Limit the damage to one guy, and just for fun, this imaginary guy is a real jerk! Articles with headlines like this GlobeSt article, if they’re not going to help me find this one guy, I’m going to be really disappointed.

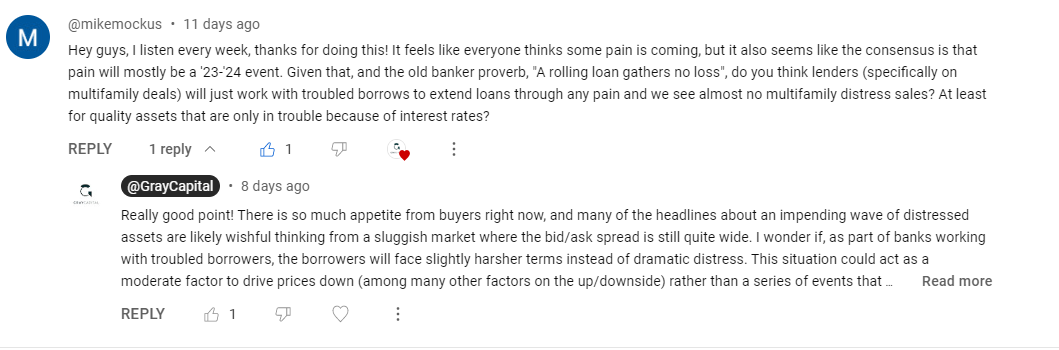

We received a nice comment last week from @mikemockus, and he really hit on an idea that brings a lot of the speculation on distressed properties down to earth, which is that there are going to be some (relatively) reasonable financing options that multifamily borrowers can take, which includes working with their existing lenders to avoid the distressed property situation that so many buyers are hoping for.

The phrase “a rolling loan gathers no loss” succinctly captures the perspective and motivation of lenders here: They’re going to do what they can to keep it so that you’re paying your loan.

I’m still paying off some sizable student loans, but when I was finishing up grad school, I remember how easy it was to defer my student loans, and I remember picturing my lender saying something like “sure, take a deferment! Take as long as you like!” and then watching as the amount I owed slowly increased. Turns out that there are situations where the bank is perfectly comfortable waiting until you can pay!

In my response to the commenter, I speculated that distressed property sales could act as one factor among many and would likely not characterize the market.

I’ve heard from you and read some impressions as well that the NMHC conference really solidified the sense that there are not as many apartment properties available for purchase, and many of the ones that are available have an asking price that is simply too high. There’s a large bid/ask spread, and as much as I hoped that things would work themselves out at NMHC, that did not exactly happen.

With investors largely confident in multifamily market fundamentals, by which I mean that, even as rent growth was far more sluggish than last year, it did not seem like there were very many prophets of multifamily doom at the NMHC conference. So you’ve got buyers that believe in the fundamentals, but the price isn’t right.

Are we going to see a similar situation that we saw in 2020, where people waited for a price correction that never really arrived?

Will flat or slightly-reduced multifamily valuations take the place of massive discounts?

You can’t exactly “optimism” your way out of high interest rates, so if the math doesn’t work, you’re either going to really start deluding yourself that rent growth or property values are going to skyrocket for the property you want to buy, you’re going to wait, you’re going to doggedly search for opportunities in markets big and small (which I’m sure you’re doing anyways), maybe you try to structure your deal and your debt burden in a different way, or what? The heightened investment interest in small multifamily markets will only continue in these conditions, but it’s going to be hard to pull away from the wishful thinking that something jolts the market to a point where the asking price for an apartment property is close to the price that people are willing to pay.

My thought is, what about developers who are going to be bringing these new buildings into the market? Developers may not be facing the exact same situation as potentially-distressed sellers, but they may be more motivated to sell compared to an owner-operator. That being said, I think that investors are anticipating this situation and have become less inclined to invest in apartment development projects. Here’s where I’ll offer a gentle reminder that the housing shortage is still present in the United States of America.

So, if banks working with borrowers are going to make it so that distressed properties aren’t such a huge factor, what is going to be the situation for the prime movers in the market? Are the people who decide to buy now, are we going to be jealous that they locked in a great deal, or are we going to be grateful for their sacrificial bad deal that helps get the market moving again?