Did the Fed’s New Rate Cut Path Undermine CRE Optimism?

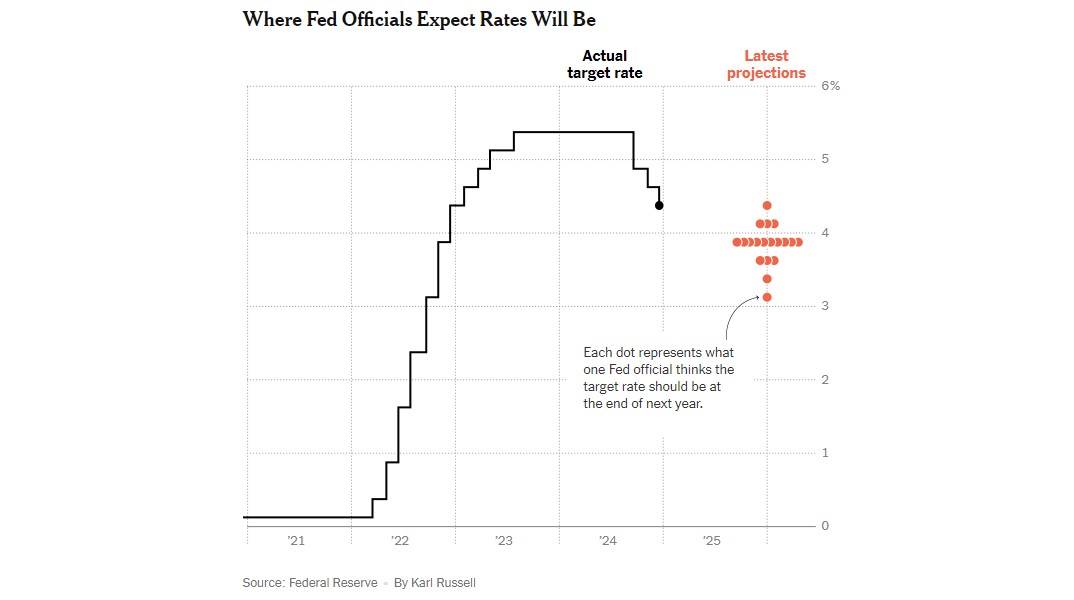

More than the 25 BPS decrease of the federal funds rate, the updated projections from the Federal Reserve Open Market Committee signal a (slightly) higher-for-longer interest rate scenario that could make impending loan maturities a larger factor in the CRE investment market, but multifamily investment prospects are buoyed by consistent housing demand and a receding apartment supply wave.

Multifamily, the Nation, and the Economy

Fed Cuts Interest Rates and Markets Plunge After 2025 Forecast

The New York Times: “Federal Reserve officials made their third and final rate cut of 2024 at their meeting on Wednesday. They also forecast two fewer rate reductions in 2025 than they had previously expected, as inflation lingers and the economy holds up.”

- The Days Of Extend-And-Pretend Strategies Are Waning, But Not Quite Over (Bisnow)

- Residential Snapshot: “The increase in housing demand was evident in the leading indicators” (NAR)

- Rent Growth Set to Accelerate in Supply-Constrained Markets (GlobeSt)

Multifamily and the Housing Market

2025: A year of stabilization and opportunities in the housing market

Via NAR: “Home prices will continue to increase in 2025, but at a slower pace compared to previous years, with increases likely to be around 2%.” Midwestern markets like Indianapolis “earned a spot on the list due its strong job growth and housing affordability.”

- Single-Family Starts Posts Solid Gain While Multifamily Falters (NAHB)

- America’s Households Are Shrinking, Ushering in the ‘Golden Age’ of Guest Bedrooms (Realtor.com)

- Rising Number of Multifamily Properties Offering Concessions (Fannie Mae)

Multifamily Markets and Reports

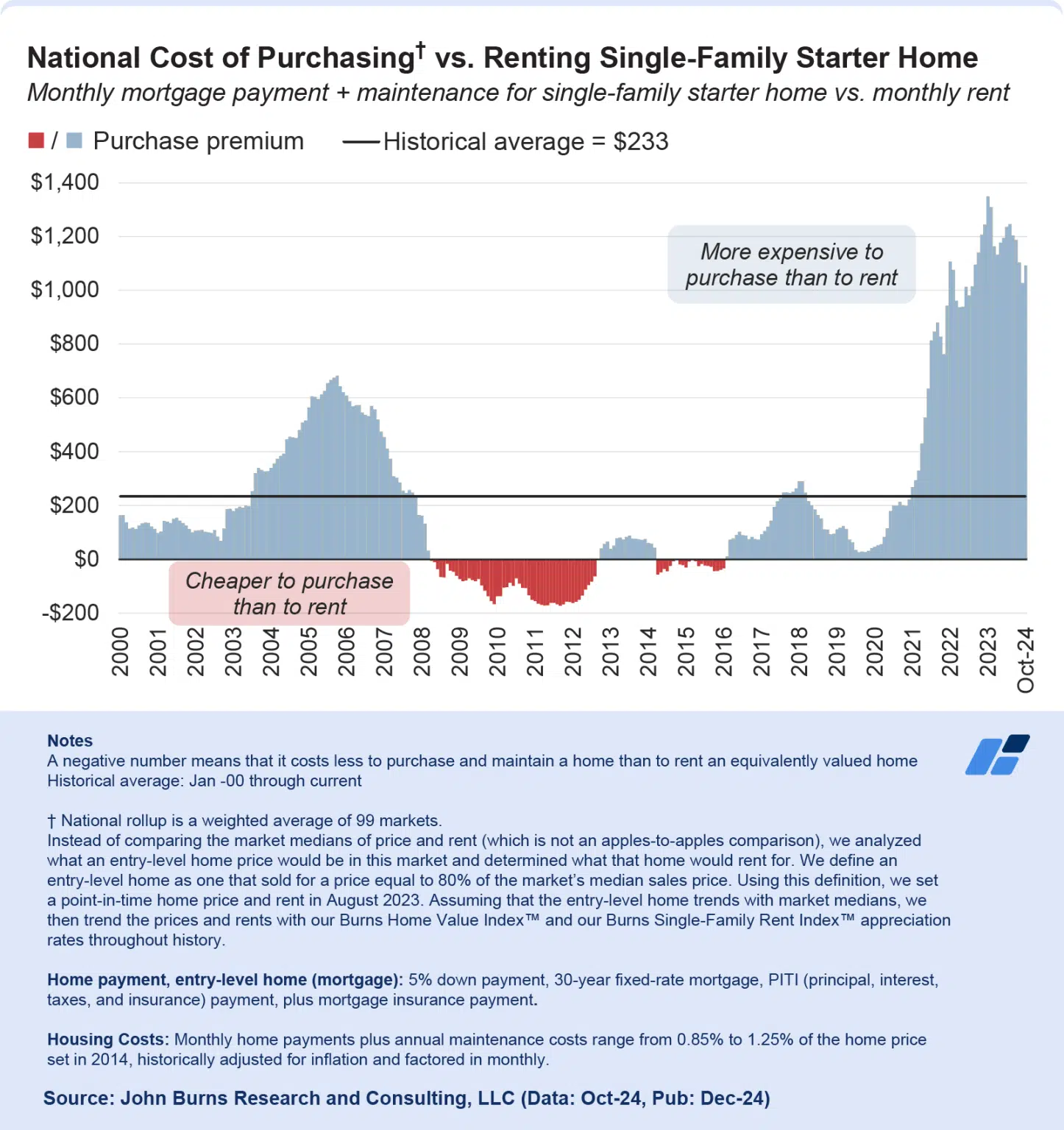

Starter homes cost $1,091 more per month to purchase than rent

Via John Burns Research and Consulting: “Despite the tailwinds of a higher purchase premium for the SFR industry, rising supply in both for-sale and rental markets is a critical factor to monitor. In areas with increasing housing availability—such as parts of Florida, Texas, and the Southeast/Southwest—SFR rent growth has slowed or moderated.”

- Renters’ Affordability Challenges Worsened Last Year (Harvard Joint Center for Housing Studies)

- 2025 Supply Increases Notable in New York and Los Angeles (RealPage)

- Multifamily Giants Turning To AI For Rent Collections (Bisnow)

Commercial Real Estate and the Macro Economy

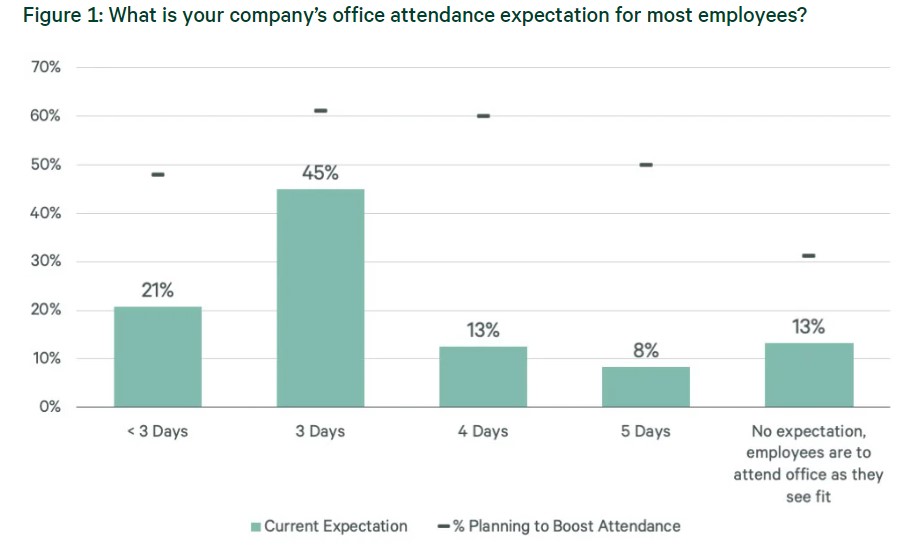

2025 Outlook for Office Attendance

Via CBRE: “Although many occupiers are accepting current attendance rates as the new normal, 51% of corporate leaders in our survey want to boost attendance from current levels. Some of those leaders are simply trying to align attendance levels with current policy (39%), while others are looking to move toward a less hybrid policy (36%).”

- NOI Index Performance: Riding the Recovery or Risking the Fall? (Moody’s Analytics)

- Large Office, Multifamily, & Lodging Delinquencies in November 2024 (Trepp)

- Q4 2024 Retail National Report: “Potential headwinds could be negated.” (Marcus & Millichap)

Other Real Estate News and Reports

The Three Trends Shaping the CRE Outlook

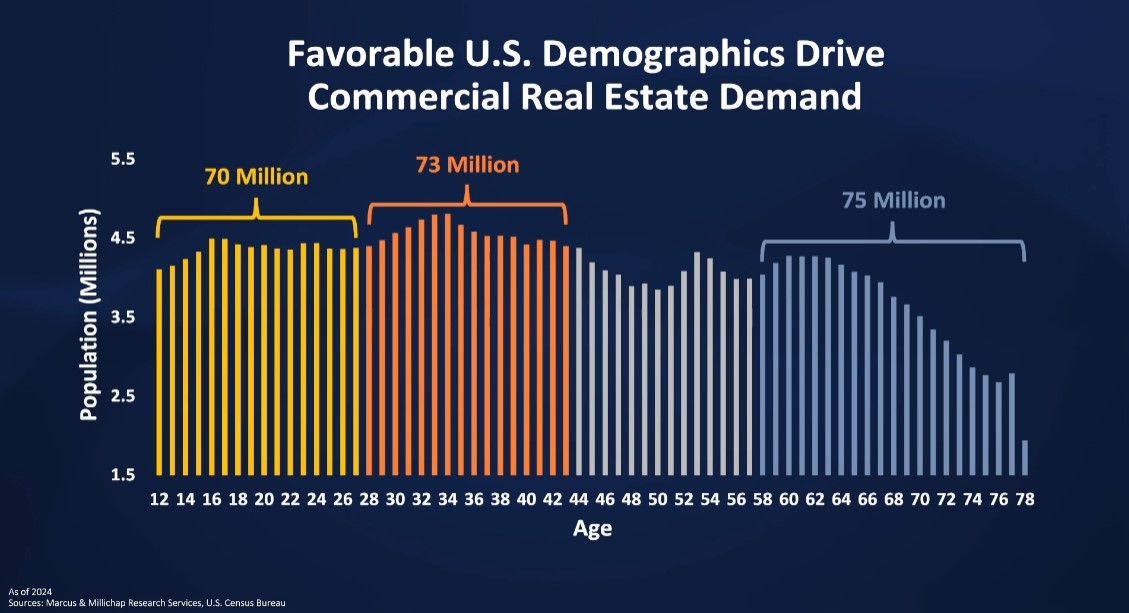

Via Marcus & Millichap: “Over the next 20 years, aging Baby Boomers and the Silent generation will transfer an estimated $84 trillion to younger generations[, which] will likely spark additional capital flows into commercial real estate investment.”

- The Tide Is Turning for CRE (Cushman & Wakefield)

- 2025: A New Era of Activity in the CRE Investment Market (CBRE)

- The Risks of Appraisal Uncertainties in Private Real Estate (MSCI)