Compelling Clarity on Multifamily Fundamentals

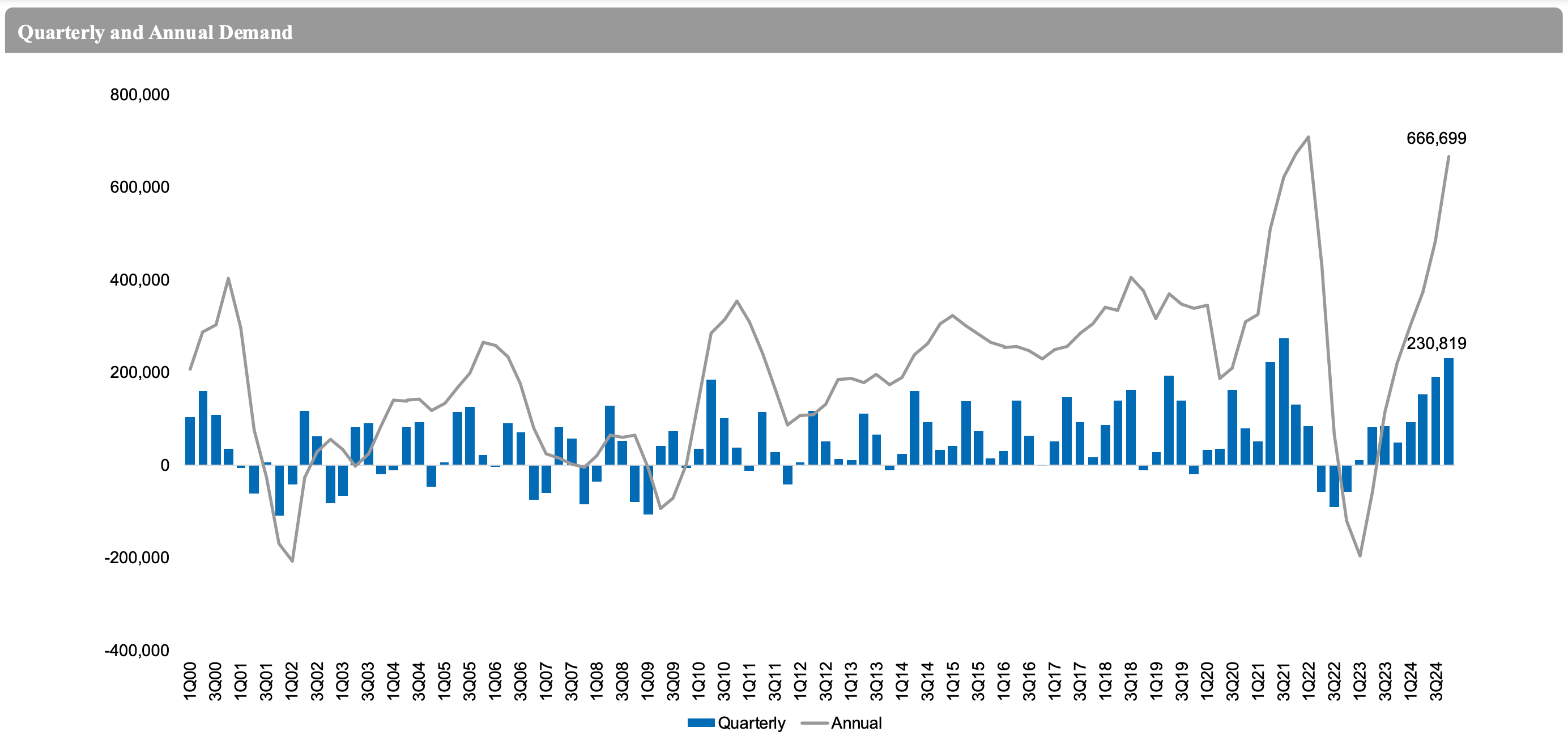

Apartment fundamentals continue to improve, with multiple data sources sharing a broad consensus of improving demand. Additionally, recent reports project a considerable drop-off in newly-delivered apartments in 2025, continuing into 2026. As this steady, elevated apartment demand meets a shrinking amount of new supply, we could see noticeably higher rent growth in 2025 and 2026.

Multifamily, the Nation, and the Economy

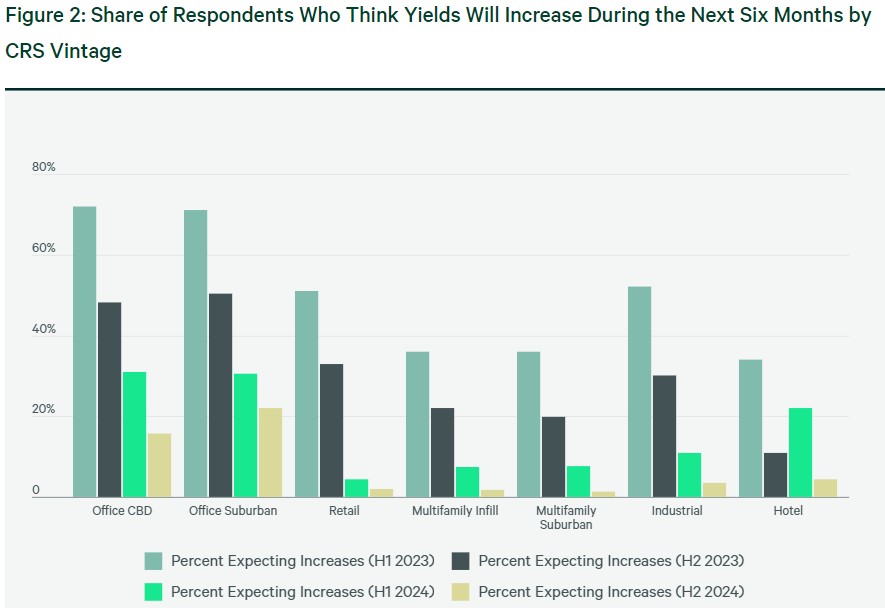

Cap Rate Survey: Progress for CRE, Multifamily as Cap Rates Decline

CBRE: “This survey comes at a time when investment sales volume remains muted but investor sentiment has improved. After an annual decline in sales volume of 51% in 2023, 2024 saw an increase of 9%.”

- HUD Could Cut Staff by Up to 50% in DOGE Purge (Realtor.com)

- As Uncertainty Rises, Stability of CRE Stands Out (Marcus & Millichap)

- We’re Headed Toward a Landlord-Friendly Era. Expect Higher Rent Prices. (The Wall Street Journal)

- Big shifts in Washington: policy uncertainty and housing (JBREC)

Multifamily and the Housing Market

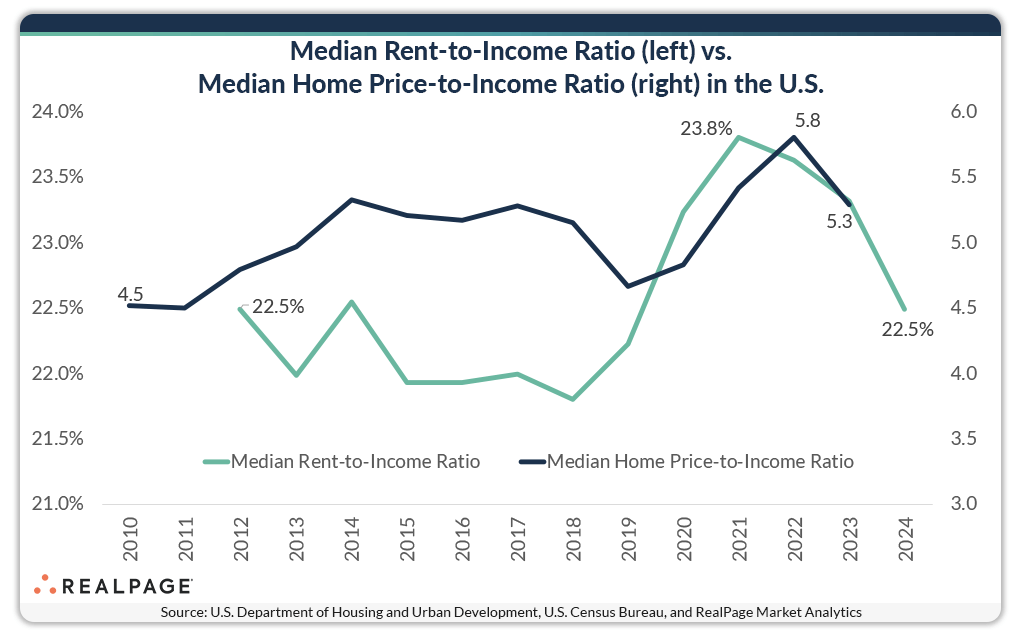

Cost to Own Skyrockets Above Average Rent

Via RealPage: “Analyzing data from 2010 to 2020, asking rents were consistently more affordable than mortgage payments, with an average difference of about $390. However, since 2021, this gap has widened significantly.”

- Affordable Housing Within America’s Housing Affordability Landscape; Notable Demand Despite Substantial Growth (Moody’s Analytics)

- “Despite slow economic conditions, December saw the strongest increase in existing-home sales since February 2024.” (NAR)

- Single Family Home Builder Confidence Falls on Tariff and Housing Cost Concerns (NAHB)

Multifamily Markets and Reports

Q4 2024 Multifamily Report: Apartment Demand Upswing While Homebuying Falters

Newmark: “New construction lease-ups have been sluggish . . . New development premiums have also narrowed, with new construction deals commanding just a 14.6% premium in price per unit, the smallest margin in 15 years, compared to the long-term average of 46.4%. This compression presents a potential opportunity for strategic buyers.”

- Multifamily Developer Confidence Reflected Mixed Results in the Fourth Quarter (NAHB)

- Apartment Rent Steadies in January (Realtor.com)

- Housing affordability is so squeezed that office-to-apartment conversions just spiked 484% (Fast Company)

Commercial Real Estate and the Macro Economy

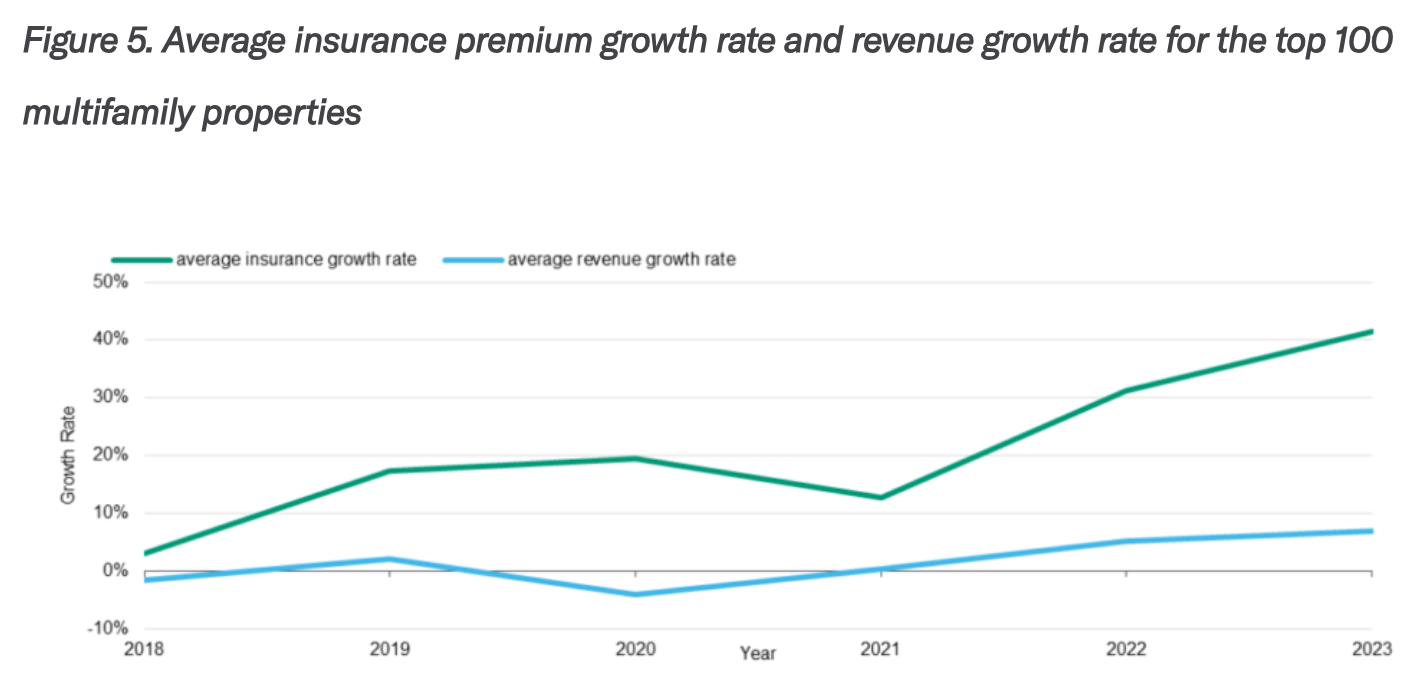

For Some CRE Owners, Insurance Now Gobbles Up Double the Revenue

Via Moody’s Analytics: “Multifamily saw the greatest increase with the insurance line item at 14.3% as a share of revenue in 2023, up from 7% in 2018. This is the case even though multifamily in general enjoyed substantial rent growth over the last five years. Retail saw a 4.8 percentage point increase over the time period to 12.8%.”

- 2025 U.S. Data Center Market Outlook (Newmark)

- CMBS Loan Loss Report: Volume of Loan Losses Surges in January 2025 (Trepp)

- United States Retail Outlook Q4 2024 (JLL)

Other Real Estate News and Reports

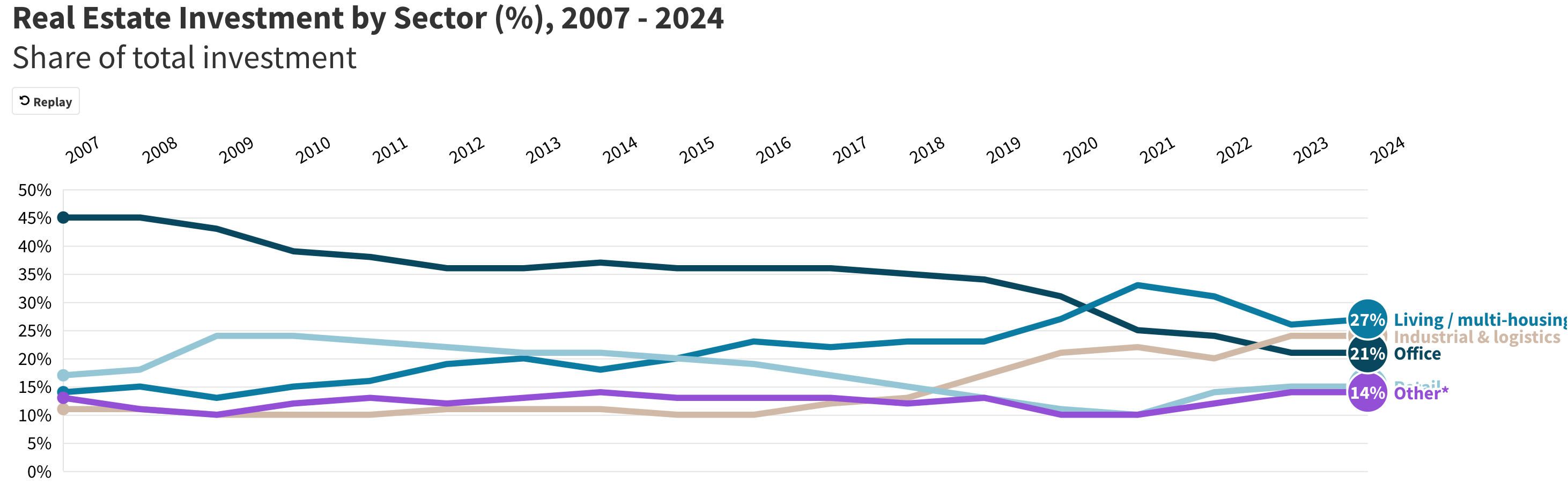

A positive but nuanced outlook for global CRE in 2025

Via JLL: “Improvement in investor sentiment led to significant increases in transaction activity through the end of 2024, firmly positioning 2023 as the market bottom. Global investment volumes rose by 37% year-over-year in the fourth quarter; this brought full-year 2024 activity to US$703 billion, a 14% increase from the previous year.”

- Construction Insights for Global Occupiers (Cushman & Wakefield)

- 4Q24 U.S. Life Science Market Report (Newmark)

- Office Loan Maturity Monitor: Another Year in the Books. What Lies Ahead? (Moody’s Analytics)