Residential Real Estate Properties

Gray Capital’s investment model is structured with the goal of eliminating the barriers to multifamily real estate investment opportunities while providing a suite of information that allows investors to create a curated investment portfolio with the best-fit risk and return profile. The following is the first of a series of entries that will help to explain our investment thesis as it operates within commercial real estate investment more generally.

U.S. housing trends highlight a significant opportunity for those investing in residential real estate: According to the U.S. Census Bureau, the number of renters in the U.S. has grown at more than twice the rate as the number of homeowners over the past ten years.

Driven in part by this marked increase in demand, Gray Capital’s experience and research have led them to a portfolio of residential real estate properties that possess the security from risk and opportunity for growth that shape their investment model. Continually discovering new insights and sharing them with their investment partners is a central element of Gray Capital’s approach, and a brief overview of the residential market will illustrate how multifamily commercial real estate exemplifies the risk and return profile that best fits their investment model.

While there is not a clear-cut division among properties, residential real estate can be usefully classified into several distinct groups, with single family homes as the first of these. Single family homes have the lowest purchase price, but they often demand the most labor and management relative to the investment. Attention to things like ongoing maintenance, landscaping responsibilities, and utilities will vary depending on the tenants, but many investors employ third-party property management groups and structure their leases in such a way that these issues are less common. However, it is more difficult to build an investment portfolio at scale when relying on many different single family properties, which require a far more complex network of deals and stakeholders than other residential real estate properties.

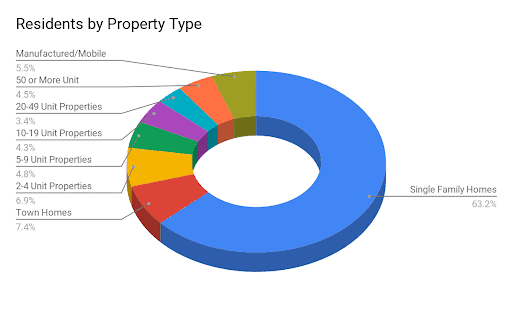

Investments in single family homes benefit from many of the larger housing trends that have made larger real estate properties more valuable, with single family homes housing 63% of the population in the United States. Corporations and trusts have emerged as major players in this market, managing large portfolios of homes and capitalizing on the increase in single family renters since the 2008 economic recession. Gray Capital has not actively pursued investments in single family homes, due in part to the added complexity of managing large numbers of homes as well as the difficulty in scaling effectively through investments in these properties. Single family homes are an accessible starting point for many investors, especially given the stated preferences of renters and home buyers, but trends toward greater accessibility and shorter drive times leave room for multifamily buildings as a more appealing housing option for both renters and investors.

Small apartment buildings and townhomes, as a group, are generally more expensive to purchase than single family homes, but they generate more revenue from rental income and have lower time and labor costs associated with property management. For properties with four units or less, which includes single family homes as well as small apartment buildings, value is determined by the price of similar properties in the surrounding area. Properties larger than four units have a value that is based on how much income they generate in a given year. Because the value of a smaller property is so closely tied to the value of properties in the surrounding area, it is more difficult to increase resale value compared to larger properties.

U.S. Census numbers count roughly 14% of Americans living in an attached townhome or a multi-unit building with four or less units. Compared to single family homes, these properties are far less common, but it is worth noting that this figure is relatively close to the amount of people living in all properties with 5 or more units. This category of small multifamily properties may not include the striking and dramatic 500-unit towers, but this is a category worth pursuing as an investment due to the interest and opportunity that these buildings represent. There is generally less competition for smaller buildings when compared to the gleaming glass skyscrapers on the waterfront, but, surface reflectivity notwithstanding, there is a bright future in smaller buildings. Smaller buildings tend to be less expensive because there are fewer buyers and therefore less liquidity. With typically higher cap rates than larger properties, smaller buildings can provide higher cash flow for the investment but may have fewer opportunities for appreciation.

Qualitatively different from single family properties, smaller multifamily properties represent a scalable investment that involves many of the same processes, networks, and resources as larger multi-unit properties. In fact, a building with more units is generally less complicated to own and manage than a larger one, especially buildings large enough where professional on-site property management becomes affordable. In terms of management, there is very little difference between 50 units and 250 units. It takes the same amount of time to negotiate, research, and manage. The real challenge, then, is the availability of capital required to make investments in larger properties. For investors looking for an accessible, less capital-intensive entry-point into commercial real estate, smaller properties do have some advantages. Building improvements can be completed efficiently, adding to the value of the investment. Gray Capital’s interest in larger multifamily properties (50+ units) is guided by their interest in security, scalability, and opportunities for growth, and they have had proven success increasing the value and cash flow of their properties through renovations, rent increases, and expense reductions.

Multifamily properties require the highest amount of capital, have the lowest management costs relative to the investment, and have the greatest potential for cash flow and forced appreciation. Gray Capital is specifically focused on large multifamily properties, in part because of interest in larger efficiencies and higher class flow associated with assets of this size. Additionally, investments at this level (residential properties five units or greater) benefit from access to commercial lending, with lenders underwriting the value of these commercial investments. As noted above, larger multifamily buildings are valued according to the income generated in a given year, which makes it easier to add value to the investment. The higher number of people living in larger multifamily buildings allows investors to have an appreciable effect on demographic/social issues and entrenched reputations that influence the value of a property. Re-assessing rents, re-branding the property, and making other improvements to an individual building can affect the value of a larger property in a way that would not be possible for smaller buildings and single family homes with values tied to the surrounding neighborhood.

For larger residential properties, issues that would be minor or nonexistent in a duplex or townhome can have a substantial effect on cash flow and overall value, but these issues also represent valuable opportunities to make tangible improvements that can increase operating efficiency, lower expenses, and increase the value of the asset. Specifically, energy efficiency, long-term maintenance, and noise-related issues may require increased attention, but addressing these issues can measurably improve property value and cash flow. Gray Capital’s diligent interest in the ongoing management and improvement of their properties complements their attention to local and national-scale real estate trends as a large part of what has made their portfolio successful. Their investments in larger multifamily properties are a product of the kinds of information and experience that they share with all of their investment partners.

Large real estate investments are sensitive to any number of minute and massive conditions, but this does not invalidate the importance of researching the macro and micro-level context to evaluate the fundamentals of a real estate deal. Fortunately, there are a number of large-scale trends that support the need for increased development and investment in multifamily properties. The Harvard Joint Center for Housing Studies has found that large residential properties, those with 20 or more units, have experienced the most growth over the past five years, continuing an upward trend that has been consistent over the last 15 years. This growth, in addition to the increased proportion of high income renters over the same period, are strong indicators of a significant wealth shift toward large rental properties. In other words, more people and more money are moving into rental units, and Gray Capital’s investments in large multifamily properties are positioned to capitalize on the opportunity that these trends so clearly indicate. Gray Capital pursues larger multifamily properties because the very clear increase in demand for these properties relative to their supply. A number of factors have motivated these investment decisions, including lowering interest rates (and therefore cap rates), the growing search yield outside of bond markets, and an aging population who are increasingly dependent on investments that will provide a steady income.

Of course, a successful real estate investment involves many more considerations than the size or number of units of a particular property, but understanding how trends, skill sets, property management, and other processes will change from a 100-unit property to a 4-unit property is only one facet of the kind of work that goes into creating a successful portfolio. Gray Capital works with investors to create a completely custom real estate portfolio composed of a specific variety of properties that align with an investor’s goals and integrate with their financial plan.

Interested in learning more?

Click or tap the button below to schedule a short meeting with a member of our investment team.