Resources

2024 U.S. Investor Intentions Survey: Investment Activity Expected to Increase

Source – CBRE: “2024 U.S. Investor Intentions Survey: Investment Activity Expected to Increase” We’ll be looking at demand from apartment renters in a moment, and I’ll say right now that compared to the demand from multifamily investors, we have a fairly crystal-clear view of the demand of apartment renters. Maybe it’s just me! But I…

GO >Earn 10% in 2022

The economy is in a volatile and uncertain place, and with inflation and rising interest rates leading to greater risk for investors and a downturn in the stock market, cash flow is the new imperative. In this video, Gray Capital President, CEO, and Co-Founder Spencer Gray explains how Gray Capital’s multifamily investment fund, The Gray…

GO >2022 Predictions: Who Gets it Right?

It is an exciting time to be a multifamily investor in 2022. Last year was a record-breaking year of rent growth and rising asset prices, which has increased the anticipation and interest in the group of research reports and forecasts published by multifamily experts and industry leaders. We have gathered some of the most prominent…

GO >Who’s Renting Your Apartment? Demographic Cohort Breakdown.

Berkadia has a nice write-up of the renter data that they use from RealPage, and RealPage put out a small report as well. The graph of the age-breakdown in renters is fairly appealing from an investment standpoint, and you can see this large group of younger millennials that will pass through peak renting years in…

GO >Why Investors Choose Real Estate Syndication

Syndication is a great tool in real estate that some do not know about already. By definition, a real estate syndication is the pooling of funds from passive investors to purchase income-producing real estate. A passive investor or limited partner has one role, and that is investing cash in a solicited real estate investment for…

GO >The Housing Affordability Crisis and the Multifamily Market

Rising home prices are correlated with rising apartment rents, and what drives both of these is demand for housing as a whole. Currently, housing prices and apartment rents are breaking records, and the fervor surrounding the housing market has many looking back at the Great Recession for comparisons. The fervor may be similar, but the…

GO >Inflation is here. What should you do about it?

Inflation is a perennial news item, but it has been an all-but-inescapable element of the news cycle in 2021. Jobs reports describe a job market full of job openings, supply crunches have spread alongside burgeoning demand, and the CPI report shows elevating inflation, although the rate of this increase has decreased slightly at the time…

GO >Introducing GrayReport.com: The Multifamily Intelligence Aggregator

Gray Capital is proud to announce the launch of a new website that brings together all of the most relevant and valuable information about the multifamily industry in one place: GrayReport.com. The Gray Report Website fills a substantial gap within the world of multifamily and apartment investing—nowhere else allows investors and multifamily professionals access to…

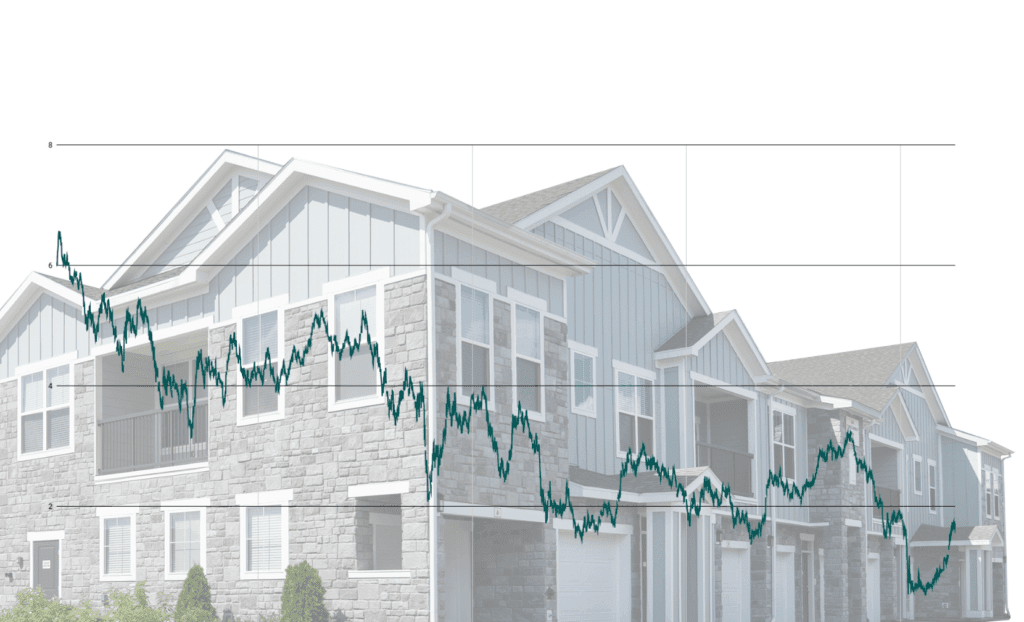

GO >Understanding Cap Rates and Interest Rates

Cap rates and interest rates are critical metrics to follow and understand when investing in commercial and multifamily real estate, and while each of these measurements will have its own impact on the analysis of an investment opportunity, looking at interest rates and cap rates together provides additional insight and can help investors identify the…

GO >Finding Commercial Real Estate Deals

As one of the central elements of real estate investment, the process of finding deals is crucially important. Even experienced investors are constantly honing the skills, numerical tools, and other resources used to find the right deals in the real estate investment market. Establish Your Investment Criteria The first thing you need to do when…

GO >