Tax benefits of investing in commercial real estate

*This is not tax, legal or financial advice and should not be taken as such. Please consult your own CPA, tax and or financial advisors.*

Investing in cash flowing multifamily properties is one of the most tax efficient investment strategies available.

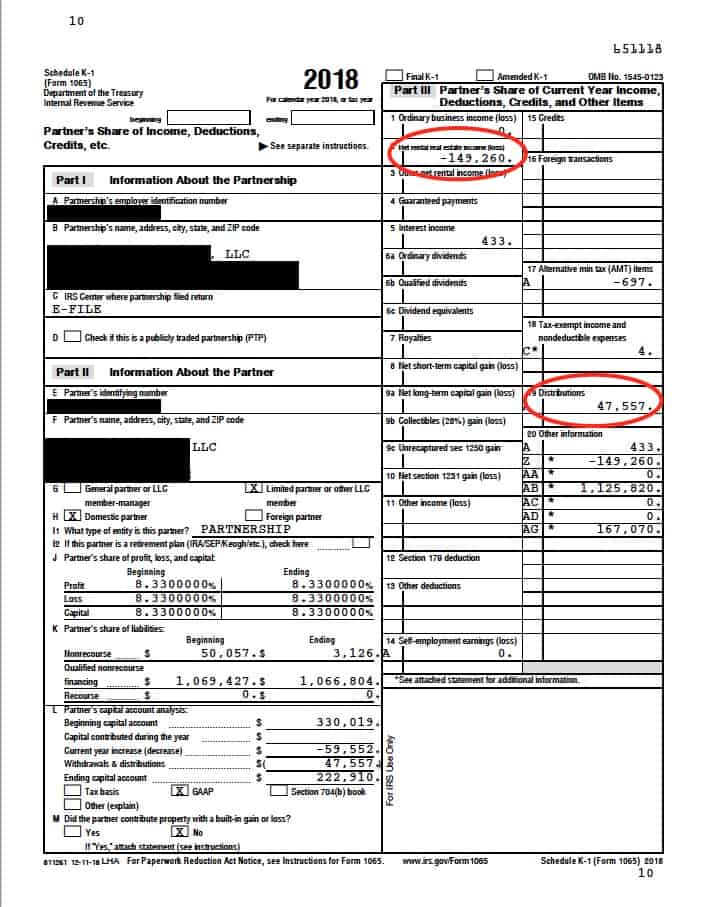

One question many new investors have is how the cash flow from investments into commercial real estate will affect them from a tax perspective. The reality is that most often the cash flow from commercial real estate comes with no additional tax payment by the investor in that tax year. This is a concept that many don’t always believe it until they see their tax documents (K1’s) after their first investment. To help illustrate, check out one of my companies K1’s from an LP investment into a multifamily syndication. Notice that while we received a $47,557 in distributions that year, the IRS sees a -$149,260 paper loss.

This incredible benefit is due to the amount of depreciation that is allowed to be written off as losses against revenue. By conducting an extensive cost segregation analysis study that indexes and accounts for every possible item at a property that can be depreciated, massive amounts of tax savings can be harnessed that creates a “paper” loss. A cost segregation study is an engineering-based tax analysis that calculates the total amount of assets that can be depreciated over a given time period.

Everything from the depreciation of buildings (39 year schedule for commercial), appliances, toilets, flag poles, in addition to other deductible items interest payments, – are all added up and that “loss” is deducted against the income from the property. This means that while you may receive a positive cash on cash return and cash distribution from a performing property, according to the IRS you actually have a loss on paper. Since one isn’t subject to paying a tax on something they took a loss on there is no further income tax liability. This technique can equate to millions in tax savings over an entire project.

Because most syndications are structured as partnerships usually through a series of LLC’s, all tax benefits can be passed through to the investor on their individual K1 tax form from the special purpose LLC that is created to hold the property.

This benefit is unlike investing through a REIT (Real Estate Investment Trust) where tax benefits (losses) are not passed through.

For example – If you were to receive $10,000 in a given year of passive income from a 10% cash on cash returns from a $100,000 investment from an investment into an apartment community, you will most likely get to keep the entire $10,000 without any being subject to additional income tax liability in that tax year.

When you look at your tax documents you will see a paper loss in addition to the amount of cash you received as a distribution, among other line items.

Significant paper losses usually are present for the first 5-7 years of ownership with distributions to that point being “sheltered” from regular income tax. That period is due to the schedule length that certain categories of items can be depreciated over.

Per the US tax code, assets are divided into “real property” and “personal property” categories which are further divisible into other categories all of which are depreciated over a specific schedule of time.

This benefit was made even greater with the passage of the Tax Cuts and Jobs Act passed in 2017. This new law allows for new immediate expensing or accelerated deprecation, as well as first year bonus depreciation. Read more from the IRS.

Deprecation Recapture

The IRS still wants the tax revenue!

Deprecation Recapture is the seldomly spoken about practice that allows the IRS to get back some of the revenue they weren’t able to collect due to depreciation when the gain from the sale of an asset exceeds the adjusted cost bases of the asset. These gains are considered part long term capital gain (beyond original tax basis) and part regular income (gain related to deprecation), both are capped at a rate of 25% for 2019.

There are several strategies to increase tax efficiency to not realize a deprecation recapture liability:

- 1031 or “like-kind” exchange into another property

- Never sell the property

- Additional paper losses from other assets offsets tax liability

- Passing the assets down to ones heirs giving them a stepped up basis

A few other common questions:

This sounds too good to be true, is this legal?:

This is standard industry practice and 100% legal. The government encourages the investment of real estate, especially real estate that provides a necessary service such as housing. This practice is no different than any other business writing off their expenses, except that in multifamily properties there are usually more items available to deduct compared to other businesses. But as always, consult with your own financial professionals.

If my K1 shows a loss can I deduct that loss against my other sources of regular income?:

If you are a passive investor, the answer is most likely no. However, If you are what the IRS defines as a “real estate professional,” which is someone who provides more than one half of their professional services in real property trades or business and performs more than 750 hours of services a year, then you may be able to deduct paper losses against other regular income.

We aren’t paying any taxes on these investments? :

Don’t feel sorry for the taxman just yet. Typically, the largest above line expense at a property is the property tax payment in addition to payroll tax, social security taxes and more. Additionally, without a 1031 like-kind exchange or a rollover of capital gains into a Qualified Opportunity Fund, proceeds from a sale are taxed via deprecation recapture.

*This is not tax, legal or financial advice and should not be taken as such. Please consult your own CPA, tax and or financial advisors.*