Can Multifamily Growth in 2025 Break through Two Years of Sluggishness?

After two years of low apartment sales activity, stagnant rent growth, and persistent expense growth pressures for multifamily operators, it is difficult to imagine a sharp turnaround in 2025. That being said, some of the trends that hampered the multifamily market in 2023-2024 are expected to weaken, but perhaps not at the rate that some may be hoping for. The wave of newly-built apartments will recede next year, but supply could remain elevated above historical trends, especially in Sunbelt markets and other hot spots that have seen a great deal of construction activity in the past few years. Likewise, interest rates may not come down as much as was hoped, but they will very likely be lower than they are currently. There is optimism among multifamily investors, but 2025 will reward realistic, disciplined investors looking for the right asset, strategy, and market.

Multifamily, the Nation, and the Economy

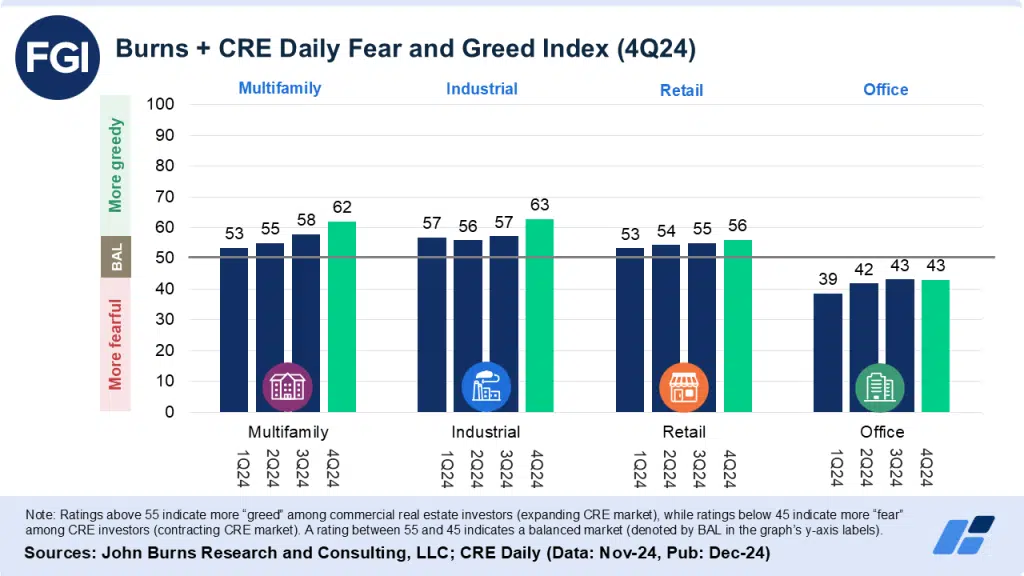

Commercial real estate optimism is rising, namely apartments

John Burns Research and Consulting: “43% of investors expect to pause further CRE investments over the next 6 months. 65% of investors expect to increase their exposure to Multifamily over the next 6 months, while just 19% of investors expect to increase their exposure to Office.”

- Multifamily Poised for Modest Growth in 2025 (GlobeSt)

- 2025 Apartment Industry Predictions (RealPage)

- Apartment Investment Market Index Continues Rise in Third Quarter of 2024 (Freddie Mac)

Multifamily and the Housing Market

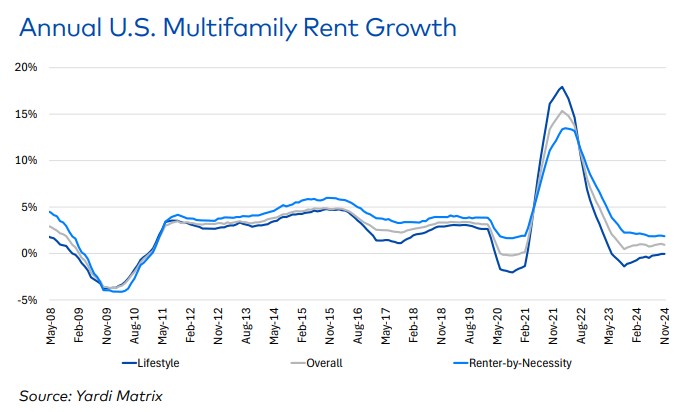

Supply, Rents Key to Multifamily Outlook in ‘25

Via Yardi Matrix: “During a time of rapid supply growth in recent years, multifamily rents have been supported by equally strong demand. We expect demand to continue to be robust in 2025, which will push rents higher as the supply boom starts to fade.”

- 2024 in Review: Top Insights Renters Need to Know (RentCafe)

- New Home Sales Rose in November (NAHB)

- Scales Tip in Favor of Sellers as Existing-Home Sales Rise (Realtor.com)

Multifamily Markets and Reports

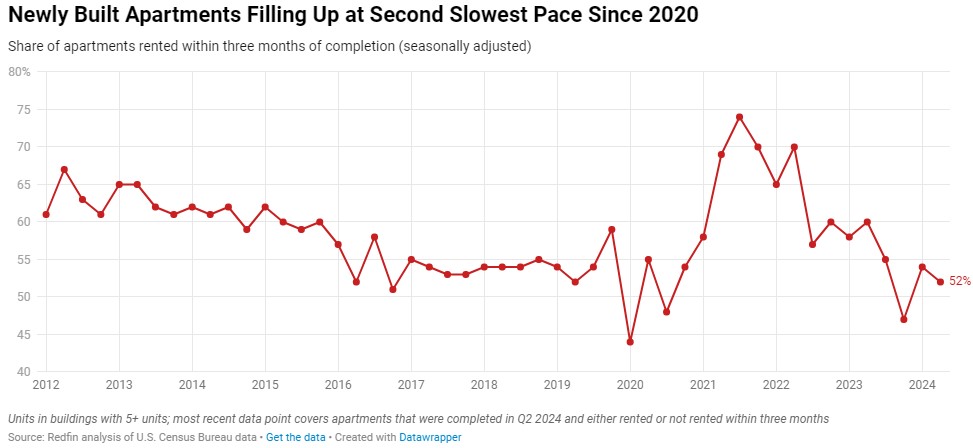

New Apartments Fill Up Slower, Returning to Pre-Pandemic Speeds Amid Construction Boom

Via Redfin: “The absorption rate over the past two quarters has returned to the 50-55% rate seen in the late 2010s, prior to wild fluctuations during the pandemic where demand rose dramatically in certain areas of the country—especially the Sun Belt.”

- Homeowner vs. Renter Spending (Freddie Mac)

- Master-Planned Communities Lower Risk, Higher Reward? (Cushman & Wakefield)

- A CFO’s Guide to Investing in Condos (CBRE)

Commercial Real Estate and the Macro Economy

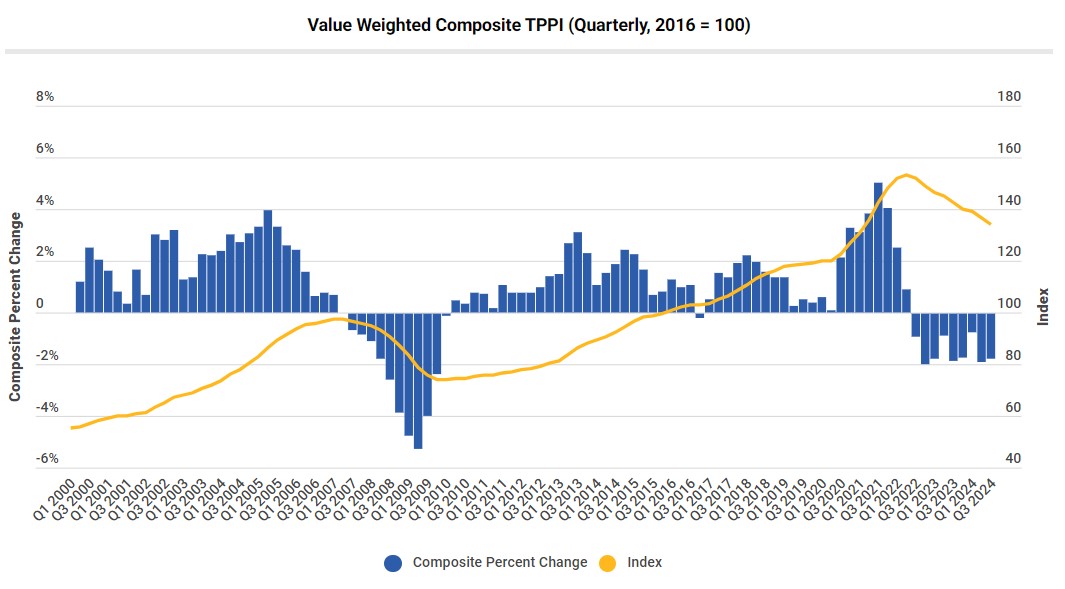

Continued Pressure on Commercial Real Estate Prices, as Market Awaits Impact of Rate Cuts

Via Trepp: “Multifamily and office properties face the steepest declines, with high-value assets deflating more severely, while industrial properties show relative price resilience despite a cooling pace of growth.”

- Suburban and tertiary office markets will continue to grow (Cushman & Wakefield)

- Signs of life in commercial real estate (Marketplace)

- CRE Set to Rise in 2025, but Risks Remain (Business Insider)

Other Real Estate News and Reports

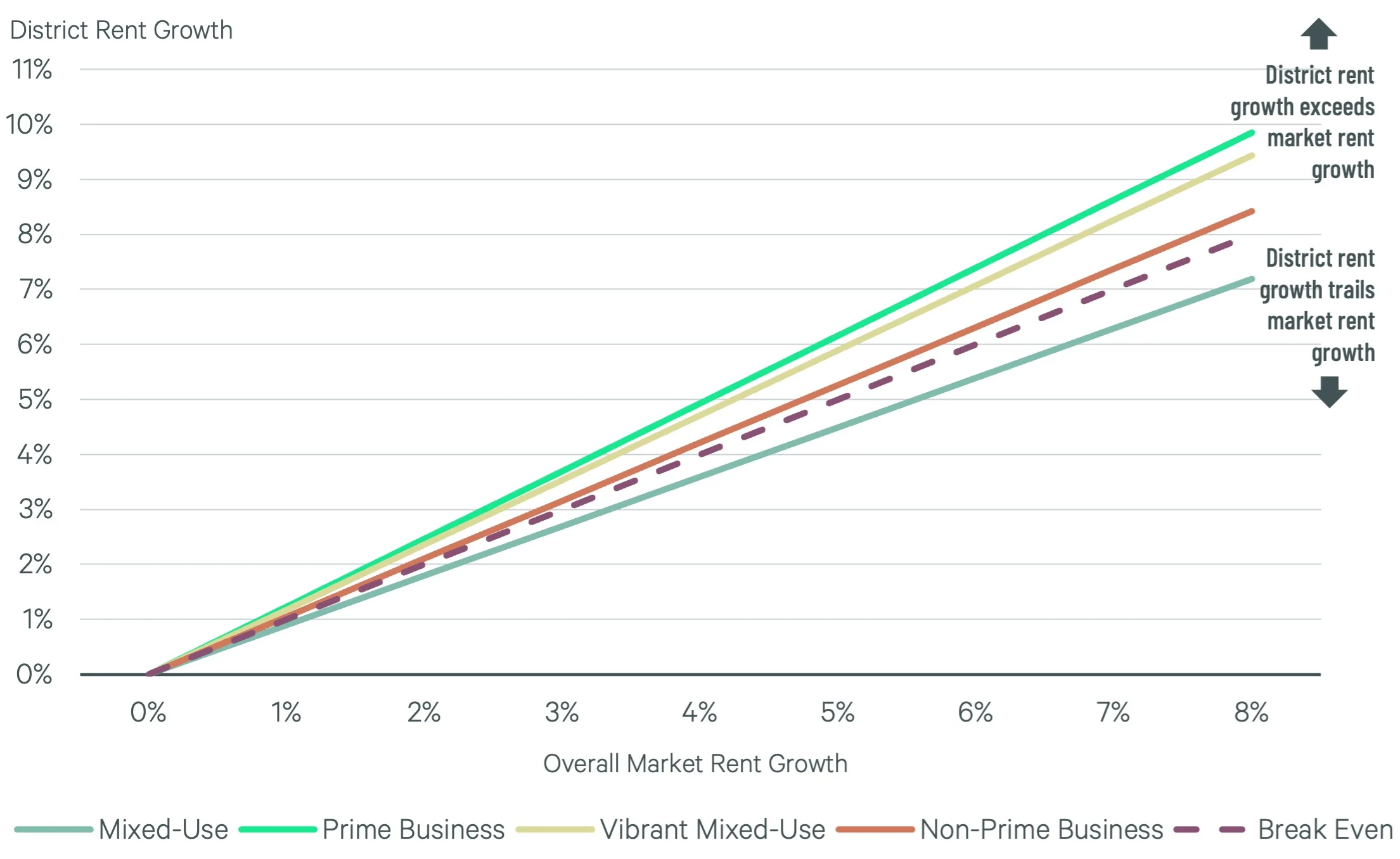

Retail Rents Outperform in Prime Business and Vibrant Mixed-Use Districts

Via CBRE: “Prime Business district performance even topped so-called “Vibrant Mixed-Use” districts, which are characterized by a mix of urban residential, entertainment, street retail and prime office. This outperformance vis-a-vis Prime Business districts is mainly due to rent levels in Vibrant Mixed-Use districts already being so high.”

- 6 Predictions On What’s In Store For CRE Next Year (Bisnow)

- The comeback of REITs: Top ways to play commercial real estate (Yahoo Finance)

- How homebuyers adapted to the 2024 market gives insights into upcoming trends (CoreLogic)