Podcast: Have Prices Hit Bottom for Multifamily?

Listen to the latest episode of The Gray Report Podcast and stay up to date on the most important news and research in the multifamily industry, commercial real estate, and the economy. The Gray Report on Spotify The Gray Report on Google Podcasts The Gray Report on Apple Podcasts

GO >Will banks help borrowers “extend and pretend”?

Multifamily assets have proven their worth in both strong and weak economies, but cripplingly high interest rates have frozen the sales market for apartment properties in 2023, leaving the outlook unclear for 2024. Even though the potential for lenders to grant accommodations to troubled borrowers could extend the stagnation and uncertainty in the multifamily sales…

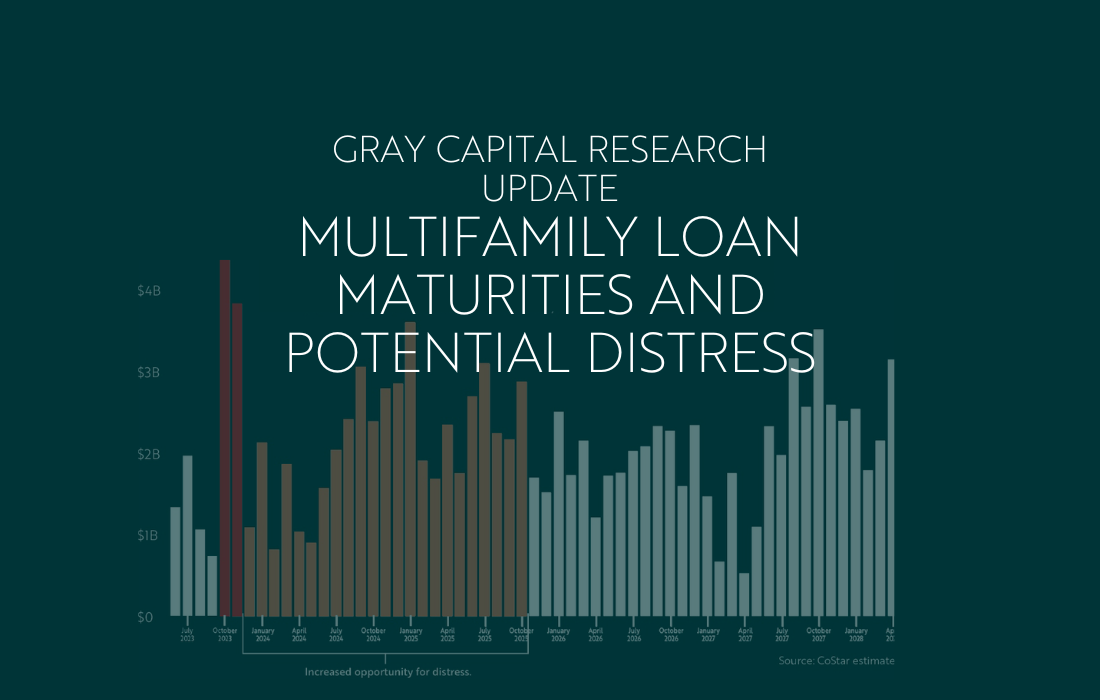

GO >Gray Capital Releases New CRE Loan Maturity Report

The wall of commercial real estate debt maturities is quickly approaching, and the marketis already adjusting to greater distress and widespread price discovery. INDIANAPOLIS, Sept. 27, 2023 /PRNewswire/ — Gray Capital, a family-owned and operated private equity real estate firm specializing in the strategic investment and acquisition of multifamily apartments in growing markets throughout the Midwest, today releases…

GO >Podcast: Will banks let multifamily borrowers “extend and pretend”?

Listen to the latest episode of The Gray Report Podcast and stay up to date on the most important news and research in the multifamily industry, commercial real estate, and the economy. The Gray Report on Spotify The Gray Report on Google Podcasts The Gray Report on Apple Podcasts

GO >Podcast: Loan Maturities Will Reshape the Market

Listen to the latest episode of The Gray Report Podcast and stay up to date on the most important news and research in the multifamily industry, commercial real estate, and the economy. The Gray Report on Spotify The Gray Report on Google Podcasts The Gray Report on Apple Podcasts

GO >Multifamily Loans Are Coming Due. Borrowers: Find a Buyer or Drown in Debt?

Reports of persistently-high expenses for commercial real estate operators, extended periods of higher interest rates, and lower rent growth have compounded the potential for distress linked to the wave of multifamily loan maturities due in Q4 of this year. Solid, long-term fundamentals and robust housing demand continue to make multifamily an attractive investment, but for…

GO >Interest Rate Reality Check for the Multifamily Market

Listen to the latest episode of The Gray Report Podcast and stay up to date on the most important news and research in the multifamily industry, commercial real estate, and the economy. The Gray Report on Spotify The Gray Report on Google Podcasts The Gray Report on Apple Podcasts

GO >Higher for Longer or Higher Forever? Interest Rates and the Multifamily Market

The Federal Reserve decided this week to maintain the current Federal funds rate without an increase (or decrease), but their updated economic projections suggest that the Fed is more driven to sustain these elevated rates through 2024, increasing their end-of-year 2024 projection from 4.6% in June to 5.1% now. While CRE pricing has been trending…

GO >Enormous Housing Demand Is a Good Sign for Multifamily

Listen to the latest episode of The Gray Report Podcast and stay up to date on the most important news and research in the multifamily industry, commercial real estate, and the economy. The Gray Report on Spotify The Gray Report on Google Podcasts The Gray Report on Apple Podcasts

GO >Enormous Housing Demand Is a Good Sign for Multifamily

While recent topline inflation numbers may help justify the recent interest rate increase from the Federal Reserve, a more compelling signal of economic activity can be seen in the robust housing demand that has led to rebounding single family home prices in spite of the high mortgage rate environment, which is a strong indication of…

GO >