Property Values and the Federal Reserve

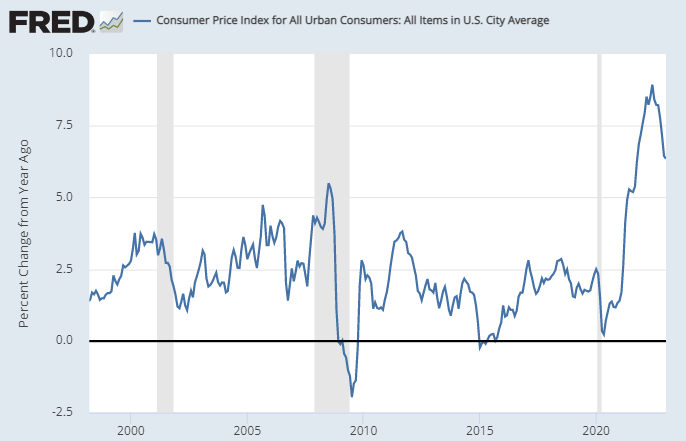

Even at a delay of one month, the release of the minutes of the last FOMC meeting offer a revealing look at the Fed’s perspective, especially when coupled with the recent release of their stress test scenarios for the economy.

Federal Reserve Bank of the United States: “Minutes of the Federal Open Market Committee January 31–February 1, 2023”

Last week, the Fed released the notes to the meeting it held at the end of January, and the headlines in the CRE world were focused on one passage specifically:

“The staff provided an update on its assessment of the stability of the financial system and, on balance, characterized the financial vulnerabilities of the U.S. financial system as moderate. The staff judged that asset valuation pressures remained notable. In particular, the staff noted that measures of valuations in both residential and commercial property markets remained high, and that the potential for large declines in property prices remained greater than usual.”

Later, the notes mention “vulnerabilities in the financial system associated with higher interest rates, including the elevated valuations for some categories of assets, particularly in the CRE sector.”

They (“they” at the Federal Reserve) use the word “elevated” here to suggest that previously low interest rates were driving up prices of commercial real estate, but at least they don’t characterize the effect of higher interest rates as “returning to normal.” It’s a small comfort to CRE owners that the Fed’s notes describe falling valuations as a “vulnerability”

The big inflation danger mentioned repeatedly in these notes is that inflation becomes “unanchored”—untethered and unmoored from the steady hand of our betters in the Federal Reserve Bank of the United States. Expectations, unanchored; prices, unanchored; hiring and wages and spending and economic activity, unanchored. A scary lack of the kind of control that the Federal Reserve so steadfastly values.

What I can only hope is that the Federal Reserve, at the same time that it’s thinking about prices like unanchored boats drifting into the vortex, maybe the Fed also thinks about the lagging effects of their interest rate increases. In Edgar Allen Poe’s A Descent into the Maelström, the main character saves himself from an enormous whirlpool by looking around and noticing that some objects are getting sucked in more slowly than others. Is there a lesson here?

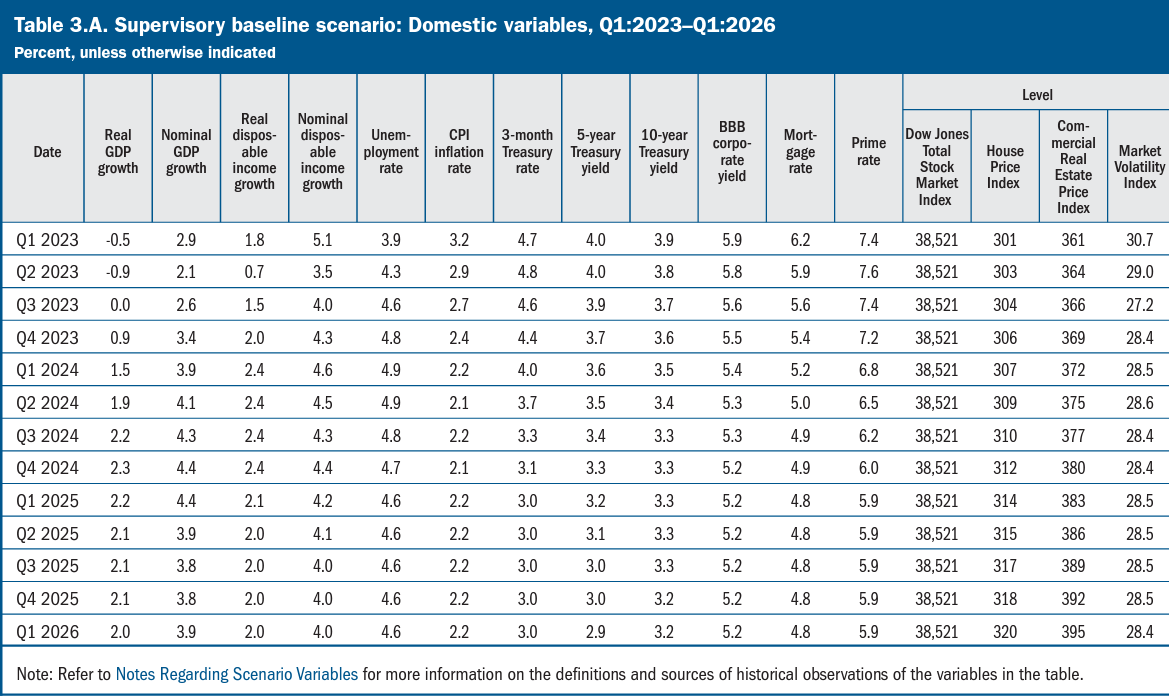

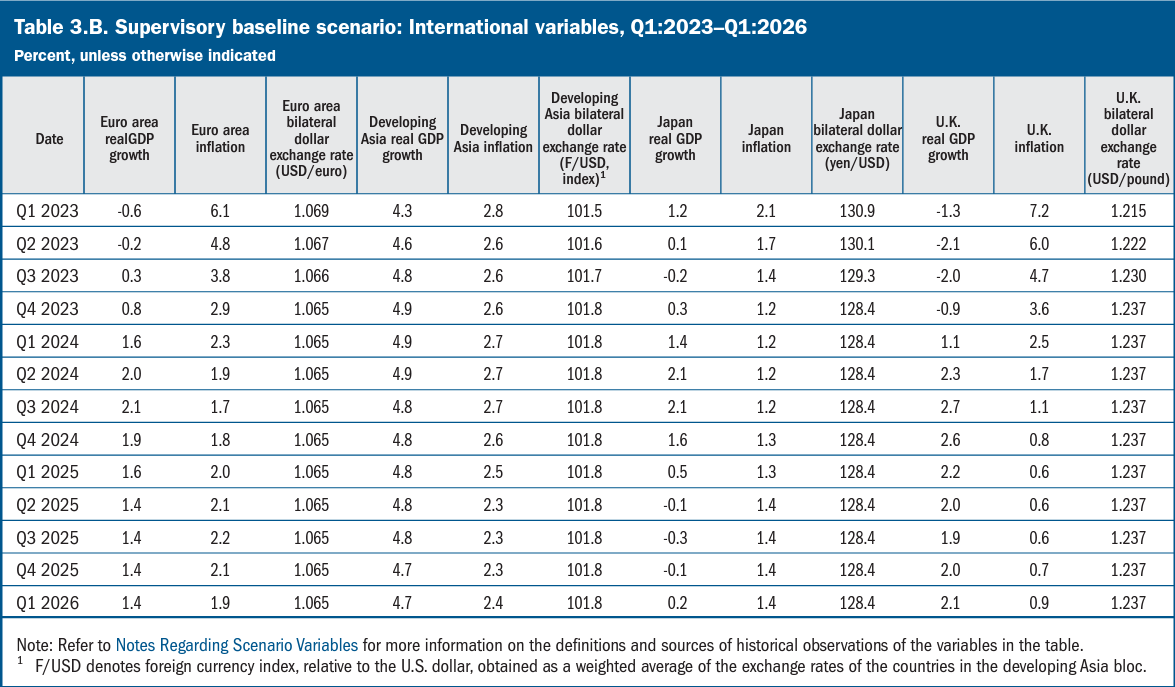

Well, at least the Fed is looking around, because along with these meeting minutes, the Federal Reserve has also published some updates to their baseline and severely adverse stress test scenarios for the economy.

You can skip to pages 21 and 22 of the pdf for the full tables, but essentially, the adverse scenario is one in which a widespread recession sends employment down, interest rates and inflation down, but asset prices down as well, although CRE asset devaluations would be strongest in office and hotel sectors.

The baseline scenario is really the more useful one here for predicting a likely economic scenario, so I’m just quoting the whole summary here:

“The baseline scenario for the United States features an initial slowdown and then a gradual recovery. The unemployment rate rises steadily from just over 3½ percent at the end of 2022 to near 5 percent by the first quarter of 2024, before declining to just over 4½ percent by the end of the scenario. Real GDP growth declines from about 1¾ percent at the end of 2022 to around negative ¾ percent by the middle of 2023 before gradually increasing to about 2¼ percent by the second half of 2024 and then settling near 2 percent at the end of the scenario.

Inflation, measured as the quarterly change in the CPI and reported as an annualized rate, declines from a little less than 3¼ percent to a trough of about 2 percent in the second quarter of 2024 and remains near 2¼ percent in the rest of the scenario. The 3-month Treasury rate increases from around 4 percent at the end of 2022 to about 4¾ percent in the second quarter of 2023, then declines to about 3 percent by the end of the scenario. Ten-year Treasury yields decline steadily from a bit below 4 percent to around 3¼ percent at the end of the scenario. The prime rate follows a path similar to short-term interest rates, while yields on BBB-rated corporate bonds and mortgage rates follow a path similar to long-term interest rates.”

The headline for the adverse scenario is a whopping 40% decline in CRE asset prices. Apartment assets, I learned in a separate source, are expected to fall by 37% in these conditions, and looking at the tables on page 22, the stress test has the low point in Q4 2024.

The baseline for CRE assets, at least as I’m reading it here through the change in the CRE Price Index, has prices slowly ticking up each quarter.

The Fed releases these stress tests and shows us, here’s how bad we could make things. This is how bad things could get if we go overboard and send the economy into a recession. You want low interest rates? You want low inflation? One way of making that happen is to make everything else low. Low economy. Low a lot of things.

Why no stress test for high inflation? Does this mean they don’t expect high inflation? The baseline has inflation steadily going down, so here’s hoping that the Fed will take the hint here, but I think that they are really motivated to convincing American consumers and businesses that they could make things worse.

No one looks up to a Fed chair who lowers interest rates. The hero is always the rate-hiking Volcker, who did what no one else could do, who stood against the clamoring masses and chaotic inflation-mongering hordes to bring peace and order to the economy.

Moody’s Analytics: “The Fed’s 2% Rule: Is It Realistic? How Would a New Economic Regime Impact CRE?”

This is a very short article, but it carries with it some crucial reminders about the economic environment in 2023: “The Fed claims to be committed to the 2% target, and they may really mean it (although the hawkish statements are expected given the negative consequences of unanchored expectations), but the likelihood of achieving this rate anytime soon remains relatively small. In contrast, the likelihood of a new, higher inflation, higher interest rate regime is growing daily.”

Depending on how much these Fed officials have mythologized Volcker as a hero with all the right ideas, the Fed could either crank up rates to economically damaging levels, or we could be in a more sustained period of elevated interest rates and elevated inflation. Maybe not runaway inflation and maybe not those Volcker-era sky-high interest rates, but both of them elevated. They’re not calling this stagflation, so we could still have decent employment GDP numbers, but again, things could run a little hotter.

This seems almost comforting in that we’ve been worried about the prospect of runaway inflation and economic recession so much, that it’s almost like we need an acceptable amount of economic hardship to get out of this uncertain emergence from the low rates and supply chain quagmires of the pandemic.

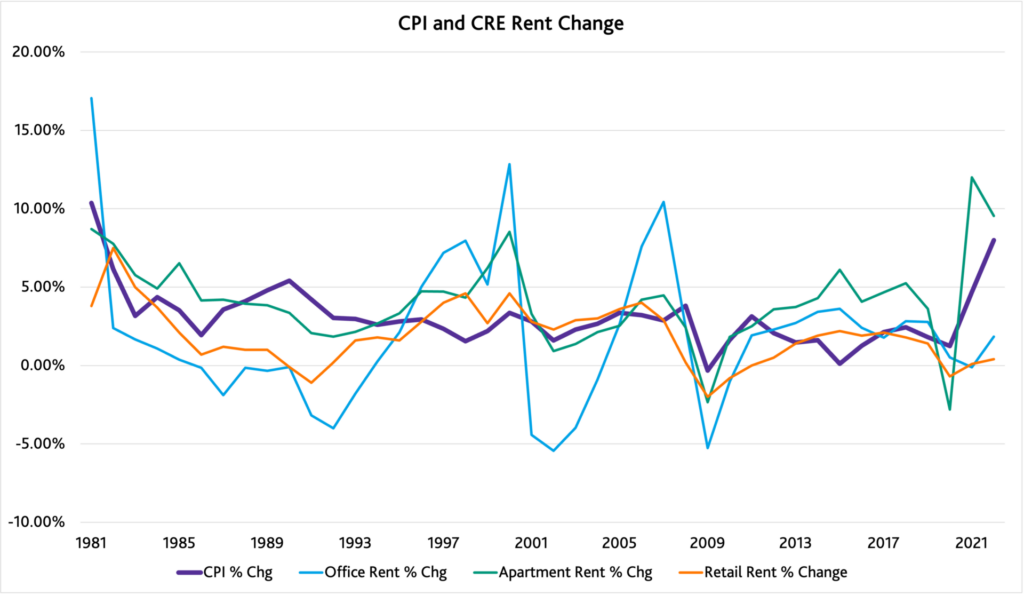

So what would happen to multifamily? Well, apart from property valuations, Moody’s notes that “higher inflation may not be a significant problem for . . . multifamily as demand tends to be pretty inelastic with landlords relatively easily passing higher costs along to renters.”

MSCI: “Prices of US Commercial Property Tumbled in January” – https://www.msci.com/www/quick-take/prices-of-us-commercial/03673737959

Prices of U.S. commercial property fell in January at an annual pace of decline not seen since late 2010, after the global financial crisis. The RCA CPPI National All-Property Index dropped 4.8% from a year ago and 2.7% from December. The monthly drop, when annualized, would be a decline of 27.9%.

Apartment prices tumbled, posting the largest declines of any property segment on the year and on the month. The apartment index dropped 4.6% from a year earlier and fell 2.8% in January from December.

The small 0.1% increase in industrial property values was the only CRE sector to have growing values.

The stark numbers here for apartment values are not unexpected, but they are a little surprising. Just today I was asking Jay about a property, is this one of those things where it’s an early 2023 sale with early 2022 prices?, and the answer was, sadly yes. But even though low sales numbers are slowing down price discovery, the fact that MSCI has already recorded a tangible decrease in property values for the multifamily sector, that’s very meaningful.