Apartment Demand Is a Juggernaut

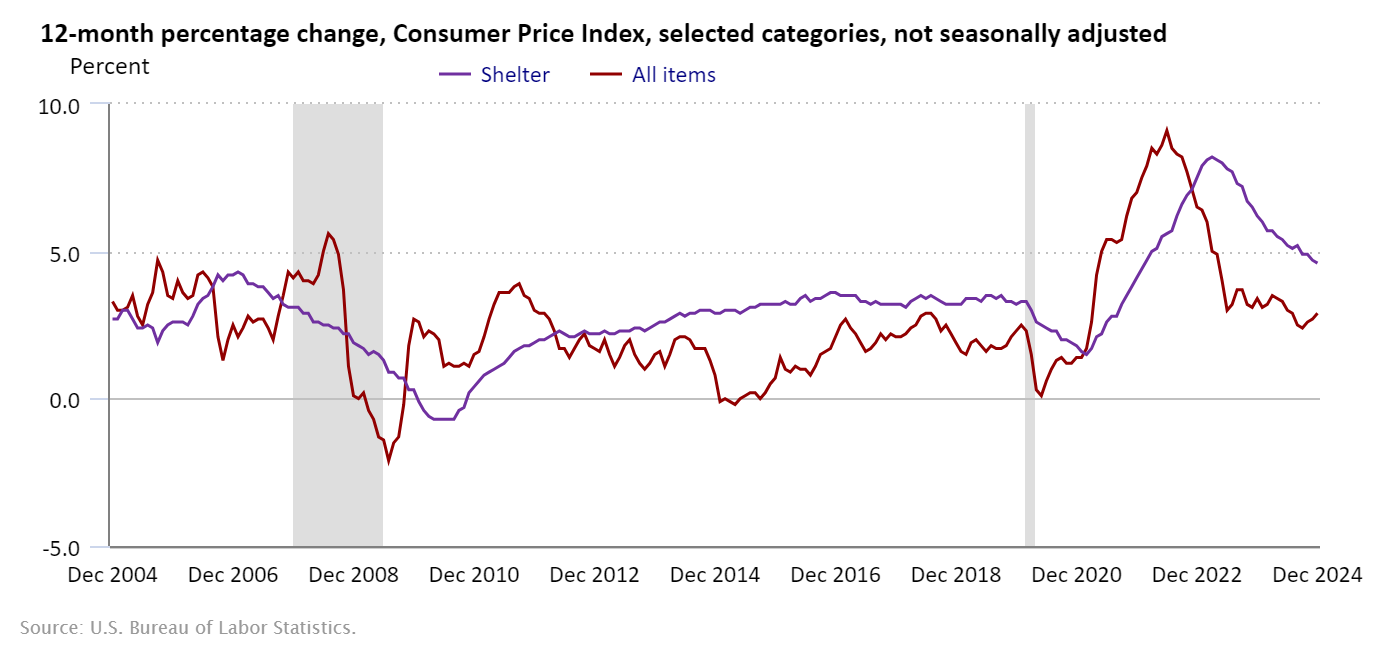

The slight increase in CPI-measured inflation (from 2.7% to 2.9%) may have been lower than expectations, but the persistence of price growth, along with recent jobs numbers showing a stronger-than-expected labor market, may lead to continued high interest rates. Amid this heating economy, apartment demand has been steadily growing throughout the past year and is now outstripping supply. Multifamily fundamentals look better than they have in years, but high interest rates will make careful asset selection an imperative in 2025.

Multifamily, the Nation, and the Economy

Dec. 2025 CPI: The Stubborn Road to 2% Inflation Continues

Bureau of Labor Statistics: “The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent on a seasonally adjusted basis in December, after rising 0.3 percent in November . . . Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment.”

- FTC Prepares to Sue Largest U.S. Apartment Landlord Over Hidden Fees (The Wall Street Journal)

- Hottest Markets of 2025: Indianapolis at #2 (Zillow)

- Dec. 2024 National Multifamily Report: Multifamily Rents End a Positive 2024 on a Down Note (Yardi Matrix)

Multifamily and the Housing Market

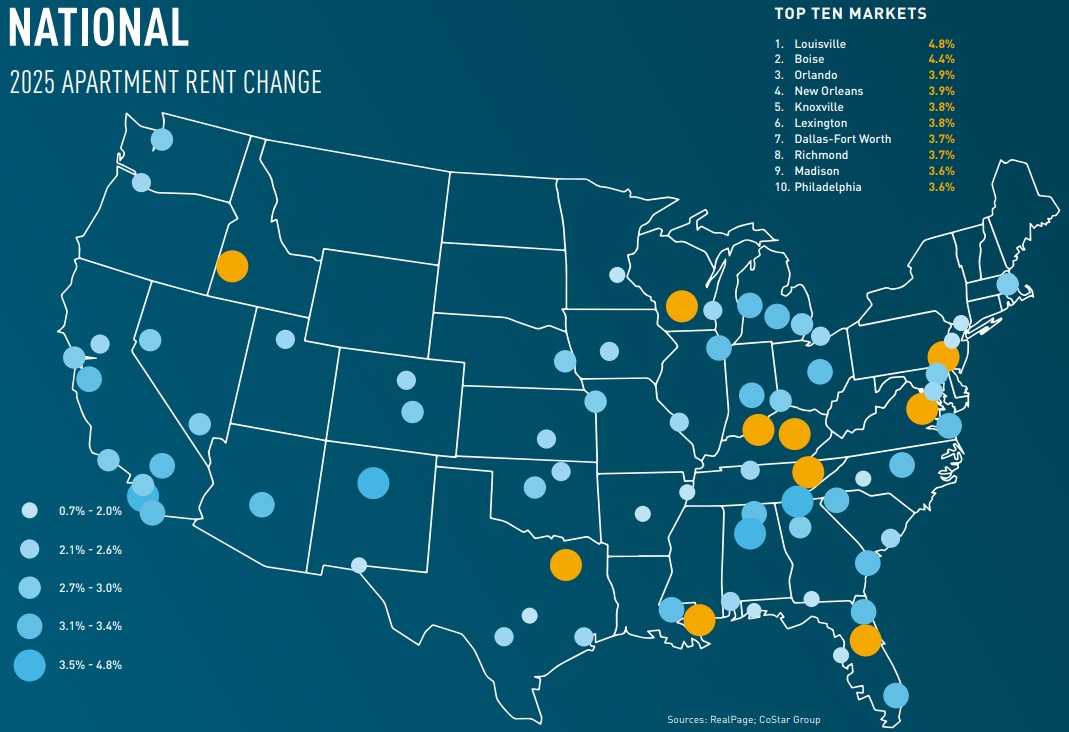

Increased Rent Growth Forecasted in 2025, After Supply Wave Crests

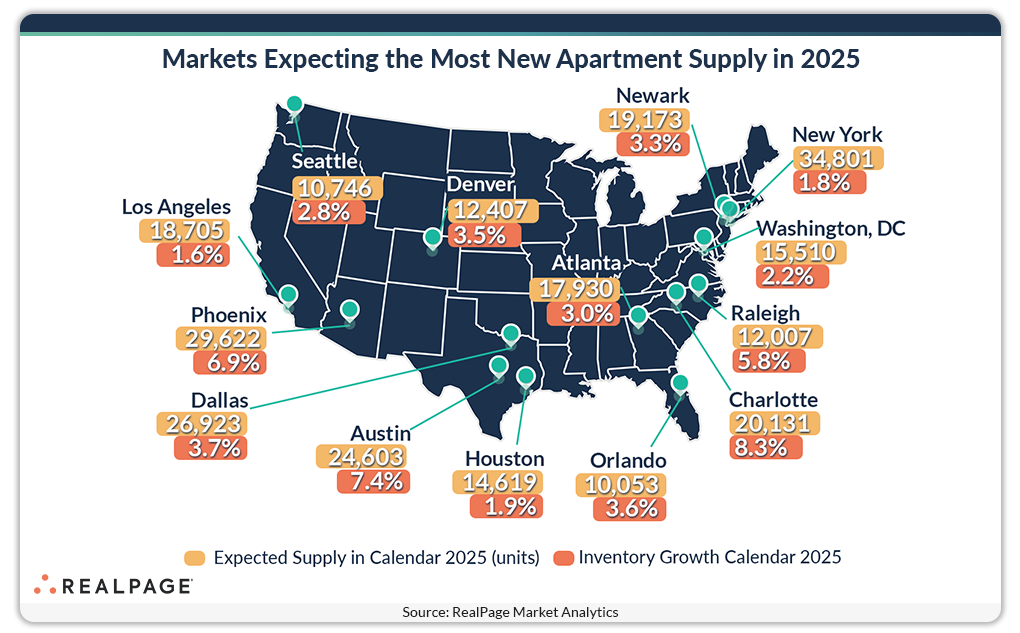

Via RealPage: “Recent reports on new permits and starts suggest that construction will slow down in the coming quarters. Our RealPage forecast indicates that in 2025, over 470,000 new apartments will come online, led by New York, Phoenix, Dallas and Newark.”

- Home Price Growth Accelerates in Q4 2024 (Fannie Mae)

- 2024 Property Tax Balloon Causing Sticker Shock for Homeowners (CoreLogic)

- HOA Fees Are Rising—and Getting Harder for Homebuyers To Avoid (Realtor.com)

Multifamily Markets and Reports

2025 Apartment Forecast: Rising Leasing Activity to Boost Fundamentals

Via Berkadia: “Healthy occupancy will support an increase in rent. Monthly effective rent is forecast to advance 2.8% year over year to an average of $1,909 by the fourth quarter of 2025.”

- Why the New Social Housing Movement Needs to Think About Design (Harvard Joint Center for Housing Studies)

- Minneapolis Is Top City to Watch in 2025 Amid Midwest – West Battle for Popularity (RentCafe)

- Major Apartment Markets Show Occupancy Improvement in 2024 (RealPage)

Commercial Real Estate and the Macro Economy

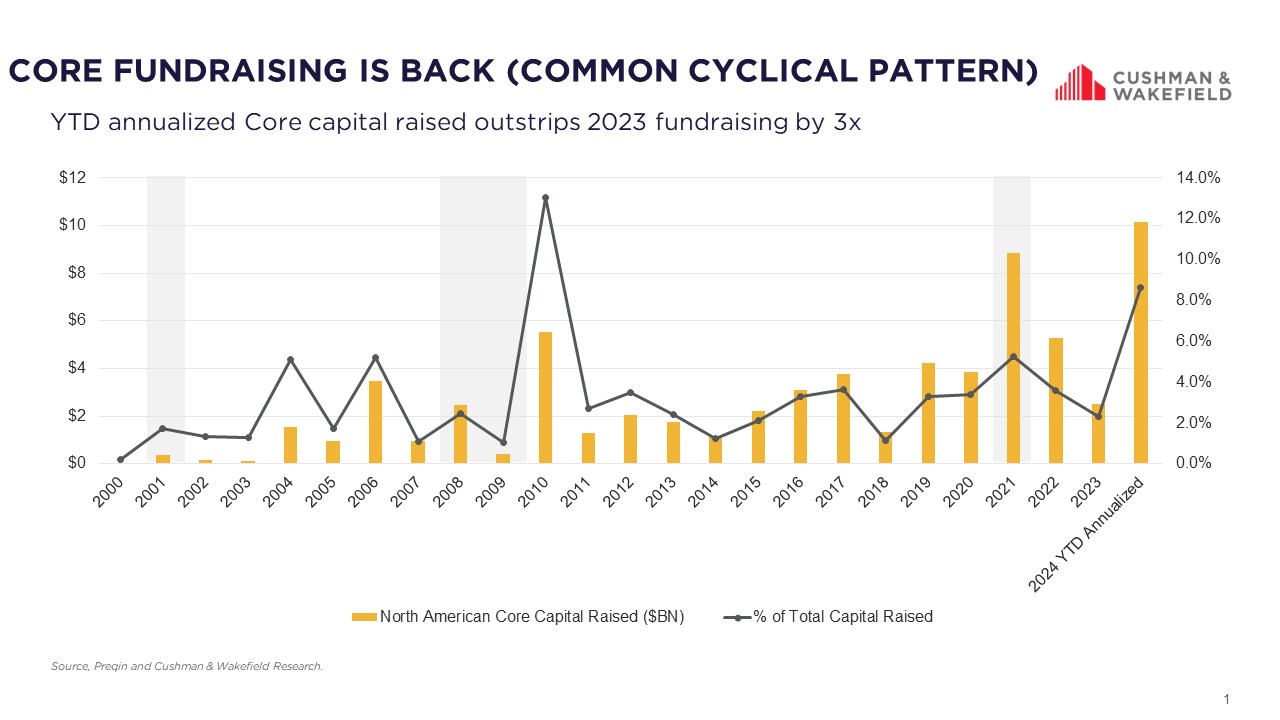

Commercial Real Estate Capital Markets Shift to Core Investments

Via Cushman & Wakefield: “As the tides shift throughout the capital markets, we’ve seen a 3x bounce-back in YTD annualized Core fundraising relative to last year . . . Closed-End funds have raised upwards of $10 billion this year, compared to $2.5 Billion last year.”

- Data Analysis: Banks at Risk Despite Declining Interest Rates (Florida Atlantic University)

- December 2024 jobs report: 256,000 jobs added, a strong finish to the year (J.P. Morgan)

- U.S. Population Grows at Highest Rate Since 2001 (NAHB)

Other Real Estate News and Reports

Retail Market Statistics | Q4 2024

Via Colliers: “The national retail vacancy rate remained at 4.1% throughout 2024, driven by limited new development since the Great Financial Crisis and increased postpandemic demand.”

- Real Estate Investment Trends: “Positive sentiment in commercial real estate is starting to build.” (MSCI)

- The Changing Retail Pharmacy Landscape (Colliers)

- Opportunity Zone Industry Gearing Up For Expansion Under Trump (Bisnow)