A Chill Wind Blows through Multifamily

Multifamily investment optimism persists, but expectations have cooled somewhat since late 2024. Persistently-high ten-year treasury yields have changed the prevailing assumptions about interest rates and the multifamily lending market, with higher-for-longer expectations taking hold, moderating the previous optimism about the multifamily investment market, but even if the lending environment remains the same, the near-unanimous consensus of improved rent growth and apartment fundamentals continues to support the strong investment prospects for multifamily, no matter how cold the wind may blow.

Multifamily, the Nation, and the Economy

2025 U.S. Multifamily Investment Forecast

Marcus & Millichap: “The coming year offers the prospect of abating headwinds for the multifamily sector, as record multifamily development begins to wane at the same time that household formation has started to accelerate[, but s]ome uncertainty still surrounds the 2025 investment outlook.”

- Multifamily Underwriting Assumptions and Investment Analysis in Q4 2024 (CBRE)

- Apartment Occupancy Returns to Historically Normal Levels at End of 2024 (RealPage)

- Fed Stays Steady, and Powell Offers No Guidance on Future Rate Cuts (New York Times)

Multifamily and the Housing Market

Housing and Economic Growth Outlook: “Positive, but moderate”

Via Freddie Mac: “Our outlook for the U.S. economy in 2025 is positive, though we expect the pace of growth to moderate . . . Mortgage rates remained higher than expected in 2024. Unlike last year when many were anticipating that mortgage rates would decline, in early 2025 the prevailing sentiment is that rates will stay higher for longer.”

- Is Multifamily Poised for a Market Rebound in 2025? (Marcus & Millichap)

- The Income Needed in Each State To Afford a Starter Home at a 7% Mortgage Rate (Realtor.com)

- Five Wild Card Markets for 2025 (RealPage)

Multifamily Markets and Reports

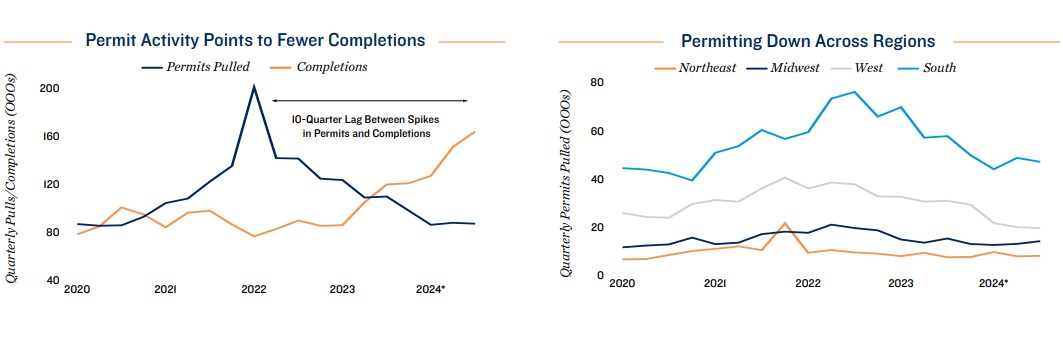

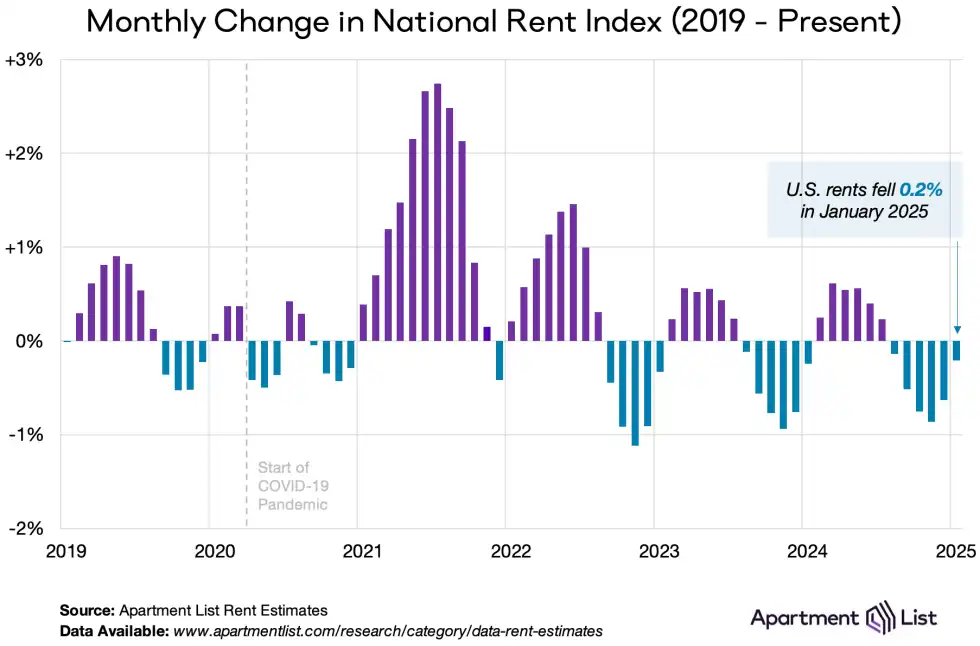

January 2025 National Rent Report

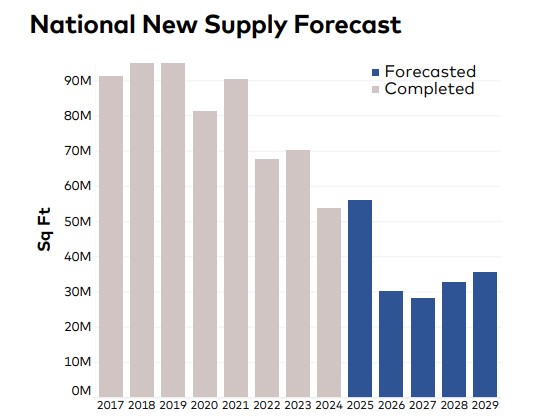

Via Apartment List: “[N]ew completions are set to gradually come down from last year’s peak, even as a significant number of units remain in the construction pipeline. Demand for rentals going forward remains a bit more uncertain, and will likely hinge on broader macroeconomic conditions.”

- Class B Apartments Lead Occupancy Recovery, Surpassing Class C for First Time (GlobeSt)

- State-Level Employment Situation: December 2024 (NAHB)

- The resilient performance of master-planned communities in 2024 (John Burns Research and Consulting)

Commercial Real Estate and the Macro Economy

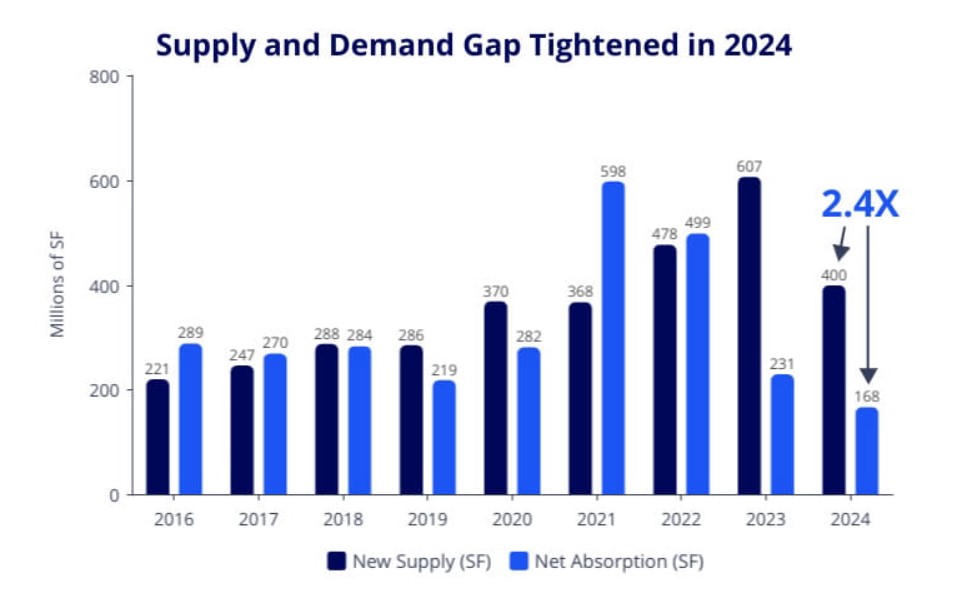

Industrial Market Statistics | Q4 2024

Via Colliers: “The U.S. industrial vacancy rate is nearing its peak as construction activity normalizes to pre-pandemic levels and demand gradually recovers. Vacancy increased during all four quarters of 2024, climbing by 126 basis points to 6.8% — the highest level since 2015.”

- Self Storage to Balance Optimism, Caution in 2025 (Yardi Matrix)

- Life Sciences Funding in View (Cushman & Wakefield)

- Office Market Statistics | Q4 2024 (Colliers)

Other Real Estate News and Reports

Office Sector Faces Another Unsteady Year

Via Yardi Matrix: “The reduction in activity is in line with what we have seen since COVID, as office culture has moved away from in-person collaboration. Attitudes from workers, who have built their lives around a new remote work model, remain entrenched on this issue.”

- Analyzing CMBS Issuance Trends from 2019 to 2024: A Comprehensive Look at the Evolving Market (Trepp)

- Regulatory Developments Related to Managing the Financial Risks of Climate Change – Q4 2024 (Moody’s Analytics)

- Trump Picks Officials To Oversee Federal Real Estate Portfolio (Bisnow)