Fed Rate Cut Aftermath

Many, many takes on the decision from the Federal Reserve Open Market Committee to cut the federal funds rate by half a percentage point. We’ve had a week to digest the news, so what are people saying?

Source – CBRE: “Fed Makes First of Several Expected Rate Cuts”

A brief, straightforward report from CBRE that came out the day of the rate cut announcement and reflects what I believe is a pretty tight ship they run at CBRE. They already had their forecast ready, they plugged it into the report, and they’re good to go. Below is a key passage from their post:

“The Fed indicated that it expects an additional 50 bps in cuts this year and 100 bps in 2025. The forthcoming rate cuts, coupled with lower bond yields, will bolster commercial real estate investment activity and asset values. CBRE forecasts a 5% increase in annual investment activity this year, with further acceleration next year.”

Source – Fannie Mae: “Fed Cuts Interest Rates Amid Sluggish Existing Sales but a Rebound in Starts Activity”

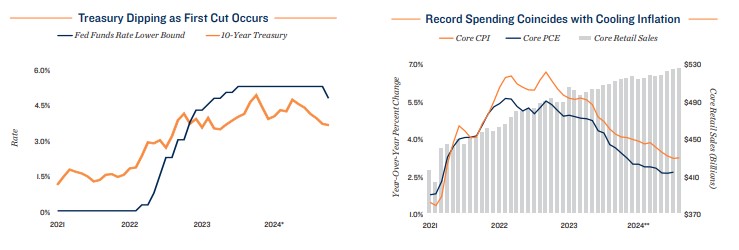

Some attention to the larger economy beyond the housing market from Fannie Mae here and a reminder that consumer spending is worth watching as an indirect (or direct, if you really want to argue about it) demand driver of the housing market, which Marcus & Millichap also covered in their own take, noting, in a subtle understatement, that the “Long-Awaited Cut Has Positive Implications for Commercial Real Estate and Consumers” and highlighting consumer resilience and the potential for higher “tenant demand” alongside the potential for higher investment activity in the event that lower borrowing costs “help re-open the yield spread relative to cap rates.”

But to return to Fannie Mae, they’re a little less happy and positive in their take on housing and consumer activity, but then again, Fannie Mae’s analysis is always a little more cynical. Is that the right word? Realistic?—nah, that implies one is more accurate than the other. Fannie Mae’s a little more gritty. More pessimistic, but not completely pessimistic:

“Looking beyond the third quarter, we continue to expect some slowing in consumption growth to better align with the current rate of real income growth . . . interest rates for auto loans and other durable goods categories have already come down in expectation of an easing in monetary policy, which could spur some additional consumption in those categories by the end of the year.”

For the housing market specifically, Fannie Mae does not see a surge in home sales happening all at once:

“Ongoing weakness in existing home sales is in line with our most recent forecast, which called for the lowest annual level of existing sales since 1995. It’s worth noting that August sales, which were mostly closed in June and July when rates were still around 6.9 percent, don’t reflect most of the recent decline in mortgage rates.”

Source – Cushman & Wakefield: “Fed Pivots: The Next Chapter for CRE”

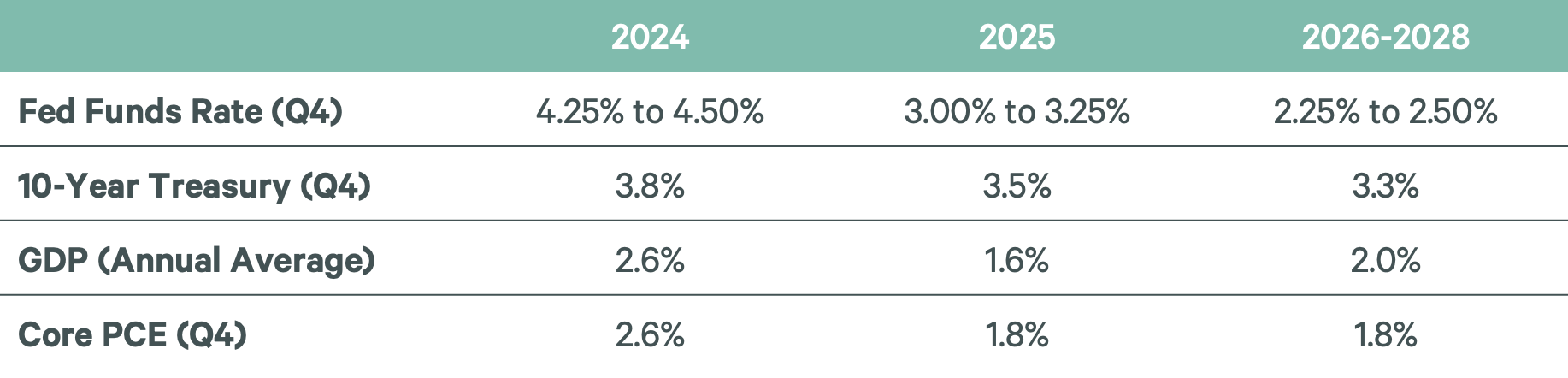

“Despite the cut, monetary policy remains restrictive to economic growth.” – The sweet spot for the federal funds rate, says Cushman & Wakefield here, is 2.5%-3%. We’ve got a full 200 BPS to go.

The above is a bit of a bummer of an assessment, and they try to cheer things up in the following point, writing that the rate cut “signals better days” for liquidity, businesses, and NOI, but I don’t like the idea that those better days need the fed funds rate to drop by 200 BPS before getting here.

But maybe we’ll see some material pickup in investment activity in the CRE markets. Cushman & Wakefield call out the end of falling CRE sales, (which are still at half the levels they were before the pandemic but posted a modest-yet-promising 3.5% increase in Q2 of this year), and they point to the rebound in REIT stock prices.

They make their final point through a well-titled line graph at the end of the report. “Fed cutting cycle signals pricing inflection ahead.” The graph shows how, coincident with Fed rate cuts and low interest rate periods, CRE price growth noticeably accelerates. What’s also noticeable is that there’s a lag between falling rates and higher CRE prices, sometimes by as much as a year or more, but the pandemic-era low interest rate period saw a fairly instantaneous boost in CRE prices once rates dropped.

Given the slower speed of CRE price discovery in general and the time it takes for a deal to close between buyer and seller, counting on this lag period as a cushion may not be helpful. The inflection is coming, and a lot of investors are already factoring that in when they bid for properties.